1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Descaler?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oil and Gas Descaler

Oil and Gas DescalerOil and Gas Descaler by Type (Liquid, Powder, Gel, Others, World Oil and Gas Descaler Production ), by Application (Food and Beverage Industries, Refinery, The Construction Sector, Others, World Oil and Gas Descaler Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

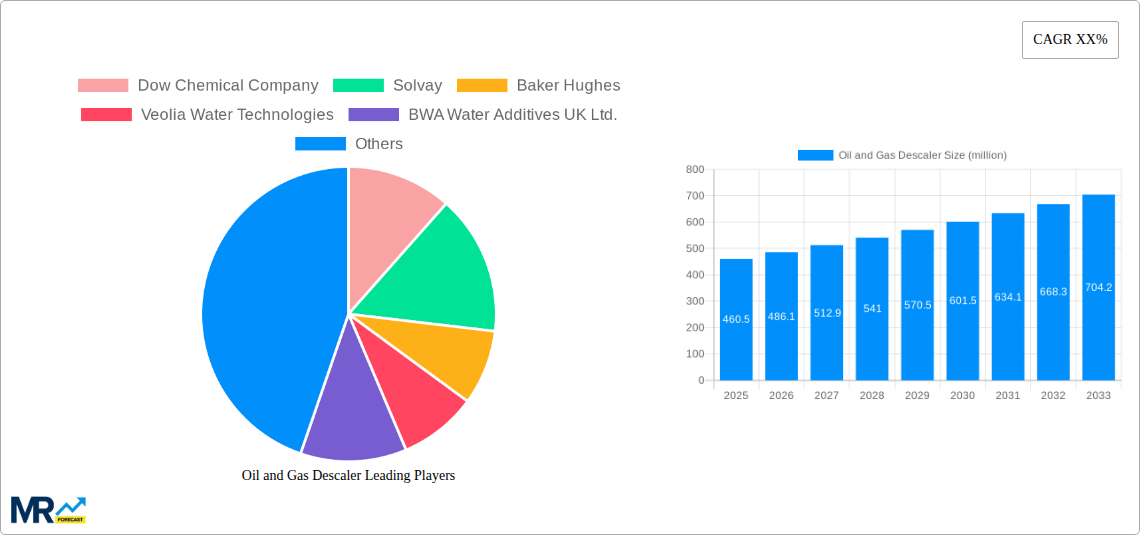

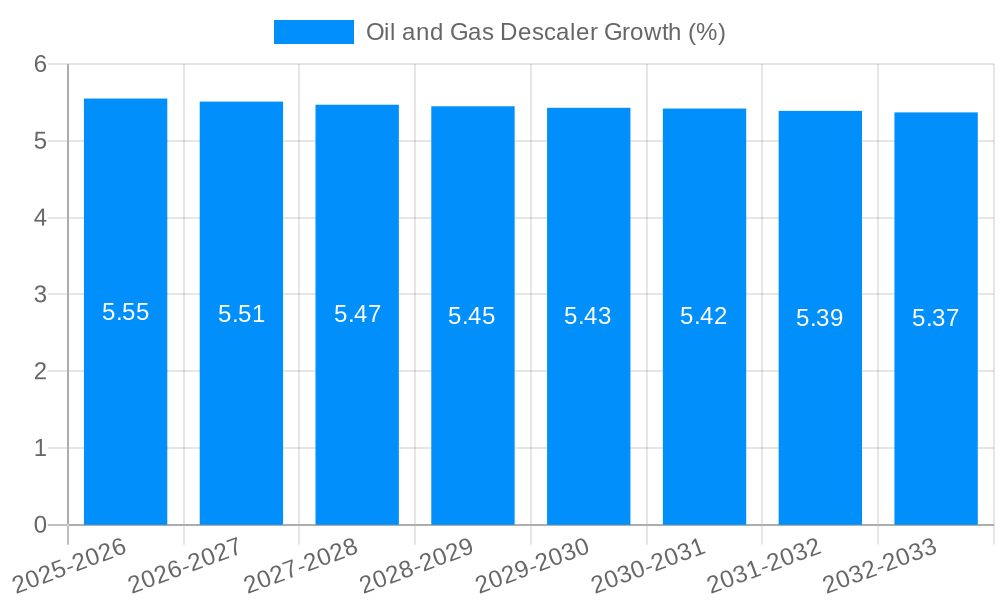

The global oil and gas descaler market is poised for significant expansion, projected to reach an estimated value of $460.5 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033. This robust growth is primarily driven by the increasing demand for oil and gas globally, necessitating efficient extraction and processing operations. The persistent challenge of scale formation in pipelines, processing equipment, and storage facilities across the oil and gas value chain creates a constant need for effective descaling solutions. Furthermore, stringent environmental regulations mandating cleaner production processes and extended asset lifespan are compelling operators to invest in advanced descaling technologies. The food and beverage industries, refineries, and the construction sector, beyond oil and gas, also contribute to market demand, seeking solutions to prevent scale buildup in their respective operational environments. The market is characterized by a diverse range of descaler types, including liquid, powder, and gel formulations, each offering specific advantages for different applications and operational conditions.

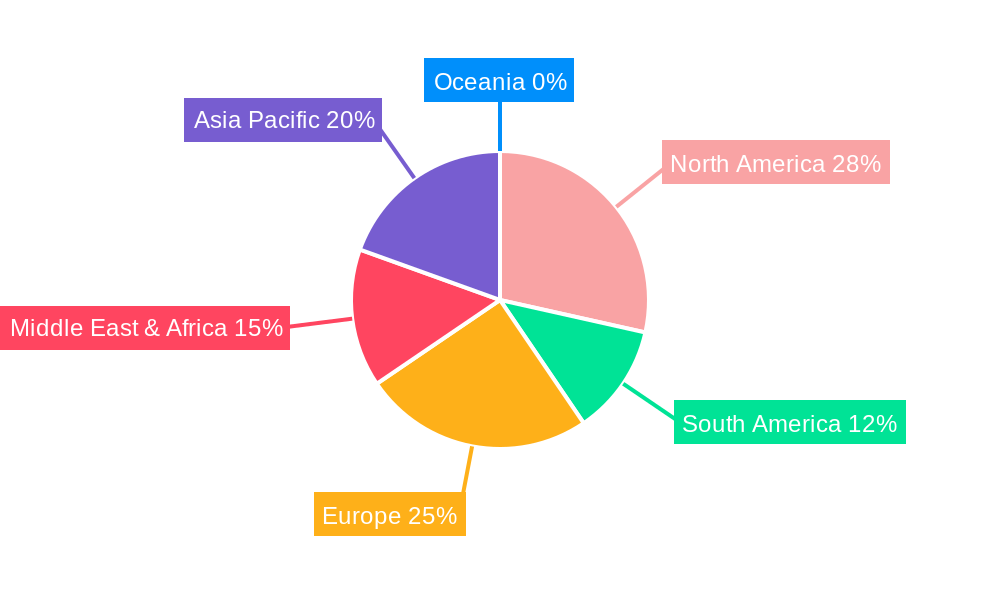

Several key trends are shaping the oil and gas descaler landscape. There's a noticeable shift towards environmentally friendly and biodegradable descaling agents, driven by increasing sustainability concerns and regulatory pressures. Innovations in chemical formulations are leading to more effective and faster-acting descalers, reducing downtime and operational costs for end-users. The integration of advanced monitoring and control systems for scale prevention is also gaining traction, enabling proactive rather than reactive descaling strategies. However, the market faces certain restraints. The high initial cost of some advanced descaling technologies and the availability of cheaper, less effective alternatives can pose challenges. Additionally, the fluctuating prices of crude oil can impact exploration and production activities, indirectly influencing the demand for descalers. Geographically, the Asia Pacific region, particularly China and India, is expected to witness substantial growth due to rapid industrialization and increasing oil and gas exploration activities. North America and Europe, with their established oil and gas infrastructure and a strong focus on technological advancements and environmental compliance, will continue to be significant markets.

This comprehensive report delves into the dynamic world of Oil and Gas Descalers, a critical component for optimizing operations and ensuring the longevity of infrastructure within the energy sector. Spanning a study period from 2019 to 2033, with a specific focus on the base year 2025 and a forecast period of 2025-2033, this analysis provides invaluable insights into market trends, driving forces, challenges, and future growth opportunities. The report leverages historical data from 2019-2024 to provide a robust foundation for its projections. The global oil and gas descaler market is estimated to be a significant economic force, with projected production volumes reaching into the tens of millions of units annually by the forecast period.

The global oil and gas descaler market is experiencing a transformative phase, characterized by a growing emphasis on operational efficiency, environmental compliance, and the need to combat the pervasive issue of scaling in critical energy infrastructure. As exploration and production activities continue to push into more challenging environments, the demand for highly effective and specialized descaling solutions is on the rise. The report highlights a strong upward trajectory in the adoption of advanced chemical formulations designed to tackle a wider spectrum of scales, including calcium carbonate, barium sulfate, and iron sulfide, which are commonly encountered in both upstream and downstream operations. Furthermore, there is a discernible trend towards the development and deployment of descalers with improved environmental profiles, driven by stricter regulatory frameworks and a heightened corporate responsibility towards sustainable practices. This includes a shift towards biodegradable and low-toxicity formulations.

Technological advancements are playing a pivotal role in shaping market trends. The integration of smart monitoring systems that can predict and preempt scaling events is influencing the demand for proactive descaling strategies rather than reactive treatments. This predictive maintenance approach not only minimizes downtime but also optimizes the usage of descaling chemicals, leading to cost savings for operators. The report also indicates a growing interest in multi-functional descalers that can address scaling issues while simultaneously offering corrosion inhibition properties, thereby providing a dual benefit to asset protection. The evolving landscape of oil and gas extraction, including the increasing reliance on unconventional resources and the need to extend the lifespan of aging infrastructure, further underpins the sustained demand for effective descaling solutions. With global production expected to reach tens of millions of units in the coming years, the market is poised for robust growth. The increasing complexity of reservoirs and the necessity to maintain optimal flow rates are paramount, making descalers indispensable tools for maximizing hydrocarbon recovery and ensuring uninterrupted production. The industry's commitment to reducing operational expenditures while enhancing asset integrity is a key driver behind the continuous innovation and adoption of sophisticated descaling technologies.

The burgeoning demand for oil and gas descalers is intrinsically linked to several powerful driving forces that are shaping the global energy landscape. Foremost among these is the imperative for operational efficiency and production maximization. Scaling within pipelines, processing equipment, and storage tanks significantly impedes flow rates, reduces heat transfer efficiency, and can lead to catastrophic equipment failures. Effective descaling directly addresses these issues, ensuring optimal performance and maximizing hydrocarbon recovery, thereby bolstering profitability for oil and gas companies. Secondly, the aging infrastructure prevalent in many mature oil and gas producing regions necessitates continuous maintenance and intervention to prevent degradation and ensure continued operational viability. Descalers are a vital tool in this maintenance regimen, extending the lifespan of existing assets and deferring costly replacements.

The increasingly stringent environmental regulations globally are also a significant catalyst. As regulatory bodies impose stricter limits on emissions and waste disposal, there is a corresponding push for descaling solutions that are both highly effective and environmentally benign. This has spurred innovation in developing greener, lower-toxicity formulations. Furthermore, the pursuit of enhanced oil recovery (EOR) techniques often involves the injection of fluids that can exacerbate scaling issues. Consequently, the application of descalers becomes critical to maintain the efficacy of these advanced recovery methods and prevent blockages in injection wells and reservoirs. The global production of oil and gas descalers, estimated in the tens of millions of units annually, is a testament to the widespread application and critical nature of these chemicals across the entire oil and gas value chain. The continuous need to maintain asset integrity and minimize downtime in a highly competitive market environment firmly positions descalers as indispensable.

Despite the robust growth prospects, the oil and gas descaler market faces several inherent challenges and restraints that can influence its trajectory. A primary concern is the complexity and variability of scale formation. Different geological formations and operational conditions lead to diverse types of scales, each requiring specialized descaling agents and treatment protocols. Developing universal descalers that are effective across all scenarios remains a significant technical hurdle, often necessitating customized solutions that can increase costs and lead times. Furthermore, the environmental impact and regulatory scrutiny associated with the use of chemical descalers pose a continuous challenge. While there is a drive towards greener alternatives, many traditional and highly effective descalers contain harsh chemicals that can pose risks to ecosystems if not handled and disposed of properly. Stringent regulations regarding chemical usage, wastewater discharge, and worker safety can increase compliance costs and limit the application of certain products.

The high cost of research and development for novel descaling technologies can also act as a restraint. Developing new formulations that are more effective, environmentally friendly, and cost-efficient requires significant investment. This can be particularly challenging for smaller players in the market. Moreover, the fluctuations in oil and gas prices can indirectly impact the demand for descalers. During periods of low oil prices, exploration and production activities may be curtailed, leading to reduced demand for chemical consumables, including descalers. Conversely, during periods of high prices, increased activity drives demand. The logistical complexities of deploying descalers, especially in remote offshore locations or challenging onshore environments, can also present operational and cost challenges, impacting the overall market accessibility and adoption. The global production, estimated in the tens of millions of units, is subject to these market dynamics.

The global oil and gas descaler market is characterized by regional variations in demand, driven by the intensity of oil and gas exploration, production, and refining activities, as well as regulatory landscapes.

Dominant Region: North America

Dominant Segment: Liquid Type

While other regions like the Middle East and Asia-Pacific are experiencing significant growth due to new exploration and infrastructure development, North America's established industry and technological advancement currently position it as the leading market. Within segments, the inherent advantages of liquid descalers in terms of application and versatility solidify their leadership.

The oil and gas descaler industry is poised for continued growth, fueled by several key catalysts. The ever-present need to maximize hydrocarbon recovery from both conventional and unconventional reserves, coupled with the drive to extend the operational life of aging infrastructure, remains a primary growth driver. Furthermore, the increasing global focus on sustainable energy production and environmental compliance is spurring innovation in developing eco-friendly and low-toxicity descaling solutions, opening up new market avenues and appealing to environmentally conscious operators. The ongoing advancements in digitalization and smart technologies are also creating opportunities for predictive maintenance and optimized chemical application, leading to more efficient and cost-effective descaling strategies.

This report provides an all-encompassing analysis of the oil and gas descaler market, offering deep insights into its current state and future trajectory. It meticulously examines the market dynamics from 2019 to 2033, with a keen focus on the base year 2025 and the subsequent forecast period. The report details critical aspects such as market size, growth rates, segmentation by type (liquid, powder, gel, others) and application (refinery, food and beverage industries, construction sector, others), and regional analysis. It also delves into the competitive landscape, identifying key players and their strategies. The comprehensive coverage ensures that stakeholders gain a thorough understanding of the factors influencing demand, the challenges to overcome, and the immense growth opportunities that lie ahead in this vital segment of the energy industry. The global production figures, estimated in the tens of millions of units, underscore the market's significance.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dow Chemical Company, Solvay, Baker Hughes, Veolia Water Technologies, BWA Water Additives UK Ltd., SUEZ Water Technologies and Solutions, AWC Water Solutions, Ecolab Inc., Clearwater Technology Ltd., Solenis LLC, Kemira Oyj, Enercleanse, AkzoNobel N.V., Clariant AG, .

The market segments include Type, Application.

The market size is estimated to be USD 460.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Oil and Gas Descaler," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oil and Gas Descaler, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.