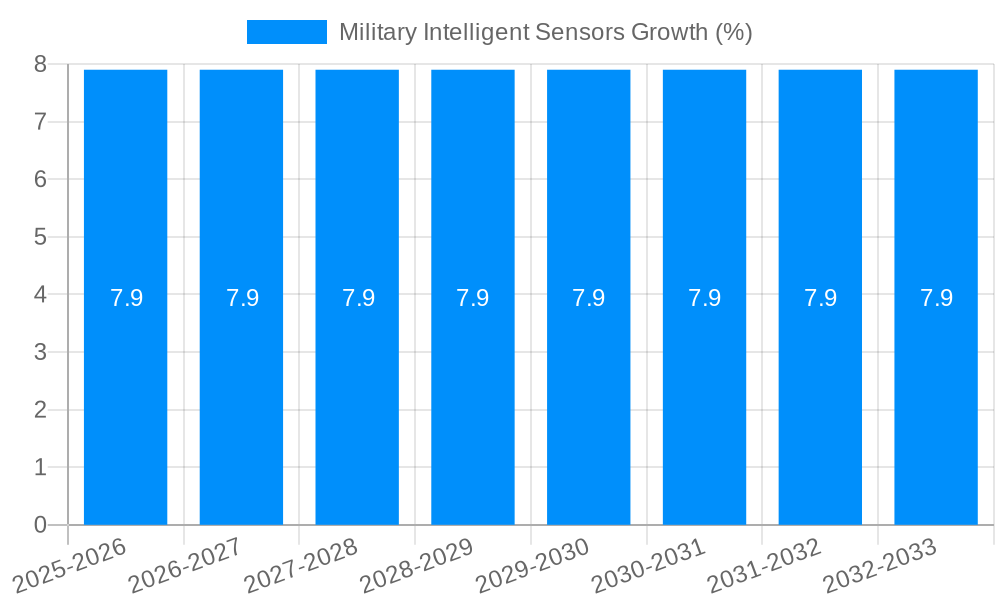

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Intelligent Sensors?

The projected CAGR is approximately 7.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Military Intelligent Sensors

Military Intelligent SensorsMilitary Intelligent Sensors by Type (Pressure Sensor, Temperature Sensor, Lidar Sensor, Accelerometer, Vibration Sensor, Other), by Application (Communication, Navigation, Surveillance And Reconnaissance, Electronic Warfare, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

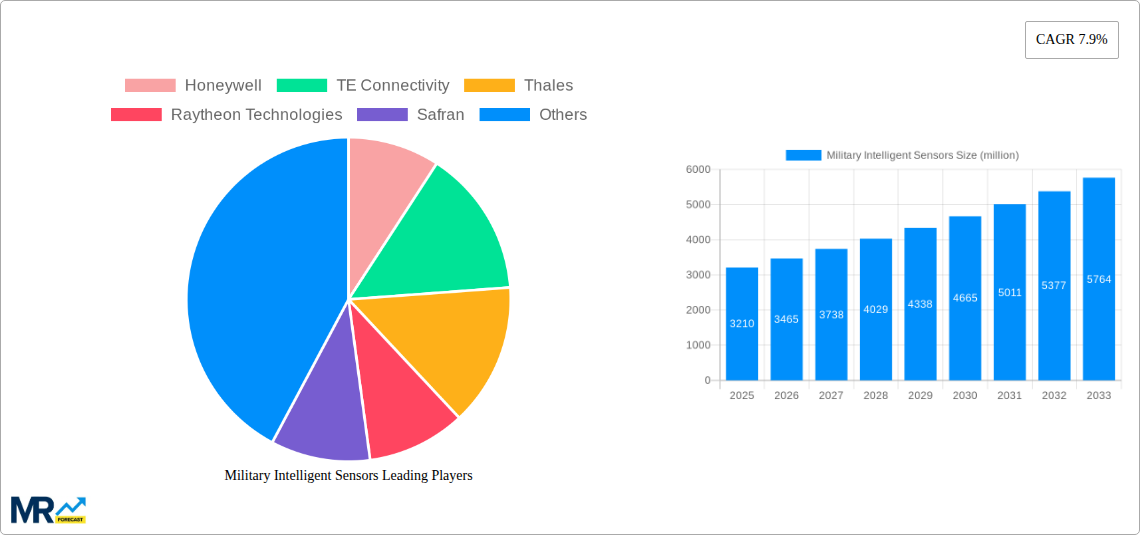

The global Military Intelligent Sensors market is projected to experience robust growth, with a current market size estimated at $3210 million and a Compound Annual Growth Rate (CAGR) of 7.9% anticipated between 2025 and 2033. This significant expansion is propelled by a confluence of factors, primarily the increasing demand for advanced surveillance and reconnaissance capabilities across global defense forces. Nations are investing heavily in cutting-edge sensor technologies to enhance battlefield awareness, improve target identification, and gain a strategic advantage. The escalating geopolitical tensions and the rise of asymmetric warfare further necessitate the deployment of sophisticated intelligent sensors that can operate effectively in complex and dynamic environments. Furthermore, the integration of artificial intelligence and machine learning into sensor systems is a key trend, enabling real-time data analysis, predictive maintenance, and autonomous decision-making, thereby boosting the market's upward trajectory.

Key drivers for this market growth include the persistent need for enhanced situational awareness, the development of next-generation military platforms, and the relentless pursuit of technological superiority by leading defense powers. The market is segmented into various sensor types, with Pressure Sensors, Temperature Sensors, Lidar Sensors, Accelerometers, and Vibration Sensors playing crucial roles in diverse military applications such as communication, navigation, surveillance, reconnaissance, and electronic warfare. Major industry players like Honeywell, TE Connectivity, Thales, and Raytheon Technologies are actively engaged in research and development, introducing innovative solutions that cater to the evolving defense landscape. While growth is strong, potential restraints may emerge from stringent regulatory frameworks, budget constraints in certain regions, and the high cost associated with the development and integration of advanced sensor technologies. However, the overarching strategic imperative for enhanced defense capabilities ensures a positive outlook for the military intelligent sensors market.

Here's a unique report description on Military Intelligent Sensors, incorporating your requirements:

XXX: The global military intelligent sensors market is poised for substantial expansion, projected to reach a valuation exceeding $15,000 million by the close of the forecast period in 2033. This robust growth is underpinned by a confluence of factors, including escalating geopolitical tensions, the imperative for enhanced situational awareness, and the relentless pursuit of technological superiority by defense forces worldwide. The historical period from 2019 to 2024 witnessed a steady upward trajectory, fueled by initial investments in advanced sensor integration for existing platforms and emerging defense programs. The base year of 2025 serves as a critical inflection point, with the market expected to solidify its growth momentum, driven by the increasing adoption of artificial intelligence and machine learning capabilities within sensor systems. This evolution is transforming raw data into actionable intelligence, enabling faster decision-making and more effective mission execution.

The surge in demand is particularly pronounced in applications necessitating high-fidelity data acquisition and real-time analysis. Pressure sensors, crucial for monitoring environmental conditions and platform integrity, alongside temperature sensors, vital for optimizing performance and preventing system failures, are experiencing consistent demand. However, the most dynamic growth is anticipated in the realm of Lidar sensors and accelerometers. Lidar's increasing utility in advanced reconnaissance, target identification, and autonomous navigation systems is a significant driver. Similarly, accelerometers, indispensable for inertial navigation, stabilization, and shock detection, are integral to modern military hardware. The market's trajectory indicates a significant shift towards sophisticated, multi-functional sensor suites that offer enhanced precision, reduced size, weight, and power (SWaP) characteristics, and improved resilience in harsh operating environments. This upward trend is further amplified by significant governmental investments in modernization programs and the development of next-generation defense capabilities. The estimated market value for 2025 stands at approximately $7,000 million, with a projected compound annual growth rate (CAGR) of roughly 10% during the forecast period.

The military intelligent sensors market is experiencing a powerful surge propelled by several interconnected driving forces. Foremost among these is the escalating global security landscape, characterized by an increase in asymmetric warfare, territorial disputes, and the proliferation of advanced weaponry. This necessitates a continuous upgrade in military capabilities, with intelligent sensors playing a pivotal role in enhancing situational awareness and providing a decisive battlefield advantage. The growing emphasis on network-centric warfare and the concept of the "internet of military things" (IoMT) are further fueling demand. These paradigms rely heavily on a robust and interconnected network of sensors to collect, transmit, and analyze vast amounts of data in real-time, enabling seamless communication and coordinated operations.

Furthermore, the relentless pace of technological innovation is a significant catalyst. Advancements in materials science, miniaturization, and data processing capabilities are leading to the development of smaller, lighter, more power-efficient, and more sophisticated intelligent sensors. This includes the integration of artificial intelligence (AI) and machine learning (ML) algorithms directly into sensor systems, enabling them to perform advanced analytics, anomaly detection, and predictive maintenance autonomously. The demand for enhanced surveillance and reconnaissance (ISR) capabilities, driven by the need for persistent monitoring and early warning, is another major impetus. Intelligent sensors are crucial for gathering critical intelligence on enemy movements, capabilities, and intentions across various domains, including air, land, and sea. Finally, the modernization efforts undertaken by major defense powers to replace aging equipment with cutting-edge technologies are directly translating into increased procurement of advanced sensor systems.

Despite the robust growth prospects, the military intelligent sensors market faces several significant challenges and restraints that could temper its expansion. A primary concern is the high cost of research and development (R&D) associated with cutting-edge sensor technologies. Developing highly specialized and resilient sensors, often incorporating advanced materials and complex algorithms, requires substantial financial investment, which can be a barrier for smaller companies and may lead to higher unit costs for defense procurement agencies. Furthermore, stringent testing and validation requirements in the defense sector add considerable time and expense to the product lifecycle. Military-grade sensors must meet exceptionally high standards for reliability, accuracy, and performance in extreme environments, demanding rigorous and often lengthy testing procedures before deployment.

The interoperability and integration challenges with existing legacy systems also pose a significant restraint. Many defense forces operate a mix of older and newer equipment, and integrating advanced intelligent sensors seamlessly with these legacy platforms can be complex and costly, requiring significant software and hardware modifications. Supply chain vulnerabilities and geopolitical disruptions can also impact the availability of critical raw materials and specialized components, potentially leading to production delays and price fluctuations. The evolving threat landscape and rapid obsolescence of technology necessitate continuous innovation, but also create a challenge in ensuring that deployed sensor systems remain relevant and effective against emerging threats, requiring ongoing upgrades and replacements. Lastly, cybersecurity concerns are paramount; the sensitive data collected by military intelligent sensors is a prime target for adversaries, necessitating robust cybersecurity measures, which add to development and operational costs.

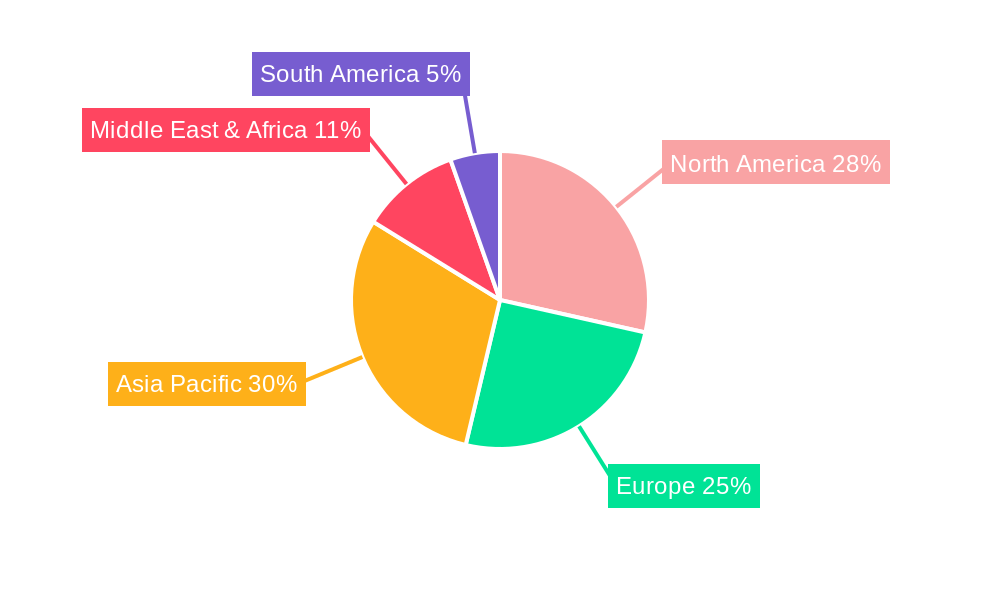

The North America region, primarily driven by the United States, is projected to maintain its dominance in the global military intelligent sensors market. This leadership is attributed to substantial and sustained defense spending, a strong emphasis on technological superiority, and the presence of leading defense contractors and research institutions. The US military's continuous pursuit of advanced ISR capabilities, coupled with significant investments in next-generation platforms and modernization programs, creates an insatiable demand for sophisticated sensor solutions. Countries like Canada and Mexico also contribute to the regional market, albeit to a lesser extent.

Within this dominant region, the Surveillance and Reconnaissance (ISR) application segment is expected to be the primary driver of market growth. This segment is inherently reliant on a diverse array of intelligent sensors to gather critical intelligence, monitor vast territories, and provide real-time situational awareness across air, land, and maritime domains. The increasing complexity of modern warfare, characterized by asymmetric threats and the need for persistent monitoring, has amplified the demand for advanced ISR technologies.

Within the ISR application segment, Lidar Sensors are anticipated to witness exceptional growth and potentially lead the market in terms of value and adoption rate. The inherent capabilities of Lidar in providing high-resolution 3D mapping, precise distance measurements, object detection and identification, and terrain analysis make it indispensable for advanced ISR missions. This includes applications such as:

Beyond Lidar, Accelerometers will also play a crucial role within the ISR segment and the broader market. Their application in inertial navigation systems is fundamental for maintaining platform orientation and position, especially in GPS-denied environments, which is critical for reconnaissance flights and long-duration surveillance. Furthermore, accelerometers are vital for detecting vibrations and shocks, enabling predictive maintenance for sensitive sensor equipment and ensuring the integrity of platforms operating in harsh conditions. The continued integration of these sensors into advanced ISR platforms, coupled with ongoing technological advancements that enhance their performance and reduce their SWaP, solidifies the dominance of the ISR application segment and highlights the critical role of Lidar and Accelerometers within it. The combined market value for military intelligent sensors in North America is estimated to exceed $6,000 million by 2025.

The military intelligent sensors industry is propelled by several powerful growth catalysts. The increasing demand for enhanced situational awareness and real-time intelligence across all operational domains is a primary driver. Furthermore, the relentless pace of technological innovation, particularly in AI and machine learning integration, is enabling sensors to perform more sophisticated analyses, leading to smarter and more autonomous systems. The ongoing modernization programs by defense forces worldwide, aimed at upgrading existing platforms and developing next-generation capabilities, directly translates into increased procurement of advanced sensor solutions. The expanding role of unmanned systems in military operations, from reconnaissance to logistics, further fuels the need for highly reliable and intelligent sensors.

This comprehensive report delves into the intricate dynamics of the military intelligent sensors market, providing an in-depth analysis of its trajectory from 2019 to 2033. It meticulously examines the market size, growth rates, and key trends, with a specific focus on the estimated market value of $7,000 million in 2025, projected to surpass $15,000 million by 2033. The report offers a granular breakdown of market segmentation across sensor types (Pressure, Temperature, Lidar, Accelerometer, Vibration, Other) and applications (Communication, Navigation, Surveillance And Reconnaissance, Electronic Warfare, Other). It identifies the key drivers propelling market expansion, such as the escalating geopolitical landscape and the drive for technological superiority, alongside significant challenges like high R&D costs and integration complexities. Furthermore, the report highlights the dominant regions and segments, with a particular emphasis on North America and the Surveillance and Reconnaissance (ISR) application, driven by advancements in Lidar and Accelerometer technologies. The report also profiles leading industry players and chronicles significant developmental milestones.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.9%.

Key companies in the market include Honeywell, TE Connectivity, Thales, Raytheon Technologies, Safran, Esterline, Curtiss-Wright, Kongsberg Gruppen, BAE Systems, Aerospace Electronics, CETC, Meggitt, Eaton, Sensata Technologies, Gaohua Technology.

The market segments include Type, Application.

The market size is estimated to be USD 3210 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Military Intelligent Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Military Intelligent Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.