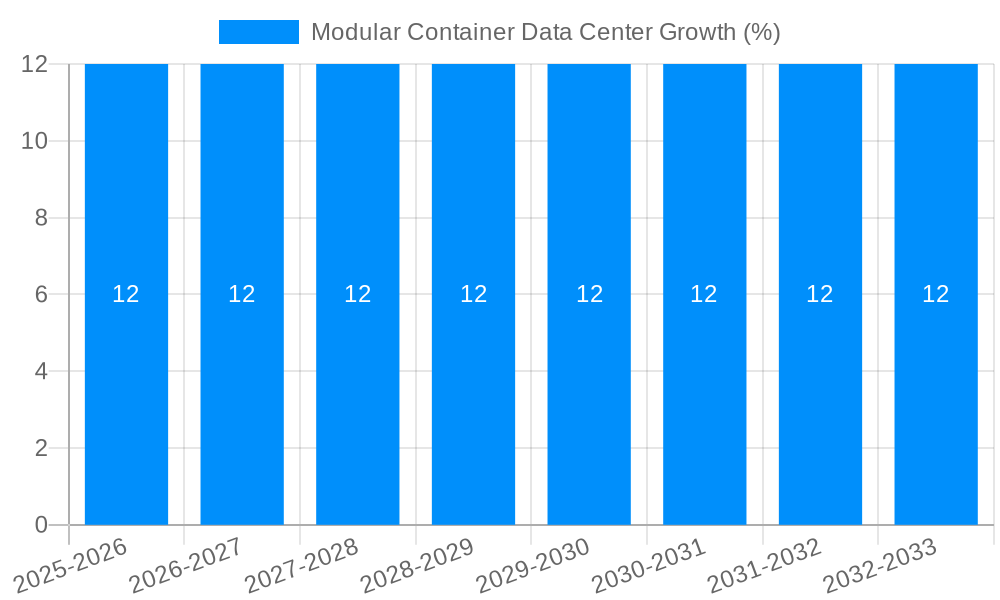

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Container Data Center?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Modular Container Data Center

Modular Container Data CenterModular Container Data Center by Type (/> <100kW, 100-200kW, >200kW), by Application (/> IT and Telecom, Finance and Insurance, Manufacturing, Government, Health Care, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

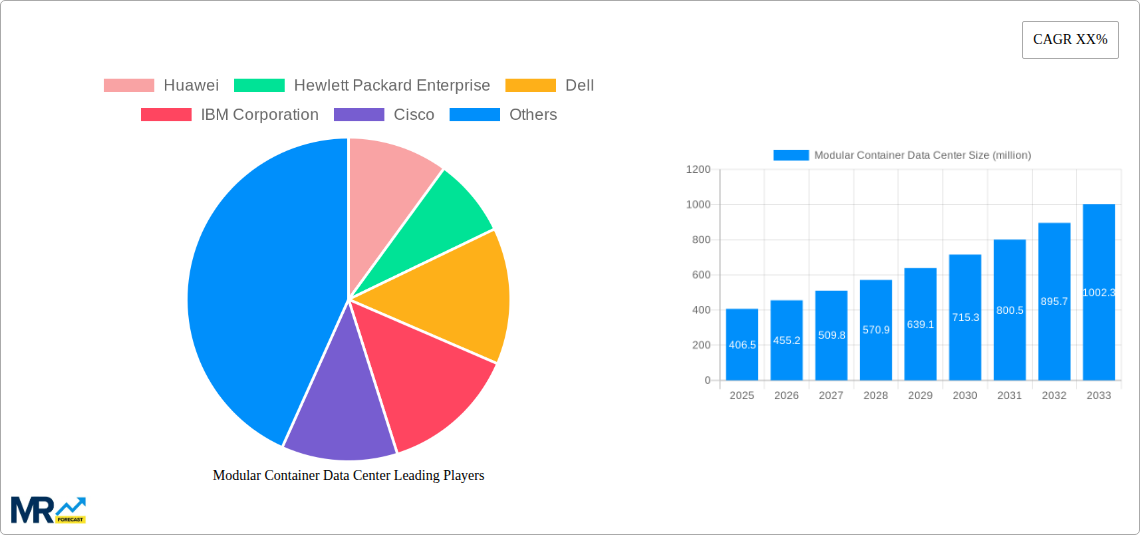

The Modular Container Data Center market is experiencing robust growth, projected to reach an estimated USD 406.5 million in 2025. This expansion is driven by an increasing demand for flexible, scalable, and rapidly deployable data infrastructure solutions across various industries. The market is witnessing a Compound Annual Growth Rate (CAGR) that suggests sustained momentum, fueled by the burgeoning need for edge computing, the proliferation of IoT devices, and the continuous expansion of cloud services. Industries such as IT and Telecom, Finance and Insurance, and Manufacturing are leading the adoption, recognizing the cost-effectiveness and agility offered by modular data centers compared to traditional builds. This trend is further amplified by the growing emphasis on reducing deployment times and minimizing on-site construction complexities, making containerized solutions an attractive proposition.

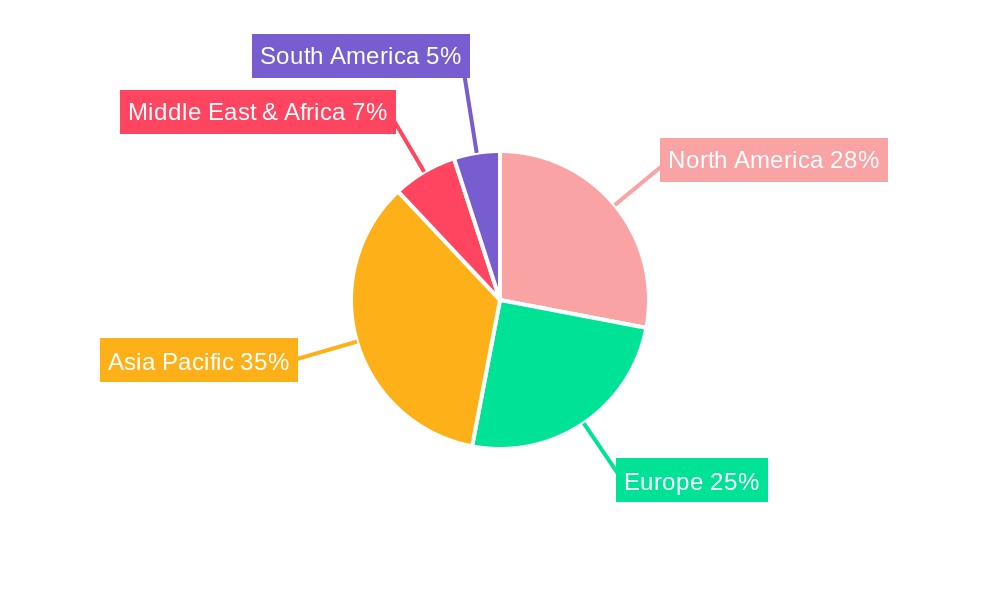

The market's trajectory is characterized by a strong emphasis on technological advancements, particularly in areas of power efficiency, cooling technologies, and enhanced security features integrated within the containerized modules. While the market is poised for significant growth, certain restraints, such as initial capital investment and complex logistical challenges for deployment in remote or challenging environments, need to be addressed. However, the inherent advantages of modularity, including standardization, pre-fabrication, and ease of relocation, are expected to outweigh these challenges. Key players like Huawei, Hewlett Packard Enterprise, Dell, and Vertiv are actively investing in R&D and expanding their product portfolios to cater to the evolving needs of this dynamic market, ensuring continued innovation and market penetration. The Asia Pacific region, with its rapid digital transformation and growing economies, is anticipated to be a significant growth engine, alongside established markets in North America and Europe.

Here's a comprehensive report description for Modular Container Data Centers, incorporating your specified details:

The global Modular Container Data Center market is poised for significant expansion, driven by an escalating demand for scalable, agile, and cost-effective IT infrastructure solutions. Between the historical period of 2019-2024 and the projected forecast period of 2025-2033, the market is expected to witness robust growth, with the base year of 2025 serving as a crucial benchmark. The industry is evolving beyond traditional fixed data centers, embracing a more flexible and deployable approach. Key trends indicate a substantial increase in adoption across various sectors, with a particular surge in the <100kW and 100-200kW segments, catering to edge computing, remote deployments, and specialized workloads. The "Plug-and-Play" nature of modular solutions, coupled with their inherent efficiency and reduced deployment times, is revolutionizing how organizations manage their data. Furthermore, advancements in cooling technologies, power distribution, and integrated software solutions are enhancing the performance and reliability of these containerized environments. The market is also seeing a growing emphasis on sustainability, with manufacturers incorporating energy-efficient designs and renewable energy integration capabilities. This shift towards distributed, on-demand computing power, facilitated by modular data centers, is a defining characteristic of the current and future market landscape. The estimated market size, projected to reach several million dollars, underscores the increasing strategic importance of these solutions in the digital transformation journey of businesses worldwide. The interplay between technological innovation and evolving business needs is creating a dynamic and rapidly developing market, where agility and responsiveness are paramount. The ability to rapidly scale IT capacity up or down in response to fluctuating demands, without the extensive lead times and capital expenditure associated with traditional builds, is a primary attraction.

The surge in the modular container data center market is fueled by a confluence of powerful drivers, fundamentally reshaping the IT infrastructure landscape. The burgeoning adoption of edge computing is a paramount catalyst, demanding localized processing power closer to data sources and end-users. This necessitates rapid deployment of compute resources in geographically dispersed locations, a capability that modular data centers excel at. The increasing proliferation of IoT devices, generating vast amounts of data at the periphery, further intensifies the need for edge infrastructure. Furthermore, the relentless growth of big data analytics and artificial intelligence workloads requires flexible and scalable computing power that can be deployed quickly and efficiently. Organizations are increasingly prioritizing agility and speed to market, and modular data centers offer a significantly reduced deployment timeline compared to traditional brick-and-mortar facilities, often measured in weeks rather than months or years. This accelerated deployment capability is critical for businesses needing to respond swiftly to market opportunities or operational demands. The inherent scalability of modular solutions allows businesses to start small and expand their IT capacity incrementally as their needs grow, avoiding over-provisioning and reducing initial capital outlay. This pay-as-you-grow model is particularly attractive in an era of economic uncertainty and evolving technological requirements. The significant cost savings associated with pre-fabricated and standardized modules, compared to the custom construction of large-scale data centers, also play a crucial role. These savings are not only in construction but also in the reduced time-to-revenue for new IT-dependent services.

Despite its burgeoning growth, the modular container data center market faces several challenges and restraints that temper its full potential. A primary concern revolves around the perception of security and resilience, particularly for highly sensitive applications in sectors like Finance and Insurance or Government. While manufacturers are continuously enhancing security features, a residual apprehension regarding the physical security of containerized units in remote or unsecured locations persists for some organizations. The limited space within a standard shipping container can also pose a constraint for high-density computing or specialized cooling requirements, potentially limiting the types of workloads that can be effectively hosted. For certain large-scale enterprise deployments, the sheer volume of compute and storage required may still favor traditional, purpose-built data centers over a collection of modular units. Another significant challenge is the upfront capital investment, though often lower than traditional builds, can still be substantial for smaller organizations or those with tight budgets. The total cost of ownership over the long term, considering power, cooling, and maintenance, needs careful evaluation. Integration with existing IT infrastructure can also present complexities, requiring specialized expertise to ensure seamless connectivity and interoperability. Furthermore, navigating diverse regulatory landscapes and obtaining necessary permits for deployment in various geographical locations can be a time-consuming and bureaucratic process. The availability of skilled personnel for installation, maintenance, and management of modular data centers in remote areas may also be a bottleneck for widespread adoption.

The dominance in the Modular Container Data Center market is a dynamic interplay between geographical expansion and the strategic adoption across various industry segments and power capacities.

Key Regions and Countries Driving Dominance:

Dominating Segments:

Type: <100kW and 100-200kW:

Application: IT and Telecom, Manufacturing, and Government:

The Modular Container Data Center industry is being propelled by several key growth catalysts. The accelerating adoption of edge computing is a primary driver, demanding localized processing and storage to reduce latency for real-time applications. The expansion of the Internet of Things (IoT) ecosystem generates massive datasets at the edge, necessitating distributed infrastructure. Furthermore, the increasing need for agile and scalable IT solutions in response to digital transformation initiatives allows businesses to quickly deploy compute power where and when it's needed, avoiding the lengthy lead times of traditional data centers. The growing emphasis on disaster recovery and business continuity planning also fuels demand for easily deployable and resilient modular solutions.

This comprehensive report delves into the intricate dynamics of the Modular Container Data Center market. It provides an in-depth analysis of market size, growth rates, and key trends from the historical period of 2019-2024 through the forecast period of 2025-2033, with 2025 serving as the base year. The report meticulously examines the driving forces, such as the burgeoning adoption of edge computing and IoT, and the challenges, including security perceptions and integration complexities. It identifies dominating regions and countries, highlighting the strategic importance of North America, Europe, and Asia-Pacific. Furthermore, the report scrutinizes segment-wise dominance, focusing on the <100kW, 100-200kW, and >200kW types, as well as key application segments like IT and Telecom, Manufacturing, and Government. It also offers insights into critical growth catalysts and profiles leading industry players, providing a holistic view of this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Huawei, Hewlett Packard Enterprise, Dell, IBM Corporation, Cisco, Vertiv, ZTE, Inspur, Rittal, Sugon, Delta Power Solutions, .

The market segments include Type, Application.

The market size is estimated to be USD 406.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Modular Container Data Center," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Modular Container Data Center, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.