1. What is the projected Compound Annual Growth Rate (CAGR) of the Nucleic Acid Detection Kits?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Nucleic Acid Detection Kits

Nucleic Acid Detection KitsNucleic Acid Detection Kits by Type (Polymerase Chain Reaction (PCR), Ligase Chain Reaction (LCR)), by Application (Disease Detection (New Coronavirus/H1N1/Ebola Virus etc), Meat Speciation Testing, Food and Drink Field, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

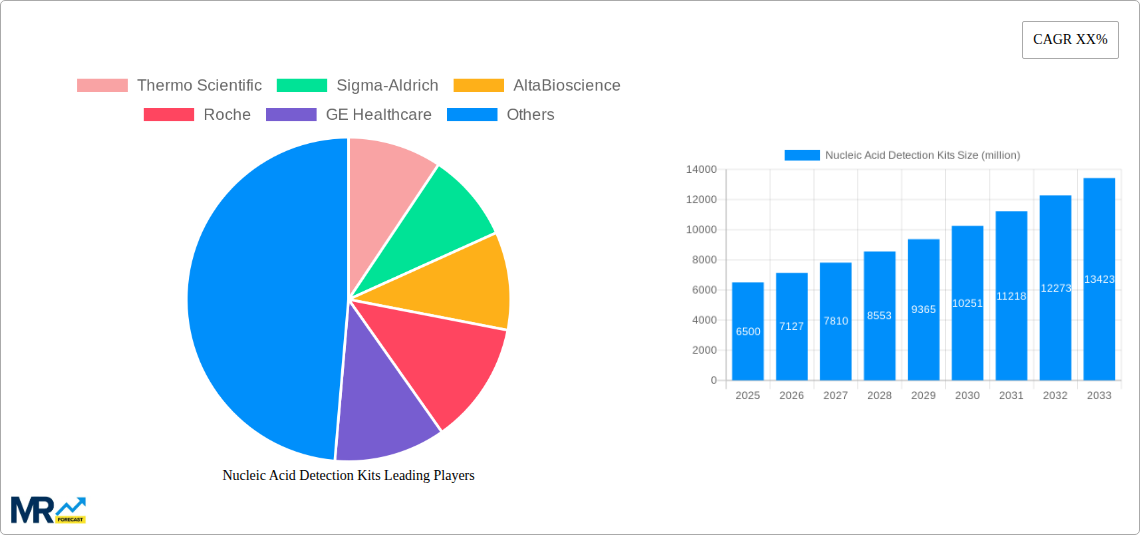

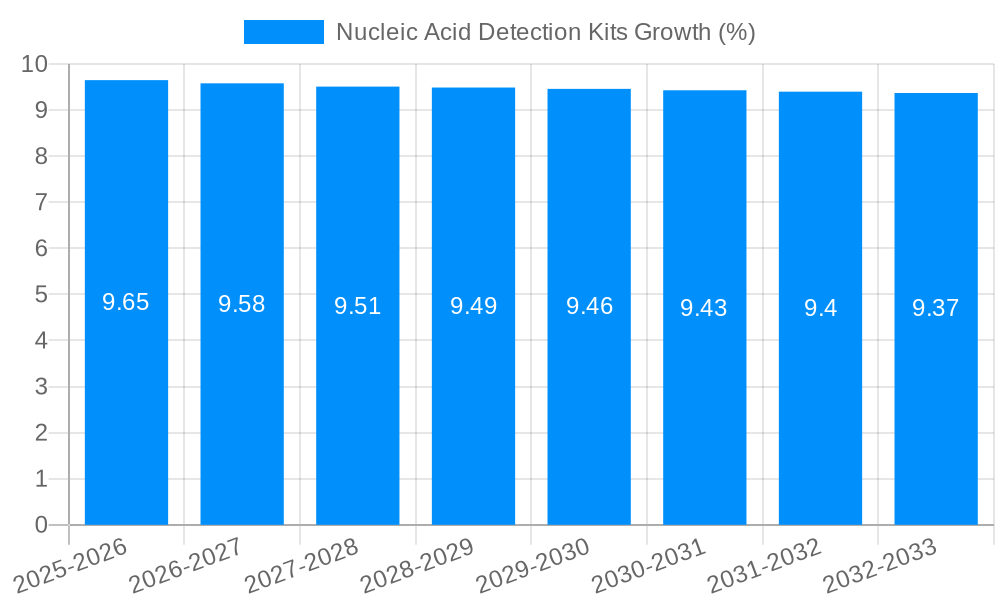

The global Nucleic Acid Detection Kits market is poised for significant expansion, projected to reach a market size of approximately $6,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2033. This robust growth trajectory is primarily propelled by the escalating demand for advanced diagnostic tools across various sectors, most notably in disease detection. The COVID-19 pandemic served as a powerful catalyst, highlighting the critical role of rapid and accurate nucleic acid testing in public health. The ongoing need to monitor and control emerging infectious diseases like novel coronaviruses, H1N1, and Ebola continues to fuel innovation and market penetration of these kits. Beyond healthcare, the application in food safety, particularly for meat speciation testing to ensure authenticity and prevent fraud, is a growing contributor.

Further market acceleration is attributed to advancements in Polymerase Chain Reaction (PCR) and Ligase Chain Reaction (LCR) technologies, offering enhanced sensitivity, specificity, and speed. The increasing investment in research and development by key players such as Thermo Scientific, Roche, and BGI, alongside the expanding regulatory approvals for new testing methodologies, are also significant drivers. However, the market faces certain restraints, including the high cost associated with developing and manufacturing these sophisticated kits, stringent regulatory hurdles for new product launches, and the need for specialized infrastructure and trained personnel for their effective implementation. Despite these challenges, the expanding applications in veterinary diagnostics, agricultural testing, and environmental monitoring, coupled with a growing awareness of the benefits of molecular diagnostics, are expected to outweigh the restraints, leading to sustained and strong market growth in the coming years.

The global Nucleic Acid Detection Kits market is poised for substantial growth, projected to reach a valuation of over 15,000 million USD by 2033. This robust expansion is underpinned by a confluence of factors, prominently the escalating global health concerns and the subsequent surge in demand for rapid and accurate diagnostic solutions. The Study Period encompassing 2019-2033, with a specific focus on the Base Year and Estimated Year of 2025, highlights a dynamic market characterized by innovation and increasing adoption across various sectors. The Historical Period (2019-2024) laid the groundwork for this trajectory, witnessing the pivotal role of nucleic acid detection in managing infectious disease outbreaks, most notably the COVID-19 pandemic, which significantly amplified awareness and investment in this technology. During the Forecast Period (2025-2033), the market is expected to witness a Compound Annual Growth Rate (CAGR) of over 8%, fueled by advancements in technology, expanding applications beyond traditional diagnostics, and a growing understanding of their utility in fields like food safety and agricultural testing. The intricate dance between increasing disease prevalence, the imperative for early detection, and the continuous refinement of assay sensitivity and specificity is creating an ecosystem ripe for innovation and market penetration. Furthermore, the ongoing digital transformation within healthcare, including the integration of point-of-care testing and the development of user-friendly kits, is expected to democratize access to nucleic acid detection, thereby broadening its market reach. The market's evolution is not merely reactive to health crises; it's proactive, driven by a scientific imperative to understand and manipulate genetic material for a myriad of applications, from personalized medicine to the authentication of food products. The trend towards multiplexing, allowing for the simultaneous detection of multiple nucleic acid targets in a single assay, is another significant development, promising greater efficiency and cost-effectiveness for end-users. This multifaceted growth narrative suggests a market that is not only expanding in volume but also in the sophistication and breadth of its capabilities. The market insights indicate a strong demand for kits that offer enhanced speed, higher sensitivity, and greater ease of use, especially in resource-limited settings. The impact of global health policies and regulatory frameworks encouraging diagnostic advancements will also play a crucial role in shaping market dynamics.

The nucleic acid detection kits market is experiencing a powerful surge, driven by several interconnected forces that are reshaping its landscape. Foremost among these is the escalating global burden of infectious diseases, a trend starkly highlighted by the recent COVID-19 pandemic, which underscored the critical need for rapid, sensitive, and accurate diagnostic tools. This heightened awareness has not only increased investment in research and development but also accelerated regulatory approvals for new testing platforms. Consequently, the demand for kits capable of detecting novel pathogens like the "New Coronavirus," H1N1, and Ebola virus has surged, creating a substantial and sustained market. Beyond infectious disease diagnostics, the burgeoning fields of precision medicine and personalized healthcare are emerging as significant growth propellers. As our understanding of the genetic basis of diseases deepens, so does the need for targeted nucleic acid detection to guide treatment decisions, monitor disease progression, and identify individuals at risk for hereditary conditions. This translates directly into an increased demand for kits used in genetic screening, pharmacogenomics, and cancer diagnostics, contributing significantly to the market's overall expansion. The growing emphasis on food safety and quality control across the globe further bolsters the market. Consumers are increasingly demanding transparency regarding the origin and composition of their food, leading to a rise in nucleic acid-based testing for meat speciation, allergen detection, and the identification of genetically modified organisms (GMOs). This expanding application set, moving beyond traditional healthcare, diversifies revenue streams and fuels innovation in assay development.

Despite the robust growth trajectory, the nucleic acid detection kits market faces certain inherent challenges and restraints that can temper its expansion. One of the primary hurdles is the high cost of advanced detection technologies and reagents. While advancements have made these kits more accessible, they can still represent a significant financial outlay, particularly for resource-limited settings or smaller research institutions. This cost factor can limit widespread adoption and necessitate strategic pricing models. Stringent regulatory requirements for diagnostic kits, while crucial for ensuring accuracy and patient safety, can also be a bottleneck. The process of obtaining regulatory approval, especially for new and innovative technologies, can be time-consuming and expensive, potentially delaying market entry for promising products. Furthermore, the technical expertise required for operating some of the more complex nucleic acid detection platforms can be a barrier to adoption, especially in settings where skilled personnel are scarce. While efforts are being made to develop user-friendly, point-of-care solutions, the need for trained professionals remains a consideration. The rapid pace of technological evolution can also act as a restraint. Companies must continuously invest in R&D to stay competitive, and the obsolescence of older technologies can necessitate frequent upgrades for end-users, adding to their financial burden. Lastly, challenges in global supply chain management, particularly exacerbated by recent geopolitical events and pandemics, can lead to shortages of critical raw materials or components, impacting the availability and cost of kits. Addressing these challenges through innovation in cost-effective solutions, streamlined regulatory pathways, enhanced training programs, and resilient supply chains will be crucial for unlocking the full potential of the nucleic acid detection kits market.

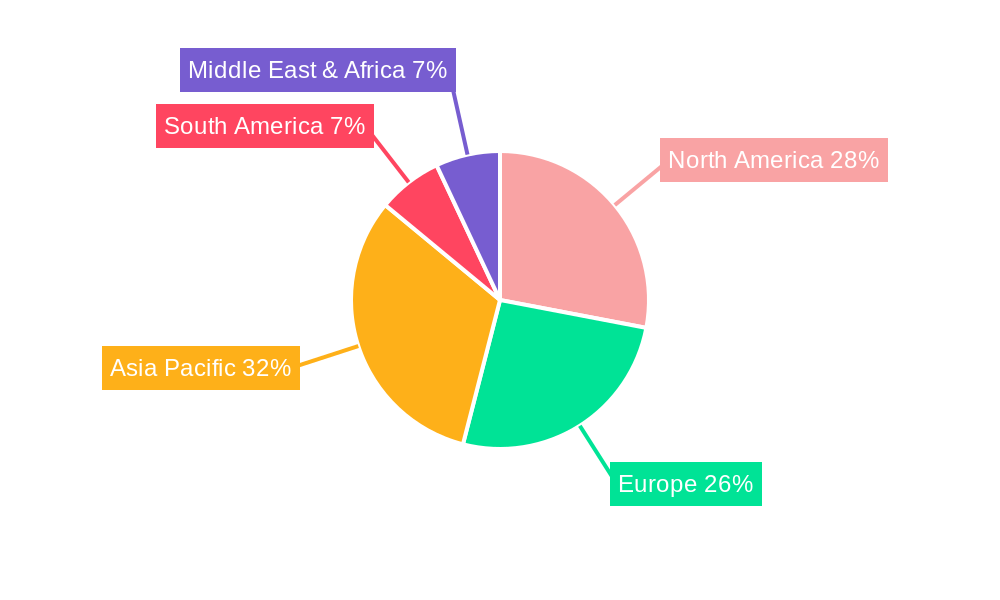

The nucleic acid detection kits market is characterized by regional disparities and segment dominance, with several key areas poised for significant influence. Among the segments, Polymerase Chain Reaction (PCR) technology is expected to continue its reign as the dominant force. PCR-based kits, due to their inherent sensitivity, specificity, and versatility, have become the gold standard for a vast array of applications, from infectious disease diagnostics to gene expression analysis and forensic science. The continuous refinement of PCR technologies, including the development of real-time PCR (qPCR) and digital PCR (dPCR), further solidifies its market leadership. Applications within Disease Detection (New Coronavirus/H1N1/Ebola Virus etc.) are also a primary driver of segment dominance, particularly in the wake of recent global health crises. The urgent need for rapid and accurate identification of infectious agents ensures a sustained demand for disease-specific nucleic acid detection kits. This segment is not only critical for public health but also represents a significant revenue stream for market players.

In terms of regional dominance, North America is projected to maintain its leading position in the nucleic acid detection kits market. This leadership is attributed to several factors:

Another significant region expected to witness substantial growth and potentially emerge as a strong contender is Asia-Pacific. This region's ascendance is driven by:

Therefore, while North America is likely to maintain its dominant position due to established infrastructure and ongoing innovation, the Asia-Pacific region is expected to be the fastest-growing market, driven by its vast potential and increasing investments in healthcare and biotechnology.

The nucleic acid detection kits industry is experiencing significant growth catalysts that are propelling its expansion. A primary catalyst is the escalating global health crises, as exemplified by the COVID-19 pandemic, which has dramatically increased awareness and demand for rapid and accurate diagnostic solutions. Furthermore, the burgeoning field of personalized medicine, with its focus on tailoring treatments based on individual genetic profiles, is a major driver, boosting the use of kits for genetic screening, pharmacogenomics, and cancer diagnostics. The growing global emphasis on food safety and quality control, leading to increased adoption of nucleic acid testing for meat speciation, allergen detection, and GMO screening, is another significant growth catalyst.

The global nucleic acid detection kits market is populated by a diverse range of established and emerging companies. Key players contributing to the market's innovation and supply include:

The nucleic acid detection kits sector has been marked by several significant developments that have shaped its evolution:

The comprehensive coverage of the nucleic acid detection kits market report delves deep into the intricate dynamics shaping this vital industry. It provides an in-depth analysis of market trends, identifying key growth drivers such as the persistent need for infectious disease diagnostics and the increasing adoption of personalized medicine. The report also meticulously examines the restraints, including the cost of advanced technologies and the complexities of regulatory approvals, offering strategic insights for market players. Furthermore, it highlights the dominant regions and segments, with a particular focus on the enduring strength of PCR technology and the pivotal role of disease detection applications. The report is an invaluable resource for stakeholders seeking to understand the market's current landscape, future trajectory, and the critical factors that will influence its development over the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thermo Scientific, Sigma-Aldrich, AltaBioscience, Roche, GE Healthcare, BGI, Enzo Life Sciences, TRUPCR, Promega Corporation, Eiken Chemical, Vazyme Biotech Co, Maccura, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Nucleic Acid Detection Kits," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Nucleic Acid Detection Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.