1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-athletic Shoes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Non-athletic Shoes

Non-athletic ShoesNon-athletic Shoes by Application (Online Sales, Offline Sales), by Type (Lace Up Shoes, Slip On Shoes, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

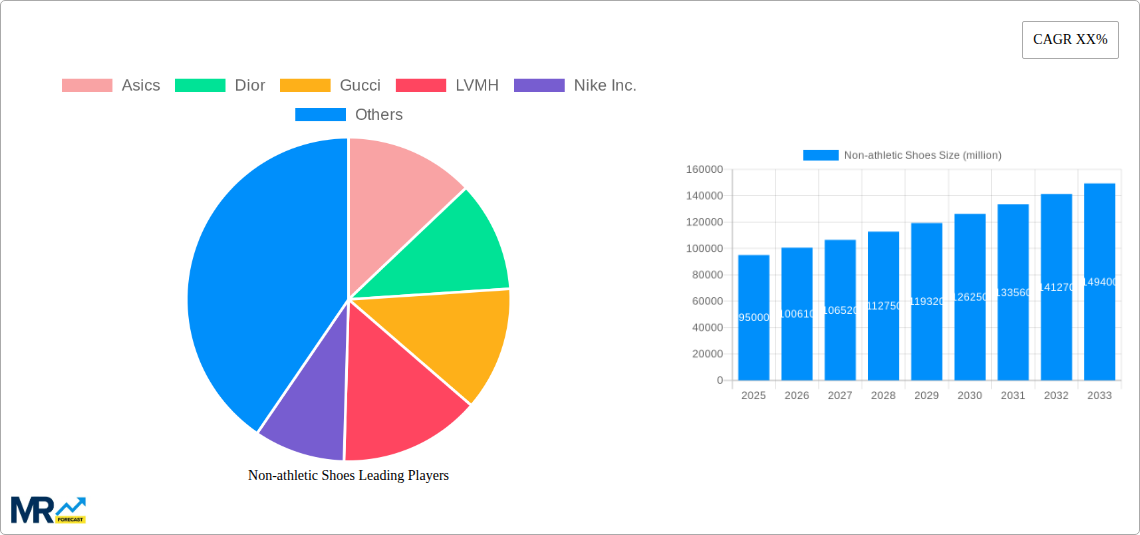

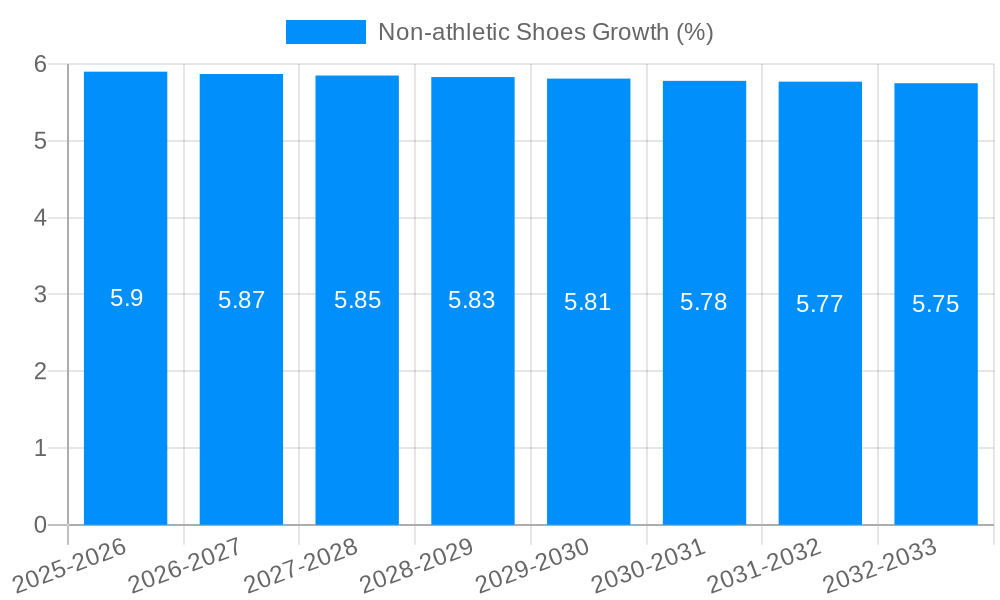

The global Non-athletic Shoes market is projected to experience robust growth, estimated to reach a significant market size of approximately $95 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.8% throughout the forecast period of 2025-2033. This expansion is primarily fueled by evolving consumer preferences, a growing emphasis on fashion and lifestyle, and the increasing disposable incomes across various economies. The market is broadly segmented by application into Online Sales and Offline Sales, with online channels demonstrating a steeper growth trajectory due to convenience and wider product accessibility. By type, Lace Up Shoes and Slip On Shoes represent key categories, catering to diverse stylistic demands, alongside a significant "Others" segment encompassing a variety of casual and dress footwear.

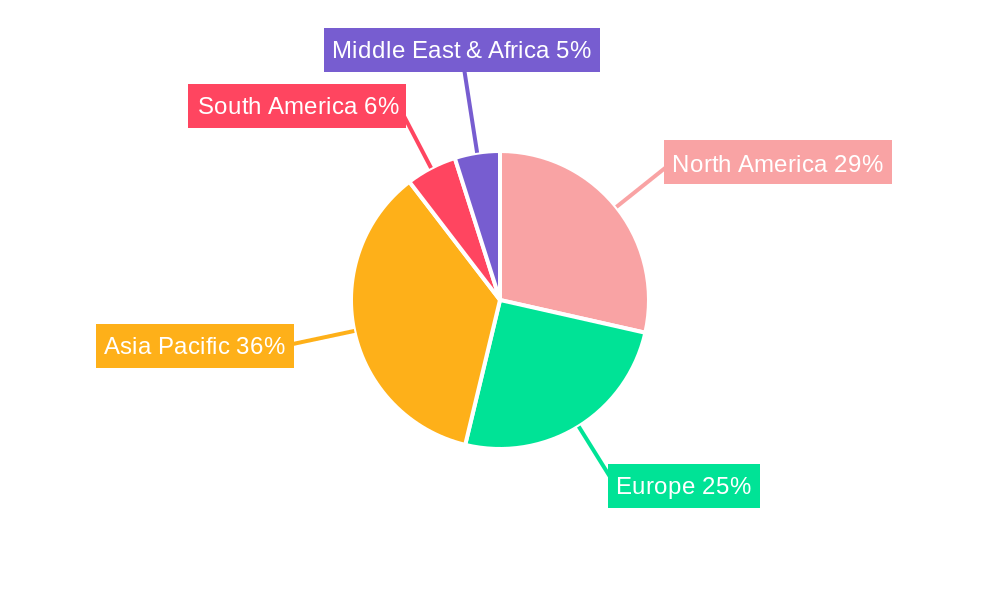

Key growth drivers for the Non-athletic Shoes market include the burgeoning influence of athleisure wear, where comfort and style are blended, leading consumers to opt for non-athletic shoe styles that offer similar comfort benefits. Furthermore, the premiumization trend, driven by luxury brands like Dior, Gucci, and Prada, is expanding the high-value segment of the market. The continuous innovation in materials, design, and sustainable manufacturing practices by leading companies such as Nike Inc., Puma, and Skechers is also attracting a broader consumer base. However, the market faces restraints such as fluctuating raw material costs and intense competition, which can impact profit margins. Geographically, the Asia Pacific region, particularly China and India, is expected to witness the fastest growth due to a large population and increasing urbanization, while North America and Europe remain significant mature markets.

This comprehensive report delves into the dynamic global market for non-athletic shoes, offering a deep dive into trends, driving forces, challenges, and future growth trajectories from 2019 to 2033, with a base and estimated year of 2025. The report utilizes a robust methodology to analyze the market size in millions of units, providing actionable insights for stakeholders.

The non-athletic shoe market is experiencing a significant evolution, driven by a confluence of changing consumer preferences, technological advancements, and evolving fashion paradigms. XXX, a key metric we will explore, highlights the growing demand for comfort and style in everyday footwear. This trend is particularly evident in the increasing popularity of casual and lifestyle-oriented shoes that seamlessly blend functionality with aesthetics. The report will illuminate how brands are responding to this demand by investing heavily in research and development to create innovative materials and designs that prioritize both wearer comfort and visual appeal. Furthermore, the influence of social media and celebrity endorsements continues to shape consumer purchasing decisions, pushing brands to constantly innovate and stay ahead of fleeting fashion trends. We observe a discernible shift towards versatile footwear that can be worn for a multitude of occasions, from professional settings to relaxed social gatherings. This versatility is a cornerstone of contemporary fashion, and non-athletic shoes are at the forefront of this movement. The report will meticulously analyze the market size in millions of units, segmenting it by application, type, and key geographical regions to provide a granular understanding of these evolving trends. For instance, the rise of the athleisure trend has blurred the lines between athletic and casual wear, with many consumers opting for stylish sneakers and slip-ons for their daily activities. This trend is expected to continue its upward trajectory throughout the forecast period, indicating a substantial growth opportunity for manufacturers and retailers.

The market is also witnessing a strong emphasis on sustainability and ethical manufacturing practices. Consumers are increasingly conscious of the environmental impact of their purchases, leading to a greater demand for shoes made from recycled materials, organic fabrics, and through eco-friendly production processes. Brands that can effectively communicate their commitment to sustainability are likely to gain a competitive edge. Moreover, personalization and customization are emerging as significant trends. With advancements in manufacturing technologies, consumers are seeking footwear that reflects their individual style and preferences, leading to a demand for customizable options. This could involve personalized colorways, unique embellishments, or even made-to-measure fittings. The report will dissect how these evolving consumer desires are translating into tangible market shifts, influencing product development, marketing strategies, and ultimately, sales figures. The study period of 2019-2033, with a detailed analysis of the historical period (2019-2024) and the forecast period (2025-2033), will provide a comprehensive outlook on the market's trajectory.

Several powerful forces are acting as catalysts for the robust growth of the non-athletic shoe market. Foremost among these is the escalating global disposable income, particularly in emerging economies. As consumers' purchasing power increases, they allocate a greater portion of their expenditure towards non-essential goods, with fashion and footwear being prominent beneficiaries. This enhanced financial capacity allows for more frequent upgrades and purchases of diverse styles of non-athletic shoes. Concurrently, the pervasive influence of fashion trends, amplified by social media and a more interconnected global culture, is a significant driver. The constant exposure to new styles, celebrity endorsements, and influencer marketing fuels a desire for fashionable and trend-driven footwear. This leads to a higher replacement rate for shoes as consumers seek to stay current with the latest styles. Furthermore, the increasing urbanization and the subsequent rise in the "on-the-go" lifestyle contribute to the demand for comfortable yet stylish footwear suitable for daily commutes, social outings, and casual work environments. The report will analyze how these intertwined factors are contributing to a projected increase in the market size of non-athletic shoes in millions of units. The convergence of these economic and cultural shifts creates a fertile ground for continued expansion within the non-athletic shoe sector. The emphasis on personal expression through fashion further fuels the demand for a wider variety of non-athletic shoe options, encouraging brands to diversify their offerings and cater to a broader spectrum of tastes and preferences.

Despite the burgeoning growth, the non-athletic shoe market is not without its challenges and restraints. One of the most prominent is the intense competition within the industry. The presence of both established global brands and a multitude of smaller, niche players creates a saturated market where differentiation and brand loyalty are paramount. This competitive pressure can lead to price wars and reduced profit margins for manufacturers. Another significant challenge stems from the increasing cost of raw materials, such as leather, synthetic fabrics, and rubber. Fluctuations in the prices of these essential components can directly impact production costs and, consequently, the retail prices of non-athletic shoes, potentially affecting consumer affordability. The volatile nature of fashion trends also presents a restraint. Brands must constantly innovate and adapt to rapidly changing consumer preferences, risking obsolescence if they fail to keep pace. This necessitates significant investment in design and product development, with no guarantee of market success. Furthermore, counterfeiting and intellectual property infringement remain persistent issues, particularly for high-end brands, eroding brand value and sales revenue. The report will explore how these challenges are being addressed by industry players and their potential impact on market growth in millions of units. The increasing consumer demand for sustainable and ethically sourced products, while a growth opportunity for some, also presents a challenge for companies that may struggle to adapt their existing supply chains and production methods.

The non-athletic shoe market is characterized by dominant regions and segments that are expected to shape its trajectory. Among the key regions, Asia-Pacific is poised to emerge as a dominant force, driven by a confluence of factors. The sheer size of the population, coupled with a rapidly growing middle class and increasing disposable incomes, translates into a massive consumer base with an expanding appetite for fashion and lifestyle products. Countries like China, India, and Southeast Asian nations are witnessing a surge in demand for stylish and comfortable footwear for everyday use. The increasing adoption of e-commerce platforms within these regions has also significantly boosted accessibility to a wide array of non-athletic shoe brands and styles, thereby further fueling market growth. The younger demographic in Asia-Pacific is particularly receptive to global fashion trends, readily embracing new designs and brands, making it a fertile ground for innovation and market penetration.

In terms of segments, Online Sales are set to dominate the market. The shift towards digital commerce, accelerated by technological advancements and changing consumer shopping habits, has made online channels the preferred avenue for purchasing non-athletic shoes for a significant portion of the global population. E-commerce platforms offer unparalleled convenience, a wider selection of products, competitive pricing, and the ability to research and compare options from the comfort of one's home. This trend is particularly pronounced in developed economies but is rapidly gaining traction in emerging markets as internet penetration and smartphone usage continue to rise. The ability to access a global marketplace of non-athletic shoe brands and styles online empowers consumers and drives higher sales volumes. The estimated market size in millions of units for online sales is expected to witness substantial growth throughout the forecast period.

Furthermore, within the Type segment, Slip On Shoes are anticipated to maintain a strong and potentially leading position. The inherent convenience and ease of wear associated with slip-on designs, including loafers, mules, and elasticated sneakers, align perfectly with the demand for casual and on-the-go footwear. Consumers are increasingly seeking footwear that requires minimal effort to put on and take off, making slip-ons an ideal choice for everyday wear, travel, and quick errands. Their versatile nature allows them to be dressed up or down, fitting seamlessly into various casual and semi-casual wardrobes. The report will provide detailed projections on the market share of slip-on shoes in millions of units, highlighting their consistent appeal and anticipated continued dominance. The comfort and practicality offered by slip-on styles, coupled with evolving design aesthetics that blend fashion with functionality, will ensure their sustained popularity in the non-athletic shoe market.

The non-athletic shoes industry is propelled by several key growth catalysts. The increasing fashion consciousness among consumers, influenced by social media and global trends, is a primary driver. This fuels demand for diverse styles that cater to various occasions, from casual outings to smart-casual work environments. The ongoing athleisure trend, blurring the lines between athletic and casual wear, also significantly boosts the demand for stylish sneakers and comfortable slip-ons. Furthermore, advancements in material science and manufacturing technologies enable the creation of more comfortable, durable, and aesthetically appealing footwear, attracting a wider consumer base.

This comprehensive report offers an in-depth analysis of the global non-athletic shoes market, projecting its growth in millions of units from 2019 to 2033, with a specific focus on the estimated year 2025. It meticulously examines key market insights, driving forces, and challenges, providing a holistic view of the industry landscape. The report highlights dominant regions and segments, with a detailed exploration of the burgeoning influence of online sales and the enduring appeal of slip-on shoes. Through a robust methodology, it delivers actionable intelligence for stakeholders seeking to navigate this dynamic market effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Asics, Dior, Gucci, LVMH, Nike Inc., Prada SpA, Puma, SKECHERS USA, Inc., U.S. Polo Assn., Vans Inc., Wolverine Worldwide, Inc., .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Non-athletic Shoes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Non-athletic Shoes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.