1. What is the projected Compound Annual Growth Rate (CAGR) of the Nickel‐free Austenitic Stainless Steel?

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Nickel‐free Austenitic Stainless Steel

Nickel‐free Austenitic Stainless SteelNickel‐free Austenitic Stainless Steel by Application (Biomedical, Cookware, Wearable Devices, Other), by Type (Ni≤0.1%, 0.1%<Ni≤1%), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

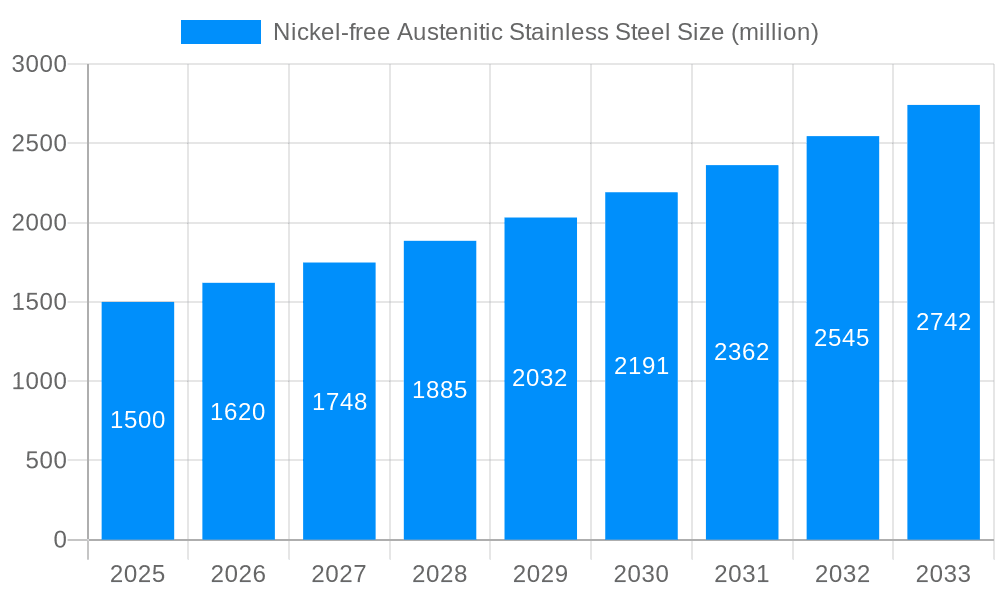

The nickel-free austenitic stainless steel market is poised for significant expansion, driven by escalating demand in key industries. Growing requirements for corrosion-resistant materials in automotive, aerospace, and chemical processing sectors are primary growth catalysts. Additionally, tightening regulations on nickel toxicity are accelerating the adoption of nickel-free solutions. Manufacturing advancements are enhancing material properties and cost-effectiveness, contributing to market growth. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.1%, with a base year market size of 134.3 billion in 2025.

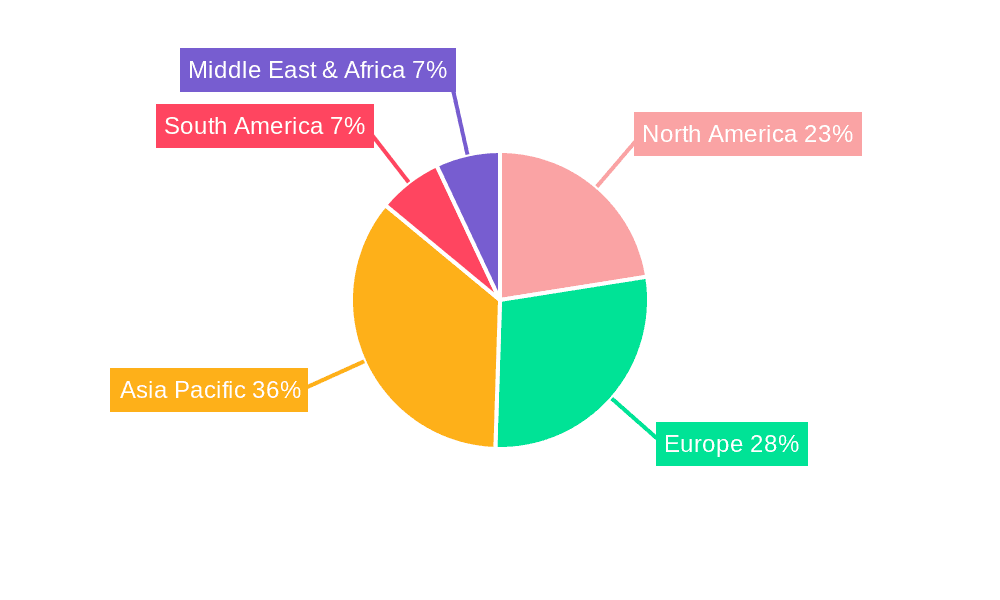

Leading companies including Carpenter Technology, OPTIMIM, GKN Powder Metallurgy, Outokumpu, and Swiss Steel Group are making strategic investments in research and development and expanding production to meet rising demand. Market segmentation is predominantly by application, with automotive components, chemical processing equipment, and medical devices being key segments, the automotive sector commanding a substantial share. Despite challenges like higher production costs compared to conventional nickel-containing stainless steel, ongoing innovation and increasing environmental consciousness will sustain market growth. Regional dynamics will be shaped by industrial development, regulatory environments, and consumer preferences. North America and Europe currently lead the market, with Asia-Pacific anticipated to experience robust growth.

The global market for nickel-free austenitic stainless steel is poised for substantial growth, projected to reach XXX million units by 2033. This represents a significant increase from XXX million units in 2025 (estimated year), demonstrating a robust Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a steadily increasing demand, driven primarily by the escalating need for corrosion-resistant materials in diverse sectors. The market's expansion is fueled by several key factors, including rising environmental concerns regarding nickel's toxicity, the increasing demand for sustainable and cost-effective alternatives, and advancements in material science leading to improved properties of nickel-free alloys. This report analyzes the market dynamics, examining the impact of these factors and highlighting the significant role played by key players such as Carpenter Technology, OPTIMIM, GKN Powder Metallurgy, Outokumpu, and Swiss Steel Group. The shift towards nickel-free alternatives is particularly evident in specific industry segments like automotive, aerospace, and medical devices, where stringent regulations and performance demands drive the adoption of high-quality, sustainable materials. The report also dives deep into regional variations, pinpointing key areas of growth and exploring future market potential. A comprehensive competitive landscape analysis provides insights into the strategies employed by leading manufacturers to maintain their market share and capitalize on emerging opportunities within this dynamic market. The study period, encompassing 2019-2033, with a base year of 2025, allows for a detailed examination of the past, present, and future trajectory of the nickel-free austenitic stainless steel market.

Several factors are accelerating the growth of the nickel-free austenitic stainless steel market. The rising environmental awareness and concerns over nickel's toxicity are paramount. Regulations aimed at reducing the environmental impact of manufacturing processes are pushing industries to adopt greener alternatives, making nickel-free stainless steel an attractive choice. Simultaneously, the fluctuating price of nickel creates significant cost uncertainties for traditional stainless steel production. Nickel-free options offer a more stable and potentially cost-effective solution, particularly in high-volume applications. Furthermore, continuous advancements in materials science are resulting in the development of nickel-free alloys that exhibit superior mechanical properties, corrosion resistance, and weldability, surpassing the capabilities of some traditional nickel-bearing counterparts. This continuous improvement in performance characteristics is attracting greater interest from various industries seeking high-performance materials. The growing demand for sustainable and ethically sourced materials further fuels the market's expansion. Many companies are increasingly prioritizing sustainability in their supply chains, leading to a preference for materials with lower environmental impact, thus boosting the adoption of nickel-free alternatives. Finally, the increasing demand for lightweight and high-strength materials across sectors like automotive and aerospace is driving the need for innovative materials like nickel-free austenitic stainless steels, further pushing market growth.

Despite the promising growth trajectory, the nickel-free austenitic stainless steel market faces certain challenges. One major hurdle is the higher initial cost of production compared to traditional nickel-bearing stainless steels. While long-term cost benefits may exist due to nickel price fluctuations and potential for recyclability, the higher upfront investment can be a barrier for some industries. Additionally, the availability and consistent supply of raw materials needed for nickel-free alloys can be a concern. The development and establishment of robust and reliable supply chains for these materials is crucial for the sustained growth of the market. Furthermore, overcoming potential performance limitations compared to well-established nickel-containing counterparts requires ongoing research and development. While advancements are being made, achieving comparable levels of strength, corrosion resistance, and weldability in certain applications might still pose a challenge for some nickel-free alloys. Finally, the market faces the challenge of educating and convincing potential customers about the benefits of adopting nickel-free alternatives. Overcoming misconceptions and fostering industry-wide acceptance of these new materials is key to widespread adoption and market expansion.

The nickel-free austenitic stainless steel market is experiencing diverse growth across various regions and segments.

Automotive: The automotive industry is a significant driver, with increasing demand for lightweight, corrosion-resistant components in vehicles. The strict emission regulations and fuel efficiency standards are pushing automakers to utilize advanced materials, including nickel-free stainless steels, to improve vehicle performance and reduce weight.

Aerospace: The aerospace sector utilizes nickel-free stainless steel for its high strength-to-weight ratio and exceptional corrosion resistance, crucial for aircraft components operating in demanding environments.

Medical Devices: This segment requires biocompatible and highly corrosion-resistant materials; nickel-free stainless steel fits these criteria, leading to its increasing adoption in implants and surgical instruments.

Chemical Processing: The chemical industry uses nickel-free stainless steels to handle corrosive chemicals and maintain production efficiency and safety.

North America: Stringent environmental regulations and a focus on sustainability are driving demand in North America. The presence of major manufacturers and automotive companies in the region further fuels growth.

Europe: The European Union's commitment to sustainable development and circular economy principles supports the adoption of nickel-free alternatives.

Asia-Pacific: This region is expected to witness significant growth driven by rapid industrialization and infrastructure development. Rising disposable incomes and increasing consumer demand for durable goods contribute to this growth.

In summary, a combination of factors makes the automotive and aerospace sectors, alongside the North American and Asia-Pacific regions, particularly significant for nickel-free austenitic stainless steel market dominance. The interplay between material performance, environmental considerations, and industry-specific needs dictates the regional and segmental variations in market growth.

Several factors are accelerating the industry's growth. Increasing environmental awareness and stringent regulations regarding nickel's toxicity are paramount. The growing demand for sustainable and ethically sourced materials, coupled with advancements in materials science yielding superior nickel-free alloys, further fuels market expansion. The continuous improvement in the performance of these alloys, combined with a more stable pricing structure compared to nickel-based alternatives, is attracting increased adoption across various industries.

This report provides a comprehensive analysis of the nickel-free austenitic stainless steel market, covering historical data, current market dynamics, and future projections. The report's detailed examination of industry trends, driving forces, challenges, and key players offers valuable insights for stakeholders seeking to understand and navigate this rapidly evolving market. The focus on regional and segmental variations ensures a precise understanding of market dynamics and opportunities for investment and growth.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

Key companies in the market include Carpenter Technology, OPTIMIM, GKN Powder Metallurgy, Outokumpu, Swiss Steel Group.

The market segments include Application, Type.

The market size is estimated to be USD 134.3 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Nickel‐free Austenitic Stainless Steel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Nickel‐free Austenitic Stainless Steel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.