1. What is the projected Compound Annual Growth Rate (CAGR) of the Off Road Electric Vehicles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Off Road Electric Vehicles

Off Road Electric VehiclesOff Road Electric Vehicles by Type (Two-wheeled, Three-wheeled, Four-wheeled), by Application (Agriculture, Construction, Transportation, Logistics, Military, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

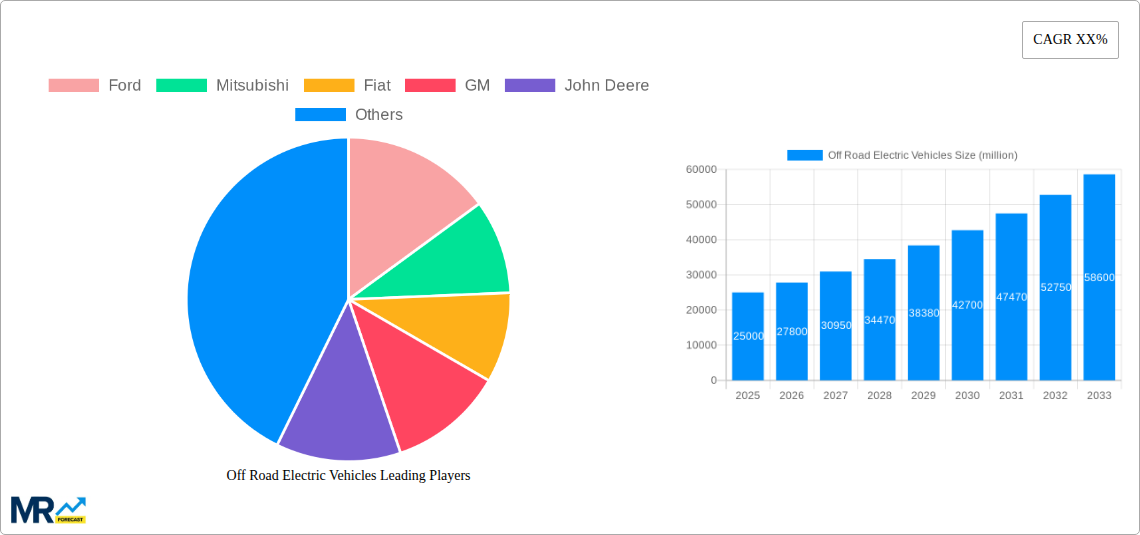

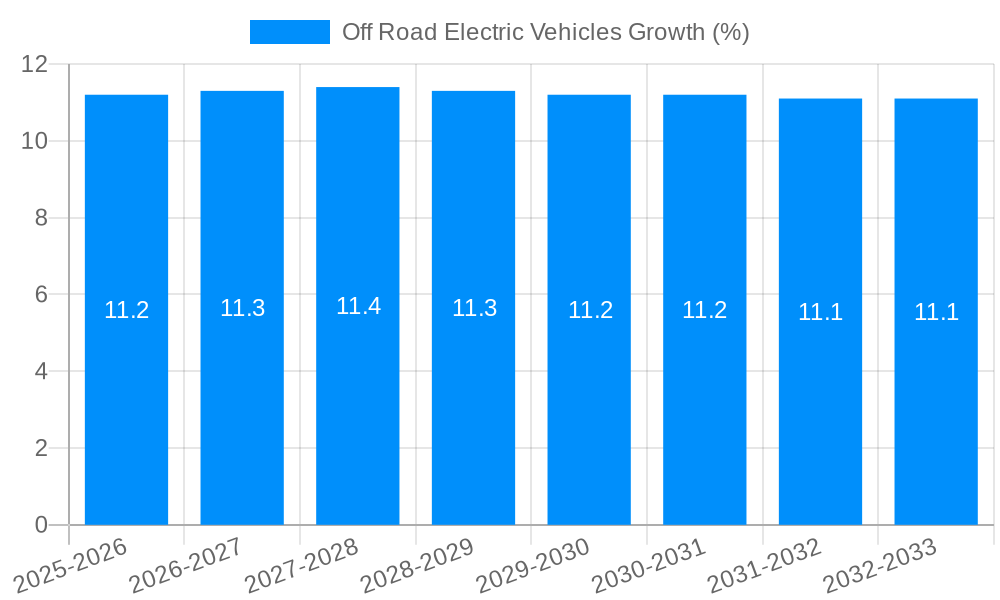

The global Off-Road Electric Vehicle market is poised for substantial expansion, projected to reach an estimated USD 25,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This growth is fueled by a confluence of escalating environmental consciousness, stringent emission regulations, and advancements in battery technology that are making electric powertrains more viable and cost-effective for off-road applications. Key drivers include the increasing demand for sustainable solutions in sectors like agriculture and construction, where reduced noise pollution and lower operational costs are significant advantages. Furthermore, the growing adoption of electric utility vehicles (UTVs) and all-terrain vehicles (ATVs) for recreational purposes is also contributing to market momentum.

The market's trajectory is further shaped by several evolving trends. The emergence of specialized electric vehicles for niche applications within agriculture, such as precision farming equipment, and for construction, like electric excavators and loaders, is a notable development. Logistics operations are also increasingly exploring electric options for last-mile delivery in challenging terrains. While the initial cost of these vehicles can be a restraining factor, declining battery prices, government incentives for electric vehicle adoption, and the long-term savings on fuel and maintenance are steadily mitigating this concern. Major players like Ford, Toyota, Yamaha, and John Deere are actively investing in research and development, introducing innovative models across various segments, from two-wheeled to four-wheeled vehicles, to capture market share and cater to diverse consumer needs across key regions like North America, Europe, and Asia Pacific.

This comprehensive report offers an in-depth analysis of the global Off-Road Electric Vehicles (OREVs) market, providing crucial insights for stakeholders across various industries. The study meticulously examines market dynamics from the Historical Period (2019-2024), establishing a robust Base Year (2025) for detailed analysis and projecting future trends through the Forecast Period (2025-2033), with key estimations made for 2025. The Study Period (2019-2033) ensures a broad perspective, capturing both past performance and future potential.

XXX The global Off-Road Electric Vehicles (OREVs) market is experiencing a significant surge, projected to witness a Compound Annual Growth Rate (CAGR) that will reshape the landscape of off-road mobility. This expansion is driven by a confluence of technological advancements, evolving environmental regulations, and a growing demand for sustainable and efficient solutions across diverse applications. In the Base Year of 2025, the market is poised for substantial growth, with preliminary estimates indicating a robust upward trajectory. The Study Period (2019-2033) highlights a transformative journey, moving from a nascent stage in the Historical Period (2019-2024) to a mature and dynamic market by the end of the Forecast Period (2025-2033). The adoption of electric powertrains in vehicles designed for rugged terrains, from agricultural tractors to military all-terrain vehicles, is no longer a niche concept but a rapidly mainstreaming reality. This shift is fundamentally altering operational costs for end-users, with reduced fuel expenses and lower maintenance requirements becoming major advantages. Furthermore, the quiet operation of electric motors is proving beneficial in noise-sensitive environments such as wildlife reserves and residential areas adjacent to work sites. The increasing availability of charging infrastructure, albeit still a developing area for off-road scenarios, is also playing a pivotal role in fostering market confidence and facilitating broader adoption. As battery technology continues to advance, offering improved energy density and faster charging capabilities, the range limitations that once hindered OREV deployment are steadily being overcome. This progress is enabling OREVs to tackle longer durations and more demanding tasks, making them increasingly viable alternatives to their internal combustion engine (ICE) counterparts. The market is also witnessing a diversification of OREV offerings, catering to a wider spectrum of needs. From compact, lightweight two-wheeled vehicles for personal recreation and light logistics to heavy-duty four-wheeled industrial machines, the innovation pipeline is robust. The convergence of smart technologies, including advanced telematics and autonomous capabilities, is further enhancing the appeal and functionality of OREVs, positioning them at the forefront of sustainable innovation in the off-road sector.

The burgeoning Off-Road Electric Vehicles (OREVs) market is being propelled by a powerful synergy of factors. Foremost among these is the escalating global emphasis on sustainability and environmental responsibility. Governments worldwide are enacting stricter emissions regulations, incentivizing the adoption of zero-emission technologies and making electric powertrains an increasingly attractive option. This regulatory push, coupled with growing consumer and corporate awareness of climate change, is creating a fertile ground for OREV expansion. Beyond environmental concerns, significant advancements in battery technology are playing a crucial role. Improvements in energy density, cost reduction, and lifespan are making electric powertrains more practical and economically viable for off-road applications. The enhanced performance characteristics of electric motors, such as instant torque and quieter operation, also contribute to their appeal, offering improved efficiency and user experience in various challenging environments. The burgeoning demand for specialized vehicles in sectors like agriculture, construction, and logistics further fuels OREV growth. Electric utility vehicles are proving adept at handling demanding tasks with reduced operational costs and environmental impact. Moreover, the increasing integration of smart technologies and automation in off-road machinery is a key driver. OREVs are well-suited for integration with advanced features like GPS navigation, remote monitoring, and autonomous operation, which are becoming essential for improving productivity and safety in industrial and agricultural settings. The growing investment in research and development by leading automotive and industrial manufacturers is also contributing to a faster pace of innovation and product diversification, making OREVs more accessible and versatile.

Despite the optimistic outlook, the Off-Road Electric Vehicles (OREVs) market encounters several significant challenges and restraints that could temper its growth trajectory. A primary hurdle remains the cost of acquisition. While long-term operational savings are a compelling benefit, the upfront investment for OREVs can often be higher than for comparable internal combustion engine (ICE) vehicles, particularly for specialized industrial and agricultural equipment. This price disparity can deter adoption, especially for smaller businesses or in regions with less robust financial incentives. Charging infrastructure availability and speed represent another critical bottleneck. Unlike urban environments where charging stations are becoming more prevalent, off-road locations often lack dedicated power sources or reliable grid access. This necessitates the development of robust off-grid charging solutions or the implementation of mobile charging units, which can add complexity and cost to operations. Furthermore, the range anxiety associated with electric vehicles, while diminishing with technological advancements, still persists, particularly for applications requiring extended operational periods or covering vast terrains without immediate access to charging facilities. Battery performance in extreme temperatures also poses a challenge for OREVs. Off-road environments can subject vehicles to a wide range of temperatures, from scorching heat to freezing cold, which can impact battery efficiency and lifespan, requiring specialized thermal management systems. Finally, limited model availability and customization options for certain niche off-road applications can hinder widespread adoption. While the market is expanding, specialized requirements in sectors like mining or heavy-duty construction may still be better served by established ICE technologies, until OREV offerings mature further to meet these precise demands.

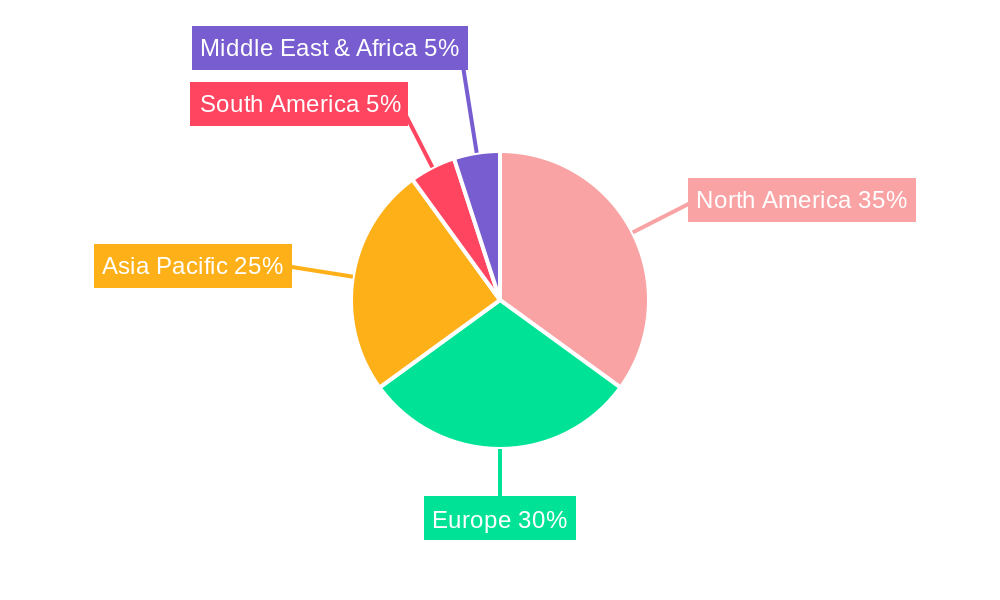

The Off-Road Electric Vehicles (OREVs) market is expected to witness dominant growth in key regions and specific segments, driven by a combination of regulatory support, technological adoption, and specific application demands.

North America (particularly the United States and Canada): This region is poised to lead due to strong government initiatives promoting electric vehicle adoption, including substantial tax incentives and grants for businesses and individuals. The presence of major OREV manufacturers and a robust agricultural and construction sector also contributes significantly. The large landmass and diverse terrains necessitate efficient and sustainable off-road solutions.

Europe (especially Germany, Norway, and France): Europe's stringent environmental regulations and ambitious climate targets are a major catalyst for OREV adoption. Countries like Norway have already demonstrated a strong commitment to electrification across all vehicle types. The emphasis on sustainable agriculture and forestry practices in many European nations further fuels demand for electric utility vehicles and tractors.

Dominant Segments:

Four-Wheeled Vehicles: This segment is expected to dominate owing to its versatility and wide range of applications.

Other Applications:

The growth in these regions and segments is further bolstered by the increasing investment from key players. For instance, Ford is expanding its electric vehicle portfolio, which includes potential future offerings for off-road applications. Toyota and Nissan are also making strides in electric mobility, and their expertise could translate into innovative OREV solutions. Polaris and Yamaha are well-established in the recreational off-road vehicle market and are actively exploring electrification. The sheer breadth of applications for four-wheeled vehicles, coupled with strong regional mandates and a growing awareness of the benefits of electrification, positions this segment and these regions for substantial market dominance in the coming years.

Several key factors are acting as significant growth catalysts for the Off-Road Electric Vehicles (OREVs) industry. The escalating global focus on environmental sustainability and the increasing stringency of emission regulations are primary drivers, compelling businesses and governments to seek cleaner alternatives. Advancements in battery technology, including higher energy density and faster charging capabilities, are directly addressing range anxiety and operational efficiency concerns, making OREVs more practical for demanding off-road use. Furthermore, the rising demand for electric solutions in key sectors like agriculture, construction, and logistics, where operational cost reduction and reduced environmental impact are paramount, is fueling market expansion. Government incentives, subsidies, and supportive policies aimed at promoting electric vehicle adoption are also playing a crucial role in accelerating market penetration and encouraging investment in OREV research and development.

This report provides a holistic view of the Off-Road Electric Vehicles (OREVs) market, covering its trajectory from 2019 to 2033. It delves into the intricate interplay of market trends, identifying key drivers of growth such as technological advancements in battery technology and increasing environmental regulations. Simultaneously, it addresses the critical challenges and restraints, including upfront costs and charging infrastructure limitations, that the industry must overcome. The report meticulously analyzes the dominant regions and segments, offering insights into where and in which applications OREVs are expected to make the biggest impact, particularly focusing on the Four-Wheeled vehicle segment within Agriculture and Construction. It also identifies the leading players and their strategic initiatives, alongside significant developments that are shaping the future of this dynamic sector. This comprehensive analysis equips stakeholders with the essential knowledge to navigate the evolving OREV landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ford, Mitsubishi, Fiat, GM, John Deere, Alkè, Textron Specialized Vehicles, Polaris, Yamaha, Toyota, Nissan, Toro, Exmark, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Off Road Electric Vehicles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Off Road Electric Vehicles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.