1. What is the projected Compound Annual Growth Rate (CAGR) of the Money Management App?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Money Management App

Money Management AppMoney Management App by Type (Cloud-based, On-premises), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

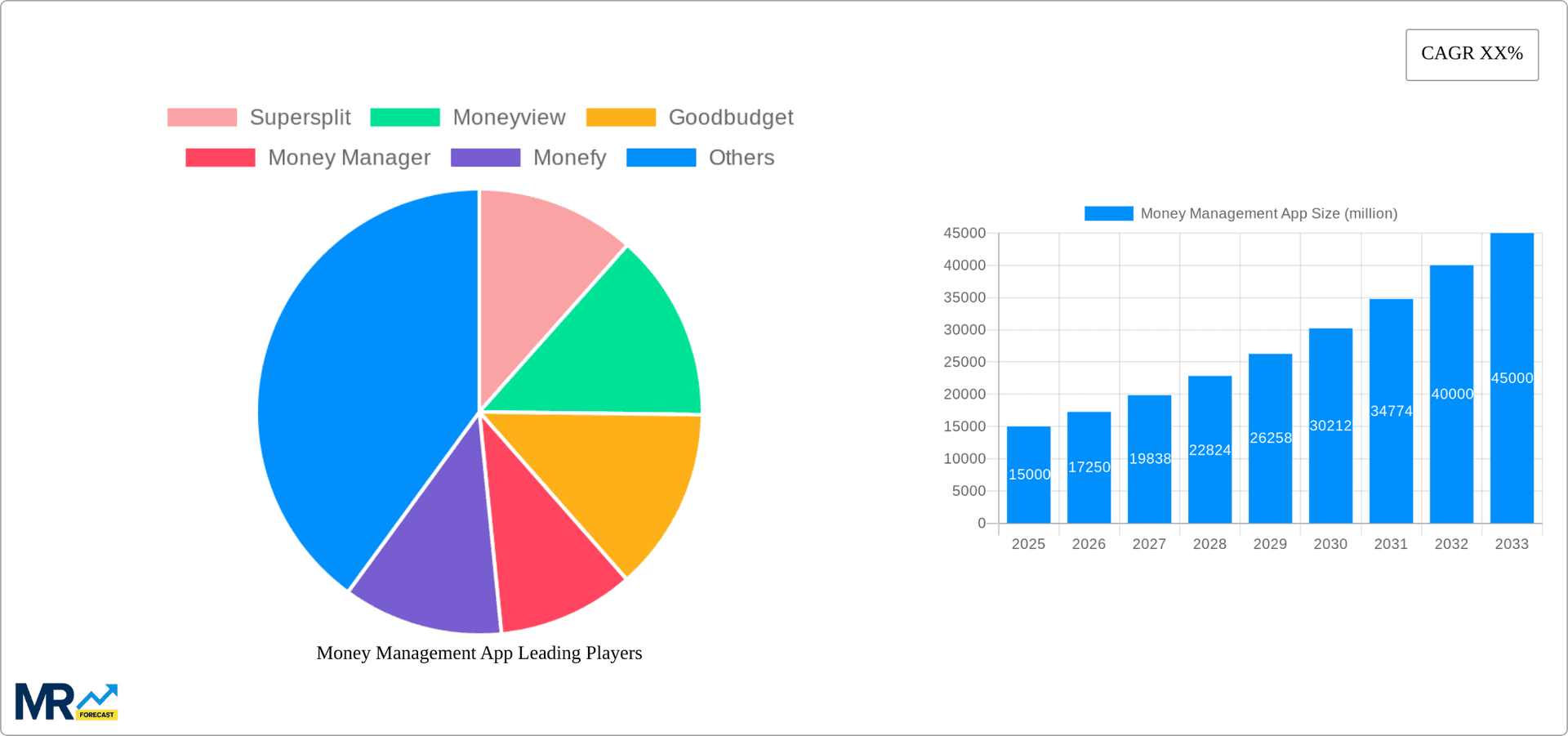

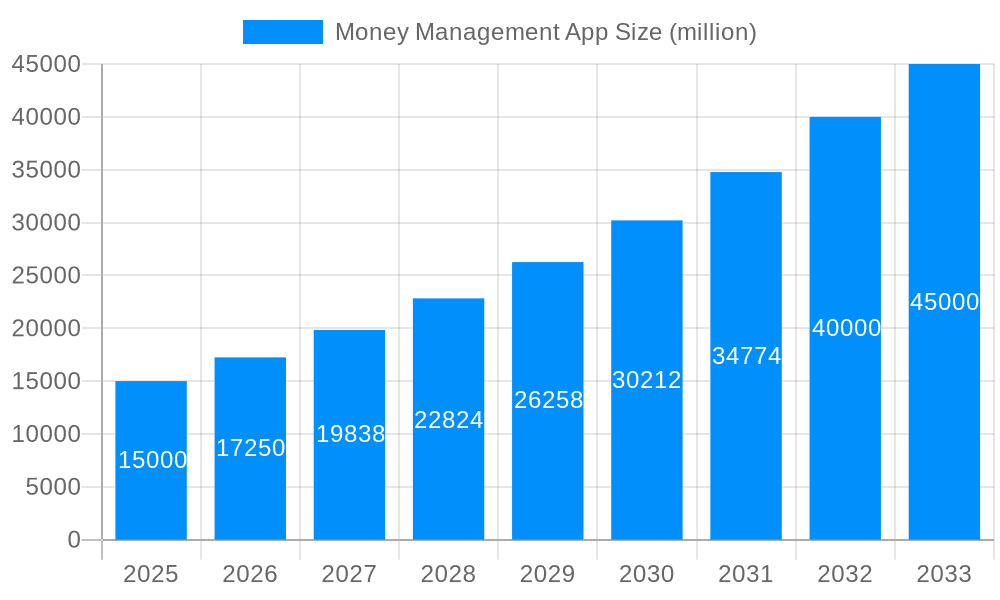

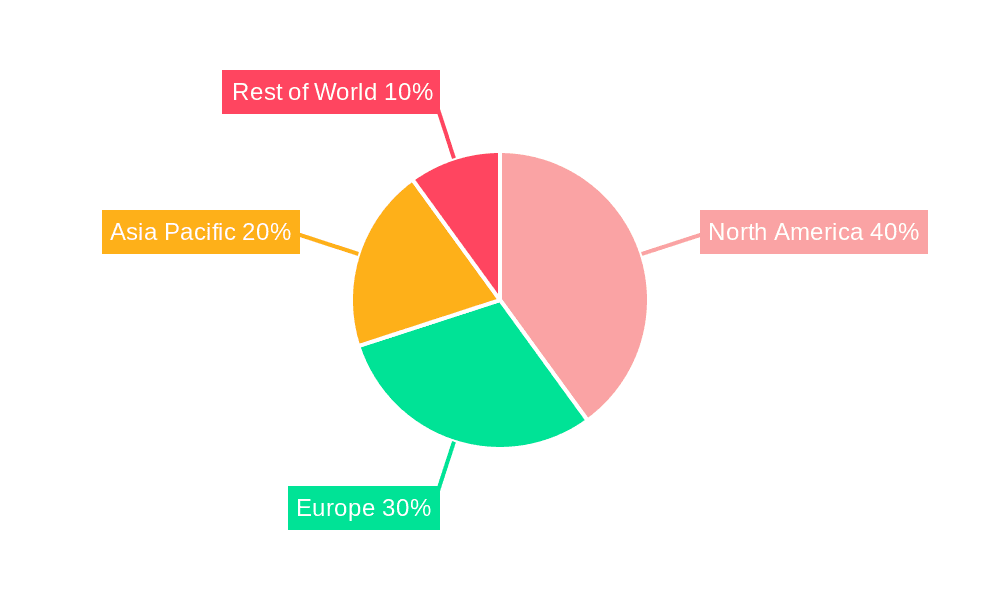

The global money management app market is experiencing robust growth, driven by increasing smartphone penetration, rising financial literacy concerns, and the need for convenient personal finance solutions. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $45 billion by 2033. This expansion is fueled by several key factors: the increasing adoption of cloud-based solutions offering enhanced accessibility and security; the growing preference for personalized financial advice and budgeting tools within apps; and a surge in demand from both large enterprises seeking employee financial wellness programs and SMEs looking for efficient expense tracking. The competitive landscape is highly dynamic, with a mix of established players and innovative startups continuously vying for market share through feature enhancements, strategic partnerships, and targeted marketing. Regional variations exist, with North America and Europe currently dominating the market due to higher levels of digital adoption and financial awareness. However, significant growth potential lies in developing economies of Asia-Pacific, particularly India and China, where a burgeoning middle class is embracing mobile technology and digital financial services.

Market segmentation further reveals significant opportunities. The cloud-based segment holds the largest share due to its scalability, accessibility, and cost-effectiveness. Within applications, large enterprises contribute significantly to market revenue through corporate wellness programs, while the SME segment exhibits high growth potential driven by increasing demand for simplified financial management tools. The continued integration of advanced technologies like AI and machine learning into money management apps, offering predictive analytics and personalized financial advice, will further accelerate market growth in the coming years. Challenges remain in the form of data security concerns, regulatory compliance, and the need to address the digital divide in certain regions. Overcoming these hurdles will be critical for continued market expansion and wider accessibility.

The global money management app market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The period between 2019 and 2024 (historical period) witnessed a significant surge in adoption, driven by the increasing penetration of smartphones and rising financial literacy among younger demographics. Our study, covering 2019-2033 (study period), with a base year of 2025 and a forecast period of 2025-2033, indicates a continued upward trajectory. By 2025 (estimated year), the market will be significantly larger than in previous years, fueled by several factors discussed later in this report. The market's growth isn't just about basic budgeting; users are increasingly demanding sophisticated features like automated savings, investment tracking, and personalized financial advice integrated directly into their apps. This trend is further supported by the emergence of innovative features such as AI-powered budgeting assistance, fraud detection, and seamless integration with banking platforms. The competition is fierce, with both established fintech giants and agile startups vying for market share through strategic partnerships, acquisitions, and continuous product innovation. The increasing preference for cloud-based solutions over on-premises systems is another defining trend, offering scalability, accessibility, and enhanced security features attractive to both large enterprises and SMEs. This shift towards cloud-based solutions is leading to a greater reliance on secure data storage and robust cybersecurity measures to protect sensitive user financial information. The market is further segmented by user type (individuals vs. businesses) and the specific services offered (budgeting, investing, debt management, etc.), each experiencing unique growth patterns and competitive dynamics. The integration of open banking APIs has significantly improved the data accuracy and efficiency of these apps, enabling a more holistic view of the user's financial situation.

Several key factors are driving the remarkable growth of the money management app market. The proliferation of smartphones and increased internet penetration, particularly in developing economies, provides unprecedented access to these applications. The convenience and accessibility offered by mobile-first solutions are proving extremely attractive to a broad spectrum of users. The rising awareness of personal finance management and the need for better control over one's finances are significant contributing factors. Users are increasingly proactive in managing their financial health, seeking tools that help them track expenses, plan for the future, and avoid debt. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) is enhancing the user experience and delivering personalized financial insights. These technologies are not only improving the accuracy of budgeting and forecasting but are also enabling sophisticated features like automated savings plans and personalized investment recommendations. The growing popularity of subscription-based services and the need for efficient bill management are further contributing to the market's expansion. Finally, the emergence of open banking APIs facilitates seamless data integration between various financial institutions, providing users with a more comprehensive view of their financial landscape.

Despite its rapid growth, the money management app market faces several challenges. Data security and privacy remain paramount concerns. Users are understandably hesitant to entrust their sensitive financial information to third-party applications. Maintaining robust security protocols and adhering to strict data privacy regulations is crucial for gaining and maintaining user trust. Competition is intense, with numerous established players and innovative startups constantly vying for market share. Differentiation and maintaining a competitive edge require continuous innovation and the development of unique value propositions. The integration of various financial accounts can be complex and time-consuming, potentially leading to user frustration and app abandonment. Ensuring seamless integration and providing a user-friendly experience is vital for success. Regulatory compliance varies across different jurisdictions, presenting a significant hurdle for companies operating internationally. Navigating this complex regulatory landscape requires significant investment and expertise. Furthermore, user adoption, particularly among older demographics who may be less comfortable with technology, remains a challenge. Educating users on the benefits of these apps and providing intuitive interfaces are essential to broader market penetration.

The cloud-based segment is projected to dominate the money management app market throughout the forecast period (2025-2033). This is driven by several factors:

The SME application segment is also poised for significant growth. SMEs are increasingly adopting money management apps to streamline their financial operations, improve cash flow management, and gain greater visibility into their financial performance. This is particularly true for smaller businesses that lack dedicated finance teams. Cloud based solutions are perfectly aligned to support the needs of SMEs.

Geographically, North America and Europe are expected to continue to lead the market, followed by the rapidly developing Asia-Pacific region. The high smartphone penetration, strong internet infrastructure, and increasing financial awareness in these regions contribute to the high demand for money management apps.

The continued growth of the money management app industry is fueled by several key catalysts. These include the increasing sophistication of these apps, integrating AI and ML for personalized financial advice and automated transactions. The rising adoption of open banking APIs allows for seamless integration with multiple financial institutions, creating a unified view of users' financial health. Furthermore, the expansion into emerging markets, coupled with growing financial literacy, fuels the demand for convenient and accessible financial management tools.

This report provides a comprehensive analysis of the money management app market, examining key trends, drivers, challenges, and growth opportunities. It includes detailed market sizing and forecasting, segment analysis, regional breakdowns, and competitive landscape assessment. The report also highlights significant developments and technological advancements shaping the future of the industry, offering valuable insights for both established players and new entrants.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Supersplit, Moneyview, Goodbudget, Money Manager, Monefy, Expense Manager, Wallet, Dhani, Walnut, CRED, Mint, PocketGuard, Rocket Money, Simplifi, Hiatus, Kango Studios, Bobby, mySubs, Billbot, Trim, Moneyhub, HyperJar, Money Network, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Money Management App," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Money Management App, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.