1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Phone Privacy Films?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Phone Privacy Films

Mobile Phone Privacy FilmsMobile Phone Privacy Films by Type (PP Material, PVC Material, PET Material, ARM Material, Offline Sales, Online Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

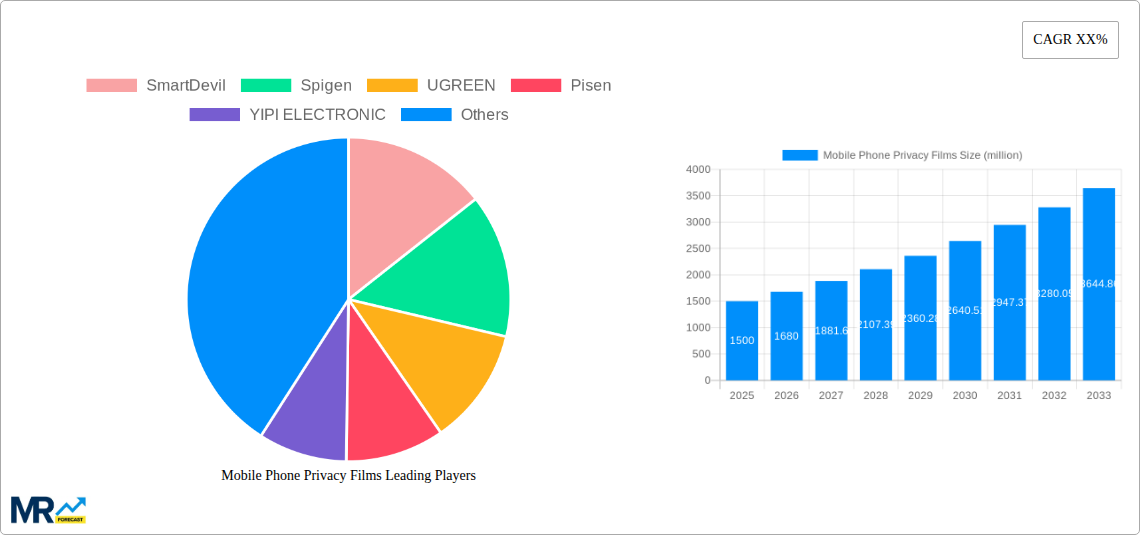

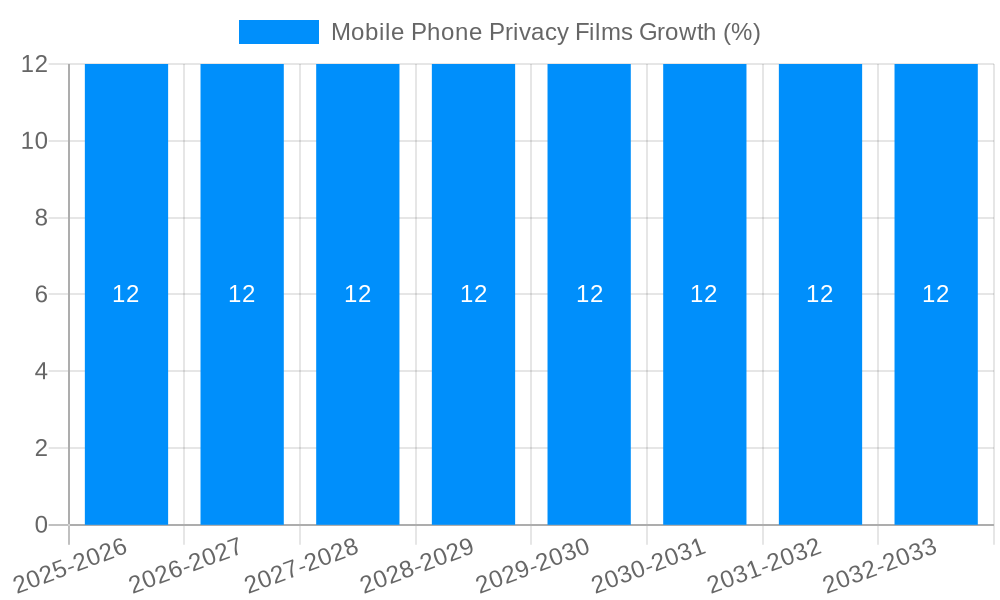

The global Mobile Phone Privacy Films market is poised for robust expansion, projected to reach approximately USD 1.5 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 12% anticipated through 2033. This significant growth is primarily fueled by increasing consumer awareness regarding data security and the escalating prevalence of smartphone usage worldwide. As personal information becomes more digitized and accessible, individuals are actively seeking protective measures for their mobile devices, making privacy films a vital accessory. The burgeoning demand for enhanced digital privacy, coupled with advancements in material science leading to more effective and aesthetically pleasing privacy screen protectors, are key drivers propelling this market forward. Furthermore, the constant innovation in smartphone designs, including larger and more immersive displays, necessitates specialized privacy solutions that cater to these evolving form factors, further stimulating market growth.

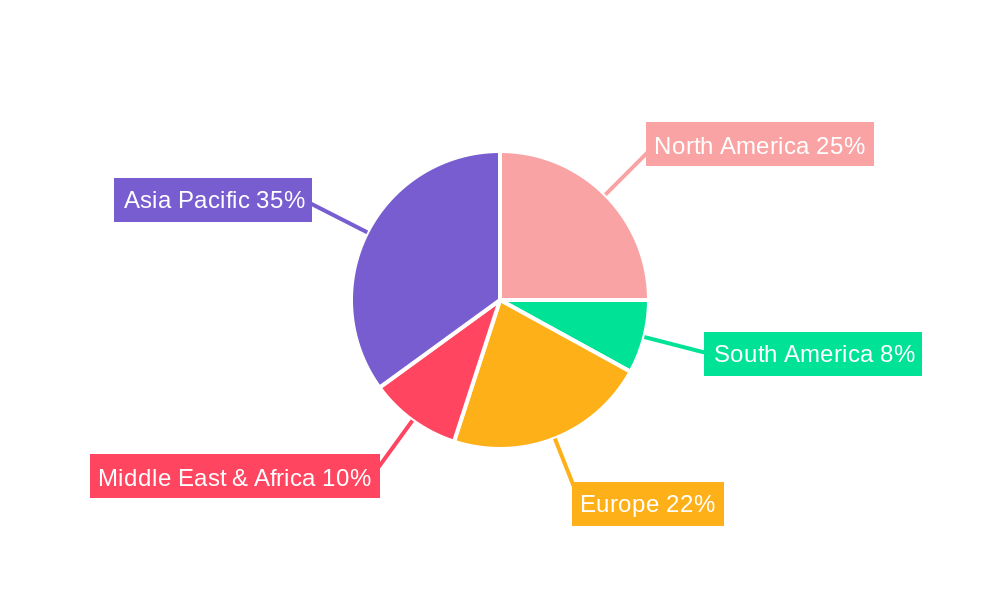

The market segmentation reveals a dynamic landscape. In terms of material, PP (Polypropylene) and PVC (Polyvinyl Chloride) materials are expected to dominate, owing to their cost-effectiveness and established manufacturing processes. However, the growing demand for premium features like anti-glare and high clarity will likely boost the adoption of PET (Polyethylene Terephthalate) and ARM (Anti-Reflective Material) films. Online sales channels are projected to experience accelerated growth, reflecting the e-commerce trend and the convenience it offers consumers in accessing a wide array of brands and products. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market, driven by a massive smartphone user base and a burgeoning middle class with a higher disposable income for mobile accessories. North America and Europe also represent significant markets, characterized by a mature consumer base with a strong emphasis on data protection. Key players like SmartDevil, Spigen, and UGREEN are actively investing in product innovation and strategic partnerships to capture market share and cater to the diverse needs of consumers.

Here is a unique report description on Mobile Phone Privacy Films, incorporating your specified elements:

The global mobile phone privacy films market is poised for substantial growth, projected to reach an impressive valuation exceeding $5,000 million by the end of the forecast period in 2033. This surge is intrinsically linked to the escalating ubiquity of smartphones and the increasing awareness of digital privacy among consumers. During the study period of 2019-2033, with a base year of 2025, the market has witnessed a consistent upward trajectory, fueled by evolving consumer behaviors and technological advancements. The historical period from 2019-2024 laid the groundwork for this expansion, as early adopters recognized the necessity of protecting sensitive information displayed on their mobile devices. The estimated year of 2025 marks a pivotal point, where the market is expected to solidify its position as a mainstream accessory. The forecast period of 2025-2033 will likely see this trend intensify, as privacy concerns continue to be a dominant factor influencing purchasing decisions. Key market insights reveal a growing demand for advanced privacy films that offer not only screen protection but also enhanced visual privacy through sophisticated light-filtering technologies. The integration of anti-peep features, adjustable privacy levels, and even anti-glare properties are becoming standard expectations, driving innovation within the sector. Furthermore, the market is experiencing a diversification in product offerings, catering to a wider range of device models and user preferences. The increasing reliance on mobile devices for financial transactions, personal communication, and sensitive data storage underscores the enduring relevance and expanding potential of the mobile phone privacy films industry. As digital footprints expand, so too does the perceived value of these protective layers, ensuring a robust and sustained market presence for the foreseeable future. The sheer volume of mobile phone users, estimated to be in the billions worldwide, provides a vast and largely untapped customer base for these essential privacy accessories.

The burgeoning demand for mobile phone privacy films is propelled by a confluence of powerful driving forces. Foremost among these is the escalating global concern over data breaches and the increasing instances of "shoulder surfing," where individuals inadvertently reveal sensitive information displayed on their screens to nearby onlookers. As smartphones become indispensable tools for managing finances, personal communications, and accessing confidential work-related data, the perceived risk of unauthorized viewing has significantly intensified. This heightened awareness translates directly into a greater willingness among consumers to invest in protective measures. Furthermore, the rapid evolution of mobile device technology, with larger and more vibrant displays, makes them more susceptible to public viewing. Privacy films offer a tangible and accessible solution for individuals seeking to maintain control over their digital interactions in public spaces. The proliferation of smartphones across all demographics and income levels further expands the market potential, making privacy protection a universal concern. Regulatory shifts and growing data privacy legislation, while not directly impacting film sales, subtly contribute to a broader consciousness about data security, indirectly benefiting the privacy film market. The ease of application and relatively low cost compared to potential data compromise make these films an attractive and practical choice for a vast consumer base. The continuous innovation in film technology, offering improved clarity and enhanced privacy angles, further fuels adoption by providing superior user experiences.

Despite the promising growth trajectory, the mobile phone privacy films market is not without its challenges and restraints. A significant hurdle is the perceived trade-off between privacy and screen usability. Some privacy films can slightly reduce screen brightness, color accuracy, or touch sensitivity, leading to a less optimal viewing experience for some users. This can be a deterrent for individuals who prioritize visual clarity and responsiveness above all else. Moreover, the market is characterized by intense price competition, particularly in the online sales segment, which can erode profit margins for manufacturers and retailers. The rapid pace of smartphone model releases also presents a challenge, requiring manufacturers to constantly update their product lines to ensure compatibility with the latest devices, leading to increased research and development costs and inventory management complexities. Consumer education remains a subtle restraint; while awareness of privacy issues is growing, some users may not fully understand the benefits and functionality of privacy films, or they might underestimate the risks associated with screen exposure. The rise of counterfeit and low-quality products from unbranded manufacturers can also dilute market trust and create negative perceptions, even for legitimate brands. Finally, the advent of built-in software-based privacy features on some smartphones might be seen by some consumers as a substitute for physical privacy films, although these software solutions often lack the comprehensive protection offered by dedicated films.

The mobile phone privacy films market exhibits a dynamic interplay between geographical regions and specific product segments, with certain areas and types of films poised for significant dominance. Among the segments, Online Sales are increasingly taking the lead in driving market growth and revenue. This dominance is attributed to several factors:

In terms of Key Regions, North America and Asia Pacific are projected to dominate the mobile phone privacy films market.

The mobile phone privacy films industry is experiencing significant growth driven by several key catalysts. The ever-increasing dependence on smartphones for sensitive data, from financial transactions to personal communications, fuels a constant demand for enhanced privacy solutions. Furthermore, the proliferation of public Wi-Fi networks and the rise of "digital nomads" who work and socialize in public spaces create a consistent need to prevent visual hacking. Technological advancements in film materials, offering improved clarity, anti-glare properties, and more effective light-filtering capabilities, make these products more appealing to consumers. The growing awareness of cybersecurity threats and personal data protection, amplified by news of data breaches, also acts as a powerful motivator for consumers to invest in privacy films.

This comprehensive report delves into the intricate landscape of the mobile phone privacy films market, offering a detailed analysis of its current state and future prospects. Spanning the study period of 2019-2033, with 2025 as the base year and an extensive forecast period from 2025-2033, the report provides invaluable insights for stakeholders. It meticulously examines key market drivers, including the escalating consumer awareness of digital privacy and the increasing reliance on smartphones for sensitive data. The report also addresses the significant challenges and restraints, such as the perceived trade-offs in screen usability and the competitive pricing landscape. Furthermore, it identifies dominant regions and segments, with a particular focus on the burgeoning growth of Online Sales and the strategic importance of North America and Asia Pacific. Leading players and their contributions, alongside significant historical and upcoming developments in the sector, are also thoroughly investigated. This report serves as an indispensable guide for businesses seeking to navigate and capitalize on the evolving opportunities within the mobile phone privacy films industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SmartDevil, Spigen, UGREEN, Pisen, YIPI ELECTRONIC, Shenzhen Renqing Excellent Technology, Light Intelligent Technology Co., LTD.

The market segments include Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Mobile Phone Privacy Films," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Phone Privacy Films, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.