1. What is the projected Compound Annual Growth Rate (CAGR) of the No Residue Security Label?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

No Residue Security Label

No Residue Security LabelNo Residue Security Label by Type (Prohibition Label, Warning Label, Others, World No Residue Security Label Production ), by Application (Personal Care and Cosmetics, Food and Beverage, Consumer Goods, Others, World No Residue Security Label Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

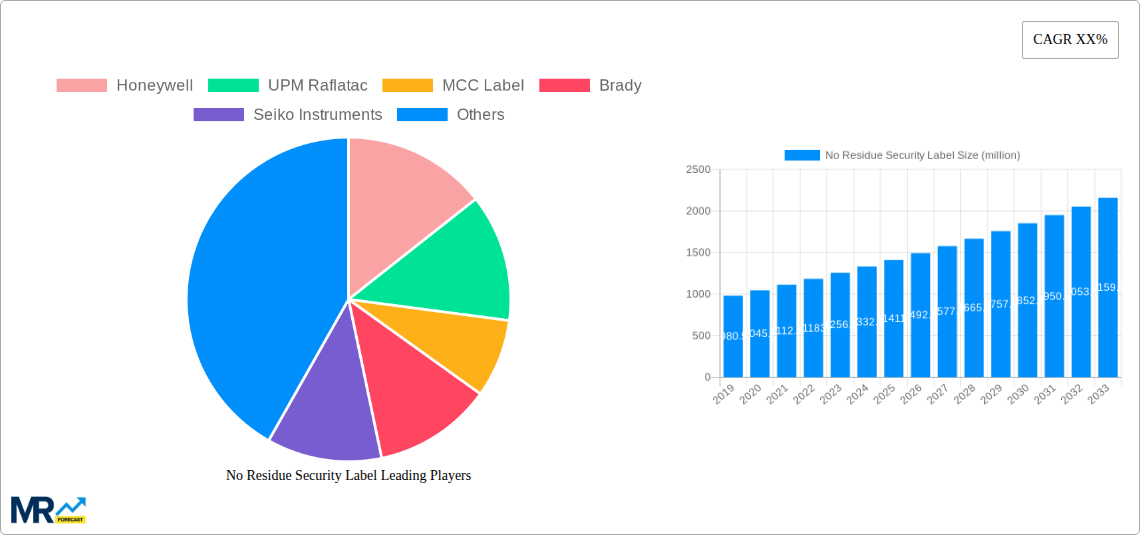

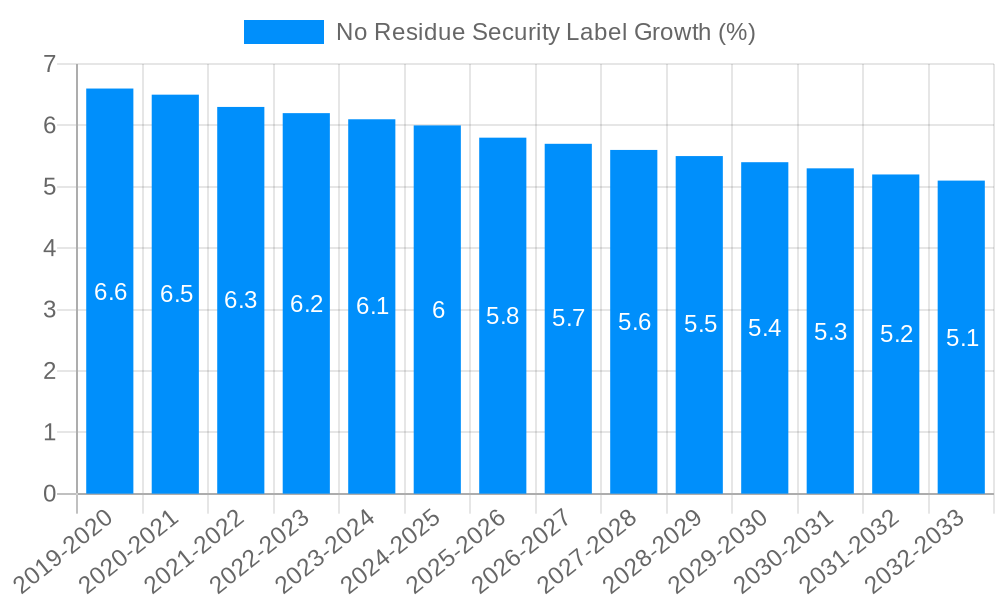

The global No Residue Security Label market is poised for substantial growth, projected to reach a market size of approximately 1517.7 million USD by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.8% between 2019 and 2033. This robust expansion is primarily fueled by the increasing demand for enhanced product security and authenticity across diverse industries. The personal care and cosmetics sector, along with the food and beverage industry, are significant drivers, as brands increasingly implement these labels to combat counterfeiting, ensure product integrity, and build consumer trust. The rising consumer awareness regarding product safety and the growing stringency of regulatory frameworks worldwide further bolster the market's upward trajectory. Moreover, the trend towards sophisticated anti-counterfeiting technologies, including advanced printing techniques and tamper-evident features, is creating new opportunities for market players.

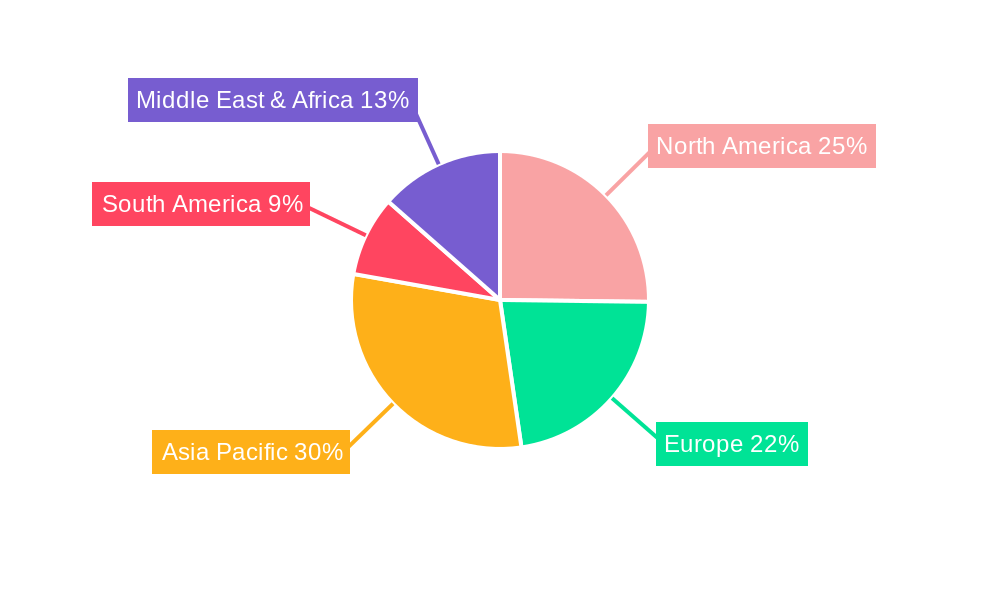

Despite the promising outlook, the market faces certain restraints. The initial cost of implementing advanced no residue security label solutions can be a barrier for smaller enterprises, potentially limiting widespread adoption. Furthermore, the development of innovative and cost-effective alternatives by competitors could exert pressure on market pricing. However, the continuous innovation in material science and printing technology, leading to more durable, user-friendly, and aesthetically appealing labels, is expected to mitigate these challenges. Key segments such as Prohibition Labels and Warning Labels are expected to witness significant demand. Geographically, the Asia Pacific region, particularly China and India, is anticipated to emerge as a dominant force due to its burgeoning manufacturing base and increasing focus on brand protection. North America and Europe are also expected to maintain strong market positions, driven by well-established regulatory environments and high consumer expectations for product security.

This report provides an in-depth analysis of the global No Residue Security Label market, offering critical insights for stakeholders across the value chain. Spanning from the historical period of 2019-2024, through the base and estimated year of 2025, and extending to a detailed forecast period of 2025-2033, this study delves into market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. The market is projected to reach a significant valuation in the hundreds of millions of dollars by the end of the forecast period, underscoring its growing importance.

The global No Residue Security Label market is experiencing robust growth, driven by an escalating demand for tamper-evident packaging solutions across a multitude of industries. In the historical period (2019-2024), the market saw steady expansion, fueled by increasing consumer awareness of product authenticity and the rising incidence of counterfeiting. The base year of 2025 serves as a crucial pivot point, with further acceleration anticipated. A key trend observed is the increasing integration of advanced security features beyond simple residue-free removal, such as holographic elements, micro-printing, and unique serialization for enhanced traceability. The Personal Care and Cosmetics segment, along with Food and Beverage, continues to be dominant application areas, as manufacturers strive to protect their high-value and sensitive products from unauthorized access and adulteration. The "Prohibition Label" and "Warning Label" types are seeing significant uptake, reflecting a proactive approach to product safety and regulatory compliance. Furthermore, the market is witnessing a shift towards more sustainable and eco-friendly label materials, with manufacturers actively researching and developing biodegradable or recyclable no-residue security labels. The underlying technology development is also a significant trend, with advancements in material science and printing techniques enabling the creation of labels that offer superior security without compromising the integrity of the product packaging or leaving behind unsightly residue upon removal. This is particularly crucial for luxury goods and premium products where aesthetic appeal is paramount. The "Others" category within both Type and Application segments also demonstrates evolving market dynamics, highlighting the emergence of novel use cases and specialized security needs that traditional labels cannot address. The projected market valuation in the hundreds of millions of dollars by 2033 underscores the substantial and growing economic significance of this market.

The market is characterized by several key insights:

The global No Residue Security Label market is experiencing a significant upswing, propelled by a confluence of potent drivers that are reshaping the packaging and security landscape. A primary force is the unrelenting global challenge of product counterfeiting. Across diverse sectors like pharmaceuticals, electronics, and luxury goods, illicit activities result in billions of dollars in lost revenue and severe damage to brand equity. No-residue security labels offer a crucial first line of defense by making it overtly evident if a product has been tampered with, thereby deterring unauthorized access and ensuring product integrity. Furthermore, the increasing stringency of global regulations concerning product safety and traceability, particularly within the Food and Beverage and Pharmaceutical industries, is a major catalyst. Governments and regulatory bodies are mandating stricter controls on product handling and authenticity, making sophisticated security labeling a necessity rather than an option. The burgeoning e-commerce sector, while offering immense growth opportunities, also presents unique security challenges, with increased potential for product diversion and counterfeiting during online transactions. No-residue security labels are instrumental in verifying the authenticity of products delivered directly to consumers. The evolving nature of consumer awareness is also a significant factor; educated consumers are more discerning and actively seek reassurance about the safety and authenticity of the products they purchase, driving demand for clear tamper-evident indicators. Finally, the inherent advantage of "no residue" – preserving the aesthetic appeal of packaging and preventing damage to sensitive surfaces – makes these labels particularly attractive for premium products where presentation is as important as protection. This multifaceted interplay of economic, regulatory, technological, and consumer-driven factors is creating a powerful momentum for the No Residue Security Label market, projected to be valued in the hundreds of millions of dollars by 2033.

The key driving forces include:

Despite the promising growth trajectory, the global No Residue Security Label market is not without its hurdles, which could temper its expansion to some extent. A significant challenge lies in the cost of implementation. Advanced no-residue security labels, often incorporating sophisticated materials and intricate printing techniques, can be more expensive to produce compared to standard security labels. This higher cost can be a deterrent for smaller businesses or for applications where profit margins are already thin, especially when considering the potential market value in the hundreds of millions of dollars that needs to be sustained. The complexity of application processes can also be a restraint. While advancements are being made, some high-security no-residue labels might require specialized application equipment or trained personnel, adding to the operational burden for manufacturers. Furthermore, the lack of universal standards across different regions and industries can create confusion and hinder widespread adoption. What constitutes an acceptable level of security and residue-free performance can vary, leading to fragmented market approaches. The development of sophisticated counterfeit methods remains a persistent threat, requiring continuous innovation and investment in newer, more advanced security features to stay ahead of illicit actors. The environmental impact and recyclability of certain label materials, despite the trend towards sustainability, can also present a challenge, especially if advanced security features rely on non-recyclable components. Finally, consumer education and awareness about the specific benefits and functionalities of no-residue security labels need to be continually reinforced to ensure their perceived value justifies the potential cost premium. Overcoming these challenges will be crucial for the sustained and widespread growth of the No Residue Security Label market.

The key challenges and restraints include:

The global No Residue Security Label market is poised for significant growth, with certain regions and segments exhibiting a pronounced leadership potential, contributing to a projected market value in the hundreds of millions of dollars.

Dominant Regions and Countries:

Dominant Segments:

In summary, while North America and Europe are expected to lead in terms of established market share, the Asia Pacific region is poised for significant growth. Within applications, Personal Care and Cosmetics stand out, while Prohibition and Warning Labels represent the most directly impactful types. The fundamental segment of No Residue Security Label Production itself is the bedrock of the market's expansion.

The No Residue Security Label industry is experiencing a surge in growth, catalyzed by several key factors. The escalating global threat of product counterfeiting, particularly in high-value sectors like pharmaceuticals and luxury goods, is a primary impetus. Increased regulatory scrutiny and the demand for enhanced product traceability in industries such as Food and Beverage further fuel adoption. The burgeoning e-commerce market, with its inherent security challenges, necessitates reliable tamper-evident solutions. Furthermore, rising consumer awareness regarding product authenticity and safety, coupled with a growing preference for brands that prioritize packaging integrity, are significant growth catalysts. The continuous innovation in material science and printing technologies leading to more sophisticated and cost-effective solutions also plays a pivotal role in expanding the market's reach.

This report offers unparalleled coverage of the No Residue Security Label market, providing a holistic view for strategic decision-making. It delves deeply into market segmentation, offering detailed analysis of growth patterns within specific types like Prohibition Labels and Warning Labels, as well as within crucial application areas such as Personal Care and Cosmetics, and Food and Beverage. The report meticulously forecasts market expansion, projecting values in the hundreds of millions of dollars, and identifies key regional and country-specific growth hotspots. It highlights the driving forces, such as the fight against counterfeiting and regulatory compliance, while also thoroughly examining the challenges and restraints, including cost and application complexity. Furthermore, the report identifies pivotal growth catalysts and provides a comprehensive overview of leading market players and their groundbreaking developments. This detailed exploration ensures stakeholders gain actionable insights to navigate and capitalize on the evolving No Residue Security Label landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Honeywell, UPM Raflatac, MCC Label, Brady, Seiko Instruments, CCL Industries, Mercian Labels, Avery Dennison, CILS international, Securikett, KURZ, Groupdc, Autajon Group, .

The market segments include Type, Application.

The market size is estimated to be USD 1517.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "No Residue Security Label," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the No Residue Security Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.