1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Food Colors and Flavor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Natural Food Colors and Flavor

Natural Food Colors and FlavorNatural Food Colors and Flavor by Type (Plant Extracts, Animal Extracts, World Natural Food Colors and Flavor Production ), by Application (Commercial, Household, World Natural Food Colors and Flavor Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

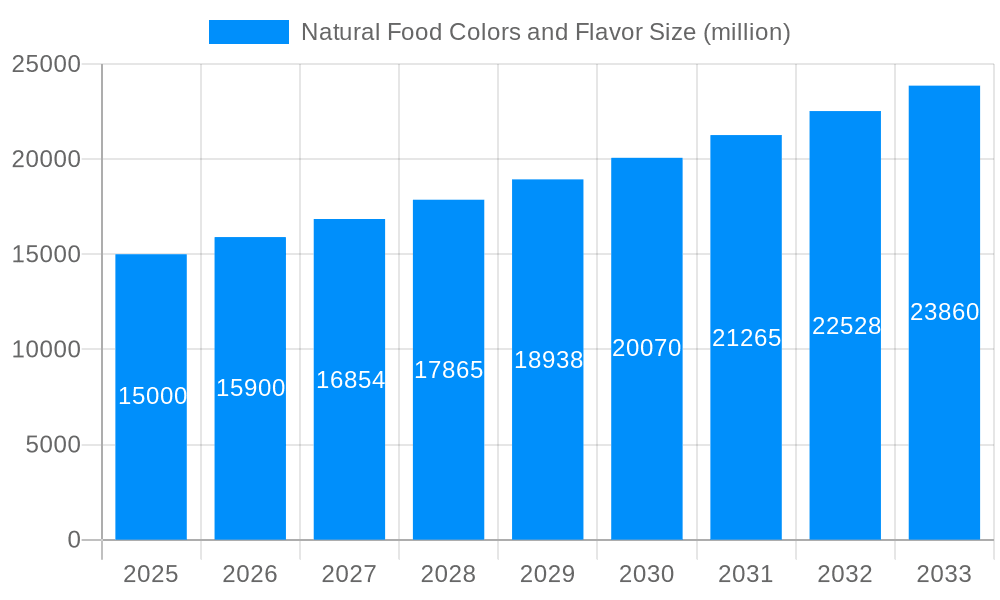

The global natural food colors and flavors market is experiencing robust growth, driven by escalating consumer demand for clean-label products and a growing awareness of the potential health risks associated with artificial additives. The market, currently valued at approximately $15 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033, reaching an estimated market size of $25 billion by 2033. This expansion is fueled by several key factors, including the increasing prevalence of health-conscious lifestyles, a surge in popularity of plant-based foods and beverages, and stringent regulatory frameworks promoting the use of natural ingredients in food products across various regions. The rising adoption of natural food colors and flavors in the commercial food sector, including confectionery, beverages, bakery, and dairy products, is a significant contributor to market growth. Furthermore, the growing interest in home-baking and culinary practices is driving demand within the household segment. Plant-based extracts currently hold a significant market share, but the animal extract segment is expected to experience notable growth owing to its unique flavor profiles and functionalities.

Geographic distribution reveals a diverse landscape, with North America and Europe dominating the market, benefiting from high consumer awareness and established regulatory frameworks favoring natural ingredients. However, developing regions in Asia-Pacific and Latin America are exhibiting promising growth potential, fueled by rising disposable incomes, expanding middle classes, and increasing penetration of Western dietary trends. Market restraints include fluctuating raw material prices, challenges in achieving consistent color and flavor stability in natural products compared to artificial alternatives, and the relatively higher cost of natural ingredients compared to their synthetic counterparts. Leading companies in this sector, including Archer Daniels Midland, Sensient Technologies, and Chr. Hansen, are investing heavily in research and development to address these challenges and introduce innovative products to meet consumer expectations and expand market reach. Strategic acquisitions, partnerships, and product diversification will be critical for sustained growth in this competitive and dynamic marketplace.

The global natural food colors and flavors market is experiencing robust growth, driven by a confluence of factors including the increasing consumer preference for clean-label products, heightened health consciousness, and stringent regulations surrounding artificial additives. The market size, estimated at $XXX million in 2025, is projected to reach $YYY million by 2033, exhibiting a CAGR of ZZZ%. This significant expansion reflects a growing demand for naturally derived colorants and flavorings across diverse food and beverage applications. Plant-based extracts, particularly from fruits and vegetables, dominate the market owing to their wide availability, diverse color profiles, and perceived health benefits. However, the animal-derived segment is also witnessing a rise, driven by specific applications requiring unique flavor profiles and textures. The commercial sector accounts for a substantial share of the market, with food manufacturers increasingly incorporating natural colors and flavors to enhance their product appeal and meet consumer expectations. Nevertheless, the household segment is showing promising growth, fueled by the rising popularity of home-baking and cooking, and the increasing availability of natural ingredients in retail stores. Geographic variations in consumption patterns and regulatory landscapes also contribute to the market's dynamism. Regions with established health-conscious consumer bases and supportive regulatory frameworks for natural ingredients, are anticipated to witness more rapid growth in the coming years. Key trends shaping the market include the rise of personalized nutrition, the growing interest in functional foods, and the increasing adoption of sustainable sourcing practices. Innovation in extraction techniques and the development of novel natural colorants and flavorings are also contributing to market evolution. The forecast period, 2025-2033, promises further expansion as consumer preferences continue to shift towards cleaner, more natural food options.

Several key factors are propelling the expansion of the natural food colors and flavors market. Firstly, the rising consumer awareness of the potential health risks associated with artificial additives fuels the demand for cleaner, healthier alternatives. Consumers are increasingly scrutinizing ingredient lists, seeking products with recognizable, natural ingredients. Secondly, the burgeoning clean-label movement has significantly impacted the food industry, with manufacturers actively reformulating products to meet consumer expectations for transparency and authenticity. Thirdly, stringent government regulations restricting or banning certain artificial colors and flavors in various regions are driving the adoption of natural alternatives. This is particularly prevalent in regions with strict food safety and labeling standards. Moreover, the growing popularity of functional foods and beverages enriched with natural ingredients further contributes to market growth. Consumers are seeking products that provide not only taste and color but also added health benefits. Finally, the increased availability of sustainable and ethically sourced natural ingredients also plays a significant role. Consumers are becoming more conscious of the environmental and social impact of their food choices, preferring products made with responsibly sourced ingredients.

Despite the significant growth potential, the natural food colors and flavors market faces several challenges. The high cost of production compared to synthetic alternatives remains a significant hurdle. The extraction and processing of natural ingredients are often more complex and expensive, impacting the overall cost of the final product. Furthermore, the inherent variability in the quality and availability of natural raw materials presents a challenge to consistent product quality and supply chain management. Climatic conditions and seasonal variations can affect the yield and quality of natural ingredients, leading to potential supply disruptions. Maintaining color and flavor stability throughout the product's shelf life also presents a considerable challenge. Natural colorants and flavors are often less stable than their synthetic counterparts, requiring specialized processing techniques and packaging solutions to ensure product quality. Finally, the complex regulatory landscape, which varies significantly across different regions, adds complexity to the market. Navigating these differing regulations and ensuring compliance can be expensive and time-consuming for manufacturers.

The North American market currently holds a significant share of the global natural food colors and flavors market, driven by strong consumer demand for clean-label products and the presence of major food and beverage manufacturers. Europe follows closely, exhibiting a strong preference for natural ingredients and strict regulations regarding artificial additives. Asia-Pacific is showing promising growth potential, fueled by increasing disposable incomes, changing consumer preferences, and rising awareness of health and wellness.

Dominant Segment: The plant extracts segment significantly dominates the market, accounting for approximately XXX million dollars in 2025. This segment’s dominance is attributable to the vast variety of plant sources (fruits, vegetables, spices, etc.), the diverse range of colors and flavors obtainable, and the generally favorable consumer perception of plant-based ingredients.

Application Dominance: The commercial application segment currently holds a larger market share compared to the household segment, primarily due to the high volume of natural color and flavor use in large-scale food production. However, the household segment is experiencing rapid growth, propelled by increasing home-cooking activities and the growing popularity of "clean eating."

Geographic Breakdown: North America and Europe are leading regions due to established health-conscious consumer bases and stringent regulations against artificial additives. However, the Asia-Pacific region presents significant growth opportunities due to increasing consumer awareness and economic growth.

The market is characterized by significant regional disparities. Developed economies, such as those in North America and Europe, are already well-established in this sector. However, developing economies, particularly in Asia-Pacific, are displaying remarkable growth potential, driven by the increasing purchasing power of a growing middle class and a rising awareness of health and wellness. This growth is particularly evident in countries such as China and India, where consumer preferences are shifting towards healthier food choices. Specific regional variations in regulatory landscape also impact market dynamics. Stringent regulations in certain regions are driving the adoption of natural alternatives at a faster rate than in others where regulatory environments may be more lenient.

The natural food colors and flavors industry is experiencing substantial growth fueled by several converging catalysts. The increasing awareness among consumers about the potential health risks of synthetic additives is driving the adoption of natural alternatives. Simultaneously, the growing demand for clean-label products with simple, recognizable ingredients is pushing manufacturers to reformulate their products using natural colorants and flavorings. Government regulations restricting or banning certain artificial colors and flavors are further accelerating this shift. Furthermore, the growing interest in functional foods and beverages contributes to the demand for natural ingredients with added health benefits. Finally, innovation in extraction techniques and the development of new and improved natural colorants and flavorings are expanding the market's possibilities.

This report provides a comprehensive overview of the natural food colors and flavors market, encompassing market size and growth projections, detailed analysis of key segments, and profiles of leading players. It delves into the driving forces, challenges, and opportunities within the industry, offering valuable insights into current trends and future prospects. Furthermore, the report addresses regional variations in market dynamics and offers a forward-looking perspective, allowing stakeholders to make informed decisions based on reliable market intelligence. The extensive analysis presented empowers businesses to strategically navigate the evolving landscape of the natural food colors and flavors market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Archer Daniels Midland Company (ADM), Sysco Corporation, Conagra Foodservice, Royal Ridge Fruits, Capricorn Food Products, ALFA LAVAL, Tricom Fruit Products, Capuzzo, Freudenberg Group, Saraf Foods, Mysore Fruits, Rhodes Food Group, Del Monte, MANDAR FOOD PRODUCTS, AOHATA CORPORATION, Reid Produce, Speyfruit, PACIFIC COAST FRUIT COMPANY, Washington Fruit & Produce, Sensient Technologies Corporation, Chr. Hansen Holding, GNT Group, Naturex, DDW The Color House, Robertet Group, Symrise.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Natural Food Colors and Flavor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Natural Food Colors and Flavor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.