1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Alternative Sweeteners?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Natural Alternative Sweeteners

Natural Alternative SweetenersNatural Alternative Sweeteners by Application (Food and Beverage, Pharmaceutical, Personal Care, Others), by Type (Stevia, Coconut Sugar, Raw Honey, Blackstrap Molasses, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for natural alternative sweeteners is experiencing robust growth, driven by increasing health consciousness among consumers and a rising prevalence of diabetes and obesity. The shift away from artificial sweeteners and the demand for clean-label products are significant contributing factors to this expansion. While precise market sizing requires proprietary data, a reasonable estimate based on reported CAGRs and similar markets suggests a 2025 market value in the range of $5-7 billion. This substantial market is further segmented by sweetener type (stevia, monk fruit, erythritol, etc.), application (food & beverages, dietary supplements), and geographical region. Leading players like Cargill, ADM, and PureCircle are strategically investing in research and development, expanding their product portfolios, and focusing on sustainable sourcing to maintain their market positions.

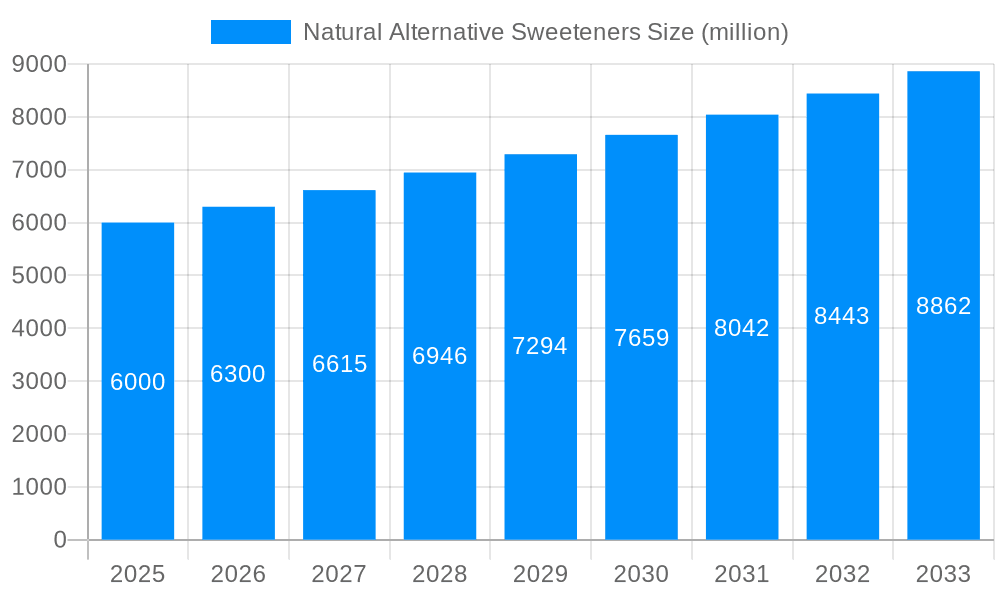

This dynamic market is expected to see continued growth throughout the forecast period (2025-2033), with a projected CAGR of approximately 5-7%. This growth is fueled by several key trends: the increasing popularity of functional foods and beverages, the development of innovative sweetener blends, and expanding distribution channels reaching broader consumer segments. However, challenges remain, including the relatively higher cost of production compared to artificial sweeteners and potential supply chain disruptions. Overcoming these challenges and capitalizing on emerging trends, such as the growing demand for plant-based and organic products, will be crucial for companies looking to succeed in this competitive yet lucrative market.

The global natural alternative sweeteners market is experiencing robust growth, driven by the escalating demand for healthier food and beverage options. The market, valued at USD XX million in 2024, is projected to reach USD YY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This surge reflects a significant shift in consumer preferences, with individuals increasingly seeking to reduce their sugar intake due to concerns about weight management, dental health, and chronic diseases like diabetes. The rising prevalence of these health issues is a key factor bolstering the market's expansion. Furthermore, the increasing awareness of the negative health impacts associated with artificial sweeteners has fueled the adoption of natural alternatives. This trend is particularly prominent among health-conscious millennials and Gen Z consumers, who are actively seeking out products with clean labels and transparent ingredient lists. The market is witnessing innovation in product formulations, with manufacturers constantly developing new and improved natural sweeteners to enhance taste and functionality in various food and beverage applications. This includes the exploration of novel sweeteners derived from natural sources, such as monk fruit, yacon syrup, and allulose, alongside the continued popularity of stevia and agave nectar. The growing demand from the food and beverage industry, coupled with advancements in extraction and processing technologies, is further contributing to the market's positive outlook. The competitive landscape is also dynamic, with established players and emerging companies constantly vying for market share through product differentiation, strategic partnerships, and expansion into new geographic markets. Overall, the natural alternative sweeteners market presents a promising investment opportunity, with substantial growth potential in the foreseeable future.

Several factors are driving the expansion of the natural alternative sweeteners market. Firstly, the global rise in health consciousness is undeniable. Consumers are actively seeking to reduce their sugar intake, leading to a surge in demand for healthier alternatives. This is further fueled by increasing awareness of the adverse health effects of excessive sugar consumption, including obesity, type 2 diabetes, and cardiovascular diseases. The growing prevalence of these conditions is directly translating into increased adoption of natural sweeteners. Secondly, the burgeoning demand for clean-label products is significantly impacting the market. Consumers are increasingly scrutinizing ingredient lists, favoring products with recognizable and naturally derived sweeteners over artificial counterparts. This preference for transparency and authenticity is shaping product development and marketing strategies within the industry. Thirdly, technological advancements in the extraction and processing of natural sweeteners have made them more cost-effective and readily available. Improvements in refining techniques have enhanced the taste and functionality of these sweeteners, making them more palatable and suitable for a wider range of applications in food and beverage products. Finally, the rising disposable incomes in developing economies are contributing to the expansion of the market, as consumers in these regions have greater purchasing power to afford premium, healthier food choices, including products sweetened with natural alternatives.

Despite the promising outlook, the natural alternative sweeteners market faces several challenges. One major hurdle is the inherent cost associated with production. Compared to conventional sugar, many natural sweeteners are more expensive to produce, potentially hindering their widespread adoption, particularly in price-sensitive markets. This cost difference is amplified by the complexities involved in extraction, purification, and processing of these natural ingredients. Furthermore, some natural sweeteners, while healthier, can present challenges in terms of taste and functionality. Certain natural sweeteners may possess a slightly bitter aftertaste or may not perform as well as sugar in various culinary applications, requiring careful formulation and blending to achieve optimal results. Maintaining consistent quality and supply can also be challenging. The production of natural sweeteners is often dependent on agricultural yields and climatic conditions, potentially leading to supply disruptions and price fluctuations. Regulatory hurdles and varying approval processes across different regions also present barriers for market expansion. Different countries have varying regulations regarding the labeling, approval, and usage of specific natural sweeteners, making it necessary for companies to adapt their products and comply with diverse regulations. Finally, consumer perception and acceptance can be variable. While awareness of health benefits is growing, some consumers might still harbor misconceptions or have negative experiences with certain natural sweeteners, affecting their adoption.

The North American market is expected to hold a significant share of the global natural alternative sweeteners market throughout the forecast period (2025-2033). This dominance can be attributed to several factors:

Similarly, the beverage segment is projected to capture a large share of the market. The versatility of natural sweeteners in various beverages, from soft drinks and juices to functional beverages and tea, contributes to this significant demand.

Other regions like Europe and Asia Pacific are also showing significant growth, fueled by rising health awareness and increasing disposable incomes, but North America maintains its leading position due to the factors mentioned above.

The natural alternative sweeteners market is fueled by a convergence of factors, including the rising prevalence of chronic diseases linked to high sugar consumption, growing health consciousness among consumers, the increasing demand for clean-label products with natural ingredients, and advancements in sweetener extraction and processing technologies leading to improved taste and functionality. These factors combined are accelerating market growth and expanding the market's reach into new applications and geographical regions.

This report offers a comprehensive overview of the natural alternative sweeteners market, analyzing market trends, growth drivers, challenges, and key players. The report provides valuable insights into market segmentation, regional dynamics, and future growth projections, facilitating informed decision-making for stakeholders in the industry. It combines qualitative analysis with robust quantitative data to offer a complete understanding of this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cargill, GLG Life Tech Corp, Zydus Wellness, Archer Daniels Midland, Merisant, Hermes Sweeteners, Imperial Sugar Company, Herbevodia, Stevia Corporation, Naturex, PureCircle, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Natural Alternative Sweeteners," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Natural Alternative Sweeteners, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.