1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Duct and Tube Bundle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Micro Duct and Tube Bundle

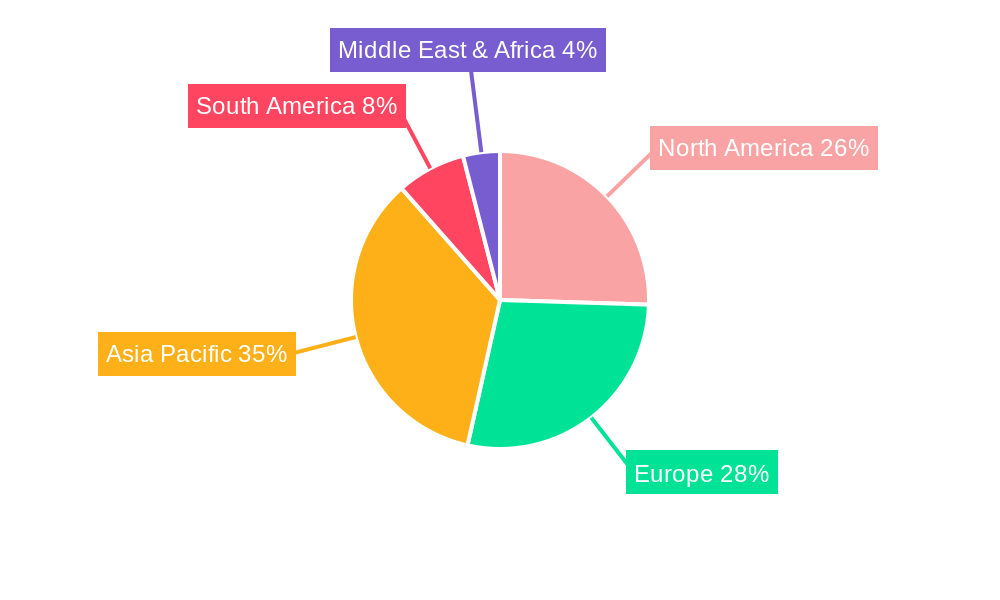

Micro Duct and Tube BundleMicro Duct and Tube Bundle by Application (Indoor, Outdoor, World Micro Duct and Tube Bundle Production ), by Type (Direct Install Type, Direct Burial Type, World Micro Duct and Tube Bundle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

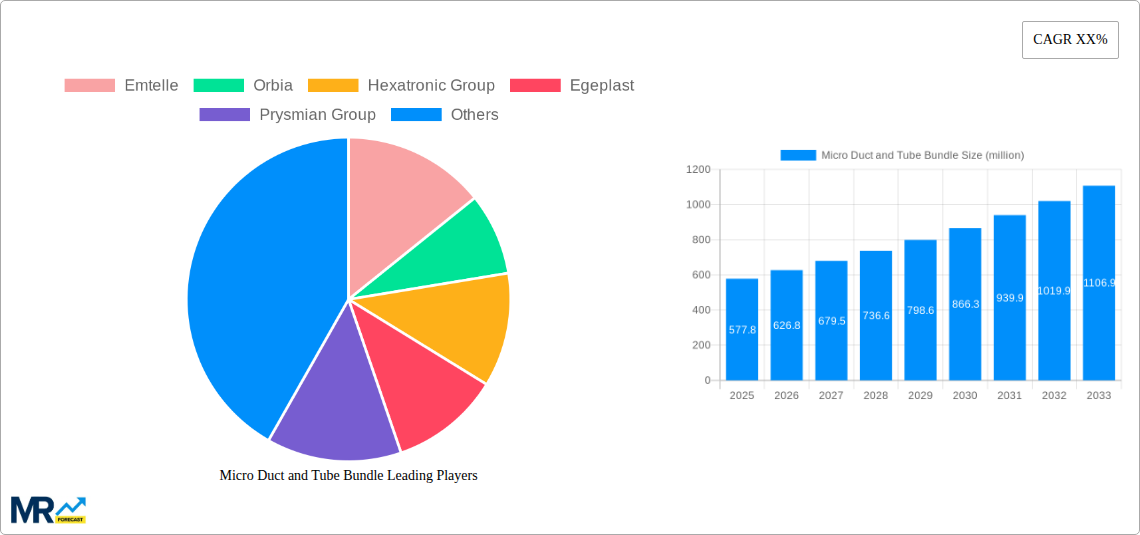

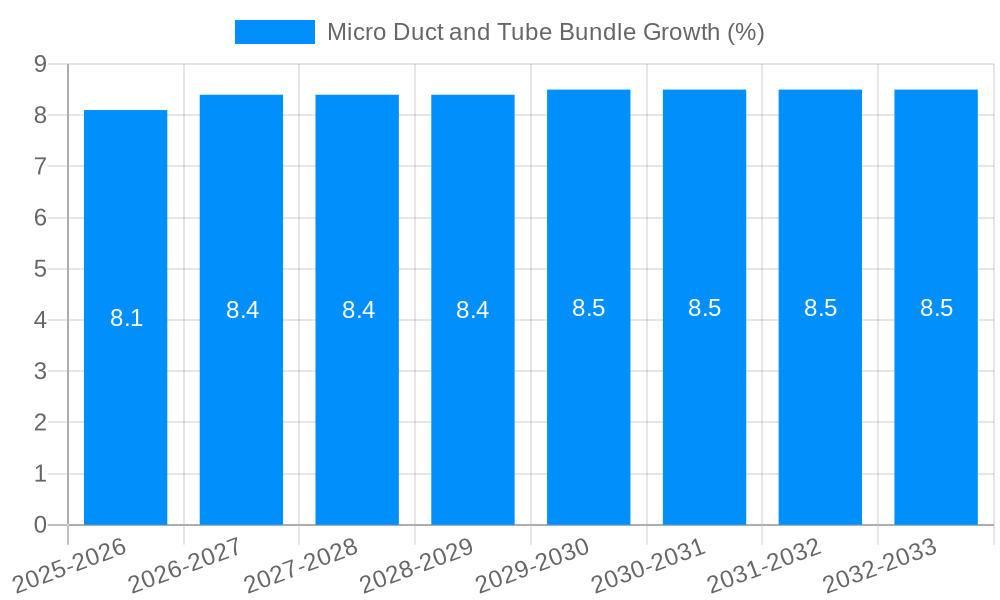

The global micro duct and tube bundle market is poised for substantial growth, projected to reach an estimated USD 577.8 million by 2025. This expansion is primarily driven by the escalating demand for high-speed internet connectivity, the rapid proliferation of fiber-to-the-home (FTTH) deployments, and the increasing investments in telecommunication infrastructure worldwide. The ongoing digital transformation across various sectors, including smart cities, enterprise networks, and 5G network expansion, necessitates robust and efficient fiber optic cabling solutions, making micro duct and tube bundles an indispensable component. Innovations in installation technologies, such as air-blowing and micro-trenching, are further fueling market adoption by offering cost-effective and less disruptive deployment methods, especially in densely populated urban areas and challenging terrains. The market's trajectory indicates a significant Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, underscoring its bright future.

Segmentation analysis reveals that the "Indoor" application segment is expected to witness robust growth due to the increasing fiber optic penetration within buildings and data centers. Simultaneously, the "Outdoor" segment, vital for backbone networks and last-mile connectivity, will continue to be a dominant force, supported by extensive infrastructure development projects. In terms of installation type, "Direct Install Type" solutions are gaining traction for their ease of deployment, while "Direct Burial Type" remains crucial for long-haul and underground fiber networks. Key industry players like Emtelle, Orbia, and Prysmian Group are actively investing in research and development to offer advanced and sustainable micro duct and tube bundle solutions, further solidifying market leadership and driving competitive innovation. The market's growth is underpinned by a strong need for future-proof broadband infrastructure, capable of supporting the ever-increasing data demands of the digital age.

Here is a unique report description on Micro Duct and Tube Bundles, incorporating your specified requirements:

The global micro duct and tube bundle market is poised for significant expansion, driven by the insatiable demand for high-speed internet connectivity and the relentless proliferation of fiber optic networks. Our comprehensive analysis, covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, reveals a dynamic landscape characterized by technological advancements and evolving deployment strategies. The estimated market size for micro ducts and tube bundles is projected to reach $7.8 billion in 2025, showcasing its substantial economic relevance. This growth trajectory is underpinned by the increasing deployment of Fiber-to-the-X (FTTx) architectures, including Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), and Fiber-to-the-Premises (FTTP). These advanced network deployments necessitate efficient and scalable solutions for fiber optic cable installation, which micro duct and tube bundles expertly provide. The technology's ability to house multiple fiber optic cables within a single, protected conduit, while allowing for future expansion and upgrades without significant civil works, makes it an indispensable component for telecommunications infrastructure.

Furthermore, the market is witnessing a pronounced shift towards higher density and specialized micro duct solutions. Innovations in material science are leading to the development of more robust, lightweight, and cost-effective micro duct products, enhancing their appeal across diverse applications. The growing adoption of aerial and direct burial installation methods, particularly in rural and suburban areas where trenching can be prohibitive, further fuels market expansion. We project the global market to surge to an impressive $14.2 billion by 2033, indicating a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This upward trend is a testament to the critical role micro duct and tube bundles play in enabling the digital transformation initiatives sweeping across industries and households worldwide. The base year of 2025 serves as a crucial benchmark, with current market conditions and immediate growth drivers being thoroughly assessed to inform robust future projections. Our study delves into the intricate interplay of technological innovation, infrastructure development, and market demand, offering invaluable insights for stakeholders seeking to capitalize on this burgeoning market. The historical data from 2019-2024 provides essential context, highlighting the market's evolution and the foundational trends that have shaped its current standing.

The micro duct and tube bundle market is experiencing robust growth, propelled by an array of powerful driving forces that are fundamentally reshaping telecommunications infrastructure deployment. Foremost among these is the escalating global demand for enhanced broadband speeds and increased network capacity. As data consumption continues to soar, fueled by video streaming, cloud computing, online gaming, and the burgeoning Internet of Things (IoT), telecommunication providers are under immense pressure to upgrade their networks. Micro ducts offer an efficient and cost-effective method for expanding fiber optic networks, allowing for the blowing or pulling of additional fibers without the need for extensive and disruptive civil engineering work. This capability is paramount for operators aiming to achieve widespread Fiber-to-the-Home (FTTH) penetration, a key objective for governments and service providers aiming to bridge the digital divide and foster economic growth.

Another significant driver is the continuous technological innovation in fiber optic cable design and deployment techniques. The development of smaller, higher-density micro ducts and multi-fiber bundles, coupled with advancements in air-blowing and micro-trenching technologies, has made the installation process faster, less intrusive, and more economical. This innovation directly addresses the need for rapid network deployment in densely populated urban areas as well as challenging terrains. Furthermore, the increasing focus on future-proofing infrastructure plays a crucial role. Micro ducts provide a flexible and scalable solution, allowing for the easy insertion of additional fiber optic cables as network demands evolve. This "deploy once, upgrade as needed" strategy minimizes long-term operational costs and disruption, making it an attractive proposition for network operators. The market is also benefiting from supportive government initiatives and investments aimed at expanding broadband access, particularly in underserved rural and remote areas. These policies often incentivize the adoption of efficient deployment solutions like micro ducts, further accelerating market penetration.

Despite the overwhelmingly positive growth trajectory, the micro duct and tube bundle market is not without its challenges and restraints, which warrant careful consideration by industry stakeholders. One of the primary hurdles is the initial capital investment required for specialized installation equipment, such as air-blowing machines and micro-trenching tools. While these investments lead to long-term cost savings, the upfront expenditure can be a deterrent for smaller operators or in regions with limited financial resources. This can slow down the widespread adoption of micro duct technology, especially in emerging markets where capital is often constrained.

Another significant challenge revolves around standardization and interoperability. While progress has been made, variations in micro duct dimensions, materials, and connector types across different manufacturers can sometimes lead to compatibility issues. This can complicate project planning and execution, requiring careful selection of components and potentially limiting the choice of suppliers. Furthermore, the technical expertise required for efficient installation and management of micro duct systems can also act as a restraint. Improper installation techniques can lead to fiber damage, performance degradation, and increased maintenance costs. Training and upskilling the workforce to handle these advanced deployment methods is an ongoing necessity. Environmental factors, such as extreme temperatures, UV exposure, and rodent damage, can also pose challenges, requiring the use of specialized materials and protective measures, which can add to the overall cost. Finally, in certain established markets, the presence of existing, albeit older, infrastructure can create inertia, making it more challenging to displace traditional cabling methods with newer micro duct solutions, particularly for less critical or immediate upgrade projects.

The global micro duct and tube bundle market is a dynamic landscape where specific regions and application segments are exhibiting exceptional growth and market dominance. The Outdoor application segment, encompassing both Direct Install Type and Direct Burial Type deployments, is projected to be the primary revenue generator and growth engine for the market. This dominance is fueled by the widespread need to expand fiber optic networks beyond central offices and data centers into residential areas, businesses, and remote locations.

Dominant Regions/Countries:

Dominant Segments:

The interplay of these dominant regions and segments highlights the critical role of outdoor network expansion, enabled by efficient and scalable micro duct and tube bundle solutions, in shaping the future of global connectivity.

The micro duct and tube bundle industry is experiencing significant growth, propelled by several key catalysts. The accelerating demand for high-speed broadband and 5G services is a primary driver, pushing telecommunication companies to expand their fiber optic networks aggressively. Secondly, government initiatives and investments focused on bridging the digital divide and enhancing digital infrastructure are providing substantial impetus. Furthermore, technological advancements in micro duct manufacturing and fiber optic installation techniques, such as air-blowing and micro-trenching, are making deployment faster, more cost-effective, and less disruptive. The increasing adoption of IoT devices and the rise of data-intensive applications are also contributing to the need for robust and scalable fiber optic networks, further fueling the demand for micro duct solutions.

This report offers a granular and forward-looking analysis of the global micro duct and tube bundle market, covering the period from 2019 to 2033. With a base year of 2025, the study provides in-depth market sizing, segmentation, and forecasting, projecting the market to reach an estimated $14.2 billion by 2033. The report meticulously examines key market trends, including the increasing adoption of higher-density solutions and innovative deployment techniques. It delves into the primary driving forces behind market expansion, such as the escalating demand for high-speed internet and 5G connectivity. Simultaneously, the report critically assesses the challenges and restraints impacting market growth, including initial capital investments and standardization issues. A significant portion of the analysis is dedicated to identifying the key regions and segments poised for dominance, with a particular focus on the Outdoor application segment (Direct Install Type and Direct Burial Type) and the World Micro Duct and Tube Bundle Production landscape. The report also highlights the crucial growth catalysts and provides a comprehensive overview of the leading market players and their recent significant developments. This report is an indispensable resource for telecommunication operators, infrastructure providers, manufacturers, investors, and policymakers seeking a complete understanding of the micro duct and tube bundle market's present status and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Emtelle, Orbia, Hexatronic Group, Egeplast, Prysmian Group, Datwyler IT Infra, Clearfield, Spyra Primo, YOFC, Nestor Cables, Brand-Rex (Leviton), GM-Plast, KNET, SPUR, Belden PPC, Twentsche Kabelfabriek (TKF), Fibrain Group, Hebeish Group, Afripipes, .

The market segments include Application, Type.

The market size is estimated to be USD 577.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Micro Duct and Tube Bundle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Micro Duct and Tube Bundle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.