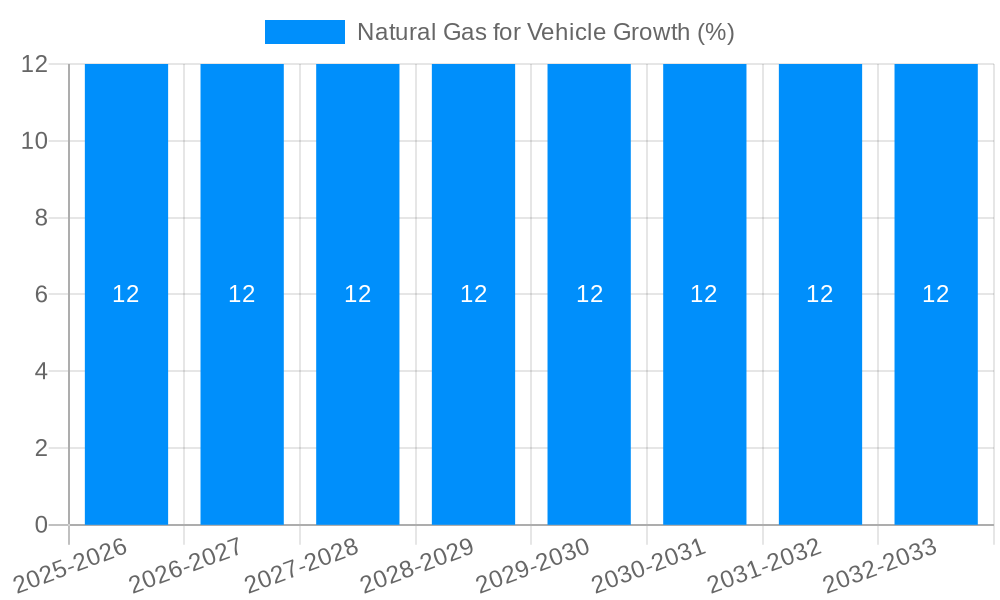

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Gas for Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Natural Gas for Vehicle

Natural Gas for VehicleNatural Gas for Vehicle by Type (CNG, LNG, World Natural Gas for Vehicle Production ), by Application (Passenger Cars, Commercial Vehicles, World Natural Gas for Vehicle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

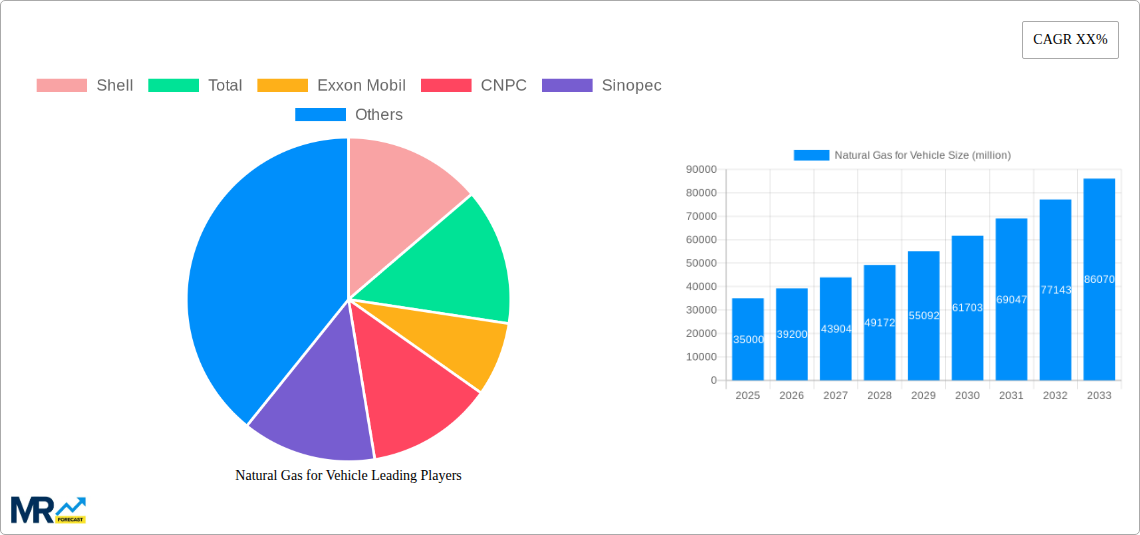

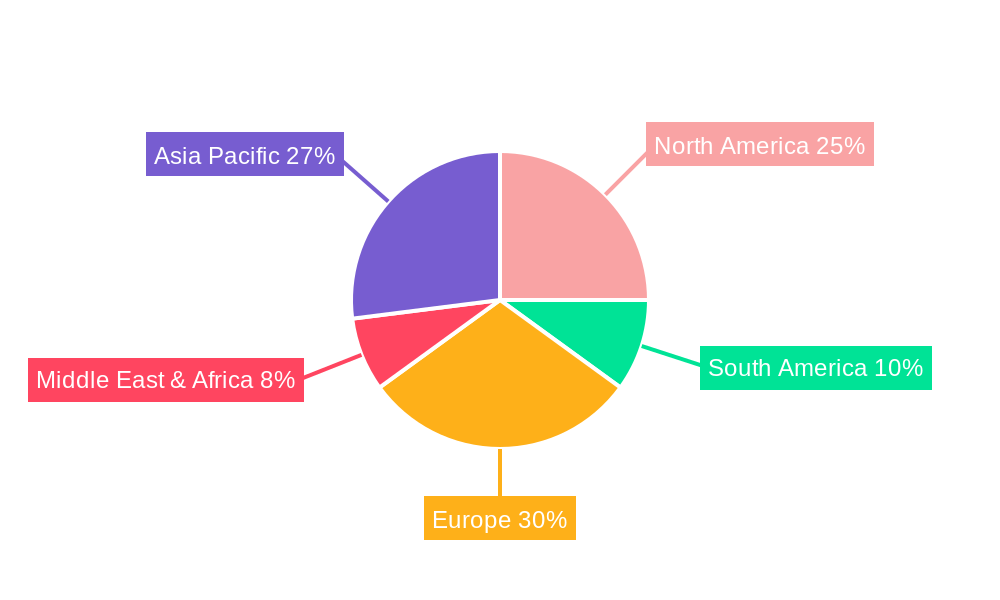

The global Natural Gas Vehicle (NGV) market is experiencing robust growth, driven by increasing environmental concerns and the need for cleaner transportation solutions. Governments worldwide are implementing stricter emission regulations, incentivizing the adoption of alternative fuels like natural gas, which produces significantly fewer greenhouse gas emissions compared to gasoline and diesel. The market's expansion is further fueled by declining natural gas prices, making it a cost-competitive alternative. While the initial investment in NGV infrastructure might be a barrier, technological advancements are leading to improved vehicle efficiency and refueling infrastructure, easing adoption. The passenger car segment currently holds a significant market share, but the commercial vehicle segment is expected to witness faster growth due to the potential for significant emission reductions in heavy-duty transportation. Key players like Shell, Total, and CNPC are strategically investing in NGV infrastructure development and vehicle technology to capitalize on this expanding market. Geographic distribution reveals strong growth in Asia-Pacific regions, particularly China and India, driven by supportive government policies and increasing vehicle ownership. Europe and North America also contribute significantly to the market, albeit at a potentially slower growth rate compared to the Asia-Pacific region. However, challenges remain, including the limited range of NGV vehicles compared to gasoline or electric vehicles and the lack of widespread refueling infrastructure in certain regions.

Despite these challenges, the long-term outlook for the NGV market remains positive. Continued technological advancements, supportive government policies, and growing environmental awareness will drive market growth throughout the forecast period (2025-2033). The market segmentation reveals significant potential in both CNG (Compressed Natural Gas) and LNG (Liquefied Natural Gas) vehicles, each catering to specific transportation needs and geographical limitations. The commercial vehicle application segment, encompassing heavy-duty trucks and buses, presents significant opportunities for emissions reduction and cost savings, contributing substantially to the overall market expansion. Competitive dynamics are intense, with major energy companies and specialized NGV providers vying for market share through strategic partnerships, infrastructure development, and technological innovation. This competition is ultimately beneficial to consumers, fostering innovation and driving down costs.

The global natural gas vehicle (NGV) market is experiencing a period of moderate growth, driven by increasing environmental concerns and the relative affordability of natural gas compared to gasoline and diesel. However, this growth is unevenly distributed geographically and across vehicle types. While CNG (Compressed Natural Gas) remains the dominant fuel type in terms of current market share, LNG (Liquefied Natural Gas) is showing potential for long-haul trucking and heavy-duty applications, particularly in regions with established LNG infrastructure. The study period (2019-2033), encompassing historical data (2019-2024), the base year (2025), and the forecast period (2025-2033), reveals a consistent, albeit gradual, increase in NGV adoption. The estimated 2025 market size, while not specified numerically here, indicates significant potential for expansion. Passenger cars currently hold a larger market share than commercial vehicles, although the latter segment shows stronger growth potential, particularly for heavy-duty trucks where LNG offers range advantages. Government incentives and policies aimed at reducing carbon emissions significantly influence market dynamics, with variations in effectiveness across different regions. Furthermore, the availability and cost of natural gas itself, along with the development and expansion of refueling infrastructure, play critical roles in shaping the overall market trajectory. The report provides a detailed analysis of these factors, offering insights into the market's future and highlighting opportunities for players across the value chain, from fuel producers to vehicle manufacturers and infrastructure developers. The analysis of key players like Shell, Total, ExxonMobil, and numerous Chinese energy giants, including CNPC, Sinopec, CNOOC, ENN Energy, and China Gas Holdings, offers crucial perspectives on the strategies driving market growth and the evolving competitive landscape. The report also assesses the impact of emerging technologies, including improved CNG storage solutions and the advancement of LNG fueling infrastructure, on the market's future evolution. In summary, the NGV market presents a compelling investment opportunity with a mix of challenges and rewards for participants in the sector.

Several factors are driving the growth of the natural gas vehicle market. Firstly, the increasing awareness of the environmental impact of traditional fossil fuels is pushing governments and consumers toward cleaner alternatives. Natural gas, with lower greenhouse gas emissions compared to gasoline and diesel, is a relatively attractive option. Secondly, the price competitiveness of natural gas, particularly in regions with abundant domestic supplies, provides a significant economic incentive for vehicle owners and fleets to switch to NGVs. This price advantage is a key driver, particularly in the current economic climate. Thirdly, technological advancements in CNG and LNG storage and delivery systems are increasing the practicality and convenience of using natural gas as a vehicle fuel. Improved tank designs, higher storage capacity, and wider availability of refueling stations are reducing the range anxiety associated with NGVs. Fourthly, government policies, including subsidies, tax breaks, and emission regulations, are playing an increasingly important role in fostering the adoption of NGVs in various countries. These policies, while varying widely in their stringency and implementation, act as significant catalysts. Finally, the growing demand for sustainable transportation solutions from both the public and private sectors adds momentum to the adoption of this cleaner fuel alternative. The combined effect of these forces is contributing to a steady, if not rapid, expansion of the natural gas vehicle market.

Despite the promising outlook, the natural gas vehicle market faces several challenges. The limited refueling infrastructure, especially for LNG, remains a significant hurdle. The density of natural gas is lower than gasoline and diesel, requiring larger storage tanks, which may reduce vehicle cargo space and/or efficiency. This limitation needs technological advancement to be fully solved. Moreover, the geographical distribution of natural gas resources affects the market penetration of NGVs; regions lacking sufficient infrastructure and supply face considerable adoption barriers. The price volatility of natural gas can also impact the economic viability of NGVs, causing uncertainty for consumers and fleet operators. In some regions, the cost of natural gas may not always be cheaper than traditional fuels, undermining the financial incentive. Furthermore, concerns regarding the environmental impact of methane leakage during natural gas production and distribution remain a challenge for the industry. Addressing this challenge requires improvements in infrastructure maintenance and technological solutions to minimize these leakages. Finally, the competition from alternative fuel vehicles such as electric vehicles (EVs) and hybrid vehicles, which often benefit from more developed charging infrastructure and superior performance in many aspects, presents a significant competitive pressure.

The Commercial Vehicle segment, specifically utilizing CNG, is poised for significant growth, particularly in regions with existing robust CNG infrastructure and supportive government policies. While passenger cars currently hold a larger market share in terms of unit numbers, the commercial vehicle segment's potential is significant due to higher fuel consumption and greater potential for emissions reduction.

China: China is expected to dominate the market due to its substantial investment in NGV infrastructure and favorable government policies aimed at reducing air pollution. The country's vast commercial vehicle fleet presents a substantial opportunity for CNG adoption. Significant government initiatives and investment in gas pipelines directly translate into widespread availability and affordability. Several large energy companies like CNPC, Sinopec, and CNOOC are playing a crucial role in developing and expanding the CNG network across China. This targeted approach ensures both the supply of gas and the refueling infrastructure required for commercial fleet operators to make the transition.

India: India is another key market due to its growing commercial vehicle sector and government efforts to curb air pollution. Similar to China, substantial investment in domestic gas production and distribution provides the foundation for NGV market growth. The focus is on improving the affordability and availability of CNG to support widespread adoption.

Other Key Regions: While China and India lead the way, regions with readily available and relatively inexpensive natural gas resources, and supportive governmental policies, will also show significant growth in the commercial CNG vehicle sector. This includes parts of Europe and certain regions in North and South America, although the degree of growth depends heavily on regulatory measures and infrastructure development.

The dominance of CNG over LNG within the commercial vehicle segment is largely due to the lower initial investment cost associated with CNG refueling infrastructure. LNG requires more specialized and expensive infrastructure, limiting its immediate impact within the commercial sector. However, LNG has significant potential for long-haul transportation where its higher energy density allows for longer ranges between refueling.

The natural gas vehicle industry's growth is catalyzed by a confluence of factors. The ongoing push for cleaner transportation, coupled with government incentives and the relative affordability of natural gas in certain regions, are prime drivers. Technological advancements, such as improved CNG storage solutions, are also enhancing the practicality and range of NGVs. This combination of environmental consciousness, economic incentives, and technological innovation makes natural gas a compelling alternative fuel in the transportation sector. Moreover, the growing focus on reducing the carbon footprint of transportation fleets is pushing businesses to adopt NGVs to meet their sustainability goals.

This report provides a comprehensive overview of the natural gas vehicle market, covering market trends, drivers, challenges, key players, and significant developments. The report's in-depth analysis, incorporating historical data, current estimates, and future projections, offers valuable insights into the market's future trajectory. It aims to be a valuable resource for industry stakeholders, investors, and policymakers interested in understanding and navigating the evolving natural gas vehicle landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shell, Total, Exxon Mobil, CNPC, Sinopec, CNOOC, ENN Energy, China Gas Holdings, Clean Energy Fuels, Guanghui Energy, Eni.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Natural Gas for Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Natural Gas for Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.