1. What is the projected Compound Annual Growth Rate (CAGR) of the Monensin Premix?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Monensin Premix

Monensin PremixMonensin Premix by Type (20% Monensin Premix, 40% Monensin Premix), by Application (Poultry, Livestock, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

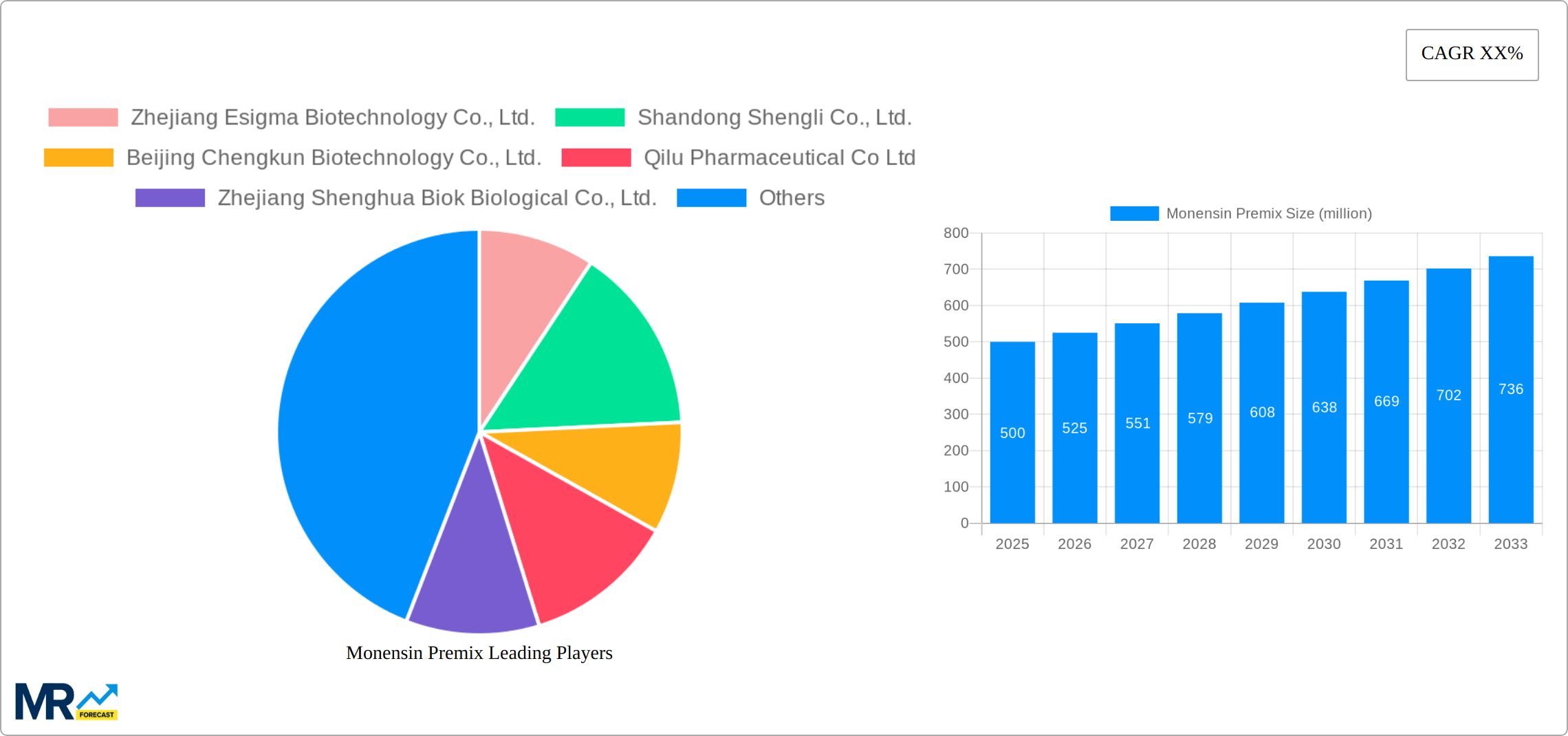

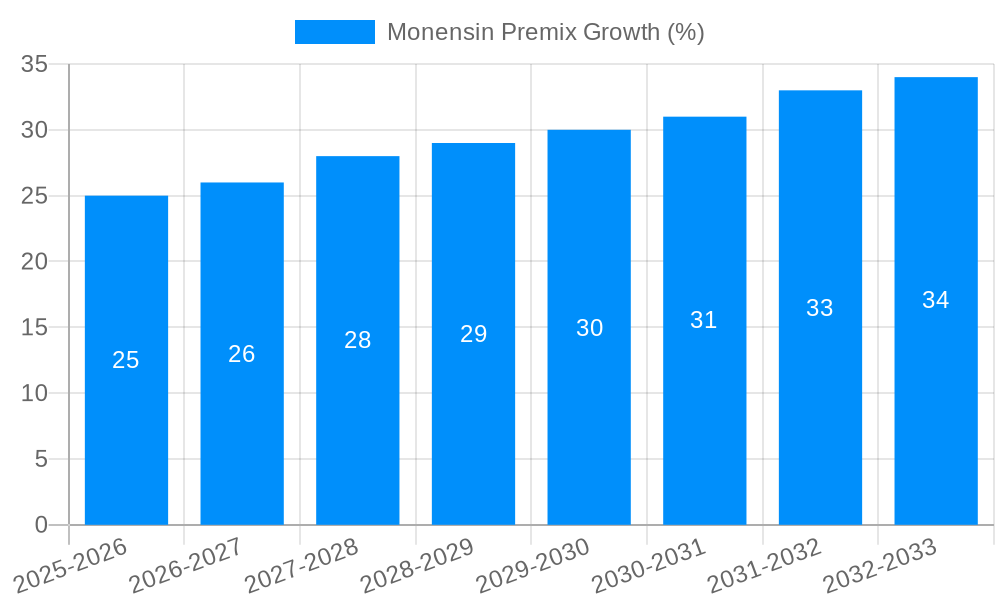

The global Monensin Premix market is poised for robust expansion, projected to reach an estimated USD 850 million in 2025, with a compound annual growth rate (CAGR) of 7.5% anticipated over the forecast period from 2025 to 2033. This significant growth trajectory is primarily fueled by the escalating global demand for animal protein, necessitating increased efficiency and productivity in livestock and poultry farming. The increasing prevalence of coccidiosis and other parasitic infections in animals, particularly in large-scale commercial operations, also drives the demand for monensin as an effective anticoccidial agent and growth promoter. Furthermore, advancements in animal nutrition and the growing emphasis on animal health and welfare are contributing to the adoption of monensin premixes for improved feed conversion ratios and reduced mortality rates. Emerging economies, with their rapidly expanding livestock sectors, are expected to be key growth engines for the market.

The market segmentation reveals a strong presence of both 20% and 40% Monensin Premix types, catering to diverse application needs across poultry and livestock segments. Poultry applications are anticipated to dominate the market share, owing to the high volume production and susceptibility to coccidiosis in this sector. However, the livestock segment, encompassing cattle, sheep, and swine, is also showing considerable growth potential as farmers increasingly recognize the economic benefits of monensin supplementation. While the market benefits from its proven efficacy and cost-effectiveness, potential restraints include evolving regulatory landscapes regarding antibiotic use in animal feed and growing consumer preference for antibiotic-free products. Nevertheless, the inherent demand for enhanced animal health and productivity in the face of a growing global population is expected to sustain the market's upward momentum, with key players like Zoetis, Merck Animal Health, and Phibro Animal Health actively investing in research and development to offer innovative solutions.

This report provides an in-depth analysis of the global Monensin Premix market, spanning a study period from 2019 to 2033, with a base year of 2025. It offers insights into historical trends, current market dynamics, and future projections, leveraging a robust methodology that includes a historical period (2019-2024) and an estimated year (2025) leading into a comprehensive forecast period (2025-2033). The report meticulously examines market segmentation by type (20% Monensin Premix, 40% Monensin Premix) and application (Poultry, Livestock, Other), while also highlighting key industry developments and influential players. The global market size is projected to reach in the millions of dollars by the end of the forecast period, driven by a confluence of factors shaping the animal health and nutrition landscape.

The global Monensin Premix market is experiencing a significant evolutionary phase, marked by an increasing demand for efficient and cost-effective animal feed additives. Over the historical period (2019-2024), the market demonstrated steady growth, influenced by rising global meat consumption and a growing awareness among livestock producers regarding animal health and productivity. The base year (2025) serves as a critical juncture, reflecting the culmination of these trends and setting the stage for accelerated expansion in the forecast period (2025-2033). Key market insights reveal a discernible shift towards higher concentration premixes, particularly the 40% Monensin Premix, as producers seek greater efficacy and reduced inclusion rates in their feed formulations. This trend is driven by an optimization in logistics and a reduction in handling complexities, contributing to a projected CAGR of XX% during the forecast period. Furthermore, the Poultry segment continues to be a dominant application, accounting for a substantial share of the market. However, the Livestock segment, encompassing cattle and swine, is exhibiting robust growth, fueled by expanding herd sizes and the increasing adoption of monensin as a coccidiostat and growth promoter. The market is also witnessing a growing interest in the "Other" application, which includes niche markets and emerging uses, though its contribution to the overall market size remains relatively smaller. Innovations in production processes and stringent quality control measures are also shaping market dynamics, ensuring the consistent supply of high-grade Monensin Premix. The competitive landscape is characterized by a mix of global leaders and regional players, each vying for market share through product differentiation, strategic partnerships, and technological advancements. The regulatory environment, while presenting some hurdles, also acts as a catalyst for market development by encouraging the adoption of safe and effective feed additives. The overall outlook for the Monensin Premix market is overwhelmingly positive, with expected revenue to reach in the millions of dollars by 2033, driven by a sustained demand for enhanced animal productivity and health solutions across the globe.

The global Monensin Premix market is experiencing robust growth, primarily propelled by the escalating global demand for animal protein. As the world population continues to expand, so does the consumption of meat, poultry, and dairy products, creating an imperative for increased efficiency and productivity in animal agriculture. Monensin Premix plays a pivotal role in this ecosystem by acting as a highly effective coccidiostat, combating parasitic infections that can significantly hinder animal growth and lead to substantial economic losses for producers. Beyond its anticoccidial properties, monensin is also recognized for its ability to improve feed conversion efficiency, meaning animals require less feed to gain a unit of weight. This not only reduces production costs for farmers but also contributes to a more sustainable agricultural model by minimizing resource utilization. Furthermore, the increasing adoption of intensive farming practices worldwide necessitates the use of feed additives that can maintain animal health and prevent disease outbreaks within crowded conditions. Monensin Premix's proven efficacy in these areas makes it an indispensable component of modern animal husbandry. The continuous efforts by animal health companies to develop advanced formulations and optimize production processes further contribute to the market's upward trajectory.

Despite the promising growth trajectory, the Monensin Premix market is not without its challenges. A significant restraint stems from the increasing scrutiny and regulatory pressures surrounding the use of antibiotic growth promoters (AGPs) and coccidiostats in animal feed. Growing consumer concerns about antimicrobial resistance and the potential residues in animal products are leading to stricter regulations in many regions, which can impact the demand for monensin. While monensin is not a medically important antibiotic, its classification and evolving regulatory landscapes present an ongoing challenge for market players. Additionally, the development and adoption of alternative coccidiostats and feed additives, often perceived as more "natural" or less controversial by consumers, pose a competitive threat. Companies investing in research and development of such alternatives could potentially erode the market share of traditional products like monensin. Fluctuations in raw material prices, particularly for the active ingredient, can also affect profit margins and pricing strategies, introducing volatility into the market. Furthermore, the geographical diversity in farming practices and regulatory frameworks means that market access and adoption rates can vary significantly, requiring manufacturers to navigate complex and often country-specific compliance requirements.

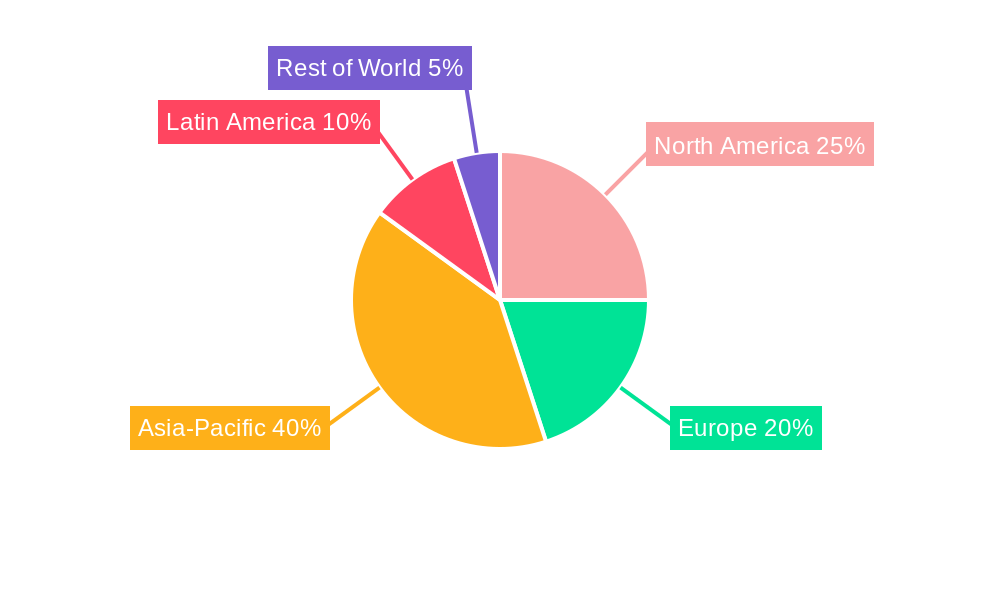

The global Monensin Premix market is poised for significant expansion, with distinct regions and segments emerging as key drivers of this growth. Among the segments, Poultry is consistently demonstrating its dominance, driven by the sheer volume of poultry production worldwide and the critical need for effective coccidiosis control in this industry. The 20% Monensin Premix and 40% Monensin Premix types are both integral to this segment. The Poultry application accounts for an estimated XX% of the total market revenue in the base year (2025), a share projected to grow by YY% during the forecast period (2025-2033). This growth is underpinned by the rapid expansion of commercial poultry farming in emerging economies, coupled with the ongoing need to manage disease outbreaks that can cripple production.

Geographically, Asia-Pacific is projected to emerge as the dominant region in the Monensin Premix market over the study period (2019-2033). The region's vast population, coupled with a rapidly growing middle class and increasing disposable income, is fueling a substantial rise in demand for animal protein, particularly poultry and pork. Countries like China, India, and Southeast Asian nations are witnessing unprecedented growth in their animal husbandry sectors. For instance, China's poultry production alone is estimated to exceed XX million tons annually, creating a substantial market for feed additives like monensin. The Livestock application, encompassing cattle and swine, is also showing considerable traction within the Asia-Pacific region, as the demand for beef and pork rises in tandem with economic development. The 40% Monensin Premix is anticipated to gain further traction in this region due to its high concentration and efficiency, appealing to large-scale industrial farms seeking to optimize their operations.

Within the Livestock segment, cattle feed applications for growth promotion and disease prevention, particularly in beef and dairy operations, represent a significant market opportunity. The increasing adoption of intensified farming techniques in North America and Europe continues to sustain demand, even as regulatory landscapes evolve. The market for Livestock applications is expected to reach approximately in the millions of dollars by 2033, with a CAGR of ZZ% during the forecast period.

The Other application segment, while smaller in market size, presents opportunities for niche growth. This includes its use in aquaculture, where monensin can play a role in disease management for farmed fish and shrimp, and potentially in other specialized animal health applications. As research and development in animal nutrition continue, new applications for monensin may emerge, further diversifying the market. The market share of the Other segment is projected to be AA% in 2025 and grow to BB% by 2033, indicating a steady but less substantial expansion compared to Poultry and Livestock.

The Monensin Premix industry is fueled by several critical growth catalysts. The escalating global demand for affordable animal protein, driven by population growth and rising incomes, is a primary driver. As consumers increasingly demand meat, poultry, and dairy products, the need for efficient and cost-effective animal production intensifies, making Monensin Premix an attractive solution for improving feed conversion and animal health. Furthermore, the ongoing advancements in animal nutrition research and the development of more precise feed formulations are creating opportunities for tailored monensin applications. The continuous efforts by leading companies to enhance production efficiency and product quality also contribute to market growth.

This comprehensive report delves into the intricate dynamics of the Monensin Premix market, providing an exhaustive analysis of its trajectory from 2019 to 2033. The study meticulously dissects market segmentation by Type (20% Monensin Premix, 40% Monensin Premix) and Application (Poultry, Livestock, Other), offering granular insights into the performance and growth potential of each sub-segment. Furthermore, it scrutinizes significant Industry Developments, identifying key trends and technological advancements shaping the market's evolution. The report's robust methodology, encompassing historical analysis (2019-2024), a detailed base year assessment (2025), and a forward-looking forecast period (2025-2033), ensures a holistic understanding of market forces. It aims to equip stakeholders with actionable intelligence, enabling informed strategic decision-making within this vital sector of the animal health industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Zhejiang Esigma Biotechnology Co., Ltd., Shandong Shengli Co., Ltd., Beijing Chengkun Biotechnology Co., Ltd., Qilu Pharmaceutical Co Ltd, Zhejiang Shenghua Biok Biological Co., Ltd., China Animal Husbandry Industry Co.,Ltd., Zoetis, Huvepharma, Lifecome Biochemistry Co., Ltd., Merck Animal Health, Animate Animal Health, Phibro Animal Health, Bio Agri Mix.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Monensin Premix," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Monensin Premix, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.