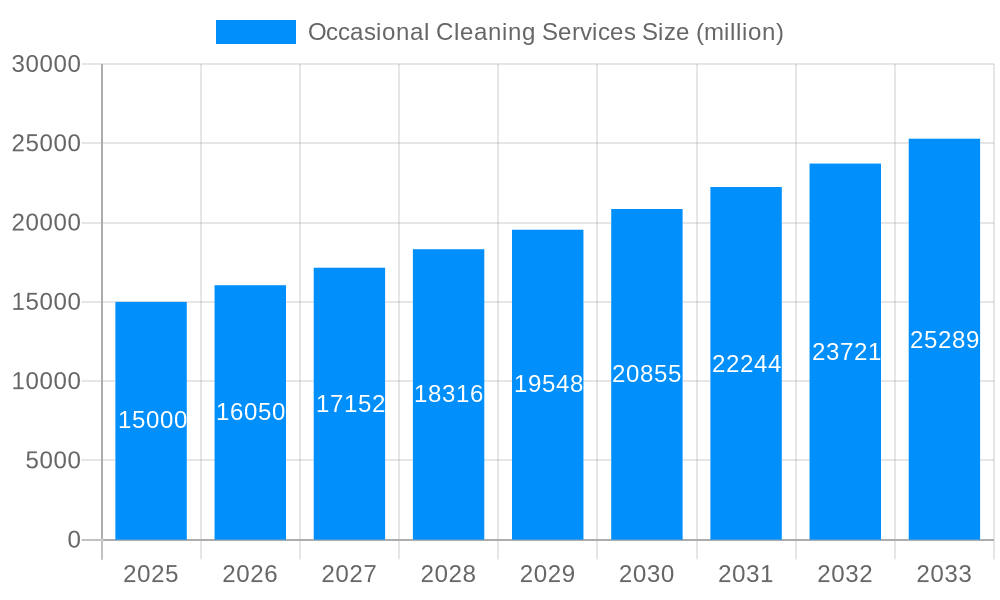

1. What is the projected Compound Annual Growth Rate (CAGR) of the Occasional Cleaning Services?

The projected CAGR is approximately 7.19%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Occasional Cleaning Services

Occasional Cleaning ServicesOccasional Cleaning Services by Application (Residential, Commercial), by Type (Regular Office Cleaning, Deep Office Cleaning), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The occasional cleaning services market is poised for substantial expansion, propelled by rising disposable incomes, increasingly busy lifestyles, and a growing inclination to outsource domestic responsibilities. The market, valued at $451.63 billion in the base year 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.19% from 2025 to 2033. This growth trajectory is supported by burgeoning trends such as the proliferation of on-demand cleaning platforms via mobile applications, escalating demand for specialized cleaning services including deep cleaning and eco-friendly alternatives, and the strategic entry into untapped niche markets like occasional commercial cleaning. Despite potential headwinds from economic fluctuations and independent service providers, the market outlook remains highly favorable, particularly in developed economies characterized by high per capita earnings. The residential sector currently leads market share, though the commercial segment is experiencing accelerated growth driven by the demand for efficient and dependable cleaning solutions for offices and other business premises. Prominent service categories encompass routine office maintenance and less frequent, intensive deep office cleaning. Key participants in this dynamic industry range from major national entities to agile local businesses, underscoring the dual importance of brand visibility and personalized service delivery.

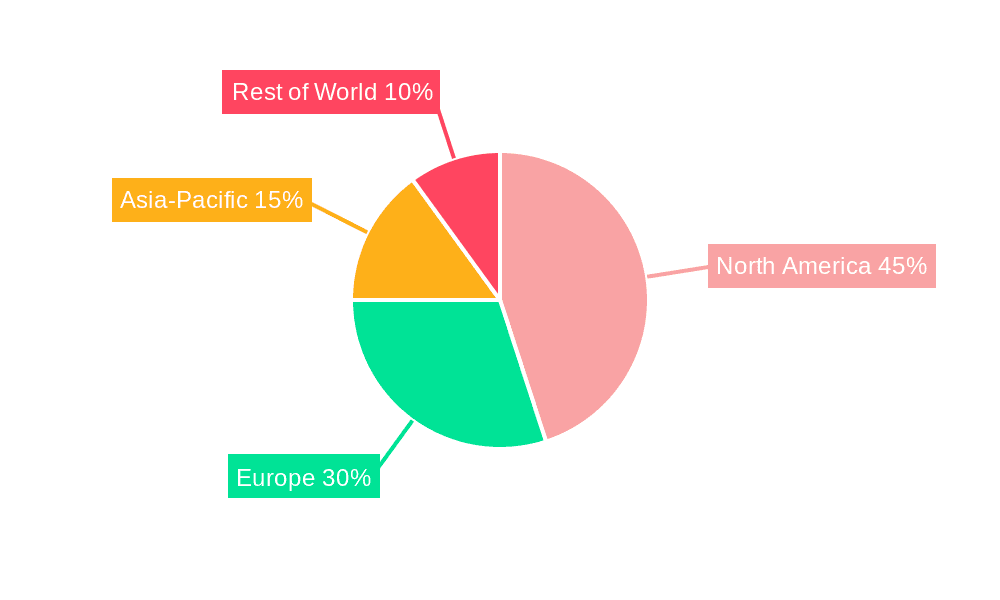

Geographically, North America and Europe currently demonstrate significant market penetration, attributed to their robust economies and mature service sectors. Nevertheless, Asia-Pacific and other emerging markets present considerable growth potential, fueled by expanding middle classes and evolving lifestyle patterns that increasingly favor convenient home services. Service segmentation effectively addresses a spectrum of consumer requirements. Residential cleaning prioritizes convenience and recurring arrangements, while commercial cleaning emphasizes operational efficiency and bespoke solutions for diverse business environments. This segmentation aligns with shifting consumer preferences and fosters market distinction, thereby contributing to the sustained growth of the overall occasional cleaning services market. Future expansion will likely be driven by technological integration, the adoption of sustainable practices, and an elevated customer experience through enhanced online booking and service management systems.

The occasional cleaning services market, valued at USD X million in 2025, is poised for significant growth during the forecast period (2025-2033). Driven by evolving lifestyles, increased disposable incomes in many regions, and a growing preference for convenience, the demand for occasional cleaning services – encompassing both residential and commercial applications – is experiencing a substantial upswing. The historical period (2019-2024) witnessed a steady rise in market size, reflecting a growing awareness of the benefits of outsourcing cleaning tasks. This trend is further amplified by the increasing number of dual-income households and busy professionals who prioritize time efficiency. While regular cleaning services remain popular, the segment dedicated to occasional deep cleans or one-time services for specific events (e.g., pre-holiday cleaning, post-renovation cleaning) demonstrates particularly robust growth. This suggests a shift in consumer behavior, where cleaning is not solely viewed as a routine chore but as an on-demand service catering to specific needs and circumstances. Furthermore, technological advancements, such as online booking platforms and sophisticated cleaning tools, are contributing to improved service delivery and heightened consumer satisfaction, propelling the market forward. The commercial sector, specifically offices, is also demonstrating increasing adoption of occasional deep cleaning services, driven by concerns about hygiene and workplace productivity. This trend is likely to continue as businesses increasingly value a clean and healthy work environment. The market's trajectory suggests a continued expansion, shaped by factors ranging from demographic shifts to technological innovations, indicating a bright future for occasional cleaning service providers.

Several key factors are propelling the growth of the occasional cleaning services market. The rise of dual-income households and increasingly busy lifestyles are leading to a significant time crunch for many individuals and families. Outsourcing occasional cleaning tasks becomes a logical solution, freeing up valuable time for other pursuits. Furthermore, the growing awareness of hygiene and the importance of a clean and healthy living environment is driving demand, particularly for deep cleaning services. This is particularly true post-pandemic, with heightened concern for sanitation in both residential and commercial spaces. Technological advancements are also playing a crucial role, with online booking platforms streamlining the process and improving service accessibility. The convenience of scheduling a cleaning service through a mobile app or website is highly appealing to busy consumers. Additionally, the increasing availability of specialized cleaning services, such as post-renovation cleans or move-in/move-out cleaning, caters to niche needs and further expands the market. The rise of the sharing economy and the ease of finding and comparing services online have also contributed to the market’s growth, providing increased transparency and competition. Finally, the increasing disposable income in several regions enables more individuals to afford these convenience services, fostering market expansion.

Despite the positive market outlook, the occasional cleaning services industry faces several challenges and restraints. One major hurdle is the fluctuating demand. Unlike regular cleaning services, which provide a predictable revenue stream, occasional cleaning services are subject to seasonal variations and unpredictable spikes in demand. This makes it difficult for service providers to effectively manage their workforce and resources. Another significant challenge lies in the competitive landscape. The ease of entry into the market means numerous small businesses and independent cleaners are vying for the same customer base, creating intense competition and potentially driving down prices. Maintaining a skilled and reliable workforce also presents a consistent challenge. Finding, training, and retaining qualified cleaners is crucial for delivering high-quality service and maintaining a positive brand reputation. Ensuring consistent service quality across different cleaners and managing customer expectations can also be difficult. Lastly, the cost of labor, cleaning supplies, and insurance can significantly impact profitability, especially for smaller businesses operating on tight margins.

The residential segment is projected to dominate the occasional cleaning services market throughout the forecast period (2025-2033). This is primarily driven by the factors already discussed: increasing disposable incomes, busy lifestyles, and a heightened emphasis on hygiene.

North America and Western Europe are anticipated to hold significant market share due to higher disposable incomes and a greater acceptance of outsourcing household chores. These regions are more mature in terms of adoption of convenience services, resulting in a higher market penetration compared to emerging markets.

Asia-Pacific is also expected to witness substantial growth, particularly in countries with rapidly developing economies and burgeoning middle classes. While still relatively nascent compared to the West, the market's potential for growth is significant given the changing demographics and lifestyles.

Within the residential segment, deep cleaning services are experiencing rapid growth. This suggests consumers are not just looking for basic tidying but desire thorough cleans to maintain a consistently hygienic and comfortable living space. The convenience of scheduling a deep clean occasionally, rather than undertaking the task themselves, is highly valued. Furthermore, specific occasions, such as pre-holiday cleaning, post-renovation clean-up, or preparing for a move, significantly contribute to the increased demand for deep cleaning services. The increased adoption of these services will continue to shape the demand within the residential segment, bolstering its dominance within the broader occasional cleaning market.

The occasional cleaning services industry is fueled by several key growth catalysts. The rising disposable incomes, especially in developing economies, allow consumers to afford convenience services that were previously considered luxuries. The increase in dual-income households further strengthens the demand for time-saving solutions like occasional cleaning. Technological advancements, including mobile booking apps and improved cleaning tools, improve service delivery and accessibility. Finally, the growing awareness of hygiene and a desire for healthier living spaces also significantly contribute to the demand for occasional cleaning services.

This report provides a comprehensive overview of the occasional cleaning services market, offering detailed insights into market trends, driving forces, challenges, and key players. It analyzes historical data (2019-2024), current market estimations (2025), and future projections (2025-2033), providing a holistic understanding of this dynamic sector. The report offers valuable information for businesses operating in this space, investors seeking new opportunities, and anyone interested in understanding the evolving landscape of the cleaning services industry. The inclusion of key regional and segment analysis enables detailed strategic planning and informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.19% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.19%.

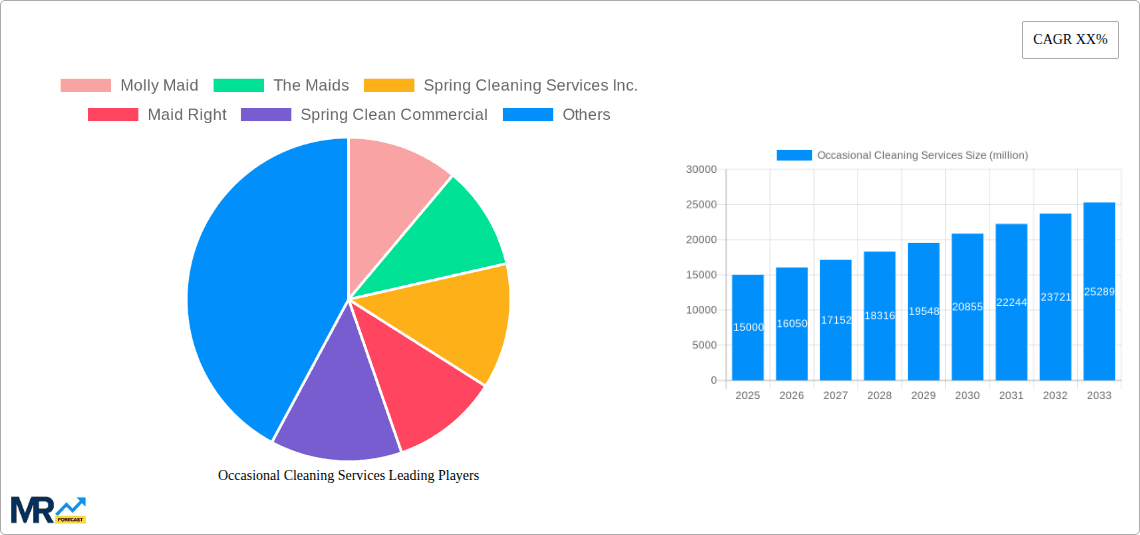

Key companies in the market include Molly Maid, The Maids, Spring Cleaning Services Inc., Maid Right, Spring Clean Commercial, Rent A Maid, CleaningPros, Miss Maid, Dirt2Tidy, Fresh Cleaning Pte Ltd, Mint Cleaning Group, .

The market segments include Application, Type.

The market size is estimated to be USD 451.63 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Occasional Cleaning Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Occasional Cleaning Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.