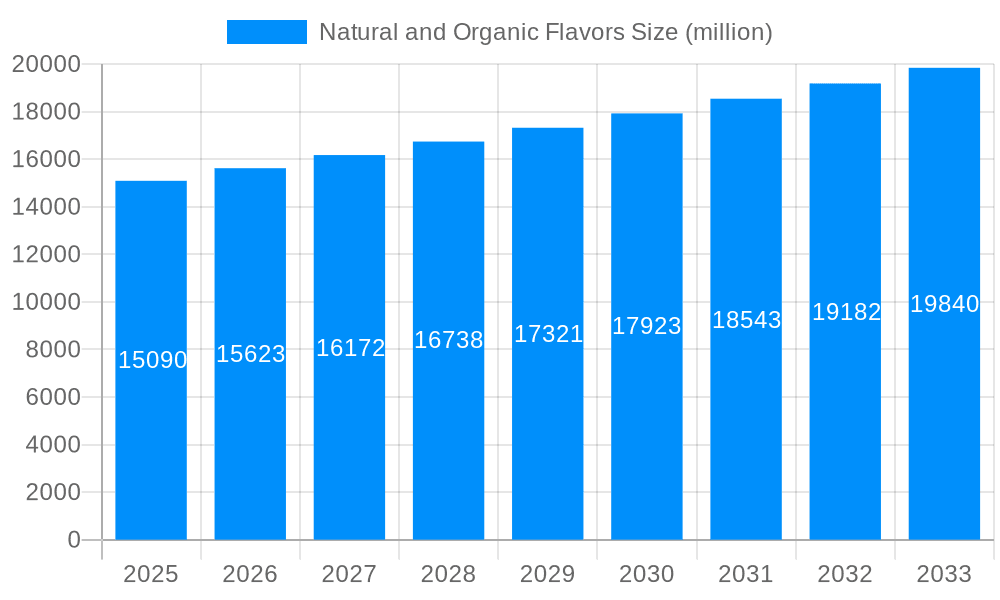

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural and Organic Flavors?

The projected CAGR is approximately 3.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Natural and Organic Flavors

Natural and Organic FlavorsNatural and Organic Flavors by Type (Vegetable Flavor, Fruit Flavor, Spices, Other), by Application (Beverages, Dairy & Frozen Products, Savory & Snacks), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global natural and organic flavors market, valued at $15.09 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for clean-label products and a growing preference for natural and organic ingredients in food and beverages. A Compound Annual Growth Rate (CAGR) of 3.5% from 2025 to 2033 suggests a market size exceeding $20 billion by the end of the forecast period. This growth is fueled by several key factors. The rising health consciousness among consumers is a significant driver, leading to increased demand for products free from artificial additives and preservatives. The expanding food and beverage industry, particularly within segments like beverages and dairy & frozen products, further contributes to market expansion. The diverse range of applications, including vegetable and fruit flavors, spices, and other natural flavorings, cater to a broad consumer base and diverse product categories, contributing to the market's robustness. While specific regional breakdowns are not provided, a logical distribution based on current market trends would indicate stronger growth in regions like Asia-Pacific, driven by a burgeoning middle class with increased disposable income and a rising interest in healthier food options. However, potential restraints such as price fluctuations in raw materials and stringent regulatory requirements for natural and organic certification could impact market growth in the long term.

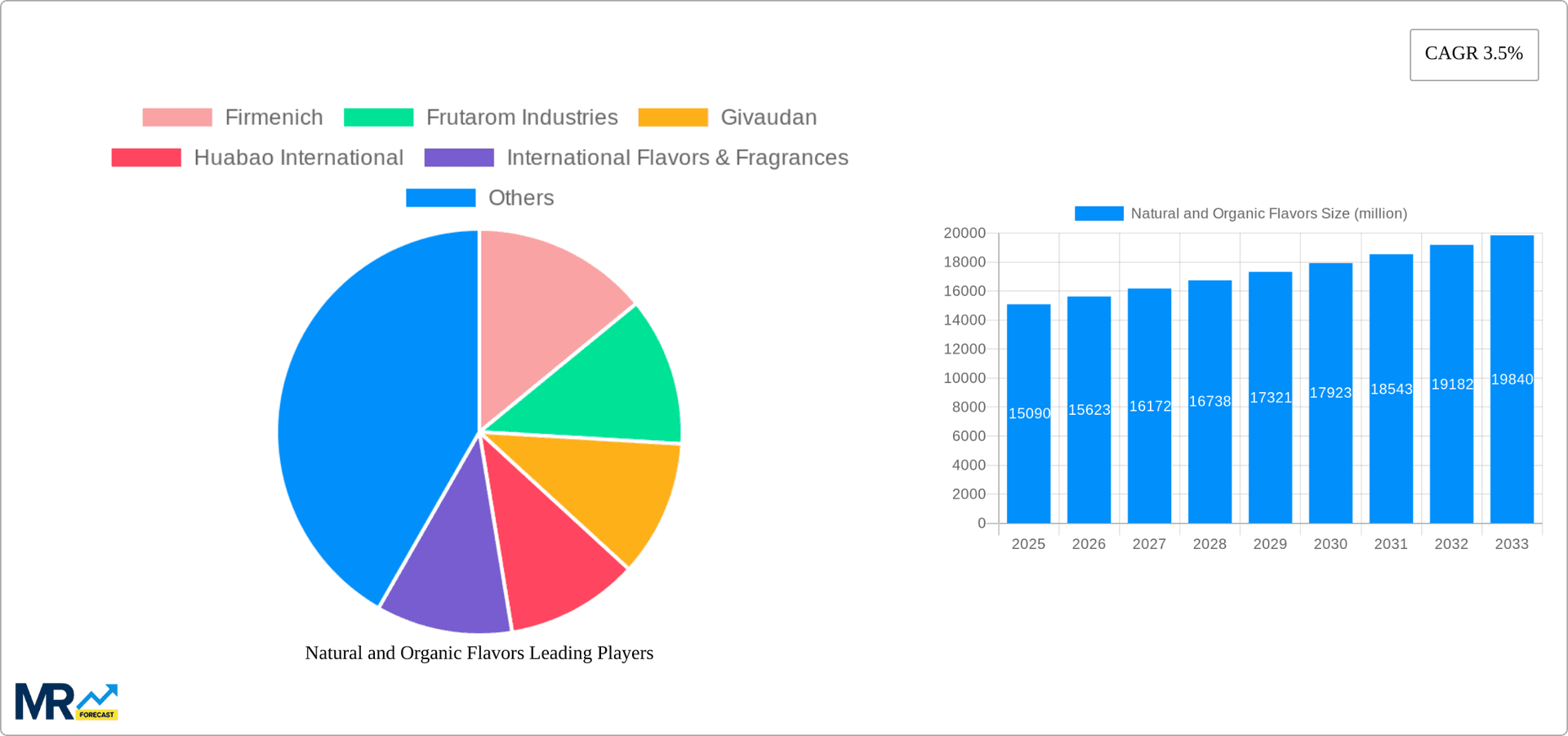

The leading companies in this market—Firmenich, Frutarom Industries, Givaudan, and others—are investing heavily in research and development to create innovative and sustainable natural flavors. This focus on innovation, coupled with strategic acquisitions and partnerships, allows them to capture significant market share. The segmentation by flavor type (vegetable, fruit, spice, etc.) and application (beverages, dairy, savory snacks, etc.) provides a detailed understanding of market dynamics. Within the application segments, the beverage sector is expected to be a primary driver due to the rising popularity of functional beverages and natural-flavored drinks. The forecast period, spanning from 2025 to 2033, offers ample opportunity for market players to capitalize on the continued growth trajectory, making it a lucrative investment space. Strategies focusing on product diversification, sustainability initiatives, and adherence to strict quality control measures will be crucial for sustained success.

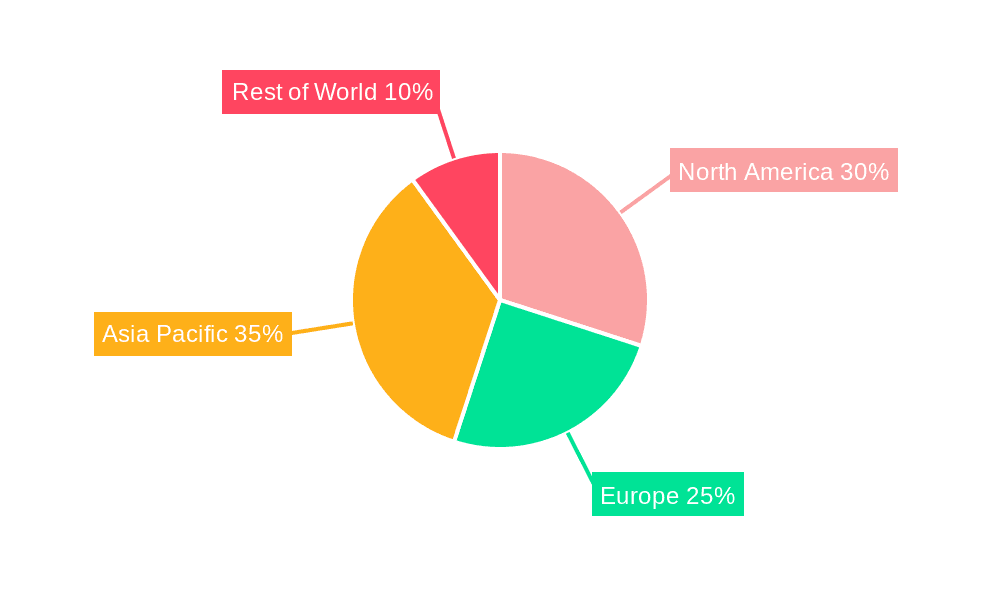

The global natural and organic flavors market is experiencing robust growth, driven by escalating consumer demand for clean-label products and a heightened awareness of the health implications of artificial additives. The market, valued at $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a CAGR of X% during the forecast period (2025-2033). This surge is fueled by several key trends: the increasing popularity of functional foods and beverages, the expansion of the organic food sector, and the growing preference for naturally sourced ingredients across diverse food and beverage applications. Consumers are increasingly scrutinizing ingredient lists, seeking transparency and authenticity. This has led manufacturers to reformulate products, replacing artificial flavors with their natural counterparts. The demand for natural and organic flavors is particularly pronounced in developed economies, with North America and Europe leading the charge. However, emerging economies in Asia-Pacific are also witnessing a significant rise in demand, driven by rising disposable incomes and changing consumer preferences. Furthermore, the market is witnessing innovation in flavor profiles, with companies developing unique and complex flavor combinations to meet the evolving palate of consumers. This includes a surge in demand for regionally specific flavors and ethnic cuisines, reflecting the globalization of tastes. The market is also experiencing the integration of sustainable sourcing practices and eco-friendly packaging, which aligns with the growing environmental consciousness of consumers. The increasing adoption of clean-label certifications and stricter regulations concerning the use of artificial ingredients further bolster the growth trajectory of the natural and organic flavors market.

Several key factors are driving the expansion of the natural and organic flavors market. Firstly, the rising health consciousness among consumers globally is a primary driver. Consumers are increasingly aware of the potential negative health effects of artificial additives and are actively seeking out products with natural and organic ingredients. This preference is particularly strong among millennials and Gen Z, demographics known for their health-conscious lifestyles. Secondly, the growing demand for clean-label products is pushing manufacturers to reformulate their products, substituting artificial flavors with natural alternatives. Consumers are demanding greater transparency and traceability in food and beverage products, and clean labels are becoming a crucial factor in purchase decisions. Thirdly, the expansion of the organic food market is directly impacting the demand for natural and organic flavors. As the organic food segment continues its upward trajectory, the need for natural flavors to complement these products is correspondingly escalating. Finally, the increasing prevalence of food allergies and intolerances is further contributing to the growth of the market. Natural and organic flavors are often considered safer and less likely to trigger adverse reactions, making them an attractive option for consumers with dietary restrictions.

Despite its impressive growth, the natural and organic flavors market faces several challenges. One major hurdle is the higher cost of production compared to artificial flavors. The sourcing, processing, and extraction of natural ingredients often entail higher expenses, which can impact product pricing and profitability. This price difference can make it difficult for manufacturers to compete with products using cheaper artificial alternatives, especially in price-sensitive markets. Another challenge is the consistency and reliability of supply. Natural ingredients are subject to variations in quality and availability depending on factors like climate and growing conditions. This can lead to supply chain disruptions and challenges in maintaining a consistent flavor profile. Furthermore, the complexity of regulations and certifications for natural and organic products adds another layer of complexity and cost for manufacturers. Meeting the stringent requirements for labeling and certification can be a substantial undertaking. Finally, the potential for adulteration and mislabeling of natural flavors is a persistent concern, which necessitates robust quality control measures throughout the supply chain. This necessitates strong partnerships with reliable suppliers and transparent production processes.

Beverages Segment Dominance: The beverages segment is projected to be the leading application area for natural and organic flavors throughout the forecast period. This is due to the escalating consumer demand for naturally flavored beverages, particularly in categories like carbonated soft drinks, juices, functional beverages, and ready-to-drink teas.

High Growth in North America and Europe: North America and Europe will continue to dominate the market, fueled by high consumer awareness of health and wellness, increased disposable incomes, and a strong preference for clean-label products. However, the Asia-Pacific region is experiencing rapid growth, driven by rising middle-class incomes and increasing awareness of health-conscious living.

Fruit Flavor Leading Type: Fruit flavors will constitute the largest segment by type, followed by vegetable flavors. The natural sweetness and versatility of fruit flavors make them widely applicable across various beverages and food applications.

Market Drivers within Beverages Segment: The popularity of organic and natural juices, functional beverages with added health benefits (e.g., probiotics), and the rising demand for low-sugar and sugar-free alternatives are significantly driving growth within this segment. Premiumization is another factor; consumers are willing to pay more for high-quality, naturally flavored beverages.

Specific Examples: The demand for naturally flavored sparkling water, herbal teas, and fruit-infused waters has increased significantly, leading to more companies incorporating natural and organic flavors.

Future Trends within Beverages: Expect to see continued innovation in flavor combinations and the exploration of lesser-known fruits and botanicals for unique flavor profiles. Furthermore, the use of sustainable and ethically sourced ingredients will gain further traction within the beverage sector.

The natural and organic flavors industry is poised for continued expansion due to a confluence of factors. The increasing consumer preference for clean-label products, coupled with the heightened awareness of the potential health risks associated with artificial ingredients, is a powerful driving force. Furthermore, the rise of the organic food sector and the growing popularity of functional foods and beverages create significant opportunities for natural and organic flavor manufacturers. The development of innovative flavor profiles that cater to diverse consumer tastes and preferences, as well as the integration of sustainable sourcing practices, also contribute to the industry's growth trajectory.

This report provides a detailed analysis of the natural and organic flavors market, encompassing historical data, current market trends, and future growth projections. The report offers in-depth insights into key market drivers, challenges, and opportunities, along with a comprehensive assessment of the leading players in the industry. It provides valuable information for businesses operating in the food and beverage sector, investment firms, and other stakeholders interested in gaining a competitive edge in this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.5%.

Key companies in the market include Firmenich, Frutarom Industries, Givaudan, Huabao International, International Flavors & Fragrances, Kerry, V. Mane Fils, Robertet, Sensient, Symrise, Takasago, DSM, Dharampal Satyapal Group, KIS, Ungerer & Company, Kotanyi, Nilon, AVT Natural, ACH Food Companies, San-Ei-Gen, .

The market segments include Type, Application.

The market size is estimated to be USD 15090 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Natural and Organic Flavors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Natural and Organic Flavors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.