1. What is the projected Compound Annual Growth Rate (CAGR) of the Mini Flying Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mini Flying Camera

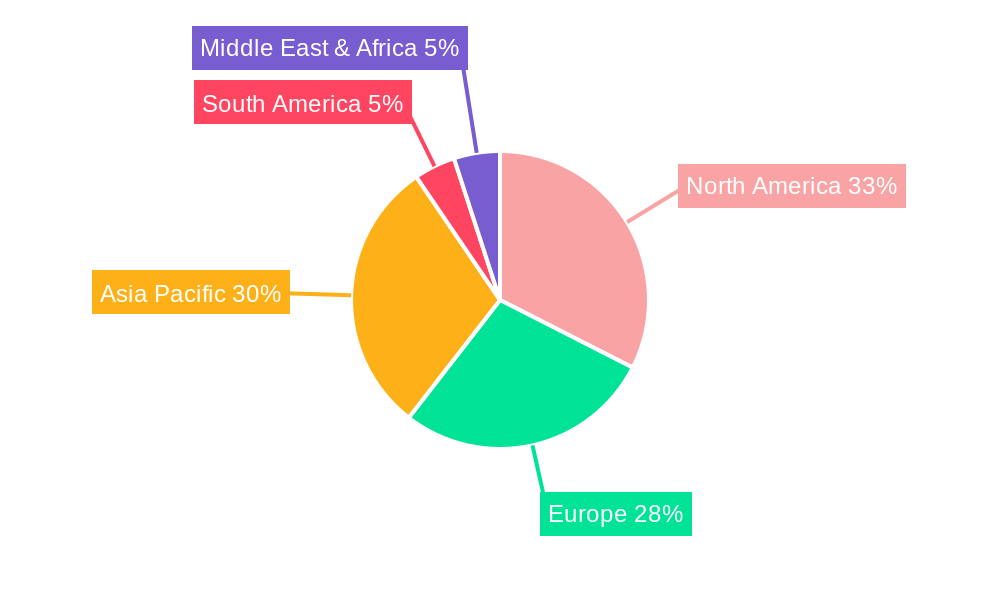

Mini Flying CameraMini Flying Camera by Type (Fixed-Wing, Hybrid-Wing, Rotary-Wing, World Mini Flying Camera Production ), by Application (Commercial Use, Private Use, World Mini Flying Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

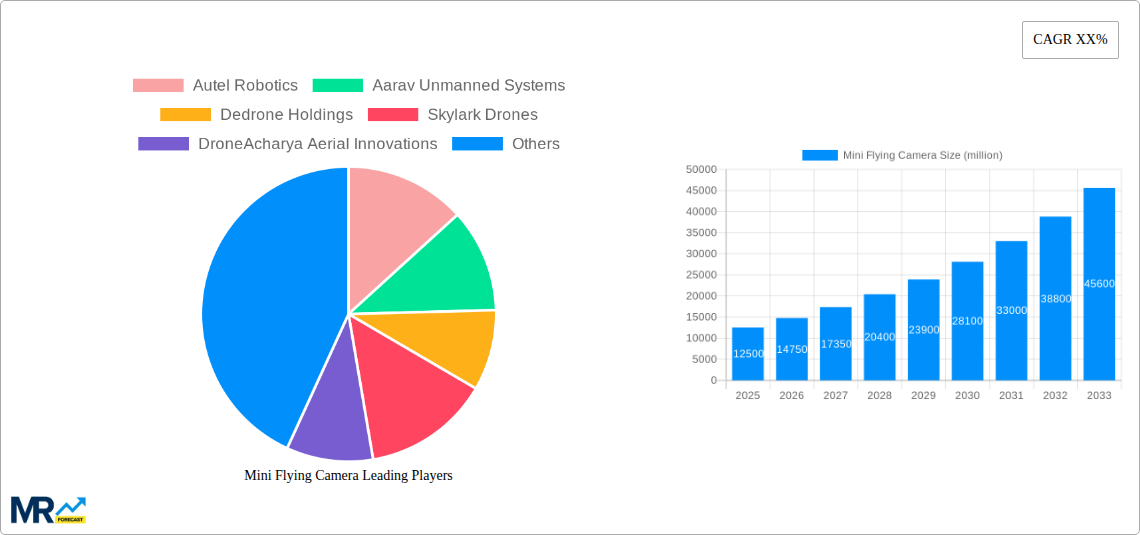

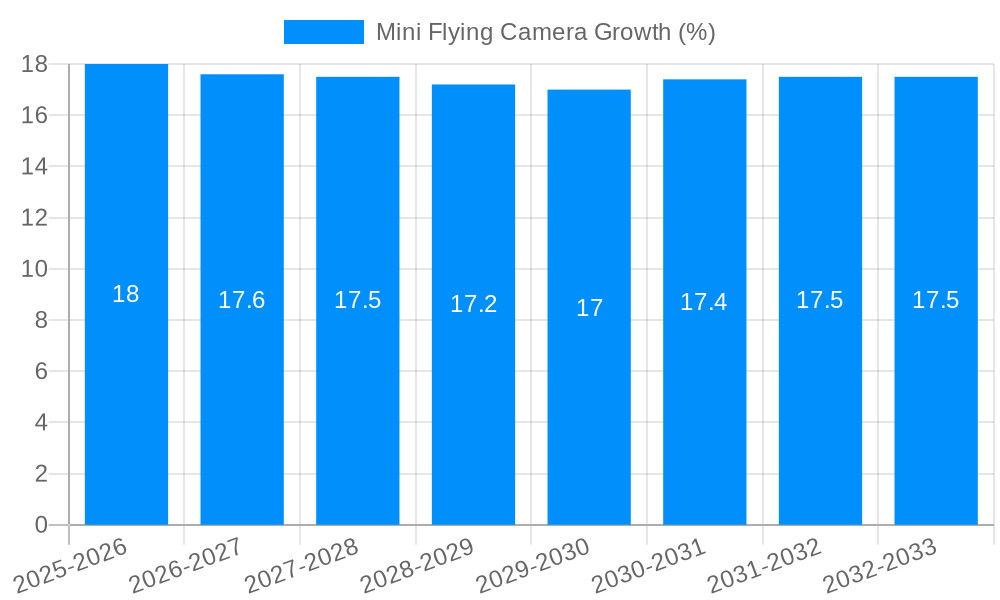

The global Mini Flying Camera market is poised for substantial expansion, projected to reach an estimated \$12,500 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of approximately 18%, indicating a dynamic and rapidly evolving sector. Key drivers propelling this market include the increasing demand for aerial surveillance and inspection in commercial applications, the burgeoning popularity of drone photography and videography for content creation, and advancements in miniaturization and battery technology that enhance portability and flight duration. The market encompasses a diverse range of drone types, with Fixed-Wing and Hybrid-Wing designs expected to gain significant traction due to their extended flight times and versatile payload capabilities, catering to professional aerial mapping, surveying, and advanced security operations. Rotary-Wing drones, while also a significant segment, will likely see continued dominance in consumer-grade and more agile aerial photography tasks.

The "World Mini Flying Camera Production" segment is a critical indicator of overall market health and supply chain dynamics. Commercial use, encompassing sectors like real estate, agriculture, infrastructure inspection, and law enforcement, represents the primary revenue stream. However, the private use segment, driven by hobbyists, content creators, and personal photography enthusiasts, is also exhibiting considerable growth. Emerging trends such as the integration of AI-powered flight control and image analysis, the development of longer-range and more secure communication systems, and the increasing adoption of mini flying cameras for last-mile delivery and emergency response operations are shaping the market's future. Restraints, including evolving regulatory frameworks, concerns over data privacy and security, and the initial cost of high-end professional drones, are being mitigated by technological innovations and increasing market accessibility. Key players like Autel Robotics, Guangdong Jianjian Intelligent Technology, and Shenzhen Hubsan Technology are at the forefront, investing heavily in research and development to capture a larger market share in this competitive landscape.

This report offers an in-depth analysis of the global mini flying camera market, encompassing a detailed examination of trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments. The study leverages data from the Historical Period (2019-2024), the Base Year (2025), and the Forecast Period (2025-2033), with a specific focus on the Estimated Year (2025) to provide actionable insights. The Study Period (2019-2033) allows for a comprehensive understanding of market evolution and future trajectory.

The global mini flying camera market is experiencing an unprecedented surge in demand, driven by miniaturization, enhanced functionalities, and a broadening spectrum of applications. XXX, representing the estimated market value in millions, is projected to witness substantial growth throughout the Study Period (2019-2033). This growth is underpinned by the increasing adoption of these devices across various sectors, from professional photography and videography to industrial inspection and personal entertainment. The inherent advantages of mini flying cameras, such as their portability, ease of deployment, and ability to capture unique aerial perspectives, are fundamentally reshaping how individuals and businesses interact with their environments. The Estimated Year (2025) marks a pivotal point where widespread accessibility and affordability have begun to democratize aerial imaging. We are observing a clear trend towards more intelligent and autonomous functionalities, with AI-powered features like obstacle avoidance, automated flight paths, and sophisticated image processing becoming standard. Furthermore, the integration of advanced sensor technologies, including high-resolution cameras, thermal imaging capabilities, and LiDAR, is expanding the operational envelope of mini flying cameras beyond mere visual capture, enabling applications in data acquisition and analysis. The evolution of battery technology is also a significant factor, offering longer flight times and more efficient charging solutions, thereby mitigating one of the historical limitations of drone technology. Regulatory frameworks, while still evolving, are becoming more defined, providing a clearer operational landscape for manufacturers and end-users, and fostering responsible innovation. The World Mini Flying Camera Production is expected to see a substantial increase in volume, reflecting the burgeoning global interest. Consumer-grade mini flying cameras are becoming increasingly sophisticated, offering professional-grade features at accessible price points, driving the Private Use segment. Simultaneously, the Commercial Use segment is experiencing robust expansion as businesses leverage these tools for efficiency gains, cost reduction, and improved decision-making across industries. The Hybrid-Wing segment, in particular, is garnering significant attention for its ability to combine the vertical take-off and landing capabilities of rotary-wing drones with the efficiency of fixed-wing designs, offering a versatile solution for various missions. The continuous innovation in drone design, materials science, and software development is ensuring that mini flying cameras remain at the forefront of technological advancement.

The proliferation of mini flying cameras is being propelled by a confluence of technological advancements and evolving market demands. The relentless pursuit of miniaturization in electronics has enabled the development of smaller, lighter, and more powerful flying cameras, making them more accessible and user-friendly for a wider audience. This trend directly impacts the World Mini Flying Camera Production, increasing its feasibility and scalability. Furthermore, the exponential growth in computational power has facilitated the integration of sophisticated artificial intelligence (AI) and machine learning (ML) algorithms into these devices. These intelligent features, such as advanced image recognition, autonomous navigation, and real-time data processing, are transforming mini flying cameras from simple aerial photography tools into versatile platforms for complex tasks. The increasing demand for aerial data acquisition across various industries is a significant catalyst. Sectors like agriculture, construction, infrastructure inspection, and public safety are recognizing the immense value of aerial perspectives for enhanced monitoring, surveying, and assessment. This is directly fueling the Commercial Use segment, as businesses seek cost-effective and efficient solutions for their operational needs. The growing popularity of content creation and social media has also contributed to the surge in demand for personal aerial photography and videography. Mini flying cameras provide individuals with the ability to capture stunning aerial footage and unique perspectives, driving the Private Use segment and influencing World Mini Flying Camera Production volumes. Moreover, continuous innovation in battery technology, leading to longer flight times and faster charging capabilities, is alleviating previous limitations and enhancing the practicality of these devices for extended use.

Despite the robust growth trajectory, the mini flying camera market faces several significant challenges and restraints that could impede its full potential. The evolving regulatory landscape remains a primary concern. Varying and often complex regulations regarding drone operation, airspace access, and data privacy across different countries and regions can create significant hurdles for manufacturers and users alike, impacting global World Mini Flying Camera Production. Developing standardized and globally recognized regulations is crucial for sustained market expansion. Public perception and safety concerns also pose a considerable restraint. Incidents involving unauthorized drone usage or potential safety hazards can lead to public apprehension and, consequently, stricter regulations. Addressing these concerns through education, robust safety features, and responsible user practices is paramount. The issue of cybersecurity is also becoming increasingly critical. As mini flying cameras become more connected and data-intensive, they become potential targets for hacking and data breaches, posing risks to sensitive information and operational integrity. Robust cybersecurity measures are essential to build trust and ensure the secure operation of these devices. Furthermore, the rapid pace of technological obsolescence necessitates continuous investment in research and development, which can be a significant cost for companies, particularly smaller players. The limited flight endurance and payload capacity, while improving, still present practical limitations for certain demanding applications, influencing the adoption rate in specific Commercial Use scenarios. The cost of advanced models and the need for specialized training for complex operations can also be a barrier for some potential users, particularly in the Private Use segment.

The global mini flying camera market is characterized by regional disparities in adoption, regulatory frameworks, and technological advancement, with certain segments poised for significant dominance.

Dominant Segments:

Rotary-Wing Type: The Rotary-Wing type of mini flying camera is expected to continue its dominance throughout the forecast period. These drones, characterized by their multi-rotor configurations, offer excellent maneuverability, vertical take-off and landing (VTOL) capabilities, and the ability to hover, making them ideal for a wide array of applications.

Commercial Use Application: The Commercial Use application segment is projected to be the largest and fastest-growing segment in the World Mini Flying Camera Production market. The economic benefits derived from using mini flying cameras in various industries are driving substantial investment and adoption.

Key Dominant Region/Country:

The mini flying camera industry is experiencing robust growth fueled by several key catalysts. The relentless advancement in miniaturization and sensor technology enables the creation of more compact, powerful, and versatile devices. The integration of artificial intelligence (AI) and machine learning (ML) is a significant growth driver, empowering drones with autonomous navigation, object recognition, and intelligent data analysis capabilities, thereby expanding their application scope. The increasing demand for aerial data acquisition across sectors like agriculture, infrastructure inspection, and public safety is directly translating into market growth. Furthermore, favorable regulatory developments in key markets, coupled with a growing awareness of the cost-effectiveness and efficiency gains offered by drone technology, are further propelling adoption.

This report provides a holistic view of the mini flying camera market, offering unparalleled insights into its trajectory from 2019-2033. The analysis delves deep into the intricate market dynamics, dissecting trends, driving forces, and the challenges that shape the industry. It meticulously forecasts the market's evolution, with a keen focus on the Base Year (2025) and the Forecast Period (2025-2033). Furthermore, the report identifies key regions and segments poised for dominance, offering strategic perspectives. Leading players and significant industry developments are highlighted, providing a comprehensive understanding of the competitive landscape and future innovations. This report is an essential resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the global mini flying camera market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Autel Robotics, Aarav Unmanned Systems, Dedrone Holdings, Skylark Drones, DroneAcharya Aerial Innovations, PrecisionHawk, Flyability SA, HOVERAir, DJA, Guangdong Jianjian Intelligent Technology, Shenzhen Hubsan Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Mini Flying Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mini Flying Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.