1. What is the projected Compound Annual Growth Rate (CAGR) of the No Sugar Added Ice Cream?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

No Sugar Added Ice Cream

No Sugar Added Ice CreamNo Sugar Added Ice Cream by Type (Soft Ice Cream, Hard Ice Cream), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

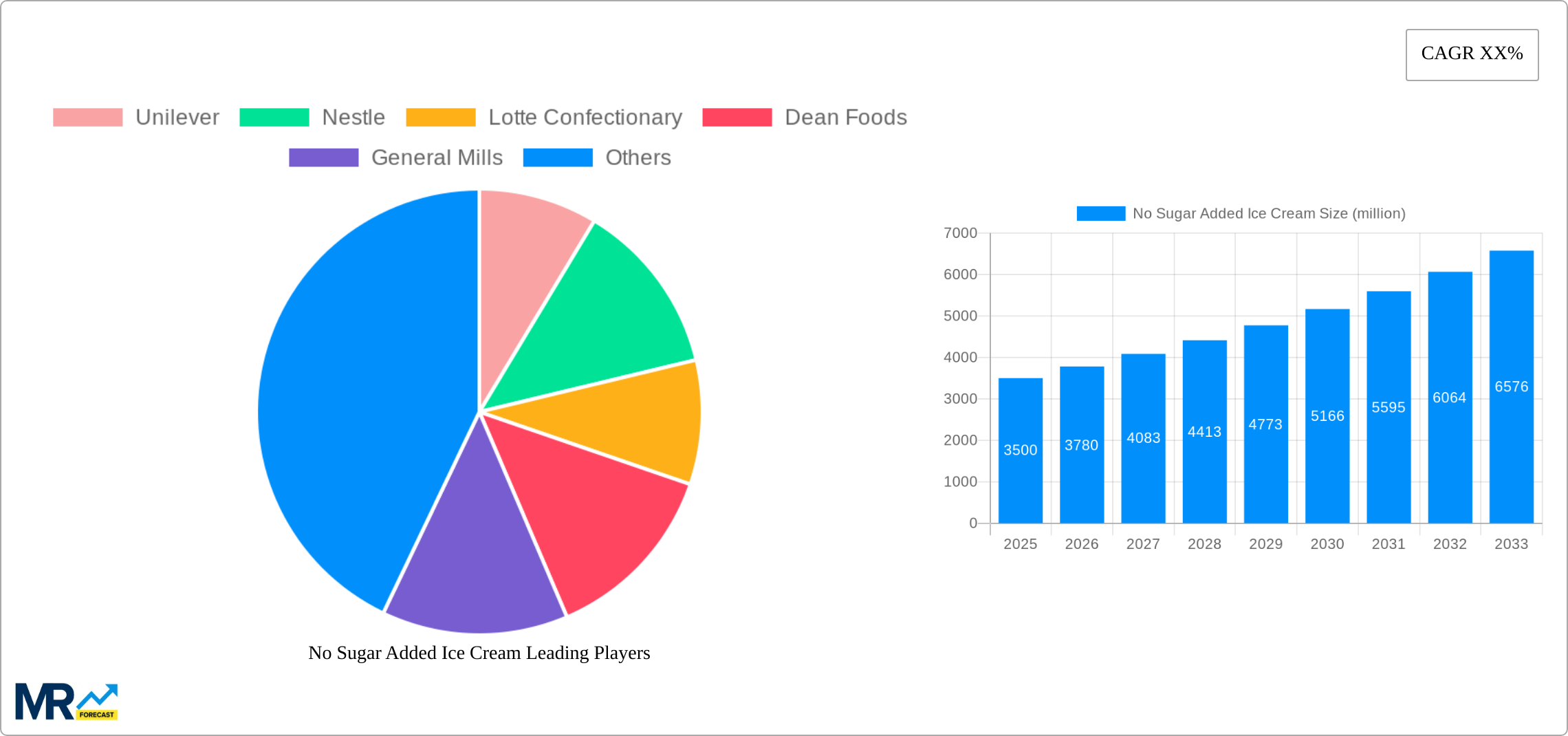

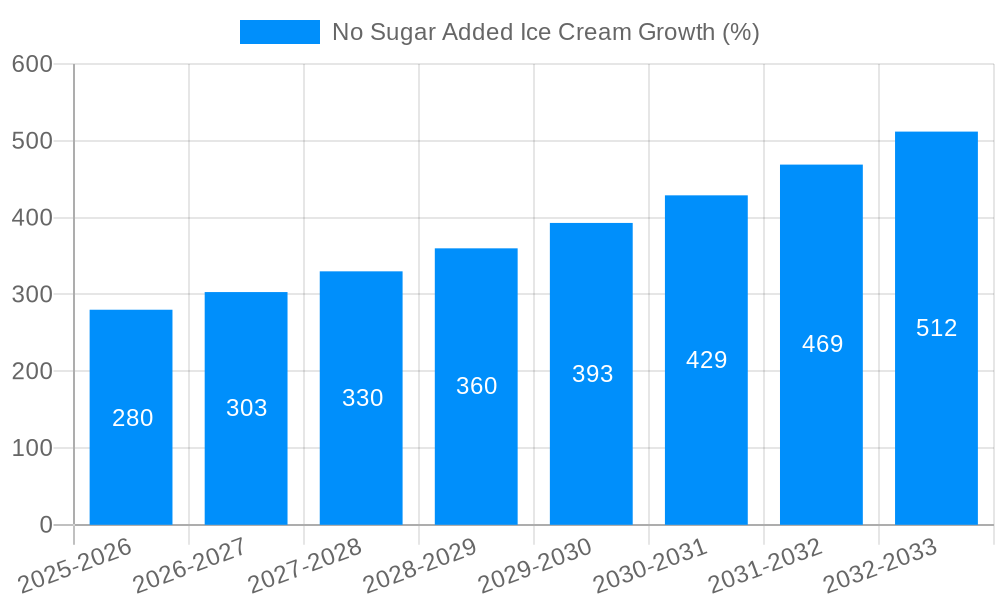

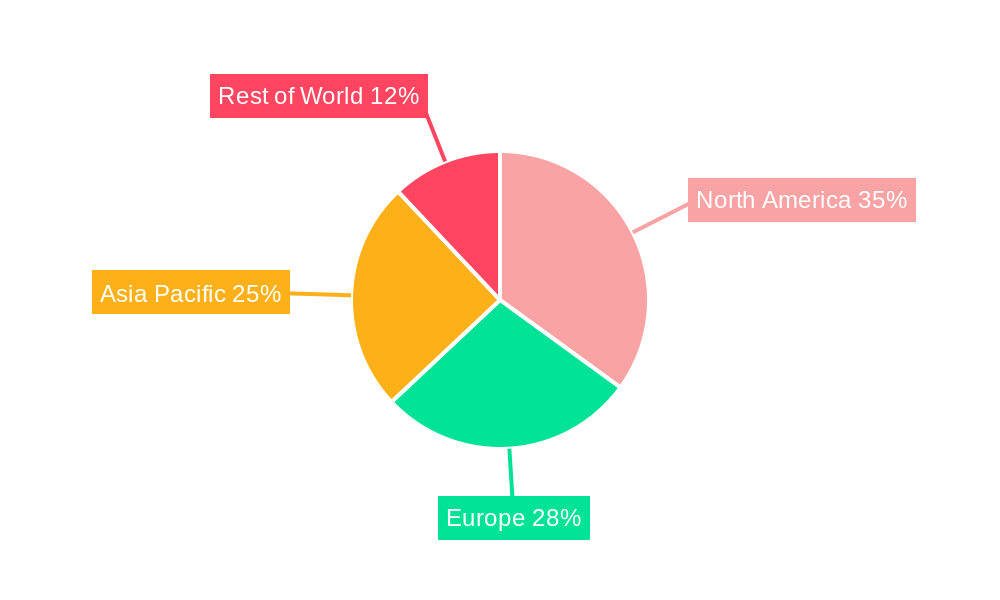

The no-sugar-added ice cream market is experiencing robust growth, driven by increasing health consciousness and the rising prevalence of diabetes and other metabolic disorders. Consumers are actively seeking healthier alternatives to traditional ice cream, leading to significant demand for products with reduced or no added sugar. This trend is particularly pronounced in developed regions like North America and Europe, where health awareness is high and disposable incomes allow for premium product purchases. While the market size for no-sugar-added ice cream in 2025 is estimated at $3.5 billion (based on a reasonable assumption considering the overall ice cream market and growing health food segments), a Compound Annual Growth Rate (CAGR) of 8% is projected for the period 2025-2033, indicating substantial future market expansion. This growth is being fueled by product innovation, including the development of low-calorie sweeteners and natural flavorings that replicate the taste and texture of traditional ice cream. Major players like Unilever, Nestlé, and others are actively investing in research and development, expanding their product portfolios with no-sugar-added options to capitalize on this lucrative market segment. The market is segmented by type (soft serve, hard pack), application (commercial vs. residential), and geography, reflecting varying consumer preferences and distribution channels. Growth is anticipated across all segments, although the hard pack segment is expected to maintain a larger market share due to higher convenience and longer shelf life.

The restraints on market growth are primarily related to the higher production costs associated with using alternative sweeteners and maintaining product quality. Consumer perception of taste and texture remains a key challenge, as some low-sugar options may not completely match the sensory experience of traditional ice cream. However, ongoing technological advancements and consumer education are gradually addressing these limitations. The Asia-Pacific region is poised for significant expansion, fueled by growing awareness of health and wellness and rising disposable incomes in emerging economies like India and China. The competitive landscape is characterized by both established multinational corporations and smaller, niche players focusing on organic and artisanal options. This dynamic market will likely see further consolidation through mergers and acquisitions as companies strive to gain market share and expand their product offerings.

The no sugar added ice cream market is experiencing robust growth, driven by the escalating global prevalence of diabetes and other health concerns. Consumers are increasingly seeking healthier alternatives to traditional sugary desserts, leading to a surge in demand for products with reduced or no added sugar. This trend is particularly pronounced in developed nations with high levels of health consciousness and disposable income, where premium, healthier food options command a significant market share. The market witnessed a Compound Annual Growth Rate (CAGR) exceeding 7% during the historical period (2019-2024), reaching an estimated value of XXX million units in 2025. This upward trajectory is projected to continue throughout the forecast period (2025-2033), propelled by innovation in product formulation, flavor profiles, and the expansion of distribution channels. Major players like Unilever, Nestlé, and Mars are actively investing in research and development to create innovative no-sugar-added ice cream varieties that cater to diverse consumer preferences. The rising popularity of plant-based and low-fat options further contributes to market expansion. Furthermore, the increasing demand for convenient and readily available frozen desserts is driving the growth of no sugar added ice cream in various formats like single-serve cups and family-sized tubs. The market is witnessing a shift towards more natural and organic ingredients, influencing the development of new product lines with clean labels and minimal processing. This consumer focus on transparency and ingredient quality adds to the growth momentum of this sector. The success of this market segment lies in effectively balancing health-conscious consumer demands with the delectable taste and creamy texture expected in premium ice cream.

Several key factors are driving the growth of the no sugar added ice cream market. The escalating global health concerns related to diabetes, obesity, and cardiovascular diseases are prompting consumers to make healthier food choices. The rising awareness of the detrimental effects of excessive sugar consumption is a significant catalyst. Consumers, particularly in developed economies, are increasingly discerning about the ingredients in their food, seeking products with clean labels and minimal artificial additives. This preference for natural and organic ingredients is further driving demand for no sugar added ice cream. The food industry’s proactive response to these trends is evident in the launch of numerous innovative products with reduced or no added sugar, often utilizing natural sweeteners like stevia or monk fruit. Technological advancements in food processing and preservation allow manufacturers to create delicious and creamy ice cream without compromising on taste or texture, even in the absence of traditional sugar. Marketing strategies that emphasize health benefits and natural ingredients are also playing a critical role in attracting health-conscious consumers. Finally, the increasing availability of no sugar added ice cream through various retail channels, including supermarkets, specialty stores, and online platforms, makes it more accessible to a wider consumer base.

Despite the promising growth outlook, the no sugar added ice cream market faces several challenges. One major hurdle is the potential for a compromised taste and texture compared to traditional ice cream. Many consumers perceive a difference in taste and texture and may be hesitant to switch to no sugar added options. The higher cost of production associated with the use of natural sweeteners and specialized processing techniques can limit affordability, particularly in price-sensitive markets. Maintaining the desirable creamy texture and preventing ice crystal formation are technological challenges that manufacturers are continuously trying to overcome. The perception of no sugar added ice cream as less indulgent or less enjoyable can also pose a challenge, requiring effective marketing strategies to address this concern. The limited shelf life of some no sugar added ice cream varieties due to the use of natural ingredients also presents a logistical challenge for manufacturers and retailers. Overcoming these challenges will require further innovations in product formulation, processing, and distribution, coupled with robust marketing efforts that effectively communicate the benefits of no sugar added ice cream to a broad consumer base.

The North American region is expected to dominate the no sugar added ice cream market throughout the forecast period. The high level of health consciousness among consumers, coupled with a robust economy and established retail infrastructure, contributes to the significant demand. Within North America, the United States holds a particularly dominant position, reflecting its large population and mature ice cream market. The European market also shows significant potential for growth, driven by rising health concerns and the increasing adoption of healthier lifestyle choices in several key European countries.

Dominant Segment: The hard ice cream segment is anticipated to hold the largest market share due to its established consumer preference and widespread availability. Hard ice cream offers a consistent texture and long shelf life, making it a desirable option for consumers and retailers.

Residential Application: The residential application segment will account for a considerable portion of the market. The increasing convenience and popularity of purchasing ice cream for home consumption drives this segment.

Market Growth by Region: North America will lead in terms of market volume and value, due to high per capita consumption rates and a prevalence of health-conscious consumers.

The high demand for premium ice cream in regions such as North America and Europe drives the high costs in this sector. Consumers are willing to pay premium prices for health-focused ice cream options, leading to higher revenue for producers. Asia Pacific presents considerable future growth potential, especially in countries with rapidly growing middle classes and increasing urbanization.

Several factors act as significant growth catalysts for the no sugar added ice cream industry. These include the increasing prevalence of health-conscious consumers prioritizing wellness and seeking healthier alternatives to traditional sugary treats. The rising awareness of the negative effects of excessive sugar intake fuels the demand for products with reduced or no added sugar. Furthermore, advancements in technology and ingredient sourcing are leading to the development of more palatable and commercially viable alternatives that closely mimic the taste and texture of traditional ice cream. The increasing availability of these products in various retail channels further expands market accessibility and fuels sales growth. Finally, clever marketing and branding strategies emphasizing the health benefits and delicious taste of these products are contributing to market expansion and consumer adoption.

This report provides a detailed analysis of the no sugar added ice cream market, including an examination of market trends, driving forces, challenges, key players, and future growth prospects. The report covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033). The report provides a comprehensive understanding of the market dynamics and offers valuable insights for stakeholders across the value chain, including manufacturers, retailers, and investors. This detailed market study helps inform strategic decision-making and investment strategies within this rapidly evolving sector. The market is segmented by type (soft and hard ice cream), application (commercial, residential), and key geographic regions, providing a granular view of market opportunities and growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Unilever, Nestle, Lotte Confectionary, Dean Foods, General Mills, Mars, Yili Group, Morinaga, Meiji, Mengniu, Turkey Hill, Blue Bell Creameries, Amul, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "No Sugar Added Ice Cream," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the No Sugar Added Ice Cream, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.