1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorcycle Rental?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Motorcycle Rental

Motorcycle RentalMotorcycle Rental by Type (Luxury Motorcycle, Commonly Motorcycle), by Application (Motorcycle Tourism, Commuter), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

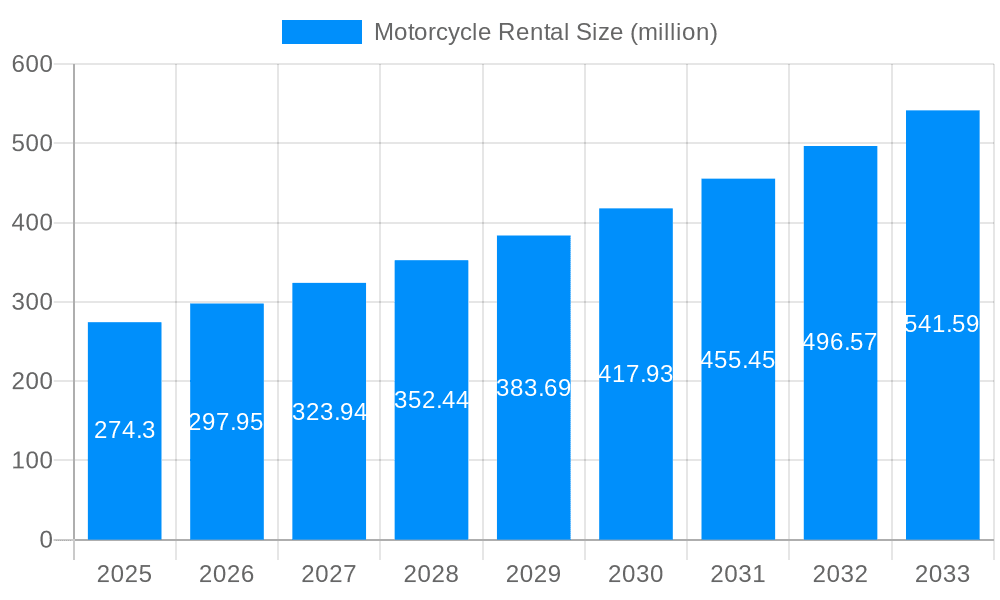

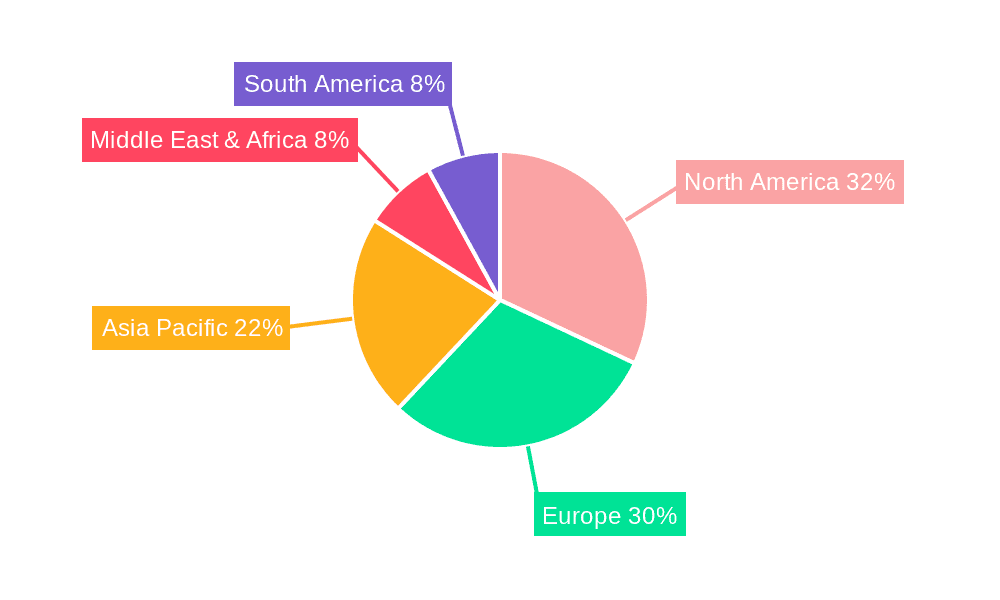

The global motorcycle rental market, valued at $209.4 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of motorcycle tourism, fueled by a desire for unique travel experiences and adventure, is a significant driver. The convenience and affordability of motorcycle rentals compared to purchasing, especially for occasional riders, further boosts market demand. Growth is also propelled by the expansion of organized motorcycle tours and the rise of peer-to-peer rental platforms offering a wider selection and increased accessibility. The market segmentation reveals a strong demand for both luxury and commonly used motorcycles, catering to diverse rider preferences and budgets. While commuter use contributes to the overall market size, the significant growth is largely attributed to the tourism segment. Geographical distribution shows strong potential in North America and Europe, with emerging markets in Asia-Pacific showing promising growth trajectories. However, factors like stringent regulations surrounding motorcycle rentals in certain regions and safety concerns could potentially hinder market expansion. The forecast period (2025-2033) anticipates a continuation of this positive trend, with a compound annual growth rate (CAGR) of 3.9%, suggesting a robust and expanding market ripe for investment and innovation. This sustained growth will likely be fueled by ongoing technological advancements, enhanced safety features, and a continuously expanding network of rental providers catering to a broadening customer base.

The competitive landscape is characterized by a mix of established players like EagleRider and emerging peer-to-peer platforms like WheelStreet. These companies are actively focusing on improving customer experience, expanding their fleet, and leveraging technology to enhance the rental process. The competitive environment drives innovation, offering customers a broader range of choices and services. Future growth will depend on adapting to evolving consumer preferences, technological integration, and expansion into new geographical markets. Market players are likely to focus on strategic partnerships, fleet diversification, and effective marketing strategies to capture an increasing market share in this dynamic sector. This includes offering insurance packages, personalized itineraries, and improved customer service to attract and retain customers.

The global motorcycle rental market roared into action during the study period (2019-2033), experiencing significant growth driven by a confluence of factors. The market, estimated at several million units in 2025, is projected to expand considerably by 2033. This surge can be attributed to the increasing popularity of motorcycle tourism, the rising disposable incomes in emerging economies enabling more individuals to afford rental services, and the convenience offered by readily accessible rental platforms. The historical period (2019-2024) laid the foundation for this growth, with a noticeable upswing in demand, particularly for commonly used motorcycles. The forecast period (2025-2033) promises further expansion, fueled by innovative business models, technological advancements in rental management systems, and the expansion of rental fleets to include a broader range of motorcycles catering to diverse rider preferences. The base year (2025) provides a solid benchmark for evaluating the market's trajectory and forecasting future performance. While commonly rented motorcycles dominate the current market share, the luxury motorcycle segment is demonstrating promising growth potential, attracting affluent travelers and enthusiasts seeking premium riding experiences. This trend is further amplified by the growing preference for experiential travel, positioning motorcycle tourism as a highly sought-after vacation activity. The market demonstrates a clear trend towards digitalization, with online booking platforms and mobile applications simplifying the rental process and enhancing customer convenience. However, the impact of external factors like fluctuating fuel prices and economic uncertainties needs to be considered in any detailed market projection. The competition amongst established players and the emergence of new entrants constantly shapes the market dynamics.

Several key factors are accelerating the growth of the motorcycle rental market. The rising popularity of adventure tourism and motorcycle-centric travel experiences is a significant driver. Many travelers prefer the freedom and flexibility of exploring destinations on two wheels, leading to a surge in demand for rental services. Furthermore, the increasing affordability of motorcycles, coupled with the convenience of renting rather than owning, makes motorcycle travel accessible to a wider demographic. Technological advancements, such as user-friendly online booking platforms and mobile apps, have streamlined the rental process, making it easier and more convenient for customers. The expansion of rental fleets to encompass diverse motorcycle models, catering to various riding styles and preferences, is another significant factor. This diversification ensures that there's a motorcycle available to suit every rider's needs and budget, whether it’s a powerful luxury bike or a practical commuter motorcycle. Finally, the growing awareness of environmental concerns and the desire for sustainable transportation are subtly contributing to the market's growth, with some riders opting for motorcycles as a more fuel-efficient alternative to cars for shorter trips or urban commutes.

Despite the positive growth trajectory, the motorcycle rental market faces several challenges. One significant hurdle is the risk of accidents and associated liability. Rental companies must invest heavily in insurance and safety measures to mitigate these risks and protect themselves from potential financial losses. The seasonal nature of the market, with demand peaking during tourist seasons and declining during off-peak periods, can also present operational challenges, necessitating effective inventory management and flexible staffing strategies. Strict regulations and licensing requirements in different jurisdictions pose another hurdle, adding complexity to operations and increasing compliance costs for rental companies. Furthermore, maintaining a well-maintained fleet of motorcycles requires significant investment in regular servicing, repairs, and replacement parts. Fluctuations in fuel prices can impact the profitability of the business, as rental rates need to be adjusted to accommodate rising fuel costs without discouraging customers. Finally, intense competition among established players and new entrants necessitates continuous innovation and strategic adaptation to stay ahead of the curve.

The motorcycle rental market exhibits diverse growth patterns across different regions and segments. While a precise breakdown of market share for each region requires extensive data analysis, several trends emerge. Developed economies in North America and Europe currently hold a significant market share, driven by established tourism sectors and a high per capita income, resulting in stronger demand for both commuter and tourism-related motorcycle rentals. However, emerging markets in Asia, particularly Southeast Asia and India, are experiencing rapid growth due to expanding middle classes and an increased appetite for adventure tourism. This is largely driven by a higher volume of commonly rented motorcycles catering to a broader customer base. Within the segment types, the commonly rented motorcycle segment is significantly larger than the luxury segment currently, simply due to scale and affordability. However, the luxury motorcycle rental segment is witnessing significant growth potential, driven by a rising number of high-net-worth individuals and increased interest in premium experiences.

Segments:

The global distribution of growth may see significant shifts in the coming years as developing nations see increases in both disposable income and tourism.

The motorcycle rental industry's expansion is fueled by a confluence of factors. The rising popularity of experiential travel and motorcycle tourism is a major catalyst, attracting adventurers and thrill-seekers. Technological advancements, such as improved online booking systems and mobile applications, are enhancing customer convenience and streamlining rental processes. Furthermore, strategic partnerships between rental companies and tourism operators create synergistic opportunities to reach wider audiences. Finally, the growing preference for eco-conscious transportation options, with motorcycles offering fuel-efficient alternatives, further contributes to market growth.

This report provides a thorough examination of the motorcycle rental market, offering invaluable insights into its current status, growth trends, and future prospects. The analysis covers key market segments, prominent players, driving forces, challenges, and regional variations, offering a holistic understanding of this dynamic sector. It will serve as an indispensable resource for businesses operating within the industry, investors seeking investment opportunities, and researchers exploring this niche market. The report also provides actionable strategies for stakeholders to navigate the competitive landscape and capitalize on growth opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

Key companies in the market include Motoroads, Adriatic Moto Tours, WheelStreet, Wicked Ride, EagleRider, .

The market segments include Type, Application.

The market size is estimated to be USD 209.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Motorcycle Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Motorcycle Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.