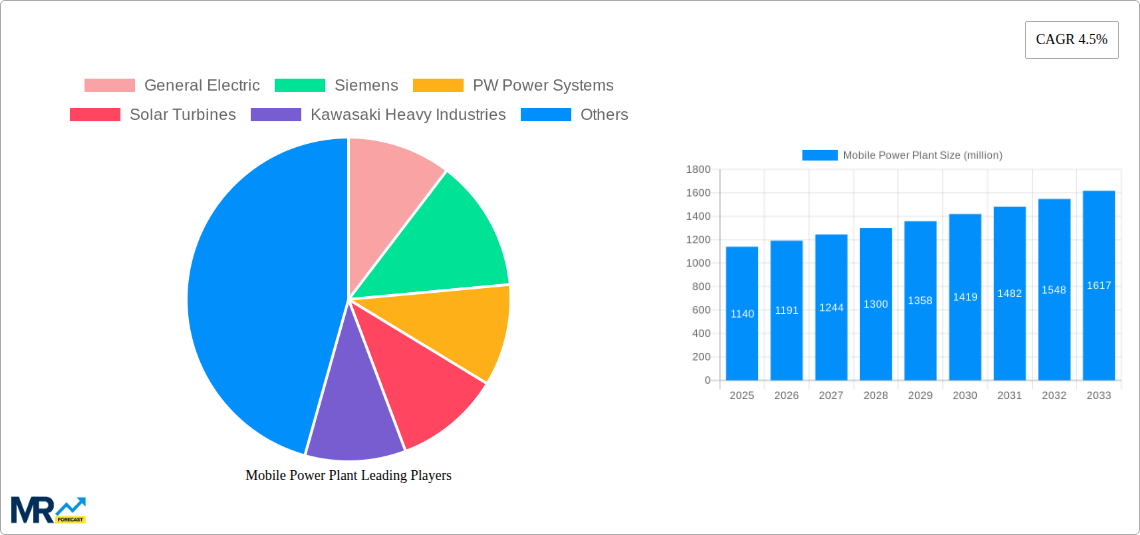

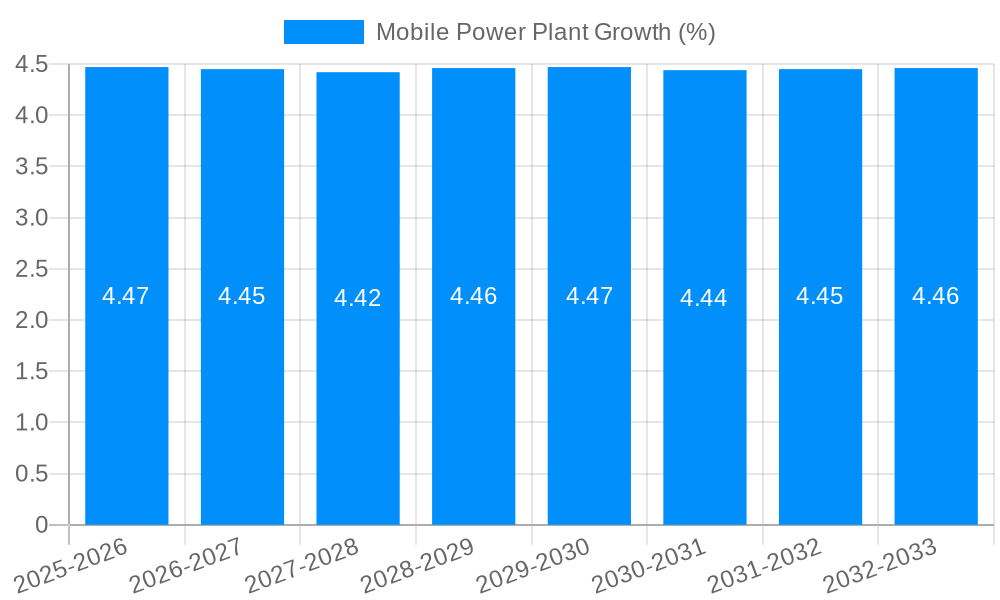

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Power Plant?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Power Plant

Mobile Power PlantMobile Power Plant by Type (1-10MW, 10-25MW, More than 25MW), by Application (Oil & Gas, Emergency Power, Remote Area Electrification, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Mobile Power Plant market is poised for significant growth, projected to reach an estimated USD 1,140 million by 2025. This expansion is fueled by a steady Compound Annual Growth Rate (CAGR) of 4.5% through 2033. The demand for flexible and rapidly deployable power solutions is a primary driver, particularly in sectors like Oil & Gas where operational continuity and temporary power needs are paramount. The increasing need for reliable emergency power during natural disasters or grid failures further bolsters market prospects. Furthermore, the electrification of remote areas, where traditional grid infrastructure is either absent or cost-prohibitive, presents a substantial opportunity for mobile power solutions. These plants offer an agile and cost-effective alternative to permanent installations, enabling swift response to evolving energy demands and unforeseen circumstances.

The market is segmented by power capacity, with a notable demand anticipated for 1-10MW units due to their versatility and suitability for a wide range of applications. The 10-25MW segment is also expected to witness robust growth as industries require higher output for more extensive operations. Key players such as General Electric, Siemens, and Solar Turbines are actively investing in technological advancements and expanding their product portfolios to cater to these diverse needs. Emerging trends include the integration of advanced control systems for enhanced efficiency and the development of more compact and transportable designs. While the market is largely driven by the need for agility, challenges such as regulatory complexities and the initial capital investment for advanced mobile units may pose some restraints, although these are expected to be mitigated by the long-term operational benefits and cost savings.

The global mobile power plant market is poised for significant expansion, projected to reach an estimated $4.5 billion by the end of the study period in 2033, with a robust Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period (2025-2033). This upward trajectory is underpinned by several interconnected trends that are reshaping the energy landscape. A primary driver is the increasing demand for flexible and rapidly deployable power solutions to address grid instability and the growing need for backup power in critical sectors. The historical period (2019-2024) witnessed steady growth, with the market valued at approximately $2.8 billion in the base year of 2025. Looking ahead, the market is expected to witness an acceleration in adoption, particularly in developing regions and in response to climate change-induced extreme weather events. The trend towards distributed generation and microgrids is also fostering the demand for modular and mobile power solutions. Furthermore, advancements in turbine technology, leading to higher efficiency and lower emissions, are making mobile power plants more attractive. The evolving regulatory landscape, which encourages rapid power restoration and grid resilience, is also a significant factor. The market is experiencing a shift towards larger capacity units, with the "More than 25MW" segment showing particularly strong growth potential, alongside continued demand for smaller, highly portable units for niche applications. The integration of digital technologies for remote monitoring and predictive maintenance is also becoming a standard feature, enhancing operational efficiency and reliability. The increasing focus on reducing carbon footprints is driving innovation in cleaner fuel options for mobile power plants, further solidifying their relevance in the future energy mix.

The burgeoning mobile power plant market is being propelled by a confluence of powerful economic and technological forces. A fundamental driver is the escalating global demand for reliable and swiftly deployable electricity. This is particularly acute in regions experiencing rapid industrialization, burgeoning populations, and aging traditional power infrastructure that struggles to keep pace. The increasing frequency and intensity of extreme weather events, such as hurricanes and heatwaves, have amplified the need for emergency power solutions, making mobile power plants a critical asset for maintaining essential services and economic continuity. Furthermore, the inherent flexibility and scalability of mobile power plants make them ideal for temporary power needs during planned maintenance of permanent facilities, disaster recovery efforts, or for supporting large-scale events and construction projects. The liberalization of energy markets and the drive towards decentralized energy generation also contribute significantly, as mobile units can be rapidly deployed to meet localized demand or to provide grid support, enhancing overall grid stability.

Despite the optimistic outlook, the mobile power plant market faces several formidable challenges and restraints that could temper its growth trajectory. One significant hurdle is the substantial initial capital investment required for acquiring advanced mobile power plant units, which can range from a few million dollars for smaller units to tens of millions for larger configurations. While operational costs are often competitive, the upfront expenditure can be a deterrent for some potential buyers, especially in price-sensitive markets. Regulatory complexities and varying permitting processes across different jurisdictions can also create delays and add to project timelines and costs. Public perception and environmental concerns, particularly regarding noise pollution and emissions from certain turbine technologies, can also present obstacles, although technological advancements are actively addressing these issues. Moreover, the logistical challenges associated with transporting, installing, and maintaining large, heavy equipment in remote or difficult-to-access locations can be complex and costly. The availability of skilled personnel for operation and maintenance is another crucial factor, as specialized expertise is required to ensure the efficient and safe functioning of these sophisticated systems.

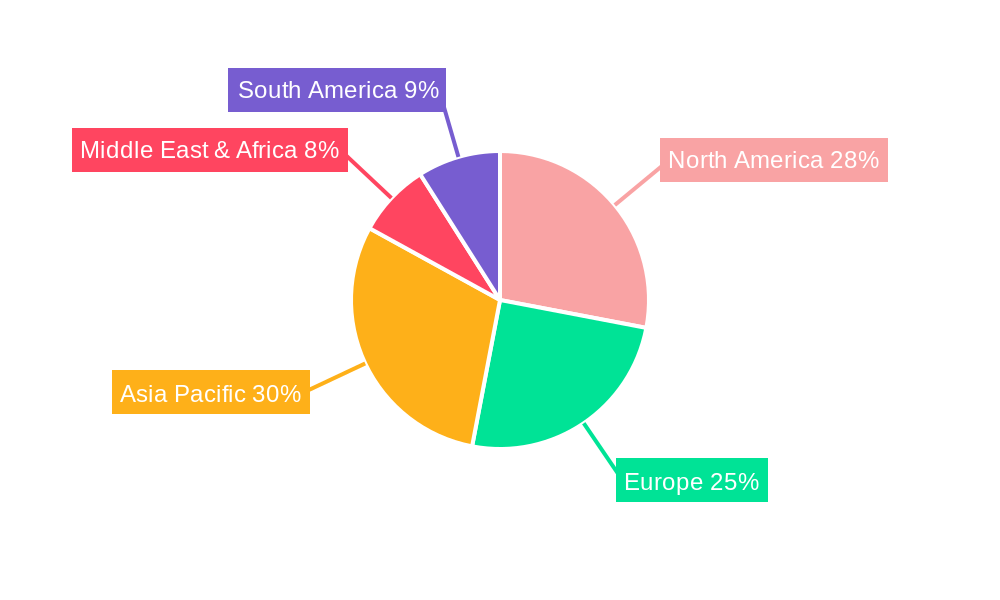

The mobile power plant market is characterized by dynamic regional growth patterns and specific segment dominance that are expected to shape its future landscape.

North America: This region is anticipated to maintain its leadership position, driven by robust demand in the Oil & Gas sector for remote operations and exploration activities. The aging infrastructure in certain parts of the United States and Canada, coupled with a proactive approach to grid modernization and energy resilience, fuels the demand for mobile power solutions for emergency backup and temporary power during maintenance. The significant presence of major oil and gas exploration sites, often in remote or challenging terrains, necessitates reliable and quickly deployable power generation capabilities, making mobile power plants indispensable. The substantial investments in renewable energy projects also contribute, as mobile power plants are often utilized to provide grid stability and backup power during the integration of intermittent renewable sources. The market is estimated to reach $1.5 billion by 2033 in this region.

Middle East & Africa: This region is projected to exhibit the fastest growth rate due to rapid industrialization, increasing energy demands from growing populations, and significant investments in infrastructure development. The Oil & Gas sector, a cornerstone of many economies in these regions, heavily relies on mobile power plants for remote drilling operations, processing facilities, and offshore platforms, where grid connectivity is often limited or non-existent. Furthermore, the drive for electrification in underserved rural areas within Africa presents a substantial opportunity for mobile power plants to provide essential electricity access. The volatile political and economic landscapes in some parts of Africa also necessitate flexible and rapidly deployable power solutions to ensure energy security during times of crisis or instability. The market is expected to grow at a CAGR of 7.2% in this region during the forecast period, reaching an estimated $1.2 billion by 2033.

Asia Pacific: This region is a significant contributor to the global mobile power plant market, driven by a growing industrial base, rapid urbanization, and an increasing focus on energy security and disaster preparedness. Countries like India and China, with their vast populations and expanding economies, require flexible power solutions to meet fluctuating energy demands and to supplement existing grid capacities. The growing concerns around climate change and the increased frequency of natural disasters, such as typhoons and earthquakes, are further accelerating the adoption of mobile power plants for emergency power restoration. The expansion of remote mining operations and the development of new industrial zones in countries like Indonesia and Vietnam also create substantial demand for off-grid power generation. The market in this region is estimated to reach $1.0 billion by 2033.

Dominant Segments:

Application: Oil & Gas: This application segment is a major growth engine for the mobile power plant market. The offshore and onshore exploration, extraction, and processing of oil and gas often occur in remote locations where grid infrastructure is unavailable or unreliable. Mobile power plants provide a vital source of electricity for drilling rigs, production facilities, and associated infrastructure, ensuring continuous operations and minimizing downtime. The segment is expected to contribute significantly to the market's overall value.

Type: More than 25MW: While smaller units cater to specific niche applications, the "More than 25MW" segment is experiencing substantial growth. These larger capacity mobile power plants are ideal for utility-scale power generation, rapid deployment for grid balancing, and supporting large industrial complexes. Their ability to provide a significant amount of power quickly makes them an attractive option for utilities facing peak demand or requiring temporary capacity.

The mobile power plant industry is experiencing a surge in growth fueled by several key catalysts. The relentless drive for grid modernization and resilience, particularly in the face of an increasing number of extreme weather events, is paramount. These events highlight the vulnerability of fixed power infrastructure, making the rapid deployment capabilities of mobile power plants indispensable for emergency power restoration. Furthermore, the ongoing expansion of renewable energy sources, which are inherently intermittent, necessitates flexible power solutions for grid stabilization and backup power, a role mobile power plants are exceptionally well-suited to fulfill. The growing demand for reliable electricity in remote and underserved regions, coupled with the ongoing oil and gas exploration activities in challenging environments, further propels market expansion.

This comprehensive report delves into the intricate dynamics of the global mobile power plant market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024 through the projected period of 2025-2033, with the base year established at 2025. The report meticulously examines key market trends, identifying drivers such as grid modernization, the increasing frequency of extreme weather events, and the growing demand for decentralized power solutions. It also thoroughly investigates the challenges, including high initial investment costs and regulatory complexities, that influence market adoption. Furthermore, the report highlights the dominant segments and key regions, such as North America's Oil & Gas sector and the rapidly growing Middle East & Africa, expected to spearhead market growth. With a detailed exploration of growth catalysts and the competitive landscape featuring leading players like General Electric and Siemens, this report offers invaluable insights for stakeholders seeking to understand and capitalize on the evolving mobile power plant industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include General Electric, Siemens, PW Power Systems, Solar Turbines, Kawasaki Heavy Industries, MWM, Meidensha, .

The market segments include Type, Application.

The market size is estimated to be USD 1140 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Mobile Power Plant," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Power Plant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.