1. What is the projected Compound Annual Growth Rate (CAGR) of the Newborn Care Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Newborn Care Products

Newborn Care ProductsNewborn Care Products by Type (Diapers, Skin Care of Newborn, Food for Newborns, Bathing Products, Other), by Application (0~6 Months, 6-12 Months, 12-24 Months, World Newborn Care Products Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

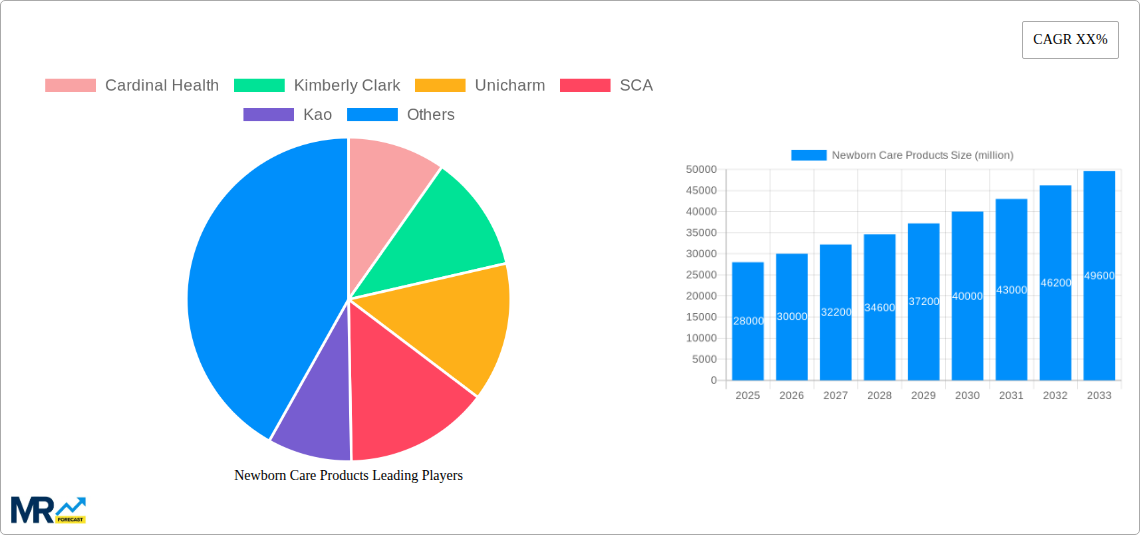

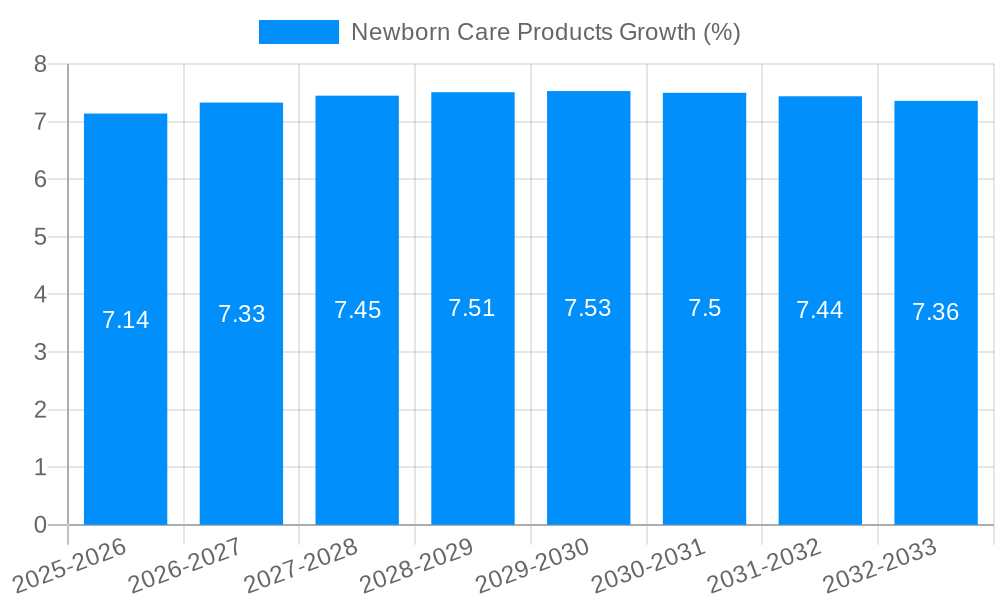

The global newborn care products market is poised for significant expansion, projected to reach an estimated market size of approximately $28,000 million by 2025. This growth is fueled by a confluence of rising global birth rates, increasing parental awareness regarding infant health and hygiene, and a growing disposable income in emerging economies. The market is expected to witness a Compound Annual Growth Rate (CAGR) of around 7.5% between 2025 and 2033, indicating a robust and sustained upward trajectory. Key drivers for this surge include the escalating demand for premium and organic baby products, innovations in diaper technology offering enhanced comfort and absorbency, and a growing segment of specialized skincare products formulated for delicate newborn skin. The "Food for Newborns" segment, in particular, is experiencing heightened interest due to advancements in infant nutrition and the increasing adoption of specialized formulas.

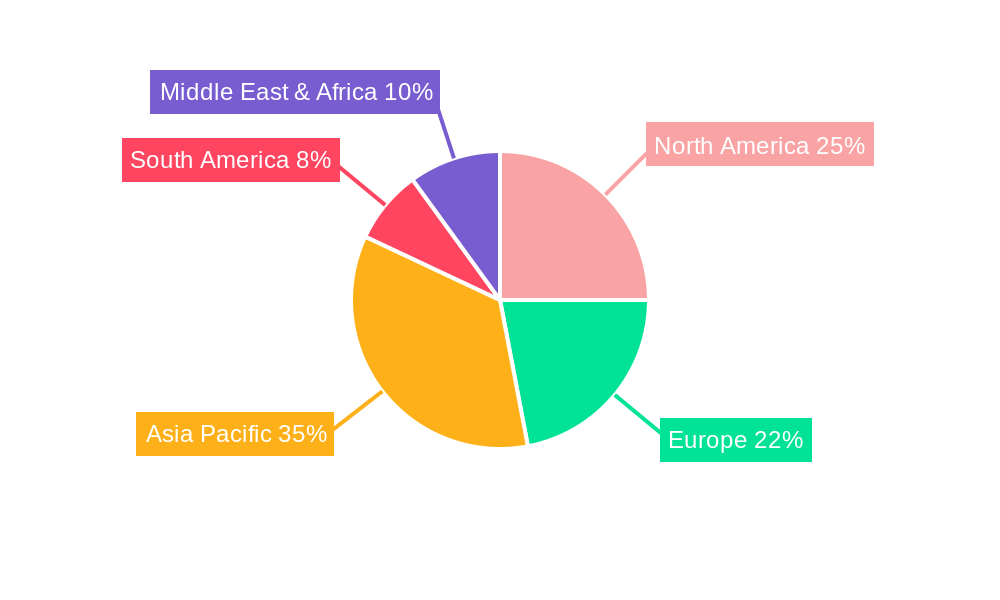

The market segmentation reveals a diverse landscape. Diapers are anticipated to maintain their dominant position, driven by consistent demand and continuous product innovation. However, significant growth is also expected in the Skin Care of Newborns and Food for Newborns segments as parents prioritize specialized and safe products for their infants. Regionally, Asia Pacific, led by China and India, is projected to be the fastest-growing market, attributed to a large young population and increasing urbanization. North America and Europe represent mature yet substantial markets, characterized by a strong preference for high-quality and branded products. Restraints such as fluctuating raw material prices and intense competition are present, but are largely offset by the strong underlying demand and evolving consumer preferences for safe, effective, and sustainable newborn care solutions.

The global newborn care products market is experiencing a dynamic shift, driven by evolving parental preferences, technological advancements, and a growing awareness of infant health and safety. XXX, a significant insight, points towards a pronounced move towards premium and eco-conscious products. Parents are increasingly willing to invest in high-quality items that offer superior performance, gentleness, and sustainability. This is evident in the burgeoning demand for organic and biodegradable diapers, which have seen production surge into the tens of millions of units annually over the historical period (2019-2024). Similarly, skin care products formulated with natural and hypoallergenic ingredients are gaining traction, with their market penetration growing by millions of units each year. The market is also witnessing a bifurcation, with both value-for-money options and luxury segments experiencing growth. For instance, while essential baby wipes and basic feeding bottles remain strong sellers, there's a parallel rise in demand for advanced sterilizers, smart feeding devices, and specialized organic baby food formulations, each contributing hundreds of thousands to millions of units to the overall production volume.

The application segment of 0-6 Months continues to be the largest by volume, as this is the period of most intensive product usage for diapers and feeding. Production in this segment alone has surpassed hundreds of millions of units in the Base Year (2025). However, the 6-12 Months and 12-24 Months segments are exhibiting faster growth rates. This is attributed to the prolonged use of diapers and the introduction of a wider array of solid foods and bathing products as the baby develops. Innovations in product design are also playing a crucial role. For example, the introduction of more absorbent and leak-proof diaper technologies has extended their usage cycles, contributing to increased unit sales. In the skin care realm, the focus has shifted from basic moisturization to specialized solutions for common infant skin concerns like eczema and cradle cap, driving the development and adoption of targeted treatments. The Bathing Products segment, encompassing gentle shampoos, washes, and lotions, is also experiencing steady growth, fueled by a desire for holistic baby care routines. The market is poised for further expansion, with projections indicating a continued upward trajectory in unit production across all segments for the Forecast Period (2025-2033). The overarching trend is one of informed parenting, where efficacy, safety, and ethical considerations are paramount in product selection.

The global newborn care products market is being propelled by a confluence of powerful driving forces that are reshaping production and consumption patterns. A primary driver is the steady increase in global birth rates, particularly in emerging economies, which directly translates into a larger consumer base for newborn essentials. This demographic shift alone contributes to the production of tens of millions of additional units of diapers, wipes, and feeding products annually. Concurrently, rising disposable incomes in developing nations are empowering parents to allocate more resources towards premium and specialized baby care items, moving beyond basic necessities. This economic uplift is enabling a broader adoption of products that were once considered niche, such as advanced sterilizers and organic skin care, with production volumes for these categories increasing by millions of units in recent years. Furthermore, the escalating awareness and concern for infant health and safety among parents globally is a significant catalyst. This has led to a demand for products that are free from harsh chemicals, allergens, and artificial fragrances. Manufacturers are responding by reformulating their products and investing heavily in research and development to create gentler, more effective, and demonstrably safer options. This shift in consumer preference for natural and organic ingredients has spurred innovation and production of specialized skin care lines and food formulations.

The influence of digital media and online communities cannot be understated. Social media platforms and parenting blogs serve as crucial information hubs, where parents share reviews, recommendations, and product comparisons. This peer-to-peer influence significantly impacts purchasing decisions, driving demand for products with proven efficacy and positive user feedback. Companies that effectively leverage these channels to build trust and educate consumers are witnessing substantial increases in sales, translating into increased production. For instance, brands that highlight their commitment to sustainable sourcing and eco-friendly packaging are resonating with a growing segment of environmentally conscious parents, further boosting the production of these specific product lines. Moreover, advancements in product technology are consistently enhancing performance and convenience. Innovations in diaper absorbency, bottle design, and skin care formulations are not only meeting but exceeding parental expectations, encouraging repeat purchases and driving overall market growth. The synergy of these factors – demographic expansion, economic empowerment, heightened health consciousness, digital influence, and technological innovation – creates a robust and dynamic environment that is continuously propelling the newborn care products market forward, ensuring consistent growth in unit production across various categories.

Despite the robust growth trajectory of the newborn care products market, several challenges and restraints act as headwinds, tempering the pace of expansion and influencing strategic decisions of manufacturers. A significant restraint is the intense competition within the market. With a plethora of established players and new entrants vying for market share, companies face pressure on pricing and profit margins. This over-saturation leads to aggressive promotional activities and a constant need for product differentiation, which can be costly. For example, the diaper segment, a cornerstone of the market, is particularly competitive, with production volumes often leading to excess inventory if market demand is misjudged. Another critical challenge is the fluctuating raw material costs. The production of many newborn care products, such as diapers and wipes, relies on materials like non-woven fabrics, pulp, and plastics, whose prices are susceptible to global commodity market volatility. Any significant price surge in these raw materials can directly impact manufacturing costs and subsequently affect the final product price, potentially reducing consumer affordability, especially for price-sensitive segments of the market.

Stringent regulatory landscapes in different countries also pose a challenge. Compliance with evolving safety standards, labeling requirements, and environmental regulations can be complex and expensive. Manufacturers must invest in research and testing to ensure their products meet these diverse and often changing mandates, adding to operational overheads. Furthermore, the growing consumer preference for eco-friendly and sustainable products, while a growth catalyst, also presents a challenge for companies that are heavily invested in traditional manufacturing processes. Shifting to sustainable sourcing, biodegradable materials, and environmentally friendly packaging requires significant capital investment and technological adaptation, which can be a deterrent for smaller players or those slow to innovate. Additionally, the maturity of certain product categories in developed markets can lead to slower growth rates. While innovation can mitigate this, the overall market expansion in these regions may be more incremental compared to emerging economies. The long gestation period and high cost associated with developing and gaining regulatory approval for new infant formula or specialized skin care products also act as a restraint, slowing down the introduction of novel solutions. Lastly, economic downturns or unpredictable global events can impact consumer spending on non-essential or premium baby care items, leading to temporary slowdowns in sales and production.

The global newborn care products market is characterized by significant regional variations in demand, production, and consumer preferences. However, certain regions and segments are demonstrably poised to dominate the market in the coming years.

Dominating Region: Asia-Pacific

Dominating Segment: Diapers

Other Contributing Segments:

While Diapers and the Asia-Pacific region are set for dominance, other segments and regions play crucial supporting roles:

The newborn care products industry is fueled by several potent growth catalysts. A primary one is the consistent global increase in birth rates, directly expanding the consumer base. Accompanying this is the rising global disposable income, empowering parents to invest in premium and specialized baby products. Heightened parental awareness regarding infant health, safety, and hygiene drives demand for high-quality, gentle, and natural formulations. Furthermore, rapid advancements in product technology, leading to more effective and convenient solutions like advanced diaper absorbency and ergonomic feeding bottles, continually stimulate consumption. The pervasive influence of digital media and e-commerce platforms also acts as a significant catalyst, facilitating product discovery, information sharing, and accessibility, thereby accelerating sales and production.

The comprehensive coverage of the newborn care products report provides an in-depth analysis of market dynamics, trends, and future projections. It meticulously examines the production landscape, detailing unit volumes for key product types like Diapers, Skin Care of Newborn, Food for Newborns, and Bathing Products, across various application segments such as 0-6 Months, 6-12 Months, and 12-24 Months. The report delves into the driving forces, including demographic shifts and rising disposable incomes, and explores the challenges such as intense competition and raw material volatility. It highlights key regions and segments poised for dominance, with a particular focus on the Asia-Pacific region and the Diapers segment, estimating substantial unit production in the millions. Furthermore, the report identifies crucial growth catalysts like technological innovation and e-commerce expansion, and profiles leading players in the industry. This detailed overview equips stakeholders with critical insights for strategic decision-making and investment planning within this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cardinal Health, Kimberly Clark, Unicharm, SCA, Kao, First Quality, Ontex, Hengan, Daio, Domtar, Chiaus, P&G, Estee Lauder, Shiseido, Unilever, Johnson & Johnson, Pigeon, Artsana.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Newborn Care Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Newborn Care Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.