1. What is the projected Compound Annual Growth Rate (CAGR) of the Nonwoven Diaper?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Nonwoven Diaper

Nonwoven DiaperNonwoven Diaper by Type (Nonwoven Baby Diaper, Nonwoven Adult Diaper, World Nonwoven Diaper Production ), by Application (Online Retail, Offline Retail, World Nonwoven Diaper Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

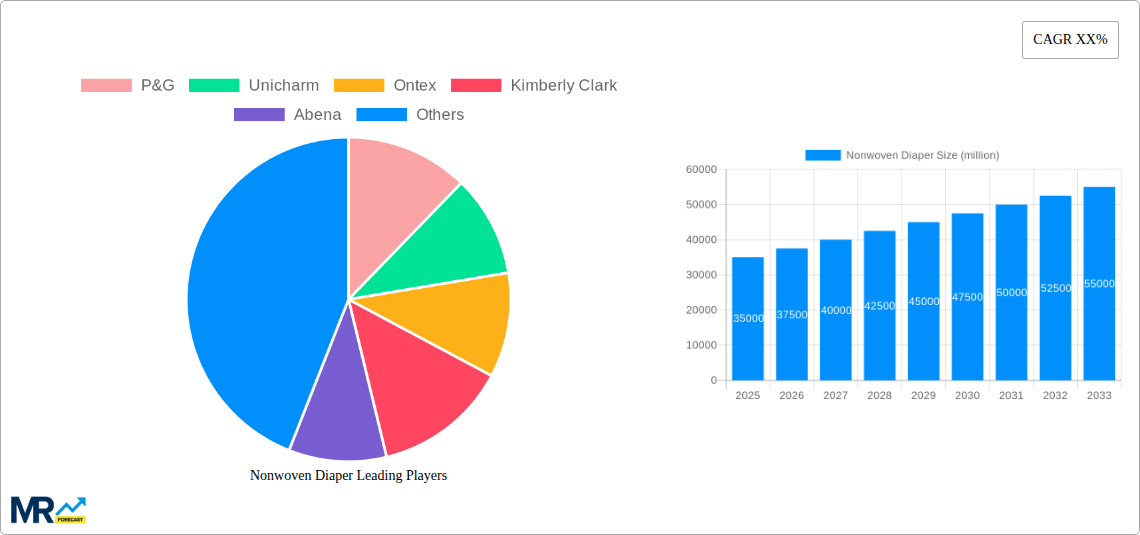

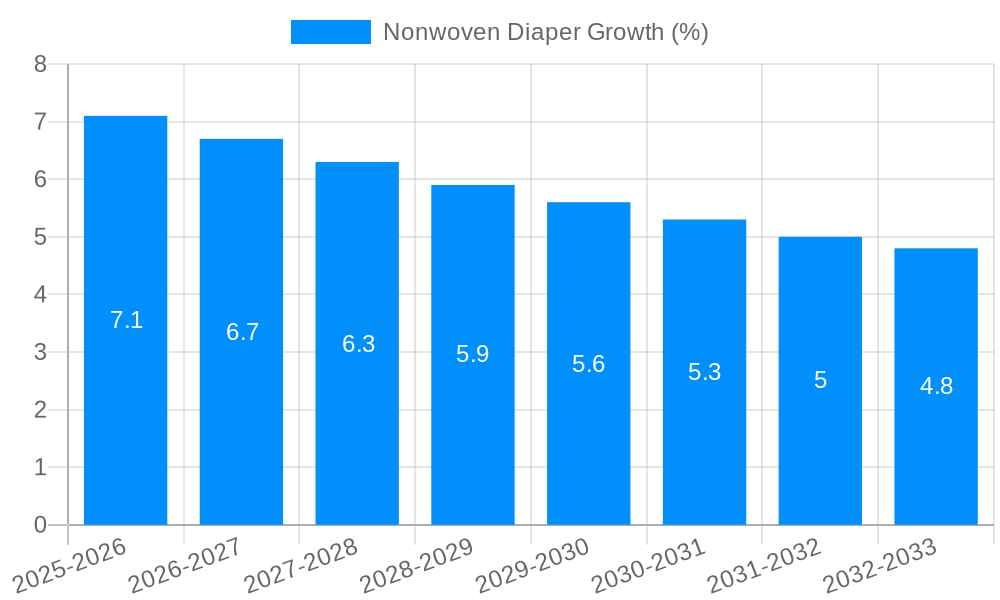

The global nonwoven diaper market is projected for substantial growth, estimated at a market size of approximately $35,000 million in 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust expansion is primarily fueled by increasing global birth rates, a growing awareness of hygiene and sanitation, and the rising disposable income in developing economies, which enhances the affordability of premium diaper products. Furthermore, the convenience offered by disposable nonwoven diapers for both baby care and adult incontinence management is a significant driver, catering to the demands of modern lifestyles. The market’s growth is also supported by continuous product innovation, with manufacturers focusing on enhanced absorbency, skin-friendliness, and eco-friendly materials, appealing to a more conscious consumer base. The shift towards online retail channels further amplifies market penetration, offering wider accessibility and a broader product selection to consumers worldwide.

Despite the optimistic outlook, the market faces certain restraints. The primary challenge lies in the environmental concerns associated with the disposal of nonwoven diapers, prompting a growing demand for sustainable alternatives and biodegradable materials. While technological advancements are addressing this, the transition to fully sustainable production and disposal systems remains a complex and costly endeavor. Moreover, fluctuating raw material prices, particularly for the synthetic polymers used in nonwoven fabric production, can impact profit margins and influence pricing strategies. Regional variations in regulatory standards regarding diaper production and waste management also present a nuanced landscape for market participants. However, the persistent demand for hygiene products, coupled with strategic expansions by key players into emerging markets, is expected to offset these challenges, ensuring a dynamic and evolving nonwoven diaper industry.

This report delves into the intricate dynamics of the global nonwoven diaper market, offering a comprehensive analysis of its evolution from 2019 to 2033. Spanning a historical period of 2019-2024 and a detailed forecast period of 2025-2033, with 2025 serving as the base and estimated year, this study illuminates key trends, driving forces, challenges, and growth opportunities. The report quantifies market movements in millions of units, providing actionable intelligence for stakeholders.

The global nonwoven diaper market is experiencing a paradigm shift, driven by a confluence of demographic, technological, and consumer behavior evolutions. Throughout the historical period (2019-2024), we observed a steady ascent in demand, fueled by increasing birth rates in developing economies and a growing awareness of hygiene and comfort amongst consumers. The base year of 2025 projects a robust market performance, setting the stage for sustained growth. A significant trend is the rising preference for premium and specialized nonwoven diapers, particularly in the baby segment. Parents are increasingly prioritizing features such as enhanced absorbency, ultra-soft materials, hypoallergenic properties, and eco-friendly compositions. This shift is evident in the sales figures, with units in the millions reflecting a discerning consumer base willing to invest in superior product offerings.

Furthermore, the adult incontinence segment is witnessing an unprecedented surge in demand. This is primarily attributed to the aging global population, coupled with a greater willingness among individuals to address incontinence issues with dignity and discretion. Innovations in adult diaper designs, focusing on discreet wear, improved leak protection, and skin-friendly materials, are directly contributing to the expansion of this segment, with sales units in the millions underscoring its substantial market share. The report also highlights the growing influence of e-commerce in reshaping distribution channels. Online retail platforms are becoming increasingly pivotal, offering convenience, wider product selection, and competitive pricing, thereby expanding the market's reach and accessibility. This digital transformation is a key differentiator, allowing for greater market penetration and increased unit sales.

Moreover, sustainability is emerging as a dominant trend, influencing product development and consumer choices. Manufacturers are actively investing in research and development to incorporate biodegradable materials, reduce manufacturing waste, and adopt more environmentally conscious packaging solutions. This aligns with a growing global consciousness towards environmental responsibility and is expected to significantly impact future market trajectories. The report quantifies the impact of these trends, showcasing the growth in millions of units for various product categories and distribution channels. The overarching narrative points towards a market characterized by innovation, increasing sophistication in product offerings, and a deepening commitment to consumer well-being and environmental sustainability, all of which are reflected in the consistent rise in unit sales across the study period.

The nonwoven diaper market is propelled by a powerful synergy of economic, social, and technological factors that collectively contribute to its sustained expansion. A primary driver is the persistent global population growth, particularly in emerging economies, which directly translates to an increased birth rate and, consequently, a higher demand for baby diapers. This demographic surge, measured in millions of new births annually, forms the bedrock of market growth. Furthermore, the steadily aging global population is a monumental force driving the nonwoven adult diaper segment. As life expectancy increases, so does the prevalence of age-related health conditions, including urinary and fecal incontinence. This demographic shift, with a significant increase in individuals aged 65 and above, translates directly into a growing consumer base for adult diaper products, with unit sales escalating into the millions.

Another crucial driving force is the escalating disposable income in many regions. As economies develop, households have more discretionary income, enabling them to opt for higher-quality, more comfortable, and feature-rich nonwoven diapers for both infants and adults. This economic empowerment allows consumers to prioritize product performance and brand reputation over price alone, thus fostering the growth of premium segments. The increasing awareness and de-stigmatization surrounding incontinence are also pivotal. Public health campaigns, improved medical understanding, and a greater openness in discussing these issues are encouraging individuals to seek effective solutions, thereby boosting the demand for discreet and high-performing adult diapers. This societal shift, though qualitative, has a tangible impact on market volume, reflected in millions of units purchased.

Technological advancements in material science and manufacturing processes play a significant role. Innovations in absorbent core technology, breathable back sheets, and leak-proof barriers have led to the development of diapers that offer superior comfort, dryness, and skin protection. These advancements enhance product appeal and performance, encouraging consumers to upgrade their choices and contributing to higher unit sales. The convenience offered by modern retail channels, especially online platforms, further fuels the market by providing easy access to a wide range of products, competitive pricing, and doorstep delivery, making it easier for consumers to procure these essential items in large quantities, thereby contributing to the millions of units sold annually.

Despite its robust growth trajectory, the nonwoven diaper market faces several significant challenges and restraints that can temper its expansion. One of the primary concerns is the volatile raw material prices, particularly those of superabsorbent polymers (SAP) and nonwoven fabrics derived from petrochemicals. Fluctuations in crude oil prices and supply chain disruptions can lead to increased manufacturing costs, impacting profit margins and potentially leading to higher retail prices, which might deter price-sensitive consumers. The report's analysis of unit sales in millions will reflect the sensitivity of demand to these price variations.

Environmental concerns and the increasing focus on sustainability pose a considerable restraint. Traditional nonwoven diapers are often not easily biodegradable, leading to significant landfill waste. Growing consumer awareness and regulatory pressures are pushing manufacturers to develop more eco-friendly alternatives, such as biodegradable or compostable diapers. However, the development and widespread adoption of such sustainable options often come with higher production costs and can face challenges in achieving the same level of performance and absorbency as conventional diapers, potentially limiting their market penetration. This aspect is crucial as the market navigates towards greener alternatives, impacting the volume of traditional units sold.

Intense market competition and aggressive pricing strategies employed by established players and emerging brands can also act as a restraint, particularly for smaller manufacturers. The market is characterized by high volume, low-margin sales, and continuous innovation, making it difficult for new entrants to gain significant market share without substantial investment. Furthermore, the penetration of reusable diaper alternatives, though currently a niche segment, could potentially pose a long-term threat in certain consumer demographics and regions, particularly those with a strong environmental consciousness and a willingness to invest in upfront costs for long-term savings. The availability and accessibility of disposable diapers in developing regions also remain a factor, as infrastructure and economic conditions can limit the purchasing power for these products, thereby capping the potential unit sales in millions.

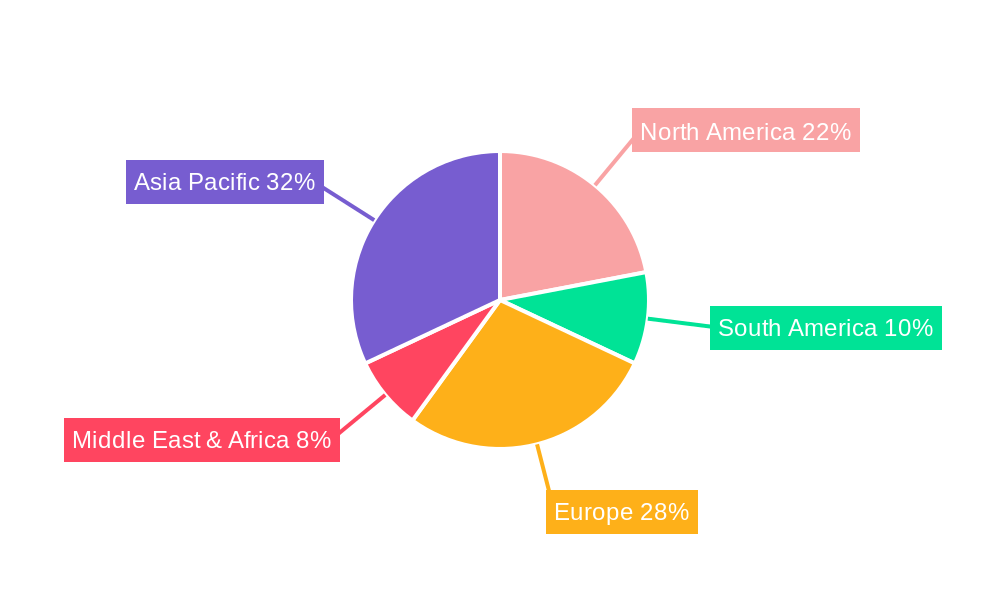

The nonwoven diaper market is characterized by diverse regional dynamics and segment dominance, with several key areas poised to lead market growth in the coming years. Among the segments, the Nonwoven Baby Diaper segment is expected to continue its stronghold, driven by a fundamental demographic imperative. The sheer volume of global births, estimated to be in the hundreds of millions annually, directly translates into consistent and substantial demand for baby diapers. This segment is further amplified by increasing urbanization and a growing middle class in developing economies, particularly in Asia-Pacific. Countries like China, India, and Indonesia, with their vast populations and rising disposable incomes, represent significant growth engines for nonwoven baby diapers. The market in these regions is projected to witness a significant increase in unit sales, potentially reaching billions of units annually. The increasing adoption of premium features like ultra-thin designs, advanced absorbency, and hypoallergenic materials by consumers in these developing nations further fuels the growth within this segment, moving beyond basic functional needs to prioritize comfort and skin health.

Conversely, the Nonwoven Adult Diaper segment is emerging as a powerful growth driver, significantly influenced by the global aging population. Regions with a higher proportion of elderly individuals, such as North America (specifically the United States and Canada) and Europe (including Germany, France, and the UK), are experiencing a substantial and accelerating demand for adult incontinence products. The increasing life expectancy, coupled with a greater awareness and reduced stigma surrounding incontinence, has led to a surge in consumption. The market for adult diapers in these regions is projected to see substantial unit sales in the hundreds of millions, driven by the need for discreet, comfortable, and highly absorbent products. Technological advancements in discreet wear, skin-friendly materials, and improved leak protection are critical in capturing this market share. The forecast period from 2025 to 2033 will likely see this segment not only maintaining its growth but potentially outpacing the baby diaper segment in terms of percentage growth due to its rapidly expanding consumer base.

Within the application segments, Offline Retail will continue to hold a significant share due to its established presence and accessibility, especially in emerging markets where online penetration might still be developing. However, Online Retail is rapidly gaining momentum and is expected to be a dominant force in driving future growth. The convenience, wider product selection, competitive pricing, and subscription-based models offered by e-commerce platforms are highly appealing to consumers, particularly in developed markets and for niche or premium diaper products. This shift is expected to see online channels account for a substantial and growing portion of the total unit sales, potentially reaching hundreds of millions of units annually and influencing the overall market structure. The interplay between these segments and regions, each contributing millions of units to the global market, paints a picture of a dynamic and evolving nonwoven diaper landscape.

Several key growth catalysts are poised to accelerate the expansion of the nonwoven diaper industry in the forecast period. The primary catalyst remains the steadily aging global population, which directly fuels the demand for adult incontinence products. Concurrently, sustained population growth in emerging economies continues to underpin the robust demand for nonwoven baby diapers. Innovations in material science, leading to thinner, more absorbent, and skin-friendly diapers, are key drivers, enhancing product appeal and encouraging consumer upgrades. The increasing penetration of e-commerce platforms offers enhanced accessibility and convenience, broadening market reach and contributing to higher sales volumes in millions of units. Furthermore, a growing societal acceptance and de-stigmatization of incontinence are encouraging more individuals to seek effective solutions, thereby boosting the adult diaper market.

This report provides an all-encompassing analysis of the nonwoven diaper market, meticulously examining its trajectory from 2019 to 2033. It offers granular insights into market segmentation by type (baby and adult diapers), application (online and offline retail), and global production volumes, all quantified in millions of units. The study thoroughly dissects the driving forces, including demographic shifts and technological advancements, and identifies key challenges such as environmental concerns and raw material price volatility. Furthermore, it pinpoints dominating regions and segments, with a particular focus on the Asia-Pacific for baby diapers and North America and Europe for adult diapers, while highlighting the escalating importance of online retail. The report also outlines significant industry developments and lists leading players, providing a holistic view of this dynamic and essential market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include P&G, Unicharm, Ontex, Kimberly Clark, Abena, Domtar, Fippi, Delipap Oy, Europrosan SpA, TZMO, First Quality Enterprise, Medline, Kao, Hengan, Chiaus, Fuburg, Hartmann, Nobel Hygiene, Daio Paper.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Nonwoven Diaper," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Nonwoven Diaper, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.