1. What is the projected Compound Annual Growth Rate (CAGR) of the Nickel for EV Battery?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Nickel for EV Battery

Nickel for EV BatteryNickel for EV Battery by Type (Nickel Sulfate, Nickel Hydroxide, World Nickel for EV Battery Production ), by Application (Nickel Cobalt Aluminium (NCA) Battery, Nickel Manganese Cobalt (NMC) Battery, Sodium–nickel Chloride Battery, World Nickel for EV Battery Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

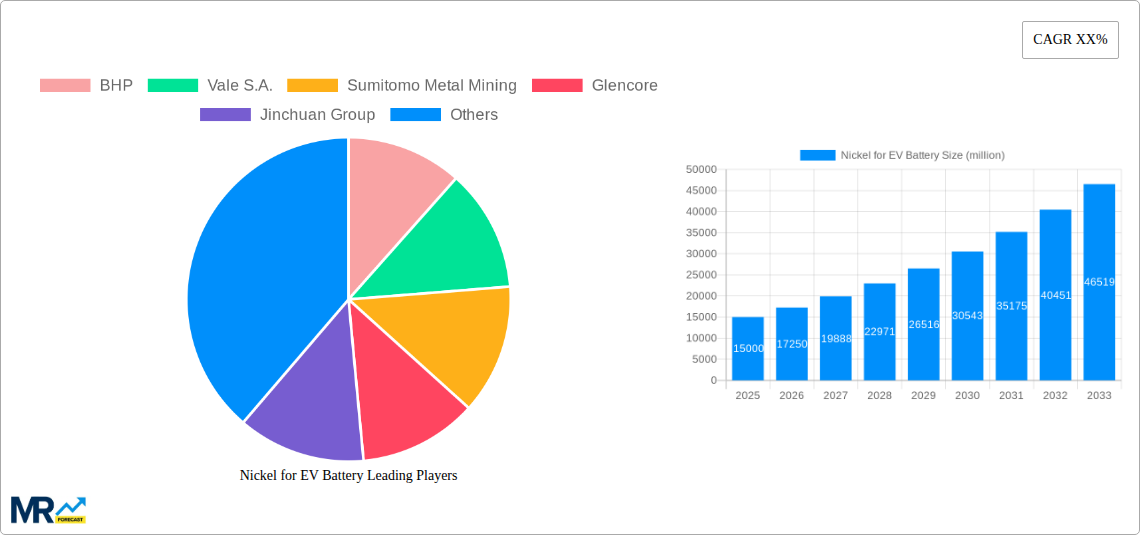

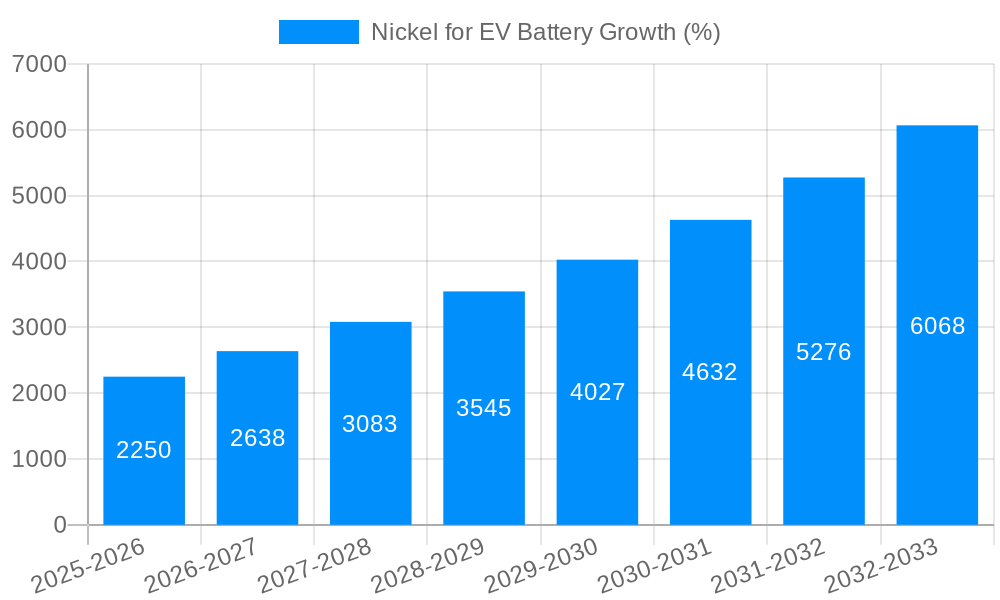

The global nickel market for electric vehicle (EV) batteries is experiencing robust growth, driven by the burgeoning demand for electric vehicles worldwide. The transition to cleaner energy sources and stricter emission regulations are key catalysts propelling this expansion. While precise market sizing data is unavailable, a reasonable estimation, considering the substantial investment in EV battery manufacturing and the projected growth of the EV sector, suggests a 2025 market size of approximately $15 billion. Assuming a conservative Compound Annual Growth Rate (CAGR) of 15% over the forecast period (2025-2033), the market could reach approximately $60 billion by 2033. This growth is fueled by advancements in battery technology, particularly the increasing adoption of nickel-rich cathode chemistries which offer higher energy density and longer range for EVs. Major players like BHP, Vale S.A., and Glencore are strategically positioning themselves to capitalize on this demand, investing heavily in nickel mining and processing capabilities.

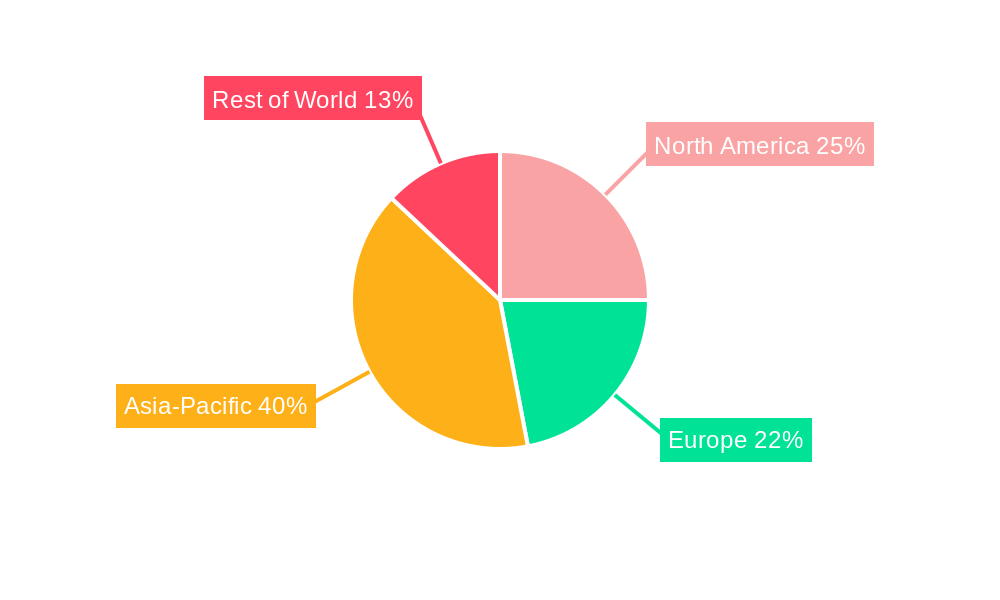

However, the market faces challenges. Supply chain disruptions, geopolitical uncertainties impacting raw material sourcing, and fluctuations in nickel prices pose significant restraints. Furthermore, the ethical sourcing of nickel, considering environmental and social impacts of mining, is becoming increasingly crucial and necessitates sustainable practices throughout the supply chain. Market segmentation is predominantly geographically based, with regions like North America, Europe, and Asia-Pacific exhibiting significant demand. The intensifying competition among established mining companies and emerging players will shape the market landscape in the coming years. Long-term success will hinge on companies demonstrating a commitment to responsible sourcing, technological innovation, and effective supply chain management to meet the surging demand for nickel in the rapidly evolving EV battery sector.

The global nickel market for electric vehicle (EV) batteries is experiencing explosive growth, driven by the burgeoning EV industry. The study period from 2019 to 2033 reveals a dramatic shift in demand, with the historical period (2019-2024) showcasing a steady increase culminating in an estimated market value of XXX million units in 2025 (the base year and estimated year). The forecast period (2025-2033) projects even more significant expansion, reaching a projected XXX million units by 2033. This surge reflects several factors, including increasing government incentives for EV adoption, stringent emission regulations pushing internal combustion engine vehicle displacement, and improvements in battery technology leading to greater energy density and longer driving ranges. The market is characterized by significant price volatility, influenced by supply chain disruptions, geopolitical instability, and the inherent complexity of nickel mining and processing. The transition towards more sustainable and responsible sourcing of nickel is also gaining momentum, impacting the market landscape and influencing investor and consumer preferences. This trend is particularly evident in the increased demand for nickel from sources committed to ethical labor practices and environmentally friendly extraction methods. The competitive landscape is dynamic, with established mining giants like BHP and Glencore vying for market share alongside emerging players focusing on innovative extraction and processing technologies. The interplay of these factors contributes to the overall dynamism and future growth potential of the nickel market for EV batteries.

Several key factors are fueling the unprecedented growth in the nickel market for EV batteries. Firstly, the global push towards decarbonization and the resulting surge in EV adoption are primary drivers. Governments worldwide are implementing ambitious emission reduction targets, incentivizing EV purchases through subsidies and tax breaks, and gradually phasing out fossil fuel-powered vehicles. This policy landscape directly translates into a significant increase in the demand for EV batteries, and subsequently, the nickel required for their production. Secondly, advancements in battery technology are crucial. Higher energy density batteries, offering extended driving ranges, are becoming increasingly prevalent, demanding larger quantities of nickel in their composition. The shift towards nickel-rich cathode chemistries, such as NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum), further intensifies this demand. Thirdly, the ongoing expansion of charging infrastructure is facilitating wider EV adoption, increasing consumer confidence and prompting greater market penetration. Finally, the exploration and development of new nickel mines and refining facilities are slowly increasing, albeit still struggling to keep pace with the escalating demand. However, this expansion suggests that the supply side is responding to the market's needs, though challenges remain in balancing supply and demand effectively.

Despite the significant growth potential, the nickel market for EV batteries faces considerable challenges. Supply chain disruptions, geopolitical instability, and price volatility pose major risks. The concentration of nickel production in a limited number of countries creates vulnerabilities to political instability and unexpected events that can disrupt supply chains and drive up prices. The environmental impact of nickel mining is another significant concern. Traditional nickel mining practices often involve significant environmental damage, resulting in calls for more sustainable and responsible mining practices. Meeting the increasing demand for nickel while mitigating environmental impacts requires substantial investment in sustainable mining technologies and responsible sourcing initiatives. Furthermore, the development of new refining capacity to process the raw nickel into battery-grade materials is lagging behind the escalating demand, potentially creating bottlenecks in the supply chain. Finally, competition for nickel from other industrial applications, such as stainless steel production, can further strain supply and influence price dynamics. Addressing these challenges requires collaborative efforts across the industry, including miners, battery manufacturers, governments, and other stakeholders.

China: China dominates the EV battery market, consequently leading in nickel demand. Its robust domestic EV industry, coupled with aggressive government support, creates immense demand. The country is also actively investing in securing nickel supplies, both domestically and internationally.

Europe: Europe is experiencing rapid EV adoption, driven by stringent emission regulations and government incentives. The region is focusing on establishing a resilient and sustainable battery supply chain, seeking to reduce its dependence on imports.

North America: North America shows considerable growth potential, driven by increasing EV sales and government support for domestic battery production. The region's focus on developing domestic nickel resources is likely to enhance its market share.

Indonesia: Indonesia possesses significant nickel reserves and is aggressively promoting downstream processing to create more value domestically. The country is becoming a major player in the nickel supply chain, supplying refined nickel products globally.

Battery-grade Nickel Sulfate: This refined nickel product is specifically tailored for use in EV battery cathodes, making it the most sought-after form of nickel. Demand for battery-grade nickel sulfate is projected to outpace other forms, driving its market dominance.

In summary, while China holds the largest share owing to its massive EV market, other regions and Indonesia's burgeoning nickel refining sector will significantly influence the nickel market for EV batteries in the coming years. The focus on battery-grade nickel sulfate underscores the refinement process's importance in the EV battery supply chain.

The growth of the nickel for EV battery industry is fueled by a combination of factors. Strong government policies promoting electric vehicle adoption, particularly through subsidies and emission regulations, are significant catalysts. Technological advancements enhancing battery performance, including higher energy density and longer lifespan, contribute to increased demand. Finally, the burgeoning global EV market, encompassing both passenger vehicles and electric buses and trucks, continuously expands the demand for nickel-based batteries.

This report provides a comprehensive overview of the nickel for EV battery market, covering historical trends, current market dynamics, and future projections. It analyses key drivers and challenges, profiles leading market players, and examines regional variations in market growth. The report offers valuable insights for stakeholders in the nickel mining, battery manufacturing, and EV industries, enabling informed decision-making and strategic planning in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BHP, Vale S.A., Sumitomo Metal Mining, Glencore, Jinchuan Group, Talon Metal, PT Aneka Tambang (Antam), Nornickel, Sherritt International, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Nickel for EV Battery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Nickel for EV Battery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.