1. What is the projected Compound Annual Growth Rate (CAGR) of the New-Style Alcoholic Beverages?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

New-Style Alcoholic Beverages

New-Style Alcoholic BeveragesNew-Style Alcoholic Beverages by Type (Wine, Sparkling Wine, Cocktail, Pre-Mixed Wine, New Style Liquor, Rice Wine, Other), by Application (E-Commerce, Offline, World New-Style Alcoholic Beverages Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

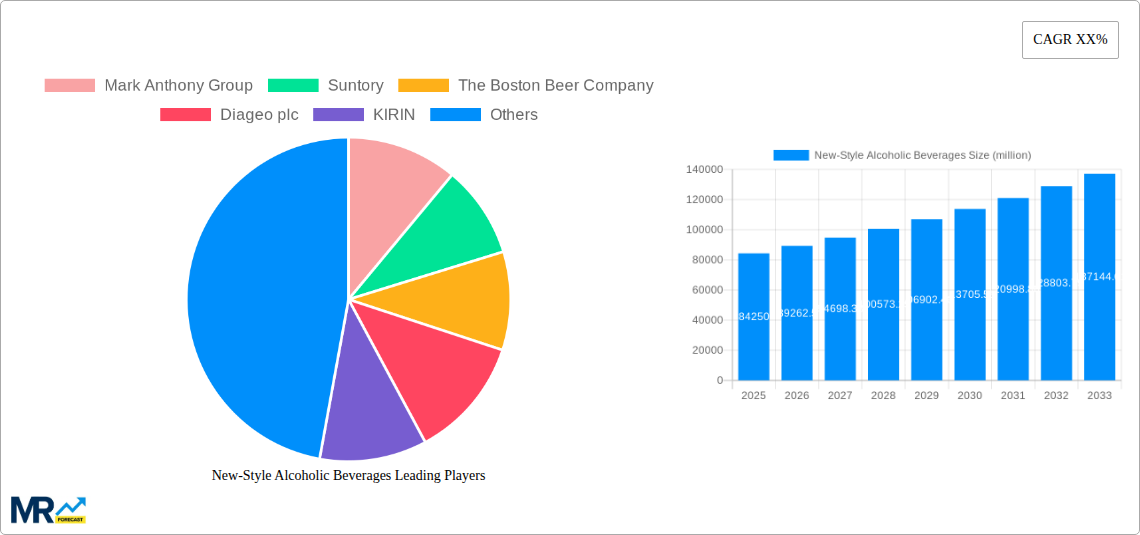

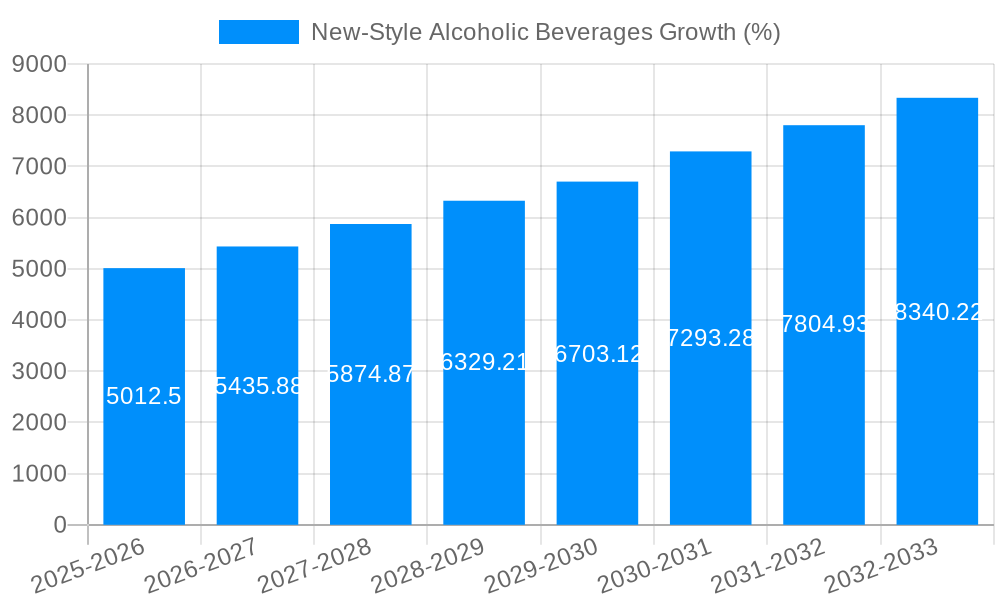

The global new-style alcoholic beverages market, currently valued at approximately $84.25 billion (2025 estimate), is poised for significant growth. While the precise CAGR is unavailable, considering the dynamic nature of the beverage industry and the increasing consumer preference for innovative and premium alcoholic drinks, a conservative estimate of a 5-7% CAGR for the forecast period (2025-2033) is reasonable. This growth is fueled by several key drivers: the rising popularity of craft beverages (including craft beers, unique spirits, and ready-to-drink cocktails), a growing demand for premiumization and diverse flavor profiles, and the increasing adoption of convenient formats like canned cocktails and ready-to-drink (RTD) options. Furthermore, the expanding young adult demographic, known for their adventurous palates, and increased disposable income are significantly contributing to this market expansion. However, challenges remain. Government regulations regarding alcohol production and sales, concerns about the health impacts of excessive alcohol consumption, and intense competition among established and emerging players pose restraints on market growth. Market segmentation includes various beverage types (craft beers, RTD cocktails, innovative spirits, etc.), distribution channels (on-premise vs. off-premise), and price points (premium vs. budget). Key players like Diageo, AB InBev, and Suntory are investing heavily in innovation and brand building to secure market share within this competitive landscape.

The market's segmentation offers diverse opportunities. The craft beer segment, for example, continues to thrive driven by consumer demand for unique, local, and high-quality products. The RTD category is also experiencing rapid expansion due to convenience and portability. Successful companies are strategically adapting to changing consumer preferences, focusing on sustainability initiatives, leveraging digital marketing, and partnering with influencers to build brand awareness and loyalty. Regional variations exist, with mature markets in North America and Europe showing steady growth while emerging markets in Asia and Latin America demonstrate higher growth potential due to evolving consumer behavior and increasing purchasing power. The market shows a clear trend towards premiumization, with consumers willing to spend more on high-quality, distinctive alcoholic beverages. Looking ahead, the forecast period will likely witness further consolidation, innovative product launches, and an increasing emphasis on health-conscious options such as low-calorie and low-alcohol beverages.

The new-style alcoholic beverage market, encompassing innovative products like ready-to-drink (RTD) cocktails, hard seltzers, flavored alcoholic beverages, and low/no-alcohol options, is experiencing explosive growth. Driven by evolving consumer preferences and a desire for convenient, flavorful, and often healthier alternatives to traditional alcoholic drinks, this sector shows remarkable dynamism. The market's value is projected to surpass XXX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). The historical period (2019-2024) already witnessed significant expansion, laying the foundation for continued robust growth. Key market insights reveal a strong preference for premiumization, with consumers increasingly willing to pay more for high-quality ingredients and unique flavor profiles. The rise of craft distilleries and breweries further fuels this trend, offering a diverse range of artisanal products. Sustainability is also gaining traction, with consumers favoring brands that demonstrate environmental responsibility. Furthermore, the market is witnessing increasing sophistication in marketing and distribution strategies, leveraging digital channels and targeted campaigns to reach specific consumer segments. The base year of 2025 serves as a critical benchmark, showcasing the market's maturity and preparedness for continued expansion. The estimated value for 2025 stands at XXX million units, illustrating substantial growth from the previous years. This surge in the market is not merely a fleeting trend but rather a reflection of a significant shift in consumer behavior, indicating a lasting transformation of the alcoholic beverage landscape. The successful integration of novel flavors, innovative packaging, and targeted marketing strategies ensures the continued relevance and expansion of this dynamic sector. The report extensively analyzes these trends, providing valuable insights for businesses seeking to navigate and capitalize on this burgeoning opportunity.

Several key factors are driving the phenomenal growth of the new-style alcoholic beverage market. Firstly, the increasing demand for convenient and ready-to-consume options is a major catalyst. Ready-to-drink cocktails and hard seltzers, in particular, offer a hassle-free drinking experience, appealing to busy consumers seeking quick and easy refreshment. Secondly, the growing preference for health-conscious alternatives is fueling the popularity of low- and no-alcohol options. Consumers are increasingly aware of the health implications of excessive alcohol consumption and are seeking lower-calorie, lower-sugar choices. Thirdly, the explosion of diverse flavor profiles is attracting a broader range of consumers. The market caters to a wide spectrum of palates, offering unique and interesting combinations that go beyond traditional alcoholic beverages. Fourthly, innovative packaging and marketing strategies play a crucial role in driving market growth. Eye-catching packaging and targeted marketing campaigns effectively communicate the value proposition of these new beverages and attract new consumer segments. Finally, the rise of social media and influencer marketing has amplified brand awareness and fostered consumer engagement, further accelerating market expansion. These combined factors create a synergistic effect, driving unprecedented growth within the new-style alcoholic beverage sector.

Despite the rapid growth, the new-style alcoholic beverage market faces certain challenges and restraints. Intense competition from established players and emerging brands is a significant hurdle. The market is highly dynamic, requiring constant innovation and adaptability to stay ahead of the curve. Maintaining consistent product quality and supply chain efficiency are also crucial considerations. Fluctuations in raw material prices and potential disruptions to the supply chain can impact profitability and market share. Regulatory changes and evolving consumer perceptions regarding alcohol consumption pose additional complexities. Navigating diverse regulatory landscapes across different regions requires careful planning and compliance. Furthermore, addressing concerns around sugar content and responsible consumption is paramount to maintaining a positive brand image and consumer trust. The marketing and distribution strategies must be carefully calibrated to meet changing consumer preferences and remain competitive in a crowded market. Finally, the increasing emphasis on sustainability necessitates a shift toward environmentally responsible practices throughout the production and distribution processes. Addressing these challenges effectively will be crucial for sustaining the market's long-term growth and ensuring its continued success.

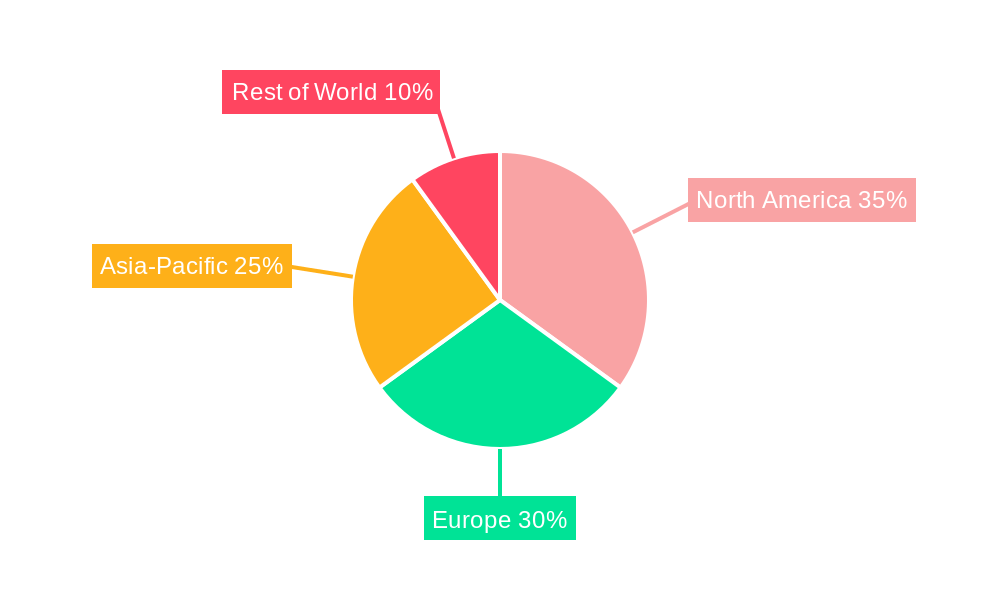

The new-style alcoholic beverage market exhibits diverse regional growth patterns, with specific segments dominating certain geographic areas.

North America: This region is expected to maintain its leading position, driven by high consumer demand for ready-to-drink cocktails and hard seltzers. The US market, in particular, is characterized by a highly developed and competitive landscape, with a wide range of brands vying for market share.

Europe: The European market demonstrates strong growth potential, particularly in Western European countries, where consumers are increasingly adopting new drinking habits and showing a preference for premium and craft alcoholic beverages.

Asia-Pacific: This region presents significant growth opportunities, especially in countries with burgeoning middle classes and a rising disposable income. However, varying cultural norms and regulations may pose specific challenges for market entry and expansion.

Ready-to-Drink (RTD) Cocktails: This segment consistently leads in terms of volume sales, driven by its convenience and appeal to a broad demographic.

Hard Seltzers: This category has shown phenomenal growth in recent years, largely driven by its perception as a lower-calorie and healthier alternative to other alcoholic beverages.

Flavored Alcoholic Beverages: The increasing demand for diverse flavors continues to fuel the growth of this segment, as consumers seek unique and exciting taste experiences.

Low/No-Alcohol Beverages: This segment represents a significant growth opportunity, tapping into the growing health-consciousness amongst consumers.

In summary, while North America maintains a dominant position, the Asia-Pacific region holds immense potential for future growth. The RTD cocktail and hard seltzer segments are projected to continue their lead in volume sales, followed by the expansion of flavored and low/no-alcohol options. A nuanced understanding of regional preferences and regulatory landscapes is crucial for companies seeking to succeed in this dynamic market. Furthermore, effective product diversification and adaptation to evolving consumer trends are vital for long-term market success.

Several factors are fueling the remarkable growth of the new-style alcoholic beverage industry. Innovation in flavors and product formats, responding directly to evolving consumer preferences for unique taste experiences and convenient options, is a key driver. The rise of health-conscious consumers is creating significant demand for low- and no-alcohol alternatives, contributing to market expansion. Effective marketing and distribution strategies, leveraging digital channels and targeted campaigns, efficiently reach specific consumer segments and promote brand awareness. This multifaceted approach, combining product innovation, consumer responsiveness, and targeted marketing, ensures continued growth and market dominance for the new-style alcoholic beverage industry.

This report provides a comprehensive analysis of the new-style alcoholic beverage market, covering key trends, driving forces, challenges, and leading players. It offers detailed market segmentation, regional insights, and growth projections for the forecast period (2025-2033). The report also analyzes significant developments and explores the impact of evolving consumer preferences and regulatory changes on market dynamics. It serves as a valuable resource for businesses seeking to understand and capitalize on the opportunities presented by this rapidly expanding market sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mark Anthony Group, Suntory, The Boston Beer Company, Diageo plc, KIRIN, AB InBev, Asahi Breweries, Ltd, Takara Shuzo Co., Ltd, Brown-Forman Corporation, Pernod Ricard, Bacardi, Chengdu Microbrewing Element Technology Co., Ltd. (VETO), Houxue (Beijing) Wine Co., Ltd. (KongKa), Shaanxi Fubixing Wine Co., Ltd., Chimi Wine (Beijing) Co., Ltd. (Sound Cup), Hangzhou Likou Wine Co., Ltd. (Lanzhou), Shanghai Not Drunk Industry Co., Ltd. (ZhuoYe), Chongqing Jiangji Winery Co., Ltd. (Mei Jian), Bairun, Geying (Shanghai) Brand Management Co., Ltd. (Miss Berry), Beijing Drunken Goose Niang Liquor Co., Ltd. (Lion Gege), Beijing Luoyin Liquor Industry Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 84250 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "New-Style Alcoholic Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the New-Style Alcoholic Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.