1. What is the projected Compound Annual Growth Rate (CAGR) of the Mining Renewable Energy Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mining Renewable Energy Systems

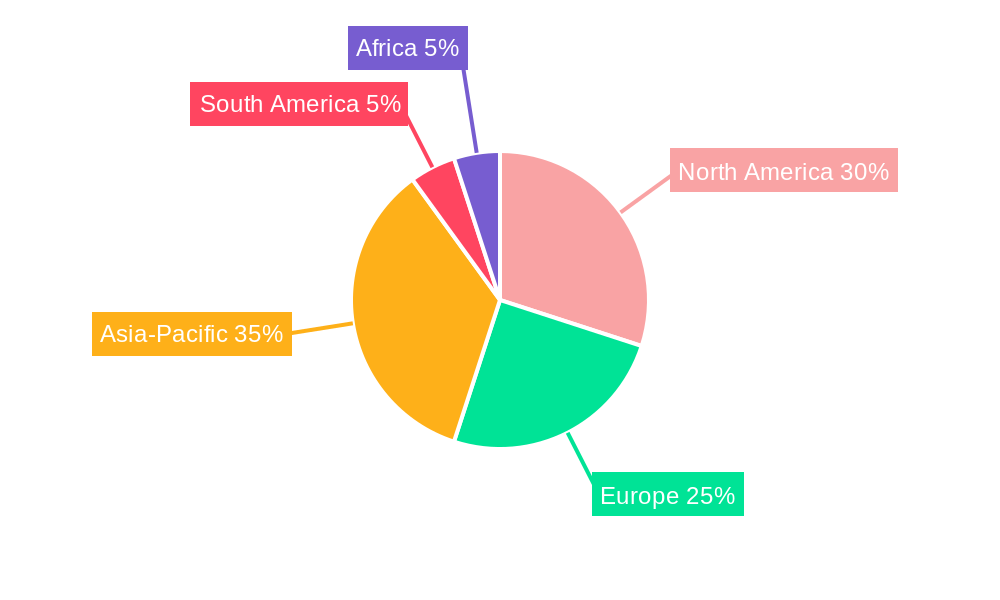

Mining Renewable Energy SystemsMining Renewable Energy Systems by Type (Wind, Biomass, Biofuel, Solar, Geothermal), by Application (Off-Grid Locations, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

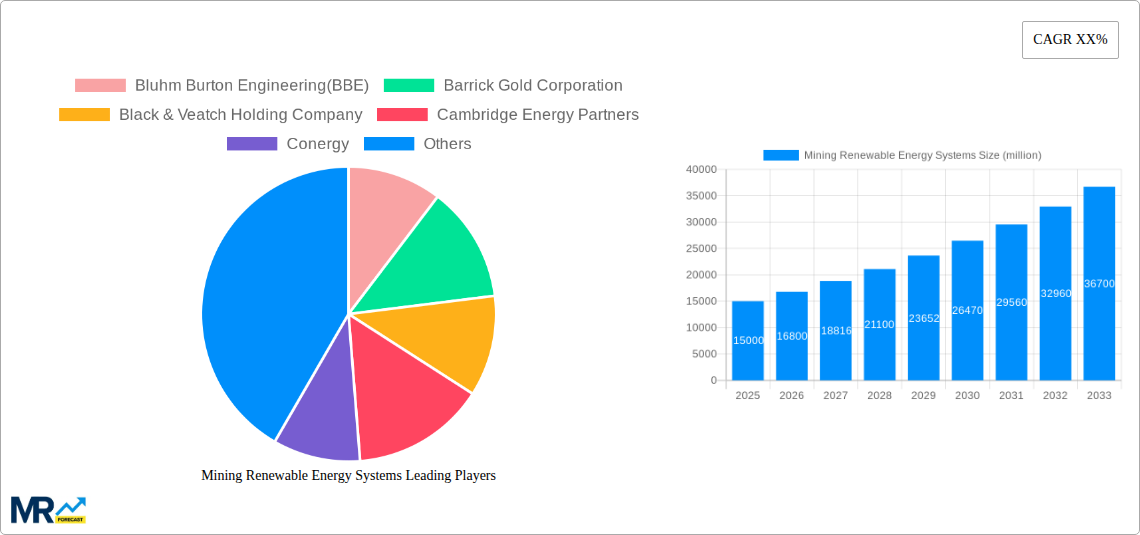

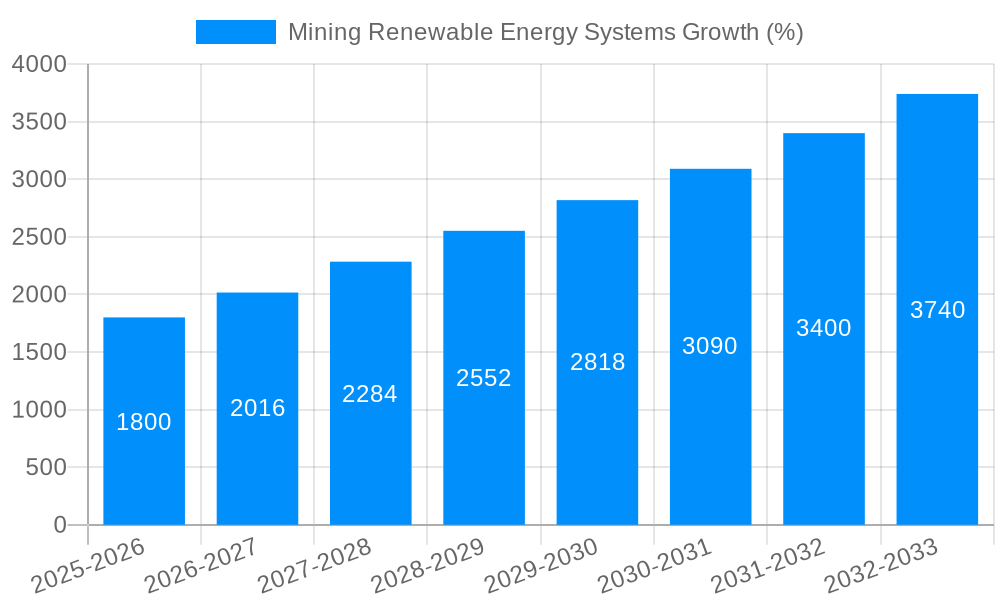

The mining industry is undergoing a significant transformation driven by the urgent need for sustainable practices and reduced carbon footprints. The adoption of renewable energy systems within mining operations is no longer a niche concept but a crucial element of future viability. The market for mining renewable energy systems, currently valued at approximately $15 billion in 2025 (estimated based on typical market sizes for related sectors and growth trajectories), is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of around 12% from 2025 to 2033. This expansion is fueled by several key drivers: stringent environmental regulations pushing for emission reductions, escalating fossil fuel costs, increasing energy demands from expanding mining operations, and the growing availability of cost-effective renewable technologies like solar PV, wind, and hydro power. Further driving adoption are advancements in energy storage solutions, which address the intermittency of renewable sources. Companies such as Bluhm Burton Engineering, Barrick Gold Corporation, and Siemens AG are actively involved in developing and implementing these systems, leading to increased competition and innovation within the sector.

Despite this positive outlook, challenges remain. High initial investment costs for renewable energy infrastructure, grid infrastructure limitations in remote mining locations, and the need for specialized expertise to integrate and manage these complex systems pose significant restraints. However, government incentives, technological advancements, and evolving industry best practices are gradually mitigating these challenges. The market is segmented by technology type (solar, wind, hydro, etc.), application (power generation, process heating), and region. Growth will be particularly strong in regions with high mining activity and supportive government policies, leading to regional variations in market penetration. The forecast period (2025-2033) promises substantial expansion, positioning renewable energy as an integral component of the future mining landscape. The industry is expected to see continued investment in research and development to improve efficiency and reduce costs, making renewable energy increasingly competitive against traditional fossil fuel-based power sources.

The mining industry, traditionally a significant consumer of fossil fuels, is undergoing a dramatic shift towards renewable energy systems. Driven by escalating energy costs, environmental regulations, and a growing commitment to sustainability, the adoption of solar, wind, hydro, and hybrid renewable energy solutions within mining operations is accelerating. The global market for mining renewable energy systems, valued at $XXX million in 2025, is projected to experience substantial growth during the forecast period (2025-2033), reaching an estimated value of $YYY million by 2033. This signifies a Compound Annual Growth Rate (CAGR) of ZZZ%. This transition is not merely a response to external pressures; it also presents significant opportunities for mining companies to enhance operational efficiency, reduce their carbon footprint, and improve their corporate social responsibility profiles. The historical period (2019-2024) witnessed a gradual uptake of renewable energy, primarily driven by pilot projects and early adopters. However, the base year (2025) marks a significant inflection point, with several large-scale renewable energy projects coming online, demonstrating the growing viability and economic attractiveness of these systems in the mining sector. This trend is further amplified by technological advancements in renewable energy technologies, making them more efficient, reliable, and cost-competitive. The increasing availability of financing options specifically tailored to renewable energy projects in the mining sector is also playing a crucial role in driving this transition. Furthermore, the growing awareness among investors and stakeholders regarding environmental, social, and governance (ESG) factors is putting pressure on mining companies to adopt sustainable practices, including the integration of renewable energy solutions. This comprehensive report delves into the multifaceted dynamics driving this transformation, offering valuable insights into market trends, growth drivers, challenges, and key players shaping the future of mining renewable energy systems.

Several key factors are accelerating the adoption of renewable energy systems within the mining industry. Firstly, the fluctuating and often unpredictable prices of fossil fuels represent a significant financial risk for mining companies. Renewable energy sources offer a degree of price stability and can hedge against volatile energy markets, leading to predictable operational costs. Secondly, stringent environmental regulations and growing public pressure for greater environmental responsibility are compelling mining companies to reduce their carbon footprint and adopt more sustainable practices. Renewable energy offers a clear pathway to achieving these goals. Thirdly, technological advancements have significantly improved the efficiency, reliability, and cost-effectiveness of renewable energy technologies, making them increasingly competitive with traditional fossil fuel-based power sources. The availability of advanced energy storage solutions, such as battery systems, further enhances the reliability of renewable energy systems by mitigating the intermittency associated with solar and wind power. Fourthly, many mining operations are located in remote areas with limited access to the national grid, making on-site renewable energy generation a more practical and economically viable option than relying on grid electricity. Finally, increasing access to financing and investment specifically targeted at sustainable mining projects is further facilitating the widespread adoption of renewable energy systems. These converging factors are collectively creating a powerful momentum behind the integration of renewable energy into the mining sector.

Despite the compelling benefits, several challenges hinder the widespread adoption of renewable energy systems in mining. The high upfront capital costs associated with installing large-scale renewable energy projects can be a significant barrier for some mining companies, particularly smaller operators. The intermittency of renewable energy sources, especially solar and wind power, remains a concern, requiring robust energy storage solutions or backup power systems to ensure reliable power supply for critical mining operations. The geographic constraints of certain mining sites may limit the suitability of particular renewable energy technologies, necessitating a careful assessment of the specific site conditions and energy demands. Furthermore, the integration of renewable energy systems into existing mining infrastructure can be complex and require significant planning and coordination. The lack of skilled workforce with expertise in designing, installing, and maintaining renewable energy systems can also pose a challenge. Finally, the long payback periods associated with some renewable energy investments might deter mining companies with short-term financial priorities. Overcoming these challenges requires innovative financing solutions, technological advancements in energy storage, and a concerted effort to develop a skilled workforce capable of supporting the transition to renewable energy.

North America (USA & Canada): Strong regulatory support for renewable energy, coupled with a significant mining sector, positions North America as a key market. Several large-scale renewable energy projects are already underway in these regions, particularly focusing on solar and wind power. The presence of leading renewable energy technology providers and experienced EPC (Engineering, Procurement, and Construction) companies further strengthens the market's growth prospects. Government incentives and policies aimed at promoting renewable energy adoption within the mining industry are also playing a pivotal role.

Australia: Australia's vast mining industry and abundant solar resources make it a promising market for mining renewable energy systems. The country is seeing increased investment in large-scale solar and wind projects specifically designed to power mining operations. Government initiatives and policies, though not always consistent, offer support to projects demonstrating strong sustainability credentials.

Segments:

Solar PV: The declining cost of solar photovoltaic (PV) technology and its adaptability make it a dominant segment. Large-scale solar farms are increasingly being integrated into mining operations, providing cost-effective and environmentally friendly power.

Wind Power: In regions with suitable wind resources, wind turbines offer a significant contribution to renewable energy generation for mining. The efficiency and scalability of wind power make it an attractive option for large-scale operations.

The above-mentioned regions and segments are projected to experience the highest growth rates during the forecast period due to a confluence of factors including supportive government policies, abundant renewable resources, and increasing awareness of the environmental and economic benefits of adopting renewable energy solutions.

The mining renewable energy systems industry is experiencing significant growth driven by several key catalysts. Falling renewable energy technology costs, particularly for solar PV and wind turbines, are making these solutions increasingly economically viable compared to traditional fossil fuel sources. Simultaneously, growing environmental regulations and commitments to corporate social responsibility (CSR) are pushing mining companies to reduce their carbon footprint and explore sustainable energy options. These factors, combined with advancements in energy storage technologies and supportive government policies in various regions, are collectively driving substantial investment in and deployment of renewable energy systems within the mining sector.

This report provides a detailed analysis of the mining renewable energy systems market, offering valuable insights into market trends, growth drivers, challenges, and key players. It includes extensive data on market size, growth forecasts, segment analysis, regional breakdowns, and competitive landscape. The report helps mining companies, investors, and policymakers understand the opportunities and challenges related to integrating renewable energy into mining operations, providing a comprehensive guide for strategic decision-making in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bluhm Burton Engineering(BBE), Barrick Gold Corporation, Black & Veatch Holding Company, Cambridge Energy Partners, Conergy, Cronimet Holding, Downer Group, Enel Green Power, General Electric, Hanwha Group, Juwi AG, Newmont Mining Corporation, Nuance Energy Group, Poyry Plc, Siemens AG, SolarReserve, Vergnet, ViZn Energy Systems, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Mining Renewable Energy Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mining Renewable Energy Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.