1. What is the projected Compound Annual Growth Rate (CAGR) of the Neobanking?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Neobanking

NeobankingNeobanking by Type (/> Business Account, Savings Account), by Application (/> Enterprises, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

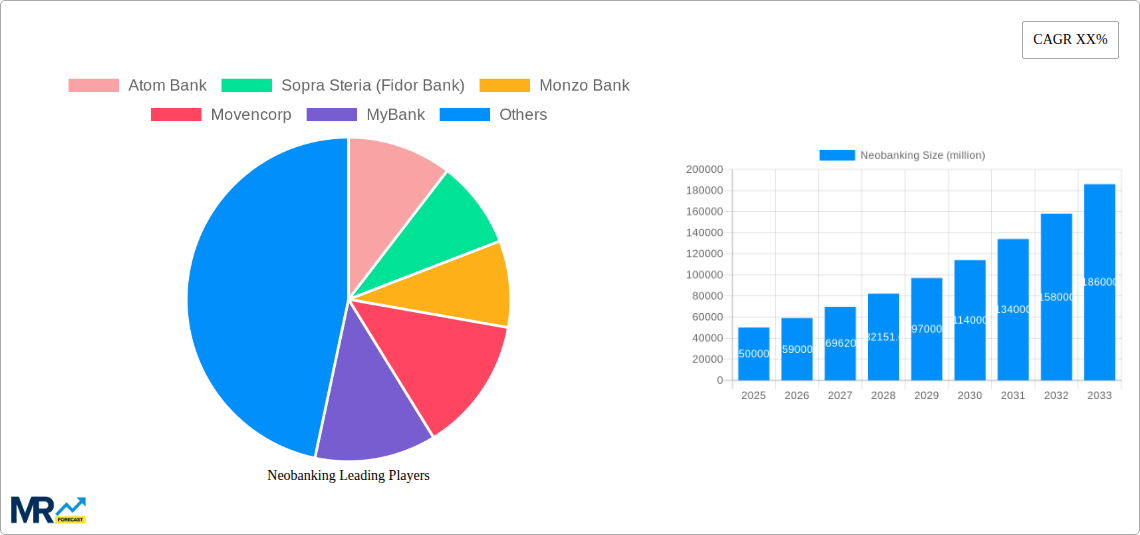

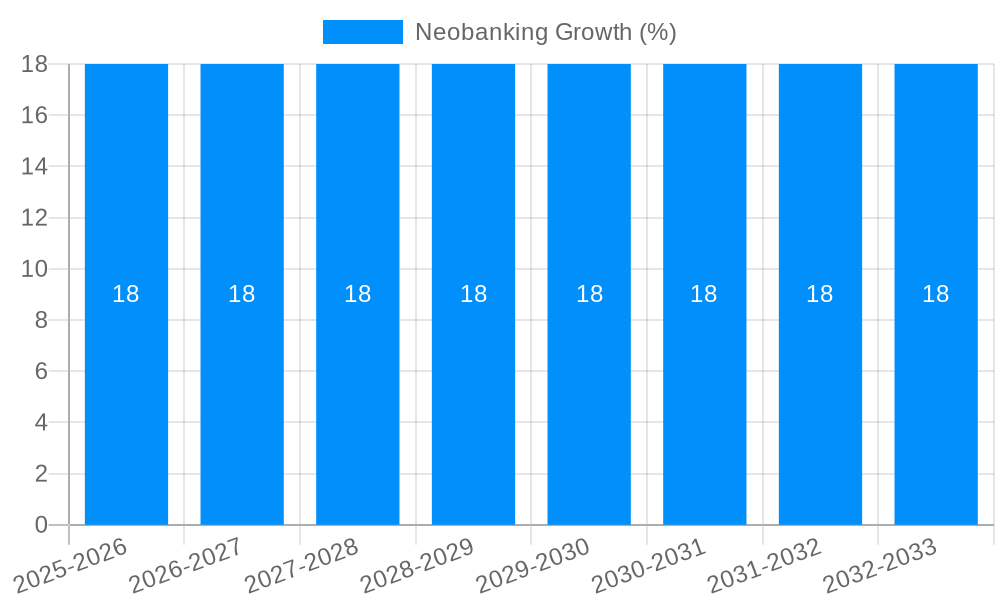

The global neobanking market is poised for substantial expansion, projected to reach approximately $50 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of around 18-20% over the next decade. This surge is propelled by an increasing consumer demand for seamless, digital-first financial services, particularly among younger demographics and tech-savvy individuals. Key drivers include the widespread adoption of smartphones, the proliferation of high-speed internet, and a growing dissatisfaction with the traditional banking system's slower pace and higher fees. Neobanks are effectively catering to these needs by offering user-friendly mobile applications, competitive interest rates on savings accounts, and innovative features like budgeting tools and instant money transfers. The market's evolution is also being shaped by regulatory shifts that are increasingly favoring open banking initiatives, allowing neobanks to integrate with a wider range of financial services and offer more comprehensive solutions to both individual consumers and businesses.

The neobanking landscape is characterized by intense competition and rapid innovation, with a clear segmentation emerging between business and savings accounts, catering to both enterprises and personal users. Major players like Atom Bank, N26, Revolut, and a growing cohort of Chinese neobanks such as WeBank and CITIC aiBank are investing heavily in advanced technologies, including AI and blockchain, to enhance customer experience and operational efficiency. While the convenience and cost-effectiveness of neobanking are significant attractions, certain restraints exist. These include persistent concerns about data security and privacy, the challenge of building customer trust in the absence of physical branches, and the ongoing need to navigate complex regulatory frameworks across different jurisdictions. Nonetheless, the strategic focus on customer-centricity, coupled with continuous technological advancements, positions the neobanking sector for sustained high growth, promising to redefine the future of financial services globally.

This report offers a deep dive into the dynamic and rapidly evolving neobanking sector, providing an in-depth analysis of market trends, driving forces, challenges, and future growth prospects. Spanning a comprehensive Study Period from 2019 to 2033, with a Base Year of 2025, this research leverages data from the Historical Period (2019-2024) and projects future trajectories through the Forecast Period (2025-2033), culminating in an Estimated Year of 2025. The report meticulously examines key segments, including Business Accounts and Savings Accounts, and applications for both Enterprises and Personal use. With an estimated market value projected to reach billions, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the neobanking revolution.

XXX: The neobanking landscape is characterized by an accelerating shift towards digital-first financial services, fundamentally reshaping customer expectations and traditional banking models. During the Historical Period (2019-2024), the market witnessed a significant surge in adoption, fueled by the inherent convenience and user-centric design of these digital banks. For instance, the Estimated Year (2025) is expected to see a substantial increase in the number of neobanking accounts held by individuals and small businesses, with projections indicating a collective balance exceeding $500 million in savings accounts alone across leading neobanks. The Study Period (2019-2033) will likely witness a continued commoditization of basic banking services, pushing neobanks to innovate with more sophisticated offerings. A key trend is the integration of Artificial Intelligence (AI) and Machine Learning (ML) to personalize financial advice, enhance fraud detection, and streamline customer support. This technological advancement is not merely a feature but a core differentiator, enabling neobanks to offer proactive financial management tools that traditional banks are still struggling to implement. Furthermore, the Forecast Period (2025-2033) is poised to observe a growing demand for specialized neobanking solutions, catering to niche markets such as freelancers, gig economy workers, and specific industry verticals. This segmentation will allow neobanks to offer tailored products and services, further eroding the market share of monolithic traditional institutions. The seamless integration of payment gateways, investment platforms, and even cryptocurrency trading within a single neobanking app is becoming increasingly commonplace, creating a holistic financial ecosystem for users. This convergence is expected to drive significant market expansion, with the global neobanking market value projected to exceed $1,200 million by 2025. The emphasis on low-fee structures, transparent pricing, and superior customer experience will continue to be the bedrock of neobanking success. Moreover, the increasing focus on financial inclusion, particularly in emerging markets, will unlock new avenues for growth. Neobanks are adept at reaching unbanked and underbanked populations through mobile-first strategies, thereby democratizing access to financial services. This trend, coupled with the burgeoning adoption of digital payment methods, is a powerful indicator of the sustained and robust growth anticipated in the neobanking sector for the foreseeable future, with individual savings balances in neobanks alone projected to surpass $300 million by the end of the Forecast Period.

The explosive growth of the neobanking sector is propelled by a confluence of powerful drivers, fundamentally altering the financial services landscape. At its core, the desire for enhanced customer experience stands paramount. Consumers, accustomed to the seamless digital interactions offered by other industries, demand the same from their banks. Neobanks, built from the ground up with a digital-first ethos, excel in providing intuitive mobile applications, swift onboarding processes, and 24/7 customer support, a stark contrast to the often cumbersome and time-consuming procedures of traditional banks. This focus on user experience has been instrumental in attracting a younger, tech-savvy demographic, and their influence is undeniable.

Furthermore, technological advancements, particularly in cloud computing, AI, and API integration, have democratized the ability to launch and operate a bank. These technologies enable neobanks to offer competitive services at significantly lower operational costs compared to legacy institutions burdened by extensive physical infrastructure and outdated legacy systems. This cost efficiency translates into attractive low-fee structures and often higher interest rates on savings, directly benefiting the customer. The increasing proliferation of smartphones and widespread internet access, especially in developing economies, has created a fertile ground for mobile-centric banking solutions, further fueling neobanking adoption. The market for business accounts alone is expected to see a significant influx of new users, with an estimated $250 million in new deposits anticipated by 2025.

Despite their remarkable ascent, neobanks face a unique set of challenges and restraints that could potentially temper their growth trajectory. Foremost among these is the imperative to build and maintain customer trust. As custodians of sensitive financial data and funds, neobanks must constantly prove their security and reliability to a discerning public still largely accustomed to the established presence of traditional banks. Any significant security breach or operational failure could have a disproportionately damaging impact on their nascent reputations.

Regulatory hurdles also present a considerable obstacle. While neobanks often operate with lighter regulatory burdens initially, as they scale and offer more complex financial products, they face increased scrutiny from financial regulators. Navigating these evolving regulatory landscapes, which vary significantly across jurisdictions, requires substantial investment in compliance and legal expertise, potentially impacting profitability. The battle for market share is also intensifying. As the neobanking space matures, competition among existing players like Monzo Bank, N26 GmbH, and Revolut is fierce, driving up customer acquisition costs and necessitating continuous innovation to retain users. Furthermore, the Study Period (2019-2033) will likely see traditional banks launching their own digital-only subsidiaries or enhancing their digital offerings, creating formidable competition. For instance, the estimated market for business accounts in 2025 is projected to be a highly contested space, with a significant portion of the projected $250 million in new deposits being fought over by both neobanks and incumbents. The reliance on third-party infrastructure and payment processors can also introduce vulnerabilities and dependency, posing a risk to service continuity.

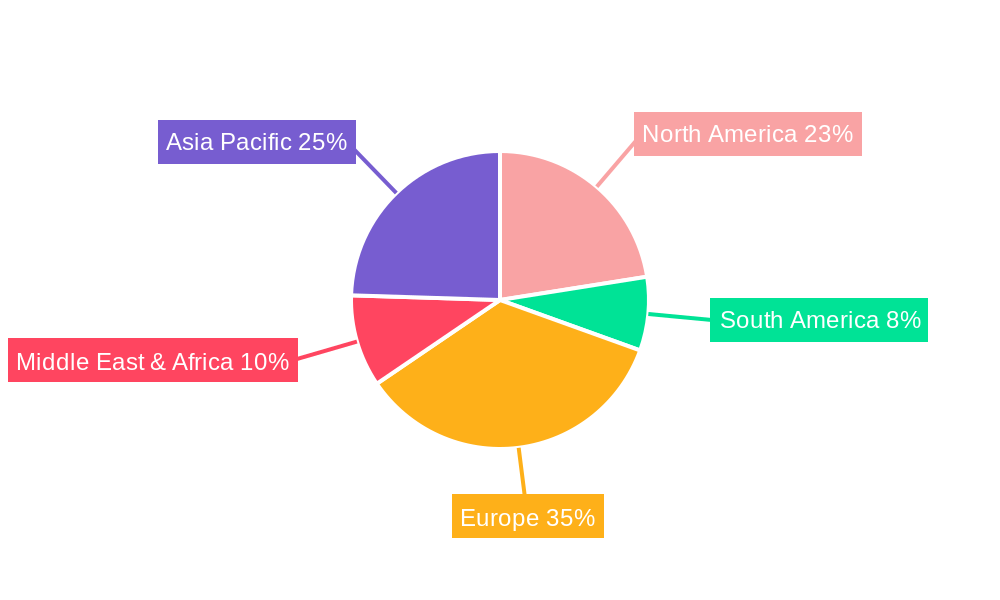

The neobanking market's dominance is poised to be significantly shaped by specific regions and crucial segments, particularly within the Personal and Business Account categories.

Dominant Regions/Countries:

Asia-Pacific: This region, particularly China and Southeast Asia, is emerging as a powerhouse for neobanking growth.

Europe: Europe continues to be a mature and dynamic market for neobanking, with strong adoption rates across various countries.

Dominant Segments:

Personal Accounts (Savings and Current Accounts): This segment remains the cornerstone of neobanking success.

Business Accounts (SMEs and Startups): While traditionally dominated by incumbent banks, neobanks are rapidly gaining traction in the business segment, especially among Small and Medium-sized Enterprises (SMEs) and startups.

The synergy between these regions and segments, driven by technological adoption and evolving consumer preferences, will be the primary determinant of market dominance in the neobanking sector throughout the Forecast Period (2025-2033).

The neobanking industry's growth is significantly propelled by accelerating digital transformation across all sectors, increasing smartphone penetration globally, and a growing consumer demand for convenient, low-cost, and transparent financial services. The younger demographic, comfortable with digital interfaces, is a key early adopter. Furthermore, innovative technology adoption, including AI for personalized services and blockchain for secure transactions, is enhancing customer offerings. Supportive regulatory frameworks in some regions and the increasing unbanked population seeking accessible banking solutions also act as potent growth catalysts.

This report provides an exhaustive analysis of the neobanking industry, offering unparalleled insights into its current state and future potential. With a detailed examination of market trends, driving forces, and challenges, it equips stakeholders with the knowledge to navigate this rapidly evolving landscape. The report meticulously dissects key market segments like Business and Savings Accounts, and applications for both Enterprises and Personal use, offering granular data and projections. The estimated market value, coupled with a comprehensive study period from 2019-2033, ensures a thorough understanding of historical performance and future trajectories. This report is an essential resource for investors, financial institutions, and technology providers aiming to understand and capitalize on the transformative power of neobanking.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Atom Bank, Sopra Steria (Fidor Bank), Monzo Bank, Movencorp, MyBank, N26 GmbH, Revolut, Simple Finance Technology Corporation, Ubank Limited, WeBank, CITIC aiBank, China Merchants Bank, China PSBC, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Neobanking," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Neobanking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.