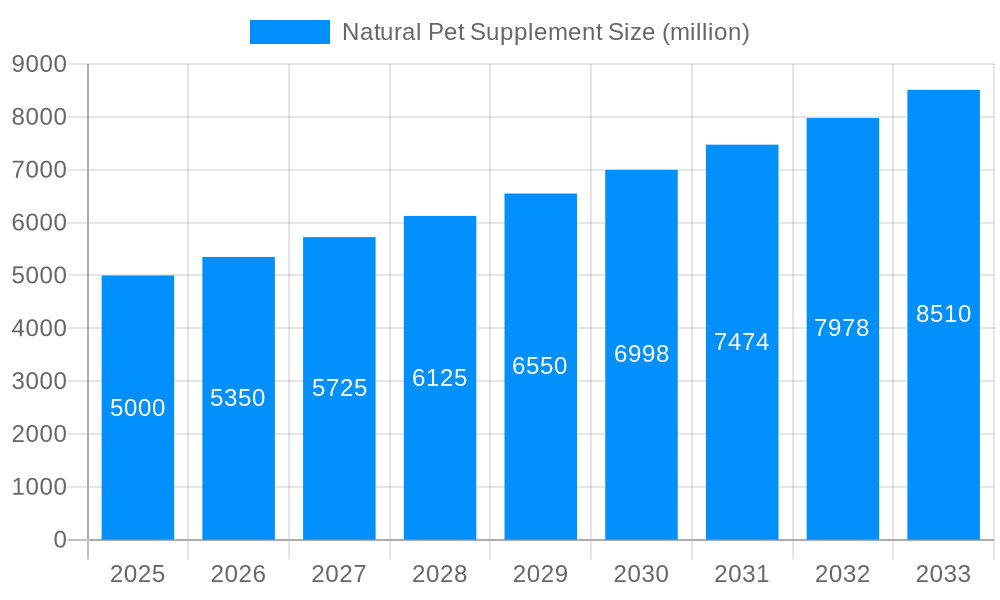

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Pet Supplement?

The projected CAGR is approximately 6.34%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Natural Pet Supplement

Natural Pet SupplementNatural Pet Supplement by Type (Vitamins, Fish Oil, Calcium, Protein, Lecithin, Herbal Ointment, Others, World Natural Pet Supplement Production ), by Application (Dog, Cat, Others, World Natural Pet Supplement Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global natural pet supplement market is poised for significant expansion, driven by escalating pet ownership, the 'pet humanization' trend, and heightened owner awareness of holistic pet care advantages. With a projected market size of $3.14 billion in the base year of 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.34%, reaching an estimated value by 2033. Key growth drivers include the preference for natural ingredients over synthetic alternatives, the expanding availability of specialized supplements for specific pet health concerns (e.g., joint, cognitive, and allergy support), and the convenience offered by online retail channels. Leading companies are investing in R&D, product diversification, and strategic acquisitions. Challenges include regional regulatory hurdles and concerns regarding ingredient standardization and efficacy.

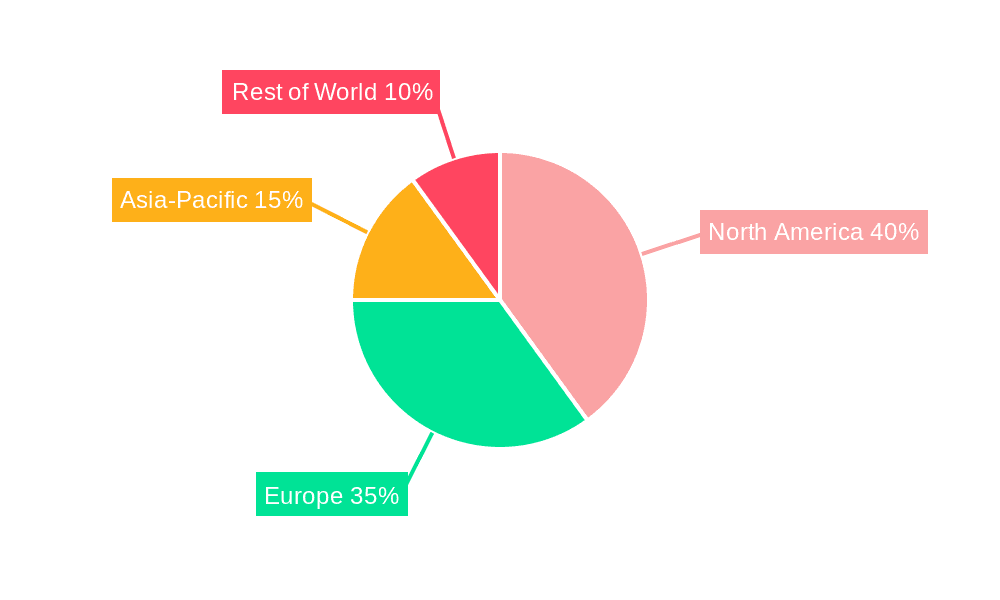

Market segmentation showcases a variety of product types, including supplements for joint, skin & coat, digestive, immune, and cognitive health. North America and Europe currently dominate, attributed to higher pet ownership and disposable income. However, emerging markets in Asia-Pacific present substantial growth opportunities due to increasing pet ownership and a rising middle class. Competitive intensity remains high, with established and niche brands competing for market share. Success hinges on robust branding, effective marketing, and a commitment to product quality and safety. Future growth will be influenced by advancements in pet nutrition research, innovative formulations, and the adoption of personalized pet care.

The global natural pet supplement market experienced robust growth during the historical period (2019-2024), exceeding several billion units in sales. This upward trajectory is projected to continue throughout the forecast period (2025-2033), driven by several key factors. The rising pet humanization trend, where pets are increasingly viewed as family members, is a primary driver. Owners are increasingly willing to invest in premium products, including natural supplements, to enhance their pets' health and well-being. This is further fueled by growing awareness of the potential benefits of natural ingredients, such as improved digestion, enhanced immune function, and relief from common ailments like joint pain and allergies. Consumers are actively seeking alternatives to conventional pharmaceuticals, favoring natural solutions perceived as safer and gentler for their beloved companions. This shift is reflected in the expanding product portfolio within the natural pet supplement market, encompassing a wider range of formulations catering to specific pet needs and health conditions. Furthermore, the increased availability of natural pet supplements through online retailers and specialized pet stores has broadened market accessibility, contributing significantly to its expansion. The estimated market size for 2025 already signals a substantial increase from previous years, and projections for 2033 indicate a continued, significant growth trajectory in the tens of billions of units. This expansion isn't simply a matter of volume but also represents a shift in consumer preferences towards holistic pet care approaches and premium, natural product offerings. Market segmentation continues to evolve, reflecting this nuance and leading to specialized products targeting particular breeds, ages, and health concerns.

The burgeoning natural pet supplement market is fueled by a confluence of powerful factors. The rising pet ownership rate globally plays a significant role, with more households welcoming pets into their lives. Simultaneously, there's a strong trend towards premiumization in pet care. Owners are willing to spend more on high-quality products that they perceive as offering superior health benefits for their pets. The increasing awareness of the potential health risks associated with synthetic ingredients in traditional pet medications is also pushing consumers towards natural alternatives. Natural ingredients are often perceived as safer and gentler, leading to increased demand for supplements made from botanical extracts, vitamins, minerals, and other naturally derived compounds. Furthermore, the growing accessibility of information through online platforms and pet health professionals has fueled educated decision-making among pet owners, solidifying the preference for natural pet supplements. This enhanced awareness empowers them to actively participate in their pets' health management, leading to higher adoption rates for products perceived as safer and more holistic. This combination of factors – increased pet ownership, premiumization trends, concerns about synthetic ingredients, and improved consumer awareness – creates a dynamic market ripe for continuous expansion.

Despite the positive growth trajectory, the natural pet supplement market faces several challenges. One significant hurdle is the lack of stringent regulatory oversight in some regions, leading to inconsistent product quality and potential safety concerns. This necessitates heightened consumer vigilance and relies on robust self-regulation within the industry. Furthermore, proving the efficacy of natural supplements can be more difficult compared to pharmaceuticals, leading to challenges in marketing and consumer trust. Establishing clear dosage guidelines and demonstrating clinical efficacy through rigorous testing is crucial to overcome these hurdles. The increasing cost of raw materials, particularly for organically sourced ingredients, can also impact profitability and potentially lead to price increases that might affect market accessibility. Competitive pressures from both established players and emerging brands create a dynamic landscape that requires ongoing innovation and differentiation to maintain market share. Finally, managing consumer expectations about the purported benefits of natural supplements, and avoiding unsubstantiated claims, is critical to maintaining credibility and consumer confidence in the industry.

North America (United States and Canada): This region is expected to maintain its dominance due to high pet ownership rates, increased disposable incomes, and a strong preference for premium pet care products. The rising awareness of holistic pet health and the growing acceptance of natural supplements are also major contributing factors. The market's maturity and established distribution channels further solidify North America's leading position.

Europe (Germany, UK, France): Europe also represents a significant market, driven by a growing pet-owning population, increased consumer awareness of animal welfare, and a preference for natural and organic products. However, regulatory landscapes vary across European countries, presenting both opportunities and challenges for market players.

Asia-Pacific (Japan, China, Australia): This region is experiencing rapid growth, driven by increasing pet ownership rates, especially in countries like China and Japan. Rising disposable incomes and a growing awareness of pet health are driving the demand for natural pet supplements. However, the market is still developing compared to North America and Europe, presenting significant opportunities for future expansion.

Segments: The joint health and digestive health segments are anticipated to experience particularly strong growth, reflecting the prevalence of these health concerns in pets. Furthermore, supplements for immune support and cognitive function are gaining significant traction, reflecting a holistic approach to pet wellness. These are likely to see a substantial rise in the billions of units sold across the forecast period.

In summary, while North America currently holds the leading position, the Asia-Pacific region shows immense potential for rapid expansion in the coming years. Within segmentations, joint health, digestive health, immune support, and cognitive function supplements will lead the charge in terms of unit sales.

Several factors are propelling the growth of the natural pet supplement industry. The increasing humanization of pets, leading to higher spending on their well-being, is a major catalyst. This is coupled with a heightened awareness of the potential health risks associated with conventional pet medications, driving demand for safer, natural alternatives. Further fueling this trend is the expanding availability of information about natural pet health solutions, leading to better informed consumer decisions and higher adoption rates. The increasing accessibility of these supplements through online and brick-and-mortar retail channels also broadens market reach and availability.

This report provides a detailed analysis of the natural pet supplement market, encompassing market size estimations for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). It offers insights into key market trends, driving forces, challenges, and growth catalysts. The report profiles leading players in the industry, examines significant developments, and provides a comprehensive overview of the market's regional and segmental dynamics. This data-driven analysis aims to provide a holistic understanding of this rapidly evolving market and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.34% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.34%.

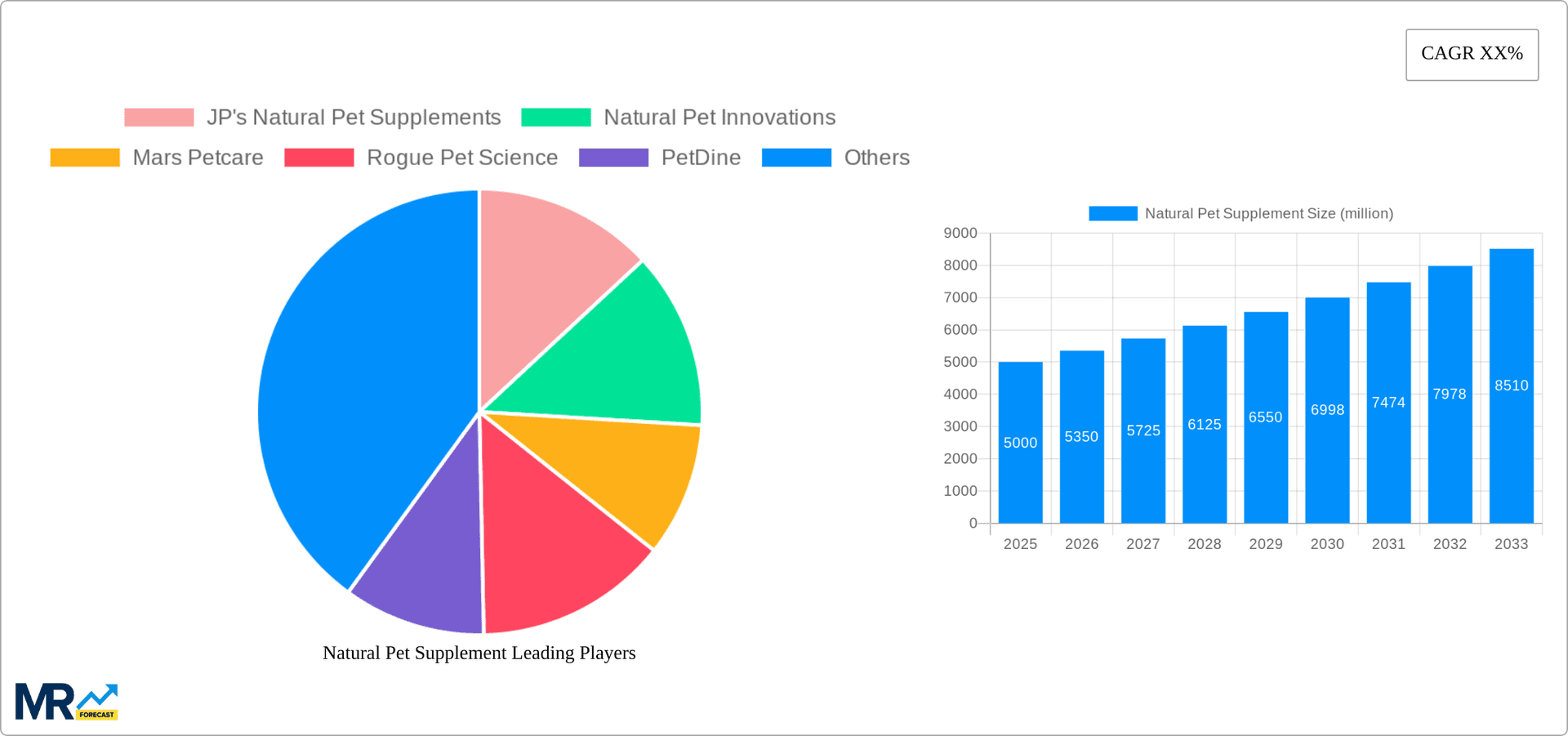

Key companies in the market include JP's Natural Pet Supplements, Natural Pet Innovations, Mars Petcare, Rogue Pet Science, PetDine, Matsun Nutrition, Pet Wellbeing CA, Lintbells, SALPET, Grizzly Pets, Wellness Pet Food, Blue Buffalo, Robinson Pharma, Ion Labs.

The market segments include Type, Application.

The market size is estimated to be USD 3.14 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Natural Pet Supplement," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Natural Pet Supplement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.