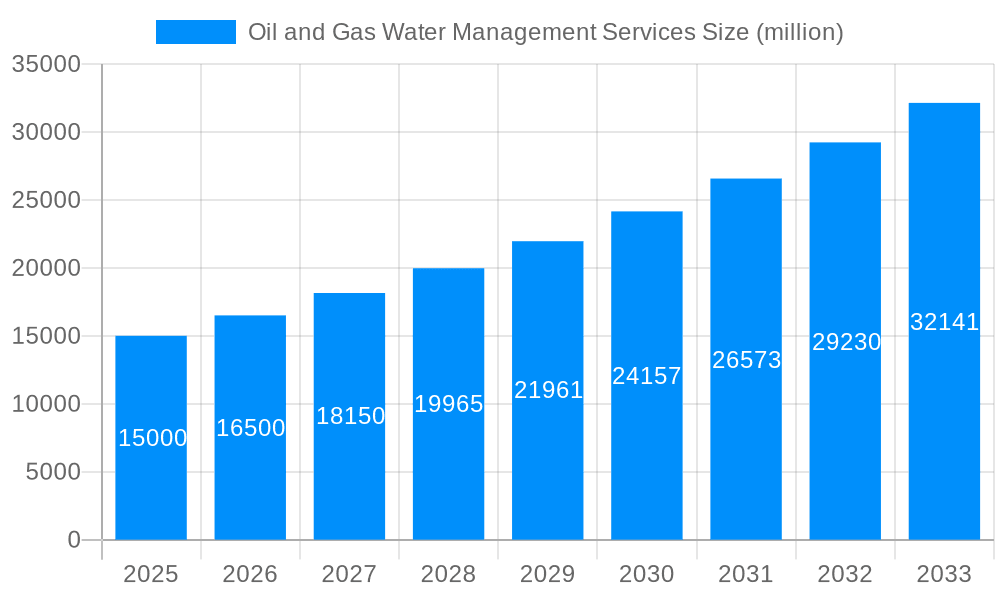

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Water Management Services?

The projected CAGR is approximately 12.91%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oil and Gas Water Management Services

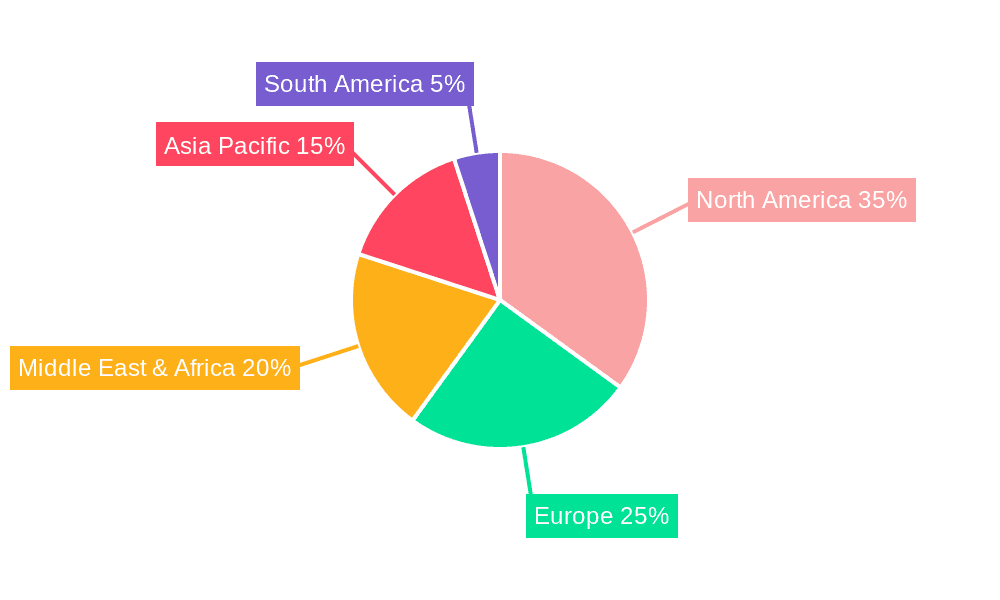

Oil and Gas Water Management ServicesOil and Gas Water Management Services by Type (Technology, Equipment, Other), by Application (Oil and Gas Industry, Water Treatment Industry, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

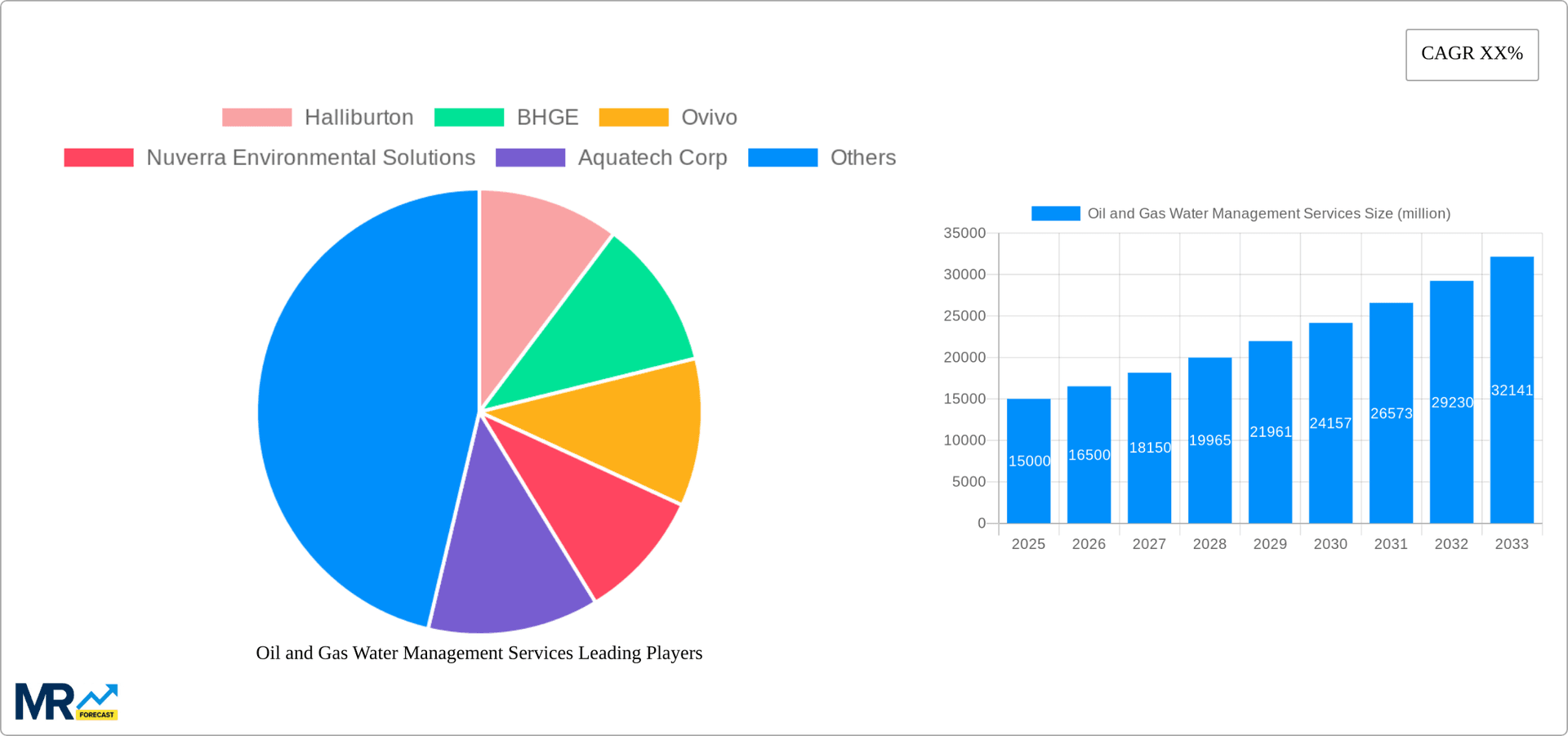

The global Oil and Gas Water Management Services market is projected for substantial growth, driven by escalating environmental regulations, stringent discharge mandates, and the critical need for efficient water handling in hydrocarbon extraction. Technological advancements in water treatment, such as advanced membrane filtration, produced water recycling, and Zero Liquid Discharge (ZLD) systems, are key growth enablers. These innovations empower operators to minimize their environmental impact, optimize water consumption, and reduce operational expenditures. The market is segmented by technology (e.g., membrane filtration, thermal treatment), equipment (e.g., pumps, filtration systems), and application (primarily oil and gas production, with extensions to industrial water treatment). Leading entities, including Halliburton, Schlumberger, and Veolia, are actively investing in R&D, M&A activities, and strategic alliances to strengthen market positions and broaden service portfolios. North America and the Middle East & Africa currently dominate market share due to extensive oil and gas operations, with the Asia Pacific region anticipated to experience significant expansion driven by rising energy demands and infrastructure development. Despite challenges such as volatile oil prices and complex regulatory compliance, the market's long-term outlook remains favorable, supported by the persistent requirement for sustainable water management practices within the energy sector.

The competitive environment features a mix of established leaders and innovative new entrants offering specialized solutions. Market consolidation is evident, with larger enterprises acquiring niche firms to enhance service offerings and global reach. The increasing integration of digital technologies, including data analytics and predictive modeling, is vital for elevating operational efficiency and optimizing water management strategies. The development of sustainable and cost-effective water treatment solutions is paramount for sustained market expansion. Future growth will also hinge on the successful deployment of cutting-edge technologies, collaborative efforts among industry participants, and robust regulatory frameworks promoting responsible water stewardship in the oil and gas industry. The anticipated widespread adoption of integrated water management solutions, covering the entire water lifecycle from generation to disposal, is expected to be a significant growth driver in the forthcoming years.

The oil and gas water management services market is experiencing robust growth, driven by increasing environmental regulations, the need for efficient water recycling, and the expanding global oil and gas production. The market, valued at XXX million in 2025, is projected to reach XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This growth is fueled by several key trends. Firstly, the shift towards more sustainable practices in the energy sector is compelling operators to adopt advanced water management technologies to minimize their environmental impact. This includes a greater emphasis on water reuse and recycling, minimizing freshwater consumption, and effective wastewater treatment to meet stringent discharge regulations. Secondly, technological advancements in areas such as membrane filtration, desalination, and advanced oxidation processes are improving the efficiency and cost-effectiveness of water treatment, making these solutions more attractive to oil and gas companies. The increasing adoption of digital technologies like IoT sensors and data analytics is further enhancing operational efficiency and optimizing water management strategies. Finally, the growing prevalence of hydraulic fracturing and enhanced oil recovery (EOR) techniques, both highly water-intensive processes, is significantly contributing to the demand for efficient water management solutions. This trend is particularly pronounced in regions with limited freshwater resources, leading to a greater focus on water reuse and recycling strategies. The historical period (2019-2024) showed a steady increase in market size, setting the stage for the accelerated growth projected during the forecast period. The market analysis incorporates data from various sources, ensuring a comprehensive and accurate representation of the current market dynamics and future projections.

Several factors are significantly driving the growth of the oil and gas water management services market. Stringent environmental regulations globally are forcing oil and gas operators to implement robust water management strategies to minimize their environmental footprint. These regulations often mandate specific treatment levels for produced water before discharge, driving demand for sophisticated water treatment technologies and services. Furthermore, the increasing scarcity of freshwater resources, particularly in regions with significant oil and gas production, is pushing operators towards water reuse and recycling initiatives to reduce their dependence on freshwater sources. The economic benefits of water reuse, including reduced water procurement costs and minimized waste disposal expenses, are also compelling companies to adopt these practices. The expansion of oil and gas exploration and production activities, particularly unconventional resources like shale gas and tight oil, contributes significantly to the growing demand for water management services. These operations require large volumes of water for hydraulic fracturing, leading to a surge in the need for effective water treatment and disposal solutions. Technological advancements in water treatment, such as the development of more efficient and cost-effective technologies, are also boosting market growth. Finally, the increasing adoption of digitalization and automation in water management operations is enhancing efficiency, optimizing resource allocation, and improving overall operational performance, further driving market expansion.

Despite the promising growth prospects, the oil and gas water management services market faces several challenges. High upfront capital costs associated with implementing advanced water treatment technologies can be a significant barrier to entry for smaller operators. The fluctuating prices of oil and gas directly impact the investment budgets of companies in this sector, influencing their willingness to invest in water management solutions. Moreover, the remote and geographically challenging locations of many oil and gas production sites can make the deployment and operation of water management infrastructure costly and complex. The complexity of produced water, which often contains various contaminants requiring specialized treatment methods, adds to the operational challenges. Finding skilled labor and expertise to operate and maintain these sophisticated systems is another key concern, especially in remote areas. Lastly, ensuring the long-term sustainability and economic viability of water reuse and recycling projects is crucial, as these solutions require ongoing maintenance and potentially involve significant operational costs over their lifespan. Addressing these challenges effectively is critical to sustaining the growth trajectory of this vital market segment.

The oil and gas water management services market is geographically diverse, with significant growth opportunities across various regions. However, North America (particularly the United States) and the Middle East are expected to dominate the market due to their extensive oil and gas production activities and stringent environmental regulations. Within these regions, the shale gas boom in North America and the large-scale oil production in the Middle East contribute significantly to the high demand for water management services.

Dominant Segment: The Technology segment is poised to dominate the market due to the continuous advancements in water treatment technologies. Advanced technologies such as membrane filtration, desalination, and advanced oxidation processes are increasingly being adopted to improve the efficiency and effectiveness of water treatment. This segment is further propelled by the increasing demand for automated and digitally enabled water management systems. The need for real-time monitoring, data analytics, and remote operation capabilities drives investment in these technological solutions. This segment's rapid innovation, improving cost-effectiveness, and growing integration with digital technologies will continue to shape the future of oil and gas water management. Furthermore, the Oil and Gas Industry application segment will remain the largest and fastest-growing end-user segment due to the inherent high water usage in upstream, midstream, and downstream operations.

Several factors are significantly accelerating the growth of the oil and gas water management services industry. The increasing stringency of environmental regulations, coupled with growing awareness of water conservation, is driving adoption of advanced water treatment and reuse technologies. Simultaneously, technological advancements in areas like membrane filtration and advanced oxidation processes are offering more efficient and cost-effective solutions. Finally, the expansion of unconventional oil and gas resources like shale gas, which necessitates large volumes of water for hydraulic fracturing, is further boosting market demand. These interconnected factors are creating a potent catalyst for sustained and rapid growth in this vital sector.

This report provides a detailed analysis of the oil and gas water management services market, covering market trends, driving forces, challenges, key players, and significant developments. The comprehensive study incorporates data from multiple sources, providing a complete and accurate picture of the market landscape. The report offers invaluable insights for stakeholders in the industry, including oil and gas companies, water treatment providers, and investors, enabling informed decision-making and strategic planning within this dynamic sector. The detailed segmentation and regional analysis provide a granular understanding of market dynamics, allowing for a precise assessment of growth opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.91% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.91%.

Key companies in the market include Halliburton, BHGE, Ovivo, Nuverra Environmental Solutions, Aquatech Corp, Layne Christensen, Severn Treatment Services, Veolia Water Technologies SA, Schlumberger, Green Hunter Resources, WSP, .

The market segments include Type, Application.

The market size is estimated to be USD 10.43 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Oil and Gas Water Management Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oil and Gas Water Management Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.