1. What is the projected Compound Annual Growth Rate (CAGR) of the NFC Digital Business Card?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

NFC Digital Business Card

NFC Digital Business CardNFC Digital Business Card by Type (Offline Variant, Online Variant, World NFC Digital Business Card Production ), by Application (Private Order, Company Order, World NFC Digital Business Card Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

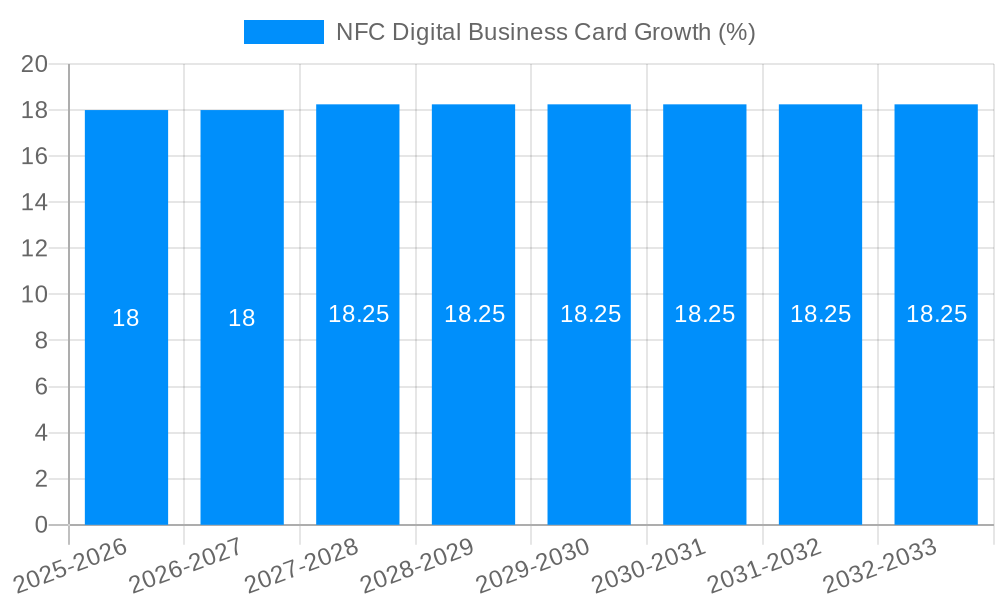

The global NFC Digital Business Card market is poised for substantial growth, with an estimated market size of approximately USD 23 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of around 18-22% through 2033. This dynamic expansion is fueled by an increasing adoption of digital solutions in professional networking and a growing awareness of the environmental benefits of paperless alternatives. Key market drivers include the inherent convenience and efficiency offered by NFC technology, enabling instant contact sharing, and the desire for a modern, sophisticated professional image. The trend towards remote work and hybrid professional environments further bolsters demand, as digital business cards offer a seamless way to connect regardless of physical proximity. The market is segmented by Type into Offline Variants, which offer standalone functionality, and Online Variants, often integrated with comprehensive digital profile management platforms. Both Private and Company Orders constitute significant application segments, with businesses increasingly investing in branded digital cards for their employees to enhance brand recognition and streamline internal communication.

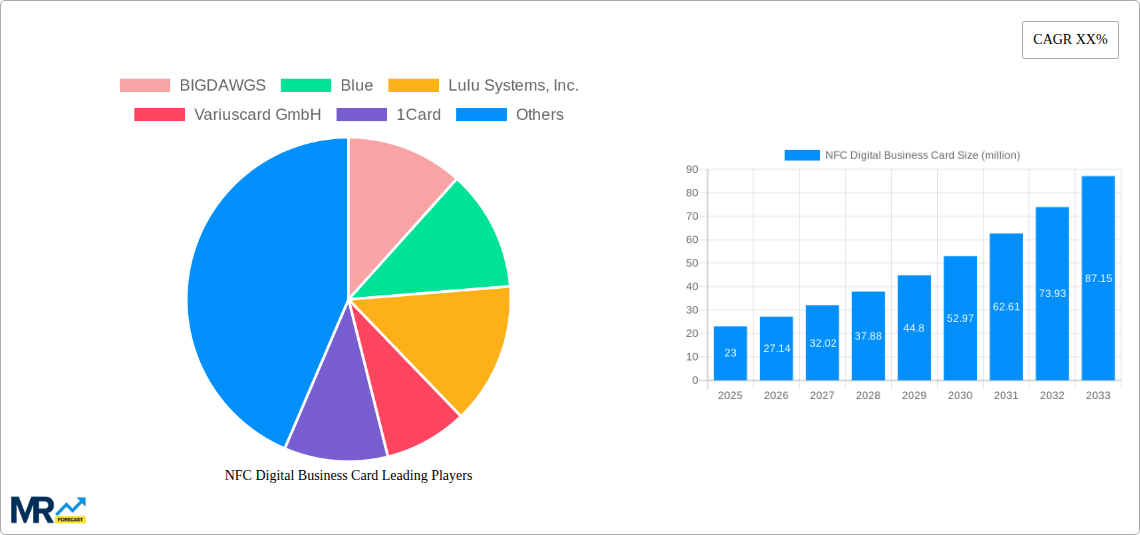

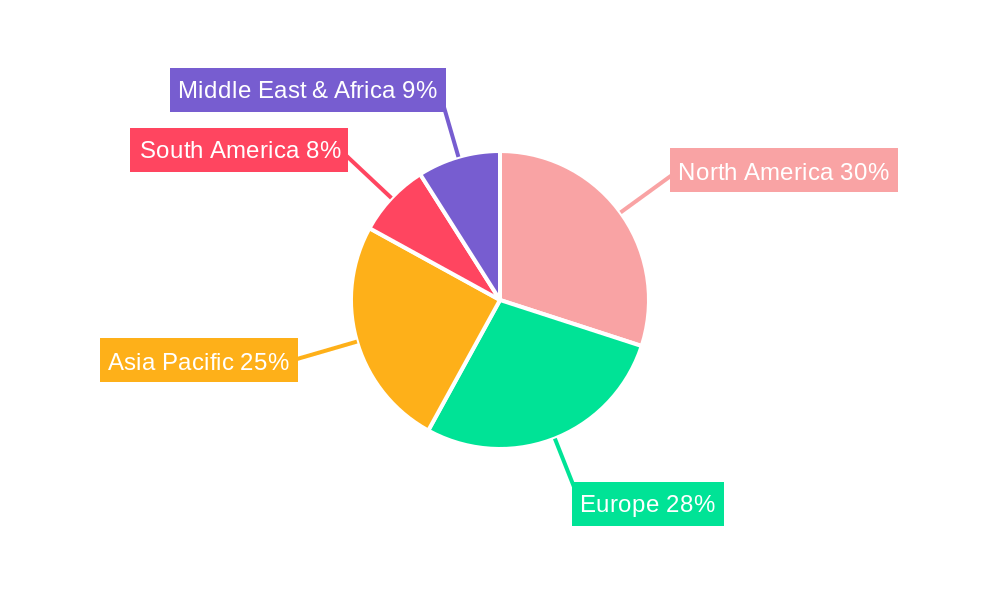

The forecast period (2025-2033) anticipates a robust trajectory for NFC Digital Business Cards, driven by technological advancements, enhanced user experience, and a shift in corporate procurement towards sustainable and digitally integrated solutions. While the market's rapid growth is promising, certain restraints may emerge, such as potential initial implementation costs for some businesses or varying levels of NFC technology familiarity among different demographics. However, these are expected to be mitigated by falling hardware costs and user-friendly interface designs. Geographically, North America and Europe are anticipated to lead market penetration due to early adoption of advanced technologies and a strong business ecosystem. The Asia Pacific region, particularly China and India, is expected to witness the fastest growth, driven by a burgeoning startup culture and rapid digitalization efforts. Companies like BIGDAWGS, Blue, Lulu Systems, Inc., and Variuscard GmbH are at the forefront, innovating and expanding their offerings to cater to this evolving market demand, from individual professionals to large enterprise deployments.

This comprehensive report offers an in-depth analysis of the global NFC Digital Business Card market, projecting significant growth and transformation over the Study Period: 2019-2033. With a Base Year: 2025, the report provides precise projections for the Estimated Year: 2025 and forecasts the market trajectory through the Forecast Period: 2025-2033, building upon the insights gleaned from the Historical Period: 2019-2024. We anticipate a market valuation reaching into the millions, underscoring the burgeoning demand for innovative networking solutions.

The global NFC Digital Business Card market is on the cusp of a revolution, driven by an escalating desire for sustainable, efficient, and trackable networking solutions. The traditional paper business card, a relic of a bygone era, is rapidly being supplanted by its digital counterpart, powered by Near Field Communication (NFC) technology. This paradigm shift is not merely a technological upgrade; it represents a fundamental evolution in how professionals connect and exchange vital contact information. Over the Historical Period: 2019-2024, we have witnessed a steady increase in adoption, with early adopters and tech-forward companies paving the way. The Base Year: 2025 marks a pivotal point where mainstream acceptance is becoming a tangible reality. As we move into the Forecast Period: 2025-2033, the market is expected to witness exponential growth, fueled by several key trends. Firstly, the increasing awareness surrounding environmental sustainability is a major catalyst. Businesses are actively seeking to reduce their carbon footprint, and eliminating paper waste associated with traditional business cards is a straightforward yet impactful step. Secondly, the demand for enhanced data analytics and lead generation capabilities is soaring. NFC digital business cards offer unparalleled opportunities for tracking engagement, understanding contact interaction, and refining marketing strategies. This ability to gain actionable insights transforms a simple contact exchange into a powerful data-driven networking tool. Thirdly, the seamless integration with existing digital ecosystems is crucial. Users expect their digital business cards to effortlessly sync with CRM systems, contact management applications, and social media platforms, streamlining workflow and enhancing productivity. Finally, the customization and branding opportunities offered by NFC digital business cards are becoming increasingly sophisticated. Companies can now embed rich media, videos, and direct links to websites and portfolios, creating a dynamic and memorable first impression. The convergence of these trends paints a vibrant picture of a market ripe for innovation and significant expansion, poised to reach values in the millions as businesses worldwide embrace this modern networking paradigm.

The NFC Digital Business Card market is experiencing a robust surge, propelled by a confluence of powerful driving forces that are fundamentally reshaping professional interactions. At its core, the escalating need for efficiency and convenience in a fast-paced business environment is paramount. Professionals are constantly on the go, attending conferences, meetings, and networking events, and the cumbersome nature of exchanging and managing paper cards has become a significant bottleneck. NFC technology offers an instantaneous and effortless solution, allowing for the direct transfer of contact details with a simple tap. Furthermore, the growing emphasis on environmental consciousness and corporate social responsibility is a significant tailwind. As businesses worldwide strive to reduce their paper consumption and carbon footprint, the eco-friendly nature of digital business cards presents a compelling alternative. This aligns with global sustainability goals and enhances a company's brand image. The advancement and widespread adoption of smartphones, coupled with the inherent NFC capabilities in a vast majority of these devices, have created a fertile ground for this technology. The ubiquity of smartphones ensures that virtually every potential contact possesses the necessary hardware to facilitate an NFC exchange. Beyond mere convenience, the demand for sophisticated lead generation and customer relationship management (CRM) integration is a major growth driver. NFC digital business cards allow for the collection of valuable data on contact interactions, providing businesses with insights into engagement levels and enabling more targeted follow-ups. This analytical capability transforms networking from a transactional exchange into a strategic business function. The desire for enhanced brand visibility and memorable interactions also plays a crucial role. Digital business cards offer richer content possibilities, allowing users to include links to portfolios, social media profiles, videos, and other multimedia, creating a more impactful and personalized introduction than a static paper card ever could. These combined forces are creating a powerful momentum, pushing the NFC Digital Business Card market towards significant valuations in the millions.

Despite the compelling advantages and burgeoning growth of the NFC Digital Business Card market, several challenges and restraints need to be addressed to ensure its widespread and sustained adoption. A primary concern revolves around user adoption and digital literacy. While smartphone penetration is high, a segment of the professional population, particularly those in older demographics or less tech-savvy industries, may exhibit reluctance or lack the understanding to fully embrace NFC technology. Overcoming this inertia through education and simplified user interfaces is crucial. Another significant hurdle is the ongoing perception of security and privacy concerns. Users may be apprehensive about the security of their personal data being shared wirelessly, even with the inherent security protocols of NFC. Robust security measures, transparent data handling policies, and clear communication about these aspects are essential to build trust. The interoperability between different NFC digital business card platforms and applications also presents a challenge. A lack of standardization can lead to compatibility issues, hindering seamless exchange and integration across various devices and software. Efforts towards developing universal standards are vital for market maturation. Furthermore, the initial cost of implementation for some advanced solutions, especially for businesses requiring bulk orders with sophisticated customization, can be a deterrent for smaller enterprises. While the long-term cost savings of eliminating paper cards are evident, the upfront investment might be a barrier. The reliance on battery power for smartphones is also a minor, yet present, restraint. While typically not an issue, a dead phone battery can render the NFC digital business card unusable in a critical moment, underscoring the need for robust device management by users. Finally, the need for consistent connectivity for certain advanced features, such as real-time analytics, can be a limitation in areas with unreliable internet access. Addressing these challenges proactively will be key to unlocking the full market potential and reaching the projected millions in valuation.

The global NFC Digital Business Card market is poised for significant growth, with certain regions and segments expected to lead the charge in terms of adoption and innovation.

Dominating Segments:

Online Variant: This segment is projected to experience the most substantial growth. The inherent scalability and accessibility of online NFC digital business cards make them highly attractive to a broad spectrum of users. They offer a dynamic and constantly updatable platform for professionals to showcase their skills, portfolios, and contact information. The ability to seamlessly integrate with online profiles, social media, and professional networking sites further amplifies its dominance. Features like embedded videos, rich media content, and analytics on profile views and contact shares are key drivers within this segment. Companies like BIGDAWGS, Blue, and 1Card are at the forefront of developing and popularizing these online solutions, offering user-friendly platforms that cater to individual professionals and small businesses alike. The value generated from this segment is expected to contribute significantly to the overall market valuation reaching into the millions.

Company Order: While individual adoption of the "Online Variant" is high, the "Company Order" application segment is expected to drive substantial volume and revenue, particularly for enterprise-level deployments. Large corporations are increasingly recognizing the benefits of a unified and professional digital networking solution. Implementing NFC digital business cards for their entire workforce not only enhances brand consistency and strengthens corporate identity but also offers centralized management, easier updates, and robust data analytics on employee networking activities. Companies like Lulu Systems, Inc., Variuscard GmbH, and Shenzhen Xinyetong Technology are well-positioned to capitalize on this demand, offering tailored solutions that integrate with existing corporate IT infrastructure and CRM systems. The ability to deploy thousands of digital business cards with consistent branding and security protocols makes this segment a powerhouse for market value, projected to contribute considerably to the millions in overall market revenue.

Dominating Regions/Countries:

North America: The United States, in particular, is expected to be a frontrunner in the NFC Digital Business Card market. Its strong technological infrastructure, high smartphone penetration, and a culture that embraces innovation and efficiency make it a fertile ground for adoption. The presence of numerous tech-forward startups and established corporations actively seeking cutting-edge business solutions further bolsters its leadership. The demand for advanced networking tools and sustainable business practices is particularly pronounced in this region, driving the adoption of both individual and corporate NFC digital business cards.

Europe: Western European countries, including Germany, the United Kingdom, and France, are also anticipated to exhibit significant market dominance. These regions have a strong emphasis on environmental sustainability and a well-established corporate culture that values professional networking. Stringent regulations regarding data privacy also drive the adoption of secure and compliant digital solutions. Countries with a high density of SMEs and a growing startup ecosystem are likely to see rapid uptake of NFC digital business cards for their agility and cost-effectiveness.

Asia-Pacific: While currently a developing market for NFC digital business cards, the Asia-Pacific region, especially China and Southeast Asian nations, presents immense future growth potential. Rapid urbanization, increasing digital literacy, and a burgeoning business landscape are paving the way for widespread adoption. The presence of numerous manufacturing hubs and technology companies in countries like China, such as Shenzhen Chuangxinjia RFID Tag and Shenzhen Xinyetong Technology, positions them to be key players not only in production but also in market penetration. As the cost of NFC-enabled devices decreases and awareness grows, this region will become a significant contributor to the global market value, ultimately reaching the millions.

The interplay between these dominant segments and regions, fueled by innovative companies and evolving business needs, will shape the trajectory of the NFC Digital Business Card market, driving it towards substantial valuations in the coming years.

Several key factors are acting as powerful catalysts, propelling the NFC Digital Business Card industry towards significant expansion. The undeniable shift towards digital transformation across all business sectors is creating a fundamental demand for modern, efficient networking tools. As companies embrace paperless operations and seek to streamline their workflows, NFC digital business cards offer a natural and intuitive solution. Furthermore, the increasing global focus on sustainability and environmental responsibility is a major impetus. The elimination of paper waste associated with traditional business cards aligns perfectly with corporate sustainability goals and enhances brand perception. The rapid evolution and widespread adoption of smartphones equipped with NFC technology have laid a robust foundation for this market. The convenience and immediacy of sharing contact information with a simple tap are highly appealing to a generation accustomed to instant connectivity. Finally, the growing recognition of NFC digital business cards as powerful lead generation and customer engagement tools, offering valuable analytics and integration with CRM systems, is a significant growth accelerant, paving the way for the market to reach valuations in the millions.

This report offers a holistic and in-depth exploration of the global NFC Digital Business Card market, encompassing a comprehensive analysis of its current landscape and future trajectory. We delve into the nuanced trends that are shaping user behavior and industry adoption, highlighting the increasing demand for sustainable, efficient, and data-driven networking solutions. The report meticulously examines the key drivers propelling the market forward, from the inherent convenience of NFC technology and the ubiquity of smartphones to the growing corporate emphasis on environmental responsibility and enhanced lead generation capabilities. Simultaneously, it provides a candid assessment of the challenges and restraints that may impede market growth, including user adoption hurdles, security concerns, and the need for greater interoperability. A significant portion of the report is dedicated to identifying and analyzing the key regions and segments poised for market dominance, offering valuable insights for strategic planning and investment. Furthermore, we illuminate the critical growth catalysts that are poised to accelerate market expansion, ensuring stakeholders are well-equipped to capitalize on emerging opportunities. The report also features a comprehensive list of leading industry players and a chronological overview of significant developments that have shaped and will continue to influence the sector. This detailed coverage ensures that businesses and investors gain a thorough understanding of the market's potential, projecting significant growth into the millions and beyond.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BIGDAWGS, Blue, Lulu Systems, Inc., Variuscard GmbH, 1Card, BuzzTech, MoreRFID, RFITRFID, Shenzhen Chuangxinjia RFID Tag, Shenzhen Xinyetong Technology, ZBTECH, NFC Touch, .

The market segments include Type, Application.

The market size is estimated to be USD 23 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "NFC Digital Business Card," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the NFC Digital Business Card, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.