1. What is the projected Compound Annual Growth Rate (CAGR) of the Millimeter Wave Sensor for Remote Patient Monitoring?

The projected CAGR is approximately 44.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Millimeter Wave Sensor for Remote Patient Monitoring

Millimeter Wave Sensor for Remote Patient MonitoringMillimeter Wave Sensor for Remote Patient Monitoring by Type (24GHz, 60GHz, Others), by Application (Nursing Home, Hospital, Home), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

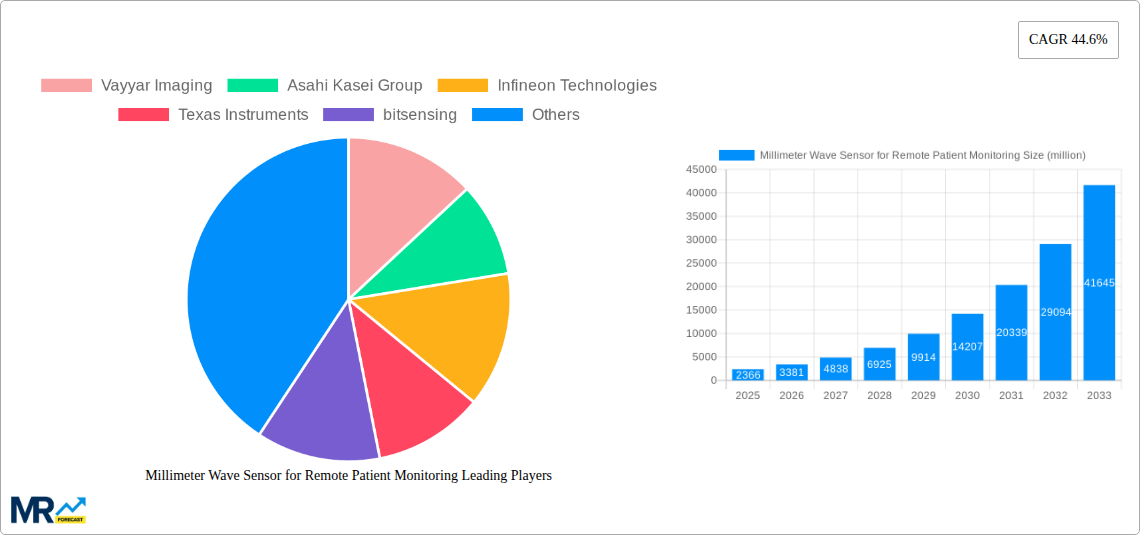

The Millimeter Wave Sensor for Remote Patient Monitoring market is poised for explosive growth, projected to reach a significant market size of approximately USD 2366 million. This surge is fueled by an exceptional Compound Annual Growth Rate (CAGR) of 44.6% from the base year of 2025 through 2033. This remarkable trajectory is driven by several critical factors, most notably the increasing demand for non-invasive and continuous patient monitoring solutions, especially among aging populations and individuals with chronic conditions. The inherent advantages of millimeter wave technology, including its ability to penetrate certain materials and its precision in detecting subtle movements and physiological changes without physical contact, are making it an indispensable tool in healthcare settings. Advancements in sensor miniaturization and cost reduction are further accelerating adoption. Furthermore, the growing emphasis on proactive healthcare, early disease detection, and the desire to reduce hospital readmissions are all powerful tailwinds for this market. The ongoing digital transformation in healthcare, coupled with supportive government initiatives promoting telehealth and remote care, is creating a highly favorable environment for widespread implementation of millimeter wave sensors in remote patient monitoring applications.

The market is segmented by technology into 24GHz, 60GHz, and other millimeter wave frequencies, with the latter likely encompassing emerging high-frequency bands offering enhanced resolution and capabilities. Application-wise, the market is bifurcated into nursing homes, hospitals, and home-based monitoring. The increasing strain on healthcare systems and the growing preference for home-based care will likely see the 'Home' application segment emerge as a significant growth engine. While the market presents immense opportunities, potential restraints such as the initial cost of integration for some healthcare providers, the need for robust data security and privacy measures, and the requirement for specialized technical expertise for deployment and maintenance, need to be strategically addressed. However, the overwhelming benefits in terms of improved patient outcomes, enhanced care efficiency, and reduced healthcare burdens are expected to outweigh these challenges, propelling the millimeter wave sensor market for remote patient monitoring to unprecedented heights. Key players like Vayyar Imaging, Asahi Kasei Group, Infineon Technologies, and Texas Instruments are at the forefront, innovating and expanding the market's reach.

The global market for Millimeter Wave (MMW) sensors in remote patient monitoring (RPM) is poised for a significant expansion, driven by an increasing demand for non-intrusive, continuous health tracking solutions. During the study period of 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033, the market is projected to witness robust growth. Key market insights reveal a palpable shift towards home-based care models, accelerated by technological advancements in MMW sensor capabilities. These sensors, operating at frequencies like 24GHz and 60GHz, offer unparalleled accuracy in detecting subtle physiological changes such as respiration rate, heart rate, sleep patterns, and even fall detection, all without requiring direct physical contact. The historical period of 2019-2024 laid the groundwork, marked by initial research and development, leading to the estimated year of 2025 where commercial adoption is expected to gain substantial momentum. The market's trajectory is further shaped by the growing prevalence of chronic diseases, an aging global population, and the burgeoning healthcare expenditure worldwide. Furthermore, the integration of MMW sensors into smart home ecosystems and wearable devices is a significant trend, promising to democratize access to advanced RPM. This convergence of technology and evolving healthcare needs is creating a fertile ground for innovation and market penetration. The value of this market is projected to reach hundreds of millions by the end of the forecast period, indicating a substantial economic opportunity. The increasing awareness and acceptance of RPM solutions among both patients and healthcare providers are also critical trends that will continue to fuel demand. The development of miniaturized, low-power MMW sensors will further enhance their suitability for continuous, long-term monitoring applications, contributing to a more proactive and preventative healthcare approach. The industry is also seeing a trend towards enhanced data analytics and AI integration with MMW sensor data, enabling more sophisticated predictive health insights.

Several powerful forces are propelling the growth of the Millimeter Wave (MMW) sensor market for remote patient monitoring (RPM). The most significant driver is the global demographic shift towards an aging population, which inherently increases the demand for continuous health monitoring and specialized care. MMW sensors offer a non-intrusive and privacy-preserving method for monitoring elderly individuals at home, facilitating independent living and reducing the burden on healthcare facilities. The rising prevalence of chronic diseases such as cardiovascular conditions, respiratory illnesses, and neurological disorders further fuels this demand, as these conditions require consistent monitoring to manage effectively and prevent complications. Furthermore, the increasing adoption of telehealth and remote patient care models, significantly accelerated by recent global health events, has created a substantial market for RPM solutions. MMW sensors, with their ability to provide accurate and reliable physiological data without the need for wearables or physical contact, are perfectly positioned to meet these evolving healthcare delivery paradigms. The continuous innovation in MMW sensor technology, leading to smaller, more energy-efficient, and cost-effective devices, is also a key enabler. These advancements make MMW sensors more accessible for widespread deployment in both home and institutional settings. The inherent advantages of MMW technology, such as its ability to penetrate certain materials and operate in diverse environmental conditions, further enhance its appeal for a broad range of RPM applications. The market's anticipated value in the millions underscores the significant economic impetus behind these driving forces.

Despite the promising growth trajectory, the Millimeter Wave (MMW) sensor market for remote patient monitoring (RPM) faces several significant challenges and restraints. One of the primary hurdles is the regulatory landscape and data privacy concerns. The collection of sensitive health data necessitates strict adherence to regulations like HIPAA and GDPR, which can be complex and costly for manufacturers and service providers. Ensuring the secure transmission and storage of this data is paramount, and any breach can severely damage trust and hinder adoption. Another challenge is the high initial cost of advanced MMW sensor systems. While prices are expected to decrease with increased production and technological maturation, the upfront investment for comprehensive RPM solutions can be a barrier for some healthcare providers and individual consumers. Integration with existing healthcare infrastructure also presents a challenge. Seamlessly integrating MMW sensor data into electronic health records (EHRs) and existing hospital information systems requires significant interoperability efforts and standardization. Public perception and awareness are also factors; while awareness is growing, a segment of the population may still be unfamiliar with or skeptical of MMW sensor technology for health monitoring, requiring extensive education and outreach. Furthermore, the need for robust algorithms and data analytics to translate raw sensor data into clinically actionable insights is critical. Developing and validating these algorithms requires significant research and development investment. Finally, scalability and manufacturing complexities for highly specialized MMW components can also pose limitations on the speed of market expansion. These factors, while substantial, are being actively addressed by industry players and researchers, and their impact is expected to lessen over the forecast period, paving the way for greater market penetration.

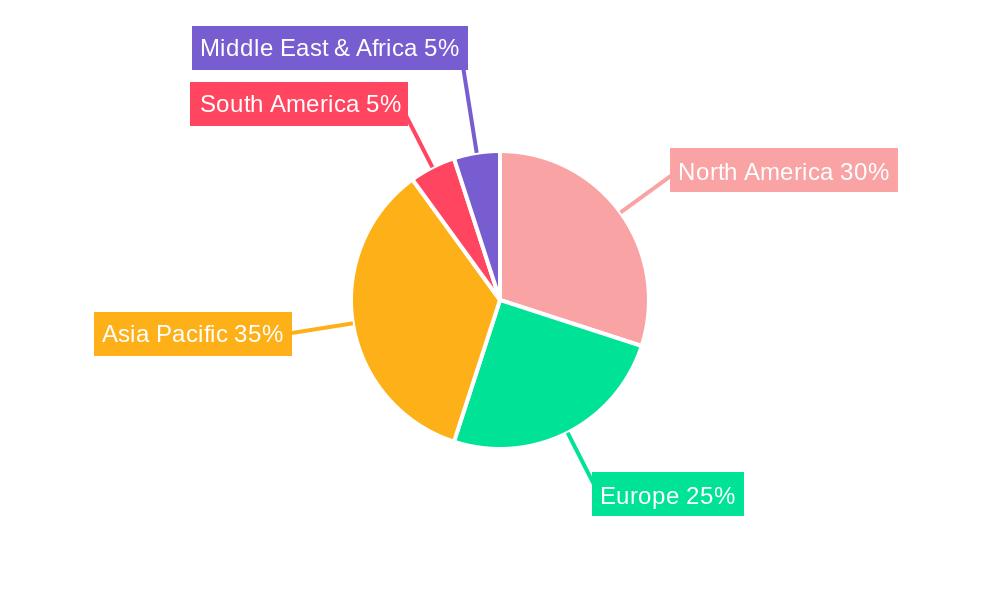

The Millimeter Wave (MMW) sensor market for remote patient monitoring (RPM) is expected to see dominance from specific regions and segments due to a confluence of factors including technological adoption, healthcare infrastructure, and demographic trends.

Dominant Regions/Countries:

Dominant Segments:

The synergy between regions with advanced healthcare and a growing need for elder care, combined with the increasing preference for home-based monitoring and the technological superiority of 60GHz sensors, will dictate the market's dominant forces.

Several key growth catalysts are propelling the Millimeter Wave (MMW) sensor industry for remote patient monitoring (RPM). The escalating global demand for proactive and preventative healthcare is a primary driver, as MMW sensors enable early detection of health anomalies. The significant increase in the aging global population necessitates continuous and non-intrusive monitoring solutions, a niche perfectly filled by MMW technology. Furthermore, the widespread adoption of telehealth and the shift towards home-based care models are creating a fertile ground for RPM solutions. Technological advancements, leading to smaller, more energy-efficient, and cost-effective MMW sensors, are making them increasingly accessible and practical for widespread deployment.

This comprehensive report provides an in-depth analysis of the Millimeter Wave (MMW) sensor market for remote patient monitoring (RPM), spanning from 2019 to 2033. It delves into the intricate dynamics shaping this burgeoning sector, offering detailed insights into market trends, driving forces, and significant challenges. The report meticulously examines key regions and countries poised for market dominance, alongside an in-depth analysis of dominant segments such as 24GHz, 60GHz, and their applications in nursing homes, hospitals, and home settings. With an estimated market value reaching hundreds of millions by 2025, this study offers a forward-looking perspective on growth catalysts, leading industry players, and significant technological developments. The report is an indispensable resource for stakeholders seeking to understand the current landscape and future potential of MMW sensors in revolutionizing remote patient care.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 44.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 44.6%.

Key companies in the market include Vayyar Imaging, Asahi Kasei Group, Infineon Technologies, Texas Instruments, bitsensing, Iflabel, Qinglei Tech.

The market segments include Type, Application.

The market size is estimated to be USD 2366 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Millimeter Wave Sensor for Remote Patient Monitoring," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Millimeter Wave Sensor for Remote Patient Monitoring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.