1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Power Buck-Boost Chips?

The projected CAGR is approximately 9.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Power Buck-Boost Chips

Mobile Power Buck-Boost ChipsMobile Power Buck-Boost Chips by Type (Below 100W, 100W-150W, Above 150W), by Application (Smartphone, Tablet PCs, Wearable Device, Laptops, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

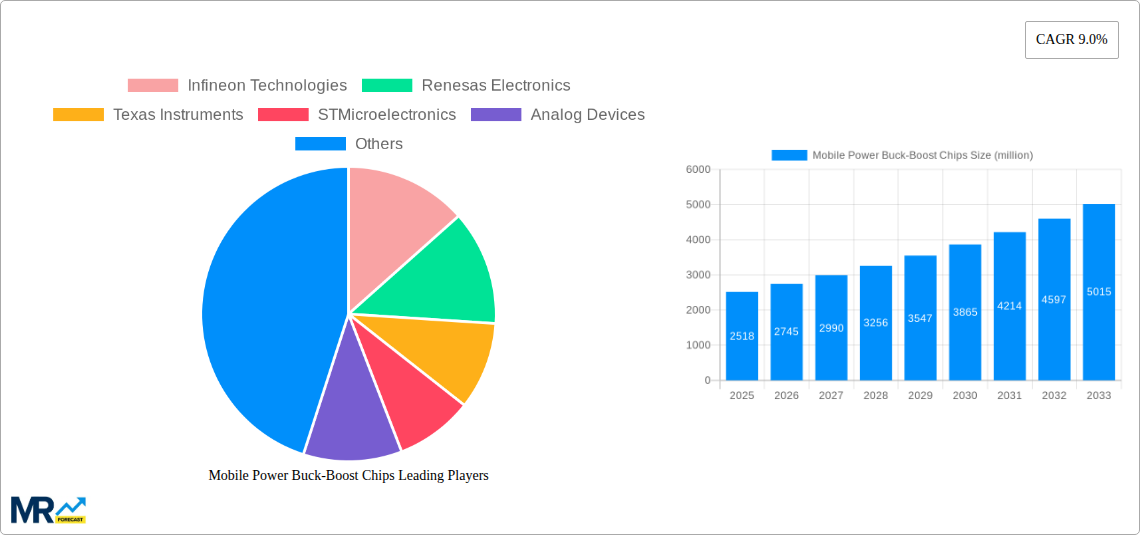

The global Mobile Power Buck-Boost Chips market is poised for significant expansion, projected to reach an estimated USD 2518 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.0%. This impressive growth trajectory is primarily fueled by the burgeoning demand for advanced power management solutions across a spectrum of portable electronic devices. The proliferation of smartphones, tablets, and increasingly sophisticated wearable devices, all requiring efficient and reliable power delivery, forms the bedrock of this market's expansion. Furthermore, the continuous evolution of laptops with enhanced power efficiency requirements and the integration of these chips into a variety of "other" electronic gadgets underscore the pervasive need for sophisticated buck-boost functionalities. Key drivers include the relentless pursuit of smaller, more powerful, and longer-lasting electronic devices, necessitating miniaturized and high-efficiency power conversion components. The increasing adoption of fast-charging technologies and the growing emphasis on energy conservation also play a crucial role in stimulating market growth.

The market is segmented by power capacity into Below 100W, 100W-150W, and Above 150W, reflecting the diverse power needs of various applications. The "Smartphone" and "Tablet PCs" segments are expected to remain dominant, driven by high shipment volumes and the constant innovation in these product categories. The "Wearable Device" segment, though smaller, presents a high-growth opportunity due to rapid technological advancements and consumer adoption. Laptops and other emerging electronic applications are also contributing to market diversification. While the market exhibits strong growth potential, certain restraints such as the increasing price sensitivity among consumers for certain device categories and intense competition among established and emerging players, particularly from the Asia Pacific region, could pose challenges. However, ongoing technological advancements, such as the development of more integrated and intelligent buck-boost solutions, are expected to overcome these limitations and propel the market forward. Leading companies like Infineon Technologies, Renesas Electronics, and Texas Instruments are at the forefront of innovation, driving the development of next-generation power management ICs.

Here's a report description on Mobile Power Buck-Boost Chips, incorporating your provided details and adhering to the specified structure and word counts.

This comprehensive report offers an in-depth analysis of the global Mobile Power Buck-Boost Chips market, spanning the crucial Study Period of 2019-2033. With 2025 serving as the Base Year and Estimated Year, the report meticulously forecasts market dynamics through to 2033, drawing upon a detailed examination of the Historical Period from 2019-2024. The market is poised for significant expansion, driven by the relentless demand for advanced power management solutions across a burgeoning array of portable electronic devices. As consumers increasingly rely on a connected lifestyle, the efficiency and performance of their mobile devices become paramount, directly influencing the adoption and innovation of buck-boost chip technology.

The market is segmented by Type into Below 100W, 100W-150W, and Above 150W, and by Application into Smartphones, Tablet PCs, Wearable Devices, Laptops, and Others. Each segment is explored with granular detail, highlighting growth trajectories, technological advancements, and regional penetration. The analysis leverages unit sales figures in the millions to provide a tangible understanding of market size and potential. Furthermore, the report delves into the strategic landscape, identifying key industry developments, leading players, and the pivotal factors shaping the future of mobile power management.

The Mobile Power Buck-Boost Chips market is experiencing a dynamic evolution, marked by a strong upward trajectory and increasing sophistication. The Study Period of 2019-2033, with 2025 as the Base Year, reveals a consistent demand for higher power density, improved energy efficiency, and miniaturization of these critical components. In 2025, the market is estimated to be driven by an ever-growing volume of portable electronics, with millions of units of smartphones, tablets, and laptops incorporating advanced buck-boost solutions. Wearable devices, though currently representing a smaller unit volume, are exhibiting rapid growth and a burgeoning need for highly efficient, ultra-small form factor power management ICs. The "Below 100W" segment, encompassing the vast majority of consumer electronics, will continue to dominate in terms of unit shipments, projected to exceed several hundred million units annually by 2025 and grow steadily through the forecast period. However, the "100W-150W" and "Above 150W" segments, catering to higher-power applications like gaming laptops and portable power banks, are anticipated to witness the most aggressive compound annual growth rates. This shift is fueled by consumer expectations for faster charging capabilities and the ability to power more demanding applications on the go. Furthermore, the integration of advanced features such as dynamic voltage scaling, overvoltage protection, and thermal management within these chips is becoming a standard expectation. The increasing adoption of fast-charging technologies like USB Power Delivery (USB PD) is a significant trend, necessitating buck-boost chips that can efficiently handle wider input and output voltage ranges and deliver higher currents. The market is also seeing a rise in the demand for wireless charging solutions, which often integrate sophisticated buck-boost circuitry for efficient power transfer. Innovation in material science and packaging technologies is enabling smaller, more efficient, and cost-effective buck-boost solutions, further accelerating market penetration.

The relentless growth of the Mobile Power Buck-Boost Chips market is propelled by a confluence of powerful technological and consumer-driven forces. Foremost among these is the insatiable demand for mobile devices. The proliferation of smartphones, tablets, and laptops, with millions of units sold annually, forms the bedrock of this market. Consumers expect their devices to offer longer battery life, faster charging, and the ability to support increasingly power-hungry applications, from high-definition video streaming and gaming to complex productivity tasks. This directly translates into a need for highly efficient power management solutions, where buck-boost chips play a pivotal role in optimizing battery utilization and ensuring stable power delivery. The burgeoning wearable device market, encompassing smartwatches, fitness trackers, and advanced audio devices, presents another significant growth driver. These devices, characterized by their compact size and battery constraints, necessitate miniaturized and highly efficient buck-boost solutions. The increasing adoption of fast-charging technologies, such as USB Power Delivery (USB PD) and proprietary fast-charging standards, is a major catalyst. These technologies require buck-boost converters capable of handling higher power levels and voltage variations, thereby boosting demand for more advanced chipsets. The continuous innovation in battery technology, leading to higher energy densities, also indirectly fuels the demand for more sophisticated power management to effectively harness and deliver this stored energy. Furthermore, the trend towards multi-functional and feature-rich portable devices, requiring diverse power rails and precise voltage regulation, underscores the importance of versatile buck-boost solutions. The expanding ecosystem of connected devices, including IoT gadgets and portable speakers, further contributes to the overall market expansion, as each requires efficient power management.

Despite the robust growth prospects, the Mobile Power Buck-Boost Chips market faces several inherent challenges and restraints that could temper its full potential. One of the primary hurdles is the intense price competition within the industry. With numerous players vying for market share, particularly in the high-volume "Below 100W" segment, there is constant pressure on profit margins. Manufacturers must strike a delicate balance between delivering cutting-edge technology and maintaining cost-effectiveness to remain competitive. Another significant challenge is the rapid pace of technological obsolescence. The constant evolution of mobile device specifications and battery technologies necessitates continuous research and development, requiring substantial investment. Companies that fail to keep pace with these advancements risk falling behind and losing their competitive edge. The global supply chain disruptions, which have become more prevalent in recent years, also pose a considerable restraint. Shortages of key raw materials, manufacturing capacity limitations, and geopolitical uncertainties can impact production schedules and increase lead times, leading to potential stockouts and missed sales opportunities. Furthermore, the stringent regulatory requirements related to electromagnetic interference (EMI) and power efficiency in different regions add complexity to product development. Ensuring compliance with these evolving standards can be time-consuming and costly. The increasing demand for miniaturization presents a design challenge, as engineers strive to pack more functionality into smaller footprints without compromising performance or thermal management. This often requires the development of advanced packaging technologies and integration techniques. Lastly, the energy efficiency expectations are constantly rising, putting pressure on designers to minimize power loss during conversion, which can be technically demanding, especially at higher power levels or under varying load conditions.

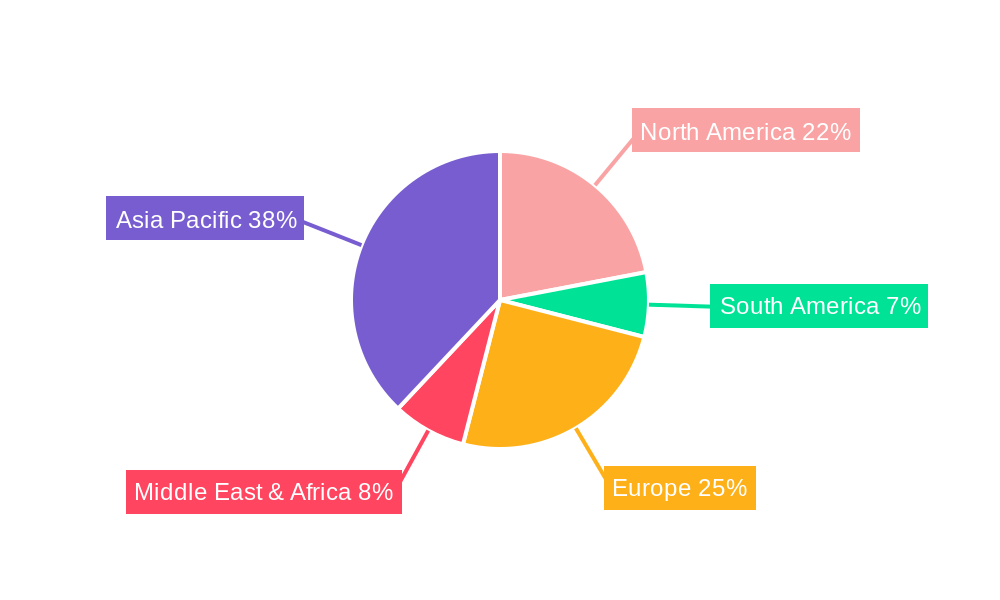

The global Mobile Power Buck-Boost Chips market is characterized by significant regional disparities and segment dominance, with Asia-Pacific emerging as the undisputed leader and the "Smartphone" application segment driving the highest unit volumes.

Dominant Segment: Application - Smartphone

Dominant Region: Asia-Pacific

Other Notable Segments:

The Mobile Power Buck-Boost Chips industry is poised for substantial growth, propelled by several key catalysts. The burgeoning demand for advanced portable electronics, including smartphones, laptops, and a rapidly expanding array of wearables, forms the bedrock of this expansion. Consumers' insatiable appetite for longer battery life and faster charging capabilities directly fuels the need for highly efficient and sophisticated power management solutions. The widespread adoption of fast-charging technologies, such as USB Power Delivery, necessitates robust buck-boost chips capable of handling higher power levels and dynamic voltage regulation. Furthermore, the increasing complexity and power requirements of mobile applications, from advanced gaming to AI processing, demand more intelligent and efficient power delivery. The ongoing miniaturization trend in electronic devices also pushes the envelope for smaller, more integrated buck-boost solutions, driving innovation in chip design and packaging.

This report provides a comprehensive examination of the Mobile Power Buck-Boost Chips market, offering invaluable insights for stakeholders. It delves into market size, segmentation by type and application, and provides detailed forecasts for the Study Period of 2019-2033, with 2025 as the Base and Estimated Year. The report meticulously analyzes market trends, driving forces, and the challenges that shape the industry's landscape. Crucially, it identifies key regions and segments poised for dominance, highlighting the strategic importance of Asia-Pacific and the smartphone application sector. Furthermore, the report profiles leading market players and details significant industry developments, equipping readers with a thorough understanding of the current state and future trajectory of the Mobile Power Buck-Boost Chips market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.0%.

Key companies in the market include Infineon Technologies, Renesas Electronics, Texas Instruments, STMicroelectronics, Analog Devices, Southchip Semiconductor Technology, Shenzhen Injoinic Technology, Shenzhen Powlicon, Wuxi Si-power Micro-Electronics, Shenzhen Weipu Innovation Technology, Zhuhai iSmartWare Technology, Suzhou MERCHIP, Richtek Technology Corporation, Shenzhen Chipsea Technologies, Toll Microelectronic, Shenzhen Kefaxin Electronics, Hangzhou Silan Microelectronics, Wuxi PWChip Semi Technology.

The market segments include Type, Application.

The market size is estimated to be USD 2518 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Mobile Power Buck-Boost Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Power Buck-Boost Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.