1. What is the projected Compound Annual Growth Rate (CAGR) of the Millboard?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Millboard

MillboardMillboard by Type (Class A Millboard, Class B Millboard), by Application (Furniture, Architecture), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

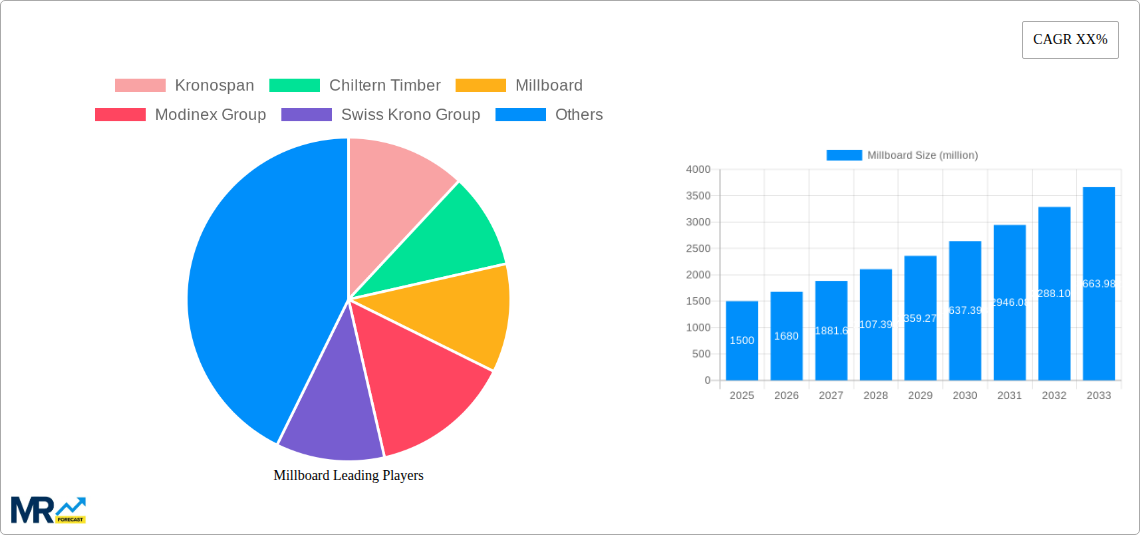

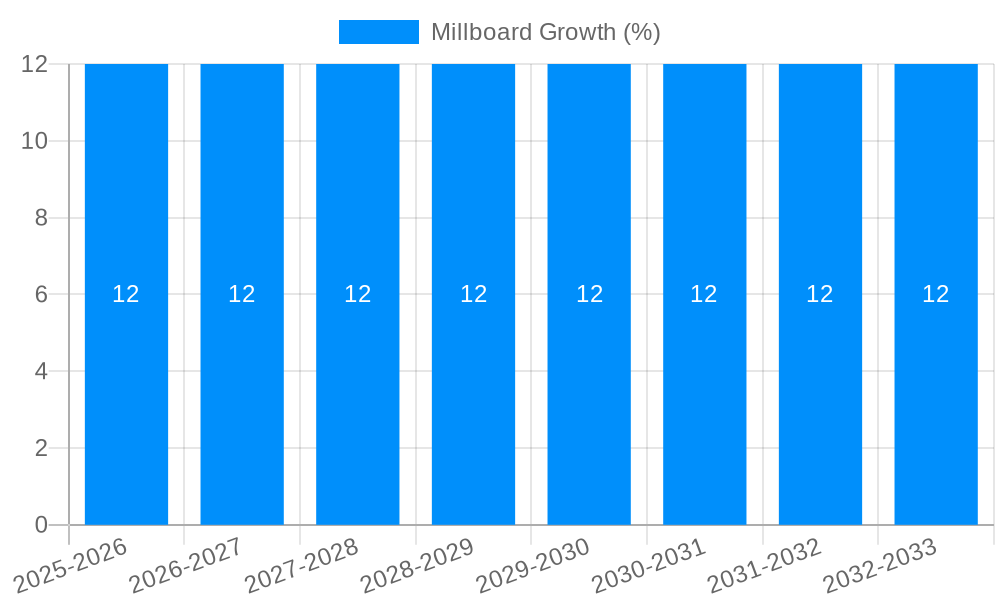

The global Millboard market is projected to experience robust growth, estimated at USD 1,500 million in 2025, with a Compound Annual Growth Rate (CAGR) of 12% anticipated over the forecast period of 2025-2033. This significant expansion is driven by a confluence of factors, most notably the increasing demand for sustainable and durable building materials. Millboard, known for its resilience, low maintenance, and aesthetic versatility, is becoming a preferred choice in both residential and commercial construction. The furniture industry also represents a substantial driver, with manufacturers increasingly opting for millboard as a cost-effective and high-performance alternative to traditional wood products, especially in applications requiring enhanced moisture and impact resistance. Furthermore, the growing trend towards modern architecture that emphasizes clean lines and sophisticated finishes is creating a favorable environment for millboard adoption.

The market's trajectory is further bolstered by ongoing advancements in manufacturing technologies, leading to improved product quality, a wider range of designs, and competitive pricing. While the market exhibits strong growth potential, certain restraints, such as the initial cost compared to some conventional materials and the availability of alternative composite materials, need to be considered. However, the long-term benefits of millboard, including its environmental advantages (often made from recycled materials) and extended lifespan, are increasingly outweighing these initial concerns. The market is segmented into Class A and Class B millboards, with Class A typically catering to higher-end applications in architecture and premium furniture. Regionally, Asia Pacific, particularly China and India, is expected to be a key growth engine due to rapid urbanization and infrastructure development, while North America and Europe will continue to be significant markets driven by renovation and new construction projects. Key players like Kronospan, Egger, and Georgia-Pacific are actively investing in product innovation and expanding their manufacturing capacities to capitalize on this burgeoning demand.

This report provides an in-depth analysis of the global Millboard market, encompassing historical performance, current trends, and future projections. The study covers a comprehensive period from 2019 to 2033, with a base year of 2025. We delve into the market dynamics, identifying key drivers, restraints, and emerging opportunities that will shape the industry landscape. The report offers valuable insights for stakeholders, including manufacturers, suppliers, investors, and end-users, aiding in strategic decision-making and market penetration.

The global Millboard market is poised for significant growth, driven by evolving consumer preferences and the increasing adoption of innovative materials across various sectors. Throughout the historical period (2019-2024), the market witnessed a steady upward trajectory, with an estimated market size reaching approximately 150 million USD by the end of 2024. This growth was primarily fueled by the burgeoning construction industry and the consistent demand from the furniture manufacturing sector. Looking ahead, the study period (2019-2033) projects a remarkable expansion, with the market anticipated to reach an estimated value of 550 million USD by the forecast year of 2033. This upward trend is underpinned by a confluence of factors including technological advancements in production processes, leading to enhanced product quality and variety. Furthermore, the growing emphasis on sustainable building materials and interior design solutions is creating new avenues for Millboard products. The estimated market size for the base year of 2025 is projected to be around 200 million USD, setting a strong foundation for the subsequent growth trajectory.

The market's evolution is marked by a distinct shift towards higher-performance and aesthetically pleasing Millboard varieties. Class A Millboard, known for its superior finish and durability, is witnessing augmented demand, particularly in architectural applications and high-end furniture. Conversely, Class B Millboard continues to hold its ground, catering to more cost-sensitive segments and industrial applications where aesthetic appeal is secondary to functionality. The architecture segment, in particular, is emerging as a dominant force, with architects increasingly incorporating Millboard for its versatility, design flexibility, and its ability to mimic natural materials like wood and stone. This is reflected in the projected market share of the architecture segment, which is expected to contribute significantly to the overall market revenue. Moreover, the furniture industry, a long-standing pillar of Millboard consumption, is also evolving, with manufacturers seeking innovative materials that offer enhanced durability, scratch resistance, and aesthetic appeal for modern furniture designs. The "Developments" section within this report will further elaborate on the specific innovations and product launches that are shaping these trends.

The Millboard market is experiencing a robust expansion driven by several key factors that are reshaping its landscape. Foremost among these is the escalating demand for aesthetically pleasing and durable materials in the construction and interior design industries. As homeowners and businesses alike prioritize both visual appeal and longevity, Millboard’s inherent properties, such as its resistance to moisture, stains, and wear, make it a highly sought-after alternative to traditional materials. This is further amplified by the growing trend towards sophisticated and customizable interior spaces, where Millboard’s versatility in design and finish allows for tailored solutions that meet specific aesthetic requirements. Moreover, the furniture manufacturing sector is a significant contributor, with an increasing focus on producing furniture that is not only stylish but also resilient to daily wear and tear. Millboard’s ability to offer a high-quality finish coupled with enhanced durability makes it an attractive choice for manufacturers aiming to differentiate their products in a competitive market. The environmental consciousness among consumers and manufacturers is also playing a crucial role. As the industry leans towards sustainable practices, Millboard, often derived from engineered wood products or composite materials, can offer a more environmentally friendly option compared to some natural resource-intensive materials, provided its production processes are sustainable. The continued innovation in manufacturing techniques further propels the market by enabling the creation of Millboard with improved performance characteristics and a wider range of design possibilities.

Despite the promising growth trajectory, the Millboard market is not without its challenges and restraints. One significant impediment is the perceived cost compared to some conventional materials. While Millboard offers long-term value through its durability and low maintenance, the initial investment can be higher for certain applications, which might deter budget-conscious consumers and smaller-scale projects. This price sensitivity is particularly evident in regions with less disposable income or where cost-effectiveness is the primary purchasing criterion. Furthermore, consumer awareness and understanding of Millboard’s benefits and applications remain a hurdle. In some markets, there is a lack of widespread knowledge about the product’s superior properties, leading to underutilization or preference for more familiar materials. Educating potential customers about the long-term advantages, including its resistance to moisture, pests, and fading, is crucial for market penetration. Another restraint lies in the availability of raw materials and the complexity of manufacturing processes. Fluctuations in the supply chain for key components, coupled with the specialized technology required for high-quality Millboard production, can impact production volumes and costs, potentially leading to supply chain disruptions and price volatility. The environmental impact of some manufacturing processes, if not managed responsibly, could also become a point of contention, necessitating a strong focus on sustainable production methods to mitigate this concern. Lastly, competition from established and emerging materials in both the construction and furniture sectors presents a continuous challenge. Traditional materials like solid wood, laminates, and even advanced composite materials are constantly evolving, requiring Millboard manufacturers to innovate and highlight their unique selling propositions effectively.

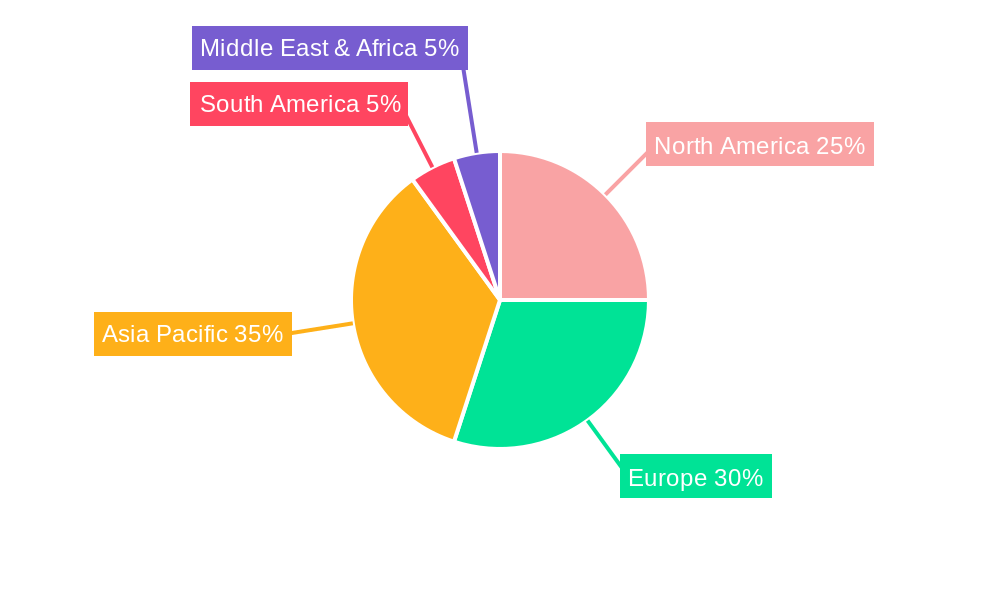

The global Millboard market is characterized by a dynamic interplay of regional strengths and segment dominance, with specific areas demonstrating significant potential for growth and influence.

Dominant Segments:

Architecture: This segment is poised to be a primary growth engine, driven by an increasing demand for sophisticated and durable materials in both commercial and residential construction. Architects are actively seeking innovative solutions that offer design flexibility, aesthetic appeal, and long-term performance. Millboard, with its ability to mimic natural materials like wood and stone while offering superior resistance to moisture, fading, and wear, is perfectly positioned to meet these evolving needs. The use of Millboard in facades, interior wall paneling, flooring, and custom architectural elements is expected to surge. This includes high-end residential projects, corporate offices, retail spaces, and hospitality establishments that prioritize a premium look and feel with minimal maintenance. The projected growth in this segment is also fueled by the increasing adoption of sustainable building practices, where Millboard, often manufactured from recycled or sustainably sourced materials, aligns with green building certifications and consumer preferences. The ability to achieve intricate designs and textures without compromising on durability makes it a favored choice for innovative architectural designs.

Furniture: The furniture sector is another significant contributor to the Millboard market's dominance. Manufacturers are increasingly opting for Millboard for its inherent durability, scratch resistance, and ease of maintenance, which are critical attributes for modern furniture designed for longevity and heavy use. This is particularly true for furniture intended for kitchens, bathrooms, and outdoor spaces, where moisture resistance is paramount. The aesthetic versatility of Millboard, allowing for a wide array of finishes, colors, and textures, enables furniture designers to create contemporary and customizable pieces that cater to diverse consumer tastes. From sleek, minimalist designs to more ornate styles, Millboard provides a reliable and attractive substrate. The growing trend of customized furniture and the demand for high-quality, long-lasting pieces further bolster the importance of this segment. The projected market share for furniture applications is expected to remain substantial, reflecting its foundational role in the Millboard industry.

Dominant Regions/Countries:

While the market is global, certain regions are expected to exhibit a more pronounced dominance due to a combination of factors including economic development, construction activity, consumer spending power, and industry adoption rates.

North America: This region is projected to lead the Millboard market. The strong presence of established furniture manufacturers, coupled with a robust construction industry and a growing preference for high-quality, durable home improvement materials, fuels demand. Furthermore, a heightened awareness of sustainable building practices and a willingness to invest in premium finishes contribute to North America’s leading position. The extensive renovation and remodeling market also presents significant opportunities for Millboard applications in both residential and commercial spaces. The presence of major players in the building materials sector further solidifies this dominance.

Europe: Europe represents another major market for Millboard. The region’s strong emphasis on design, aesthetics, and sustainability aligns well with the product's attributes. The mature construction sector, coupled with stringent building codes that often favor durable and low-maintenance materials, drives demand. Countries with high disposable incomes and a focus on quality living spaces, such as Germany, the United Kingdom, and France, are key markets. The growing interest in eco-friendly and responsibly sourced materials also resonates strongly within the European consumer base. The innovation in architectural design and interior finishing prevalent in Europe further boosts the adoption of Millboard for its versatile applications.

Asia Pacific: While currently a developing market for Millboard compared to North America and Europe, the Asia Pacific region is expected to witness the fastest growth rate in the forecast period. Rapid urbanization, a burgeoning middle class with increasing disposable incomes, and significant infrastructure development projects are key drivers. Countries like China, India, and Southeast Asian nations are seeing a surge in construction activities, leading to a growing demand for innovative building materials. As consumer awareness and purchasing power increase, the demand for aesthetically pleasing and durable materials like Millboard is expected to rise exponentially. The furniture industry in this region is also expanding rapidly, further contributing to Millboard consumption.

The interplay between these dominant segments and regions creates a complex yet predictable market dynamic, with strategic focus on these areas offering the greatest potential for market players.

The Millboard industry is propelled by several key catalysts. The increasing global emphasis on sustainable construction and interior design is a significant driver, as Millboard often offers eco-friendly production alternatives and contributes to longer-lasting structures. Advancements in manufacturing technologies are enabling the creation of Millboard with enhanced durability, improved aesthetics, and greater design versatility, meeting evolving consumer and industry demands. Furthermore, the robust growth in the construction and renovation sectors worldwide, particularly in emerging economies, directly translates to increased demand for building materials like Millboard. The furniture industry’s continuous pursuit of high-quality, resilient, and visually appealing materials also acts as a potent growth catalyst.

The Millboard market is comprised of a diverse range of companies, each contributing to the industry's innovation and growth. The following are some of the leading players in the sector:

The Millboard sector has witnessed several impactful developments over the historical period, shaping its trajectory and market offerings. These advancements reflect a commitment to innovation, sustainability, and meeting evolving consumer needs.

This comprehensive Millboard report offers an exhaustive examination of the global market, delving deep into its intricate dynamics. It provides a thorough analysis of market segmentation, dissecting the landscape by product type (Class A Millboard, Class B Millboard) and application (Furniture, Architecture, Industry). The report meticulously details historical data from 2019-2024, establishes a robust base year analysis for 2025, and presents a detailed forecast for the period 2025-2033, projecting an estimated market value of 550 million USD by the end of the study period. It further elucidates the key growth catalysts, including the burgeoning demand for sustainable materials and technological advancements, while also addressing the challenges and restraints such as cost perceptions and market awareness. Regional analyses highlight dominant markets, with a special focus on the strategic importance of North America, Europe, and the rapidly growing Asia Pacific region. Leading players are identified, and significant historical developments are cataloged, providing a holistic view of the industry's evolution. This report serves as an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within the dynamic Millboard market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kronospan, Chiltern Timber, Millboard, Modinex Group, Swiss Krono Group, Mcneil Insulation Co, Egger, Pfleiderer, Duratex, Georgia-Pacific, Masisa, Arauco, Norbord, Louisiana-Pacific, Weyerhaeuser, Daiken New Zealand, Sonae Industria, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Millboard," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Millboard, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.