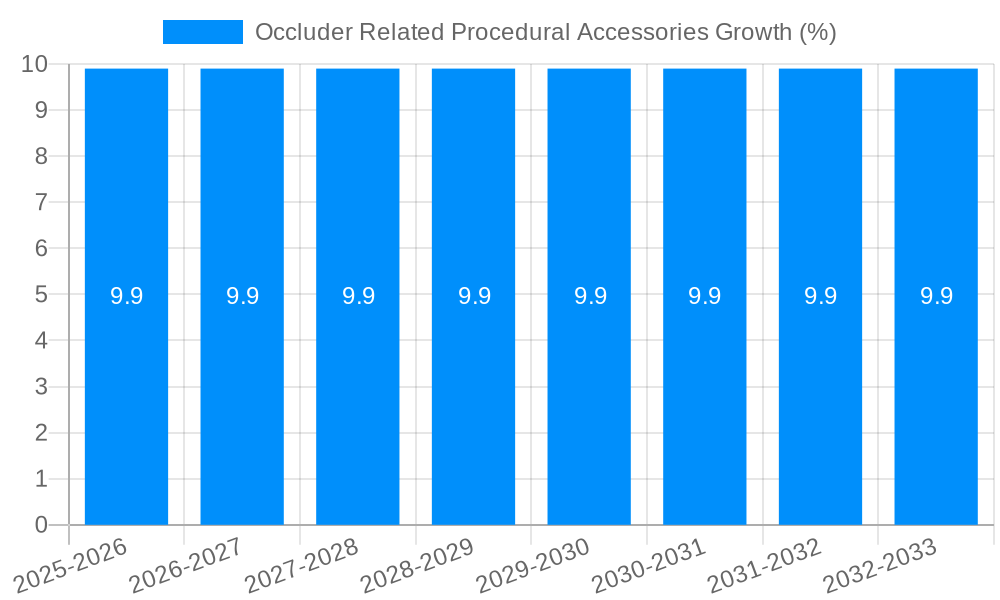

1. What is the projected Compound Annual Growth Rate (CAGR) of the Occluder Related Procedural Accessories?

The projected CAGR is approximately 9.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Occluder Related Procedural Accessories

Occluder Related Procedural AccessoriesOccluder Related Procedural Accessories by Type (Interventional Delivery Systems, Snares), by Application (Hospitals, Ambulatory Surgical Centers, Cardiac Catheterization Laboratory), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

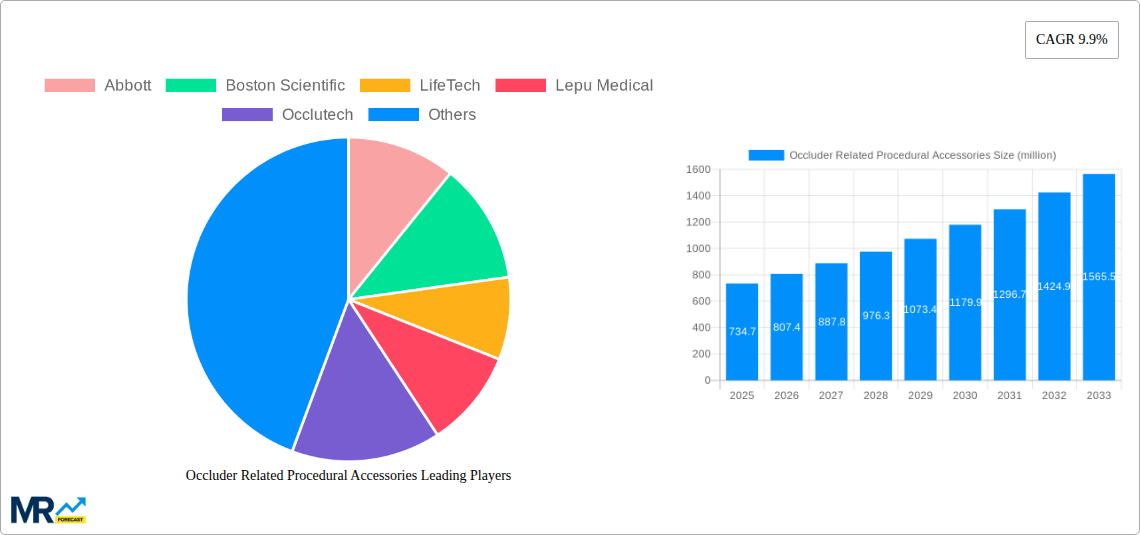

The global market for Occluder Related Procedural Accessories is poised for robust growth, projected to reach approximately USD 734.7 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 9.9% during the forecast period of 2025-2033. This significant expansion is primarily driven by the increasing prevalence of cardiovascular diseases worldwide, coupled with the growing adoption of minimally invasive procedures. Interventional delivery systems and snares, key segments within this market, are witnessing heightened demand due to their efficacy in treating congenital heart defects and other cardiac conditions. Hospitals and ambulatory surgical centers are emerging as the dominant end-use segments, benefiting from advancements in medical technology that enable more precise and safer interventions. The cardiac catheterization laboratory also plays a crucial role, serving as a central hub for these specialized procedures. Leading companies such as Abbott, Boston Scientific, and LifeTech are actively investing in research and development, introducing innovative products that enhance procedural outcomes and patient recovery, thereby fueling market expansion.

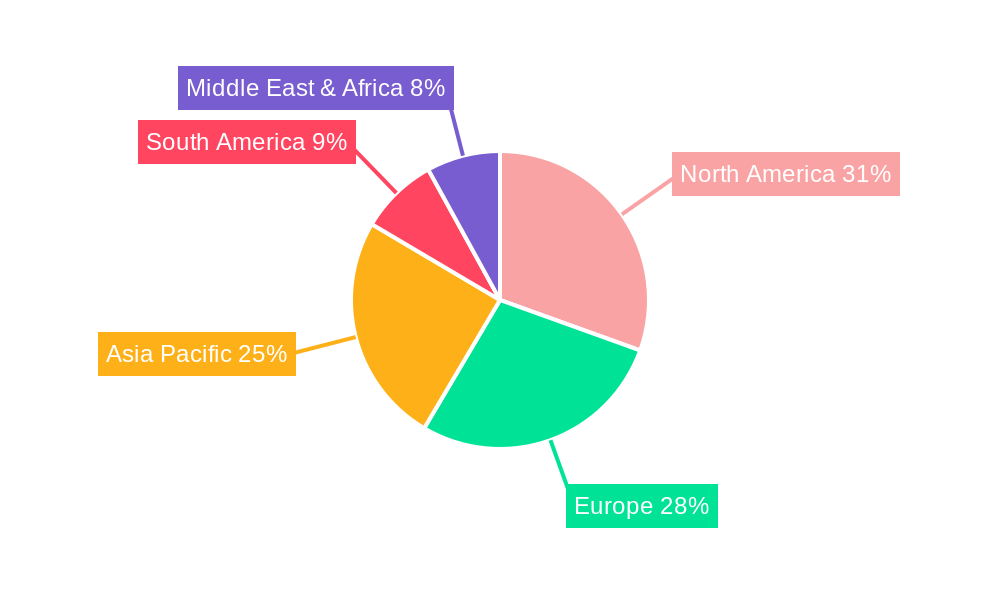

The market is also influenced by several key trends, including the development of next-generation occluder devices with improved biocompatibility and deployability, and the increasing focus on patient-specific treatment approaches. Furthermore, technological advancements in imaging and navigation systems are contributing to the precision and success rates of procedures involving occluder-related accessories. While the market is largely driven by positive factors, certain restraints, such as the high cost of advanced medical devices and reimbursement challenges in some regions, could moderate the growth trajectory. However, the rising awareness about minimally invasive cardiac interventions and the expanding healthcare infrastructure, particularly in emerging economies, are expected to offset these challenges. The Asia Pacific region, with its large population and growing healthcare expenditure, is anticipated to present significant growth opportunities for market players.

Here's a report description for Occluder Related Procedural Accessories, incorporating your specifications:

This in-depth market intelligence report provides a comprehensive analysis of the Occluder Related Procedural Accessories market, offering critical insights and actionable data for stakeholders. The study encompasses a Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year of 2025, projecting forward through the Forecast Period of 2025-2033, and examining the Historical Period of 2019-2024. Our meticulous research delves into market dynamics, key trends, driving forces, challenges, and the competitive landscape, equipping you with the knowledge to navigate this evolving sector. The report estimates the global Occluder Related Procedural Accessories market to be valued at approximately $8.5 million in 2025, with significant growth projected through the forecast period. We analyze various segments including Interventional Delivery Systems and Snares, and assess the market's penetration across Hospitals, Ambulatory Surgical Centers, and Cardiac Catheterization Laboratories. Key industry developments and strategic initiatives from leading players such as Abbott, Boston Scientific, LifeTech, Lepu Medical, Occlutech, W. L. Gore & Associates, Starway, Coherex Medical, Cardia, and MicroPort are thoroughly examined. This report is an indispensable resource for manufacturers, suppliers, investors, and healthcare providers seeking to understand and capitalize on the opportunities within the Occluder Related Procedural Accessories market.

The Occluder Related Procedural Accessories market is currently experiencing a transformative phase, characterized by an escalating demand driven by the increasing prevalence of cardiovascular diseases and congenital heart defects globally. The XXX represents a significant shift towards minimally invasive procedures, directly impacting the need for advanced and reliable procedural accessories. This trend is particularly evident in the growing adoption of transcatheter interventions, which necessitate specialized delivery systems and snares designed for enhanced precision and patient safety. The market is witnessing a continuous influx of innovative products, reflecting the commitment of key players like Abbott and Boston Scientific to refine existing technologies and develop novel solutions. For instance, the development of more atraumatic delivery systems, improved imaging integration, and biocompatible materials are key trends shaping product development. The rising awareness among both healthcare professionals and patients regarding the benefits of percutaneous procedures, such as shorter recovery times and reduced hospital stays, further fuels this demand. Furthermore, the increasing investments in research and development by companies like LifeTech and Lepu Medical are leading to the introduction of next-generation accessories that offer enhanced maneuverability and improved success rates in complex anatomies. The expanding healthcare infrastructure, particularly in emerging economies, also contributes to the market's growth trajectory. As a result, the market is poised for robust expansion, with significant opportunities arising from the need for more sophisticated and user-friendly procedural tools. The estimated market value in 2025 stands at approximately $8.5 million, indicating a substantial market size with considerable potential for further growth in the coming years, driven by technological advancements and increasing procedural volumes. The focus on patient outcomes and the drive for cost-effectiveness in healthcare are paramount considerations that are influencing the design and adoption of these crucial accessories.

The growth trajectory of the Occluder Related Procedural Accessories market is propelled by a confluence of powerful factors, primarily centered around the escalating global burden of cardiovascular diseases and congenital heart defects. As the world grapples with an aging population and lifestyle-related health issues, the incidence of conditions requiring occluder implantation, such as atrial septal defects (ASDs), patent foramen ovale (PFOs), and ventricular septal defects (VSDs), continues to rise. This burgeoning patient pool directly translates into an increased demand for the sophisticated procedural accessories essential for the successful delivery and placement of these occluders. Furthermore, the relentless pursuit of minimally invasive treatment modalities by healthcare providers worldwide serves as a significant catalyst. Transcatheter interventions, which leverage these accessories, offer distinct advantages over traditional open-heart surgeries, including reduced patient trauma, shorter hospital stays, faster recovery times, and lower overall healthcare costs. This paradigm shift towards less invasive approaches inherently necessitates a sophisticated suite of procedural accessories, including advanced delivery systems and precise snares, to navigate complex anatomical structures with unparalleled accuracy. The continuous innovation and product development efforts spearheaded by leading manufacturers like Boston Scientific and W. L. Gore & Associates, focusing on enhancing device functionality, improving biocompatibility, and simplifying procedural steps, further incentivize adoption and drive market expansion. The commitment to investing in research and development by companies like LifeTech and Occlutech is constantly pushing the boundaries of what is possible, leading to the creation of safer and more effective procedural tools. The global market for Occluder Related Procedural Accessories is projected to reach $15.2 million by 2033, demonstrating a strong upward trend fueled by these fundamental drivers.

Despite the promising growth outlook, the Occluder Related Procedural Accessories market is not without its inherent challenges and restraints that warrant careful consideration. One of the primary hurdles is the stringent regulatory landscape governing the approval and commercialization of medical devices. Obtaining regulatory clearance from bodies like the FDA and EMA can be a lengthy, complex, and expensive process, potentially delaying the market entry of innovative products and impacting the profitability of manufacturers. Companies like Lepu Medical and Cardia must navigate these intricate regulatory pathways for each new accessory they develop. Furthermore, the high cost of advanced procedural accessories can pose a significant restraint, particularly in resource-limited healthcare settings. While minimally invasive procedures offer long-term cost savings, the initial investment in specialized delivery systems and snares can be substantial, potentially limiting their widespread adoption in certain regions or healthcare facilities. The reimbursement policies associated with these procedures and the associated accessories can also present a challenge. Inconsistent or inadequate reimbursement rates may disincentivize healthcare providers from utilizing the most advanced and potentially beneficial accessories. Technical complexities and the need for specialized training for interventional cardiologists and surgeons to effectively utilize these sophisticated accessories can also be a barrier. While efforts are made to enhance user-friendliness, a certain level of expertise is still required, which can limit the adoption rate in facilities lacking adequately trained personnel. Finally, the risk of adverse events and complications, although minimized with advanced accessories, remains a concern. Any reported complications can lead to increased scrutiny, potentially impacting market confidence and driving up insurance costs for manufacturers. These factors collectively influence the pace of market penetration and necessitate strategic approaches from industry players to mitigate their impact.

The global Occluder Related Procedural Accessories market is characterized by a dynamic interplay of regional dominance and segment leadership, with distinct areas poised to drive significant growth.

North America is expected to continue its reign as a dominant region in the Occluder Related Procedural Accessories market throughout the forecast period (2025-2033). This dominance is attributed to several key factors:

Segment Dominance: Interventional Delivery Systems The segment of Interventional Delivery Systems is anticipated to be a leading contributor to the Occluder Related Procedural Accessories market's revenue and volume. This segment is crucial as it directly facilitates the precise and safe delivery of occluder devices to their target locations within the heart.

Application Dominance: Hospitals and Cardiac Catheterization Laboratories Within the application segment, Hospitals and, more specifically, Cardiac Catheterization Laboratories within hospitals, will continue to be the primary end-users and thus the dominant market segment.

While Ambulatory Surgical Centers will see growth, especially for less complex procedures, the critical nature and specialized requirements of many occluder implantations will keep hospitals and their dedicated cardiac catheterization laboratories at the forefront of market demand for Occluder Related Procedural Accessories.

Several key growth catalysts are propelling the Occluder Related Procedural Accessories industry forward. The escalating global prevalence of cardiovascular diseases and congenital heart defects is a primary driver, necessitating more interventional procedures. The unwavering shift towards minimally invasive cardiac interventions, offering reduced patient trauma and faster recovery, directly fuels the demand for specialized accessories. Continuous technological innovation, focusing on enhanced precision, maneuverability, and patient safety in delivery systems and snares, further incentivizes adoption. The expanding healthcare infrastructure in emerging economies, coupled with increasing physician awareness and training, is also unlocking new market opportunities.

This report offers an unparalleled and comprehensive view of the Occluder Related Procedural Accessories market. It meticulously details market size, segmentation, regional analysis, and forecast projections from 2019 to 2033, with a specific focus on the Base Year of 2025. Beyond quantitative data, the report delves into the qualitative aspects, dissecting the driving forces behind market expansion, the critical challenges and restraints that require strategic navigation, and the pivotal role of leading players and their innovative contributions. Furthermore, it highlights significant industry developments and emerging trends, providing a holistic understanding of the competitive landscape and future opportunities within this vital sector of interventional cardiology.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.9%.

Key companies in the market include Abbott, Boston Scientific, LifeTech, Lepu Medical, Occlutech, W. L. Gore & Associates, Starway, Coherex Medical, Cardia, MicroPort, .

The market segments include Type, Application.

The market size is estimated to be USD 734.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Occluder Related Procedural Accessories," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Occluder Related Procedural Accessories, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.