1. What is the projected Compound Annual Growth Rate (CAGR) of the Offset Printing Plate Making Consumables?

The projected CAGR is approximately 5.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Offset Printing Plate Making Consumables

Offset Printing Plate Making ConsumablesOffset Printing Plate Making Consumables by Type (PS Plate, CTP Plate, Chemicals), by Application (Books, Magazines, Newspapers, Packaging, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

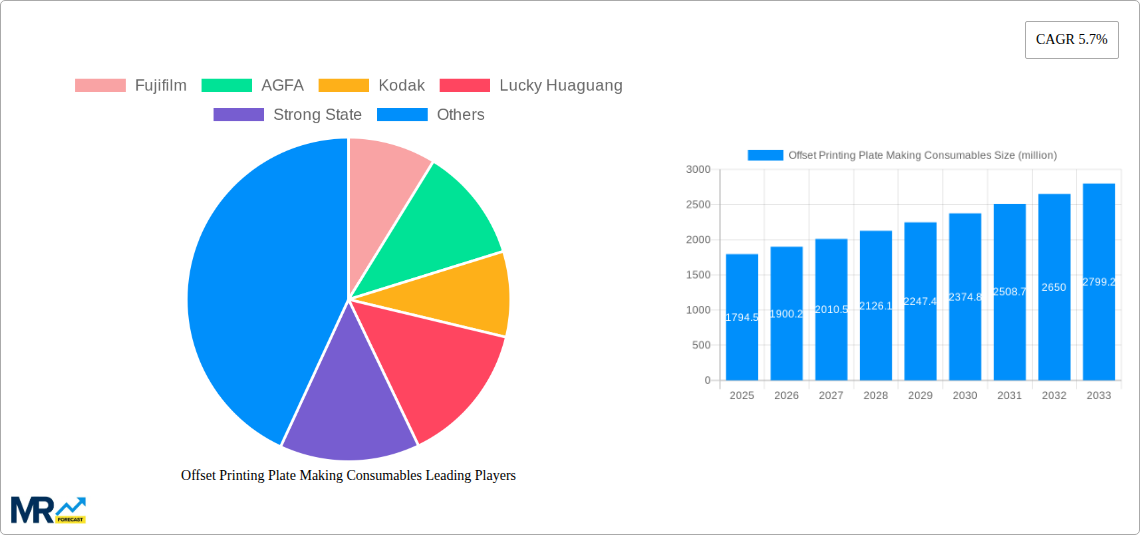

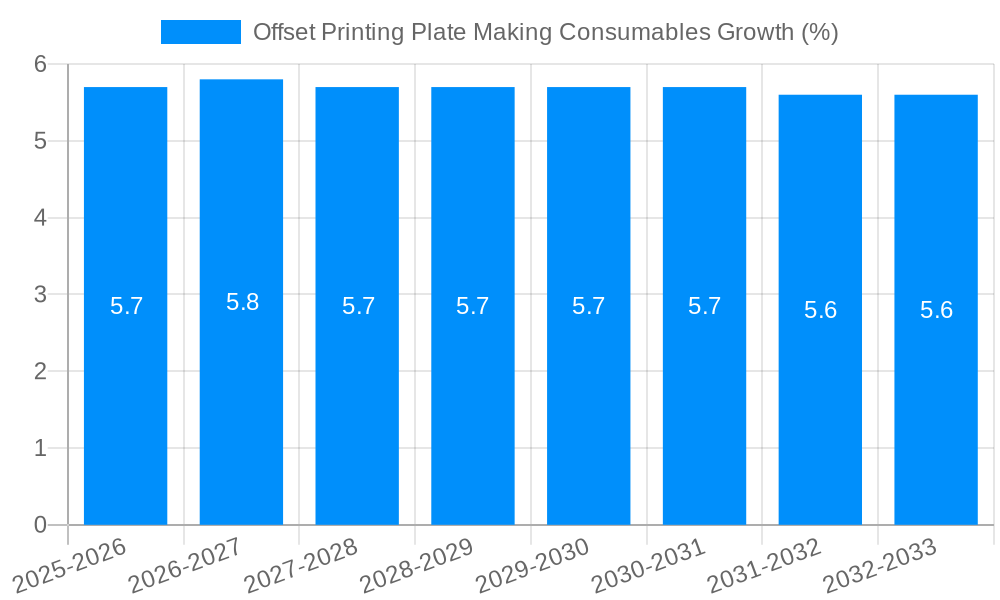

The global market for offset printing plate making consumables is projected to experience robust growth, reaching an estimated market size of USD 1794.5 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.7% anticipated throughout the forecast period of 2025-2033. This sustained expansion is primarily driven by the continued demand for high-quality printed materials across various sectors. While digital printing technologies have gained traction, offset printing remains the preferred method for large-volume, cost-effective production, especially for commercial printing applications. The market is segmented into key types, including PS Plates and CTP (Computer-to-Plate) Plates, with CTP technology steadily gaining dominance due to its efficiency, accuracy, and reduced environmental impact. Complementary chemicals are also integral to the plate-making process, supporting the operational needs of printing businesses. The application spectrum is broad, encompassing the production of books, magazines, newspapers, and increasingly, packaging materials, where the visual appeal and durability offered by offset printing are highly valued. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to market growth due to expanding print volumes and increasing adoption of advanced printing technologies.

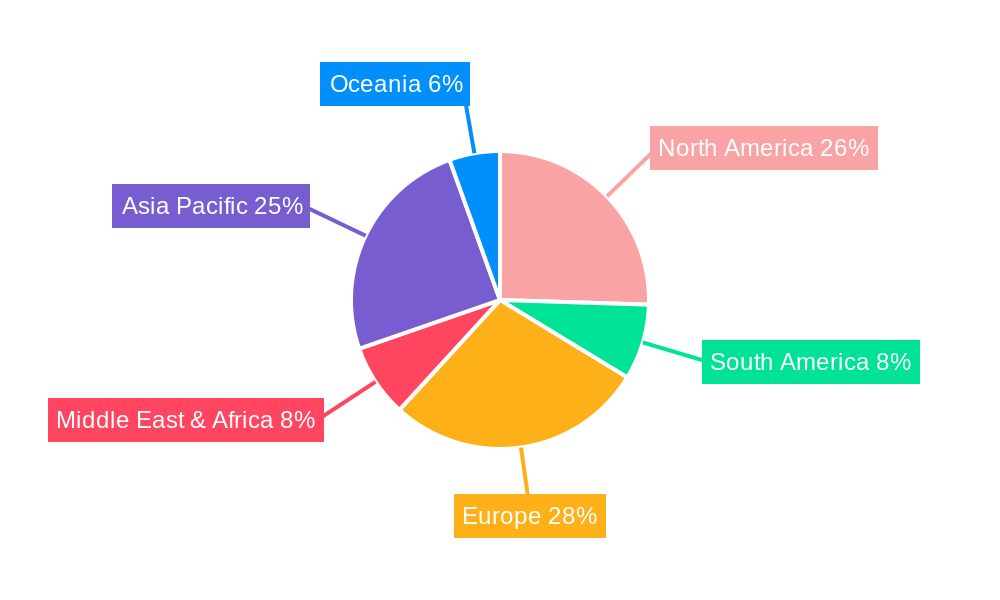

The offset printing plate making consumables market is characterized by intense competition among established global players and emerging regional manufacturers. Leading companies like Fujifilm, AGFA, and Kodak continue to innovate, focusing on developing more sustainable and efficient plate solutions. The market is navigating evolving consumer preferences and regulatory landscapes, with a growing emphasis on eco-friendly consumables and processes. Key trends include the shift towards CTP technology, the development of faster and more durable plates, and the integration of digital workflows. However, the market also faces certain restraints, such as the overall decline in print volumes for traditional media like newspapers, and the rising cost of raw materials, which can impact profitability. Despite these challenges, the persistent demand from the packaging sector, coupled with advancements in plate technology that enhance efficiency and quality, will continue to fuel market expansion. North America and Europe represent mature markets, while Asia Pacific is poised for substantial growth, driven by rapid industrialization and increasing print application demands.

This comprehensive report delves into the dynamic global market for offset printing plate making consumables, providing an in-depth analysis of market trends, driving forces, prevailing challenges, and future projections from 2019 to 2033. With a base year of 2025, the report offers critical insights into the market's trajectory, meticulously dissecting the historical performance during 2019-2024 and presenting robust forecasts for the 2025-2033 period. The study examines various product types, including PS Plates, CTP Plates, and Chemicals, alongside their application across diverse sectors such as Books, Magazines, Newspapers, Packaging, and Others. Furthermore, it explores the evolving industry developments shaping the landscape of offset printing plate making. The report leverages current market data, estimated figures for 2025, and projected volumes in the millions to offer a clear and actionable understanding of this vital segment of the printing industry.

XXX: The offset printing plate making consumables market is experiencing a significant transformation, driven by a confluence of technological advancements and evolving industry demands. A prominent trend is the accelerating shift from traditional PS (Printing Surface) plates to CTP (Computer-to-Plate) technology. This transition is primarily fueled by CTP's inherent advantages in terms of speed, accuracy, and reduced environmental impact, leading to a substantial increase in CTP plate consumption. The demand for CTP plates is projected to continue its upward trajectory, outperforming the growth of PS plates, particularly in high-volume commercial and packaging printing applications. Simultaneously, the chemicals segment is witnessing innovation focused on developing eco-friendlier formulations. With increasing environmental regulations and a growing emphasis on sustainability, manufacturers are investing heavily in research and development to create low-VOC (Volatile Organic Compound) and biodegradable printing chemicals. This includes advancements in plate developers, rinses, and fountain solutions that minimize waste and reduce the ecological footprint of the printing process. The report anticipates that the adoption of these greener alternatives will become a key differentiator for market players. Furthermore, the application landscape is diversifying. While traditional segments like magazines and newspapers may exhibit mature growth patterns, the packaging sector is emerging as a significant growth engine. The burgeoning e-commerce industry and the increasing need for visually appealing and informative product packaging are driving the demand for high-quality printing plates that can deliver exceptional detail and color fidelity. This necessitates the development of specialized plates and consumables capable of meeting the stringent requirements of the packaging industry. The "Others" segment, encompassing niche applications such as labels, commercial print for marketing collateral, and specialty printing, is also expected to contribute to market expansion, driven by the need for flexible and customized printing solutions. The report will meticulously analyze these diverging trends, providing quantitative data and qualitative insights into their impact on market segmentation and growth projections over the study period.

The offset printing plate making consumables market is experiencing robust growth, propelled by a multifaceted array of driving forces. Foremost among these is the relentless pursuit of enhanced efficiency and productivity within the printing industry. CTP technology, with its ability to directly image plates from digital data, significantly reduces make-ready times and labor costs, making it an indispensable tool for modern print shops. This technological imperative directly fuels the demand for CTP plates and the associated consumables, such as CTP platesetters and processing chemicals. Moreover, the increasing sophistication of printing applications, particularly in the packaging sector, is a significant catalyst. The demand for high-resolution graphics, vibrant colors, and consistent print quality for product differentiation and brand building necessitates the use of advanced printing plates and specialized consumables. The growth of e-commerce and the need for eye-catching retail packaging are further amplifying this trend, driving investment in plate making technologies and materials that can deliver superior visual appeal and functional properties. Additionally, growing awareness and stringent environmental regulations globally are pushing the industry towards more sustainable practices. This is driving the demand for eco-friendly plate making consumables, including waterless printing plates and low-VOC chemicals. Manufacturers who prioritize and develop such sustainable solutions are poised to capture significant market share. The report will further elaborate on how these underlying drivers are shaping the market dynamics, influencing product development, and dictating investment strategies for key players throughout the forecast period.

Despite the positive growth trajectory, the offset printing plate making consumables market faces several significant challenges and restraints that can impede its full potential. One of the most prominent challenges is the increasing competition from digital printing technologies. While offset printing maintains its dominance in high-volume runs and specific applications, digital printing offers advantages in terms of shorter runs, personalization, and faster turnaround times, leading some print service providers to invest in digital solutions, thereby reducing their reliance on traditional offset plate making. Furthermore, fluctuations in raw material prices pose a significant restraint. The cost of key raw materials used in the production of printing plates and chemicals, such as aluminum, photopolymers, and various chemical compounds, can be volatile due to global supply chain disruptions, geopolitical events, and commodity market fluctuations. This volatility directly impacts the profitability of consumable manufacturers and can lead to increased prices for end-users, potentially impacting demand. Another considerable challenge is the evolving regulatory landscape concerning environmental impact. While there's a drive towards greener consumables, the development and adoption of truly sustainable alternatives can be complex and costly. Compliance with increasingly stringent environmental regulations regarding waste disposal, chemical usage, and emissions can necessitate significant investment in new technologies and processes, posing a hurdle for smaller manufacturers. The consolidation within the printing industry also presents a challenge. As printing companies merge or downsize, the overall demand for consumables might be concentrated among fewer, larger players, potentially altering purchasing power and negotiation dynamics. The report will provide an in-depth analysis of these challenges, quantifying their potential impact on market growth and offering insights into how industry players are strategizing to mitigate these restraints and navigate the complexities of the market.

The global offset printing plate making consumables market is characterized by distinct regional dynamics and segment dominance. Among the various segments, CTP Plates are projected to be the leading force driving market growth across most regions. This dominance stems from the inherent advantages of CTP technology, including its superior image quality, faster production speeds, and reduced environmental impact compared to traditional PS plates. As print shops worldwide continue to invest in modernizing their workflows, the demand for CTP plates is expected to witness a consistent and significant expansion.

Asia Pacific is anticipated to emerge as the dominant region in the offset printing plate making consumables market. This leadership is attributed to several factors:

Within the application segments, Packaging is poised to be a significant growth driver and a key segment to dominate market share, especially in developed and rapidly developing economies. The relentless growth of e-commerce, the increasing consumer demand for visually appealing product packaging, and the need for brand differentiation are all contributing to the expansion of the packaging printing sector. This, in turn, drives the demand for high-quality printing plates and specialized consumables capable of delivering sharp images, accurate color reproduction, and durability for various packaging materials. The report will provide detailed market size estimations and growth forecasts for each region and key segment, offering a granular view of the market landscape. For instance, the global market for CTP plates is projected to reach 350 million units by 2025, with Asia Pacific accounting for over 30% of this volume. Similarly, the Packaging application segment is expected to contribute approximately 28% of the total consumables market revenue by the forecast year.

Several key factors are acting as growth catalysts for the offset printing plate making consumables industry. The escalating demand for high-quality packaging, driven by e-commerce growth and brand differentiation strategies, is a primary catalyst, pushing the need for advanced printing plates and specialized chemicals. Furthermore, the ongoing technological evolution towards CTP technology, offering enhanced precision and efficiency, continues to drive the adoption of associated consumables. The increasing global emphasis on sustainability is also a significant catalyst, fostering the development and uptake of eco-friendly plate making solutions and chemicals with reduced environmental impact.

This report offers an all-encompassing analysis of the offset printing plate making consumables market, delving into every critical aspect from historical performance to future projections. It provides granular insights into market segmentation by product type (PS Plates, CTP Plates, Chemicals) and application (Books, Magazines, Newspapers, Packaging, Others). The study meticulously examines the influence of industry developments and technological advancements on market dynamics. With detailed market size estimations in millions of units for the study period (2019-2033), including base and estimated years, the report serves as an indispensable resource for stakeholders seeking to understand current trends, identify growth opportunities, and formulate effective business strategies in this evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include Fujifilm, AGFA, Kodak, Lucky Huaguang, Strong State, Huafeng, Xingraphics, Bocica, Presstek, Ronsein, Toray Waterless, Konita, Top High, Changge Huida Photosensitive Material, Tiancheng Printing, .

The market segments include Type, Application.

The market size is estimated to be USD 1794.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Offset Printing Plate Making Consumables," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Offset Printing Plate Making Consumables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.