1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Lipstick Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Metal Lipstick Packaging

Metal Lipstick PackagingMetal Lipstick Packaging by Application (High-end Consumption, Ordinary Consumption, World Metal Lipstick Packaging Production ), by Type (Copper Material, Aluminum Material, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

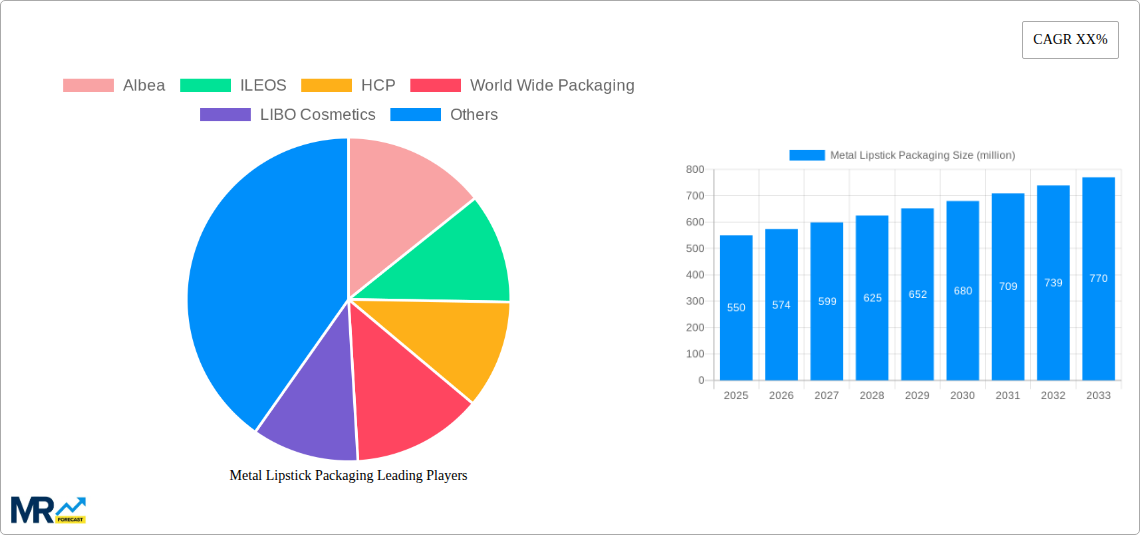

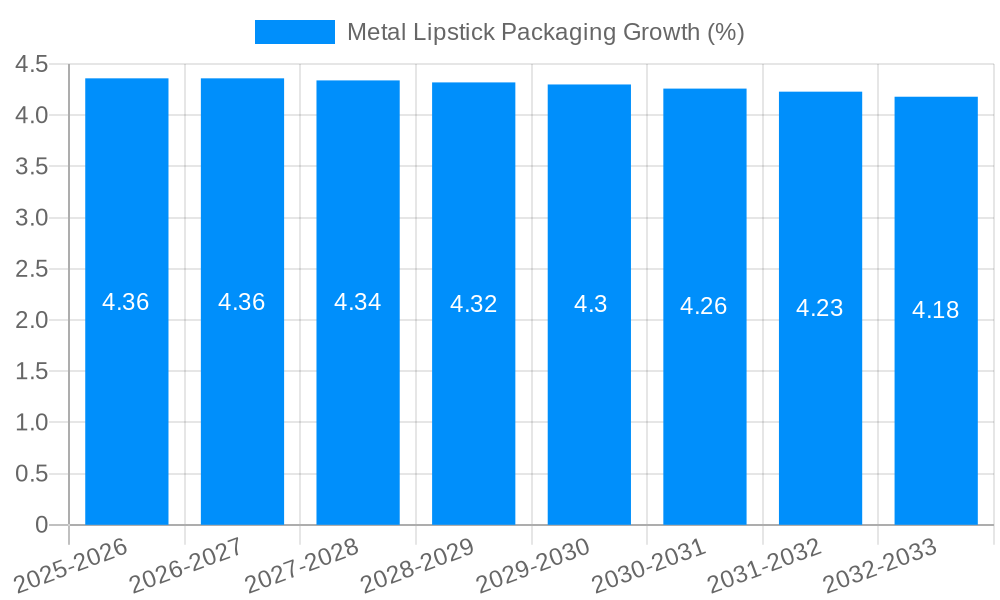

The global Metal Lipstick Packaging market is poised for significant expansion, driven by evolving consumer preferences for premium and sustainable cosmetic solutions. With an estimated market size of approximately USD 550 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of around 4.5% through 2033, the sector is demonstrating robust momentum. This growth is fueled by an increasing demand for high-end cosmetic products, where sophisticated packaging plays a crucial role in brand perception and consumer appeal. Manufacturers are increasingly adopting metal packaging for its luxurious feel, durability, and enhanced protection for formulations, directly contributing to its rising popularity among premium brands. Furthermore, the growing emphasis on eco-friendly and recyclable packaging options aligns perfectly with the inherent sustainability attributes of metal, acting as a powerful market driver. As consumers become more environmentally conscious, the preference for metal lipstick packaging over less sustainable alternatives is expected to surge, further propelling market growth.

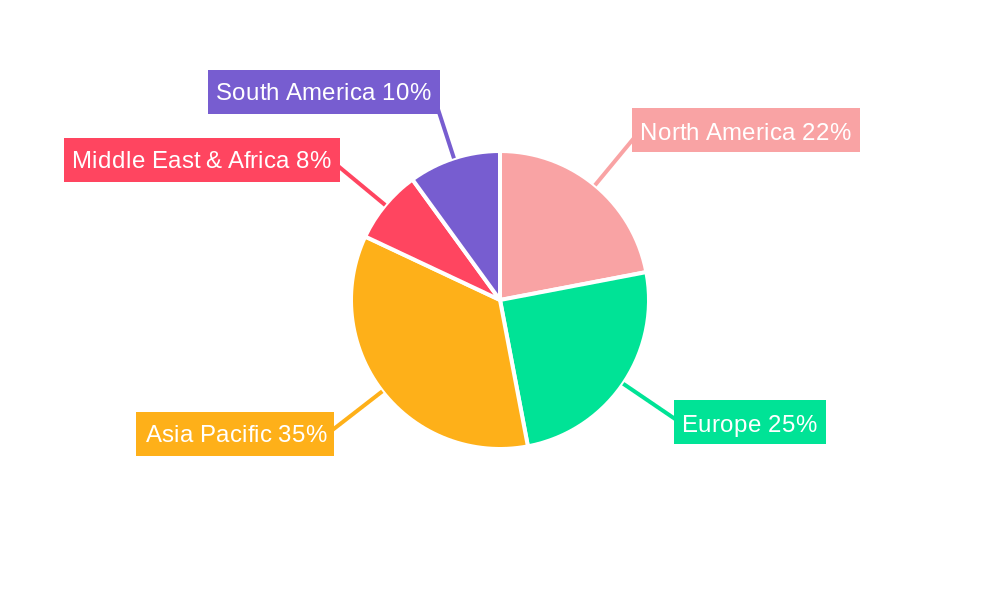

The market's expansion will be shaped by key trends such as innovation in metal finishing and decorative techniques, allowing for greater customization and aesthetic appeal. Aluminum and copper-based packaging are expected to dominate the market due to their superior malleability, corrosion resistance, and visual premiumness. While the high-end consumption segment will continue to lead, there's a discernible trend towards incorporating metal elements into more accessible cosmetic lines to elevate brand image. However, the market also faces certain restraints, including the higher initial manufacturing costs compared to plastic alternatives and potential fluctuations in raw material prices. Despite these challenges, the long-term outlook remains exceptionally positive, with Asia Pacific, particularly China and India, anticipated to emerge as a major growth hub due to the burgeoning middle class and increasing disposable incomes, alongside established markets like North America and Europe that continue to drive demand for luxury beauty products.

Here's a unique report description on Metal Lipstick Packaging, incorporating the requested elements:

This comprehensive report delves into the intricate landscape of the global Metal Lipstick Packaging market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024 to a projected forecast extending to 2033, with a base and estimated year of 2025. We aim to equip stakeholders with actionable insights into market dynamics, growth drivers, challenges, and the competitive environment. The report meticulously quantifies market volumes in millions of units, offering a tangible understanding of production and consumption patterns.

The global Metal Lipstick Packaging market is experiencing a significant evolutionary phase, marked by a discernible shift towards premiumization and an increased emphasis on sustainability. During the study period (2019-2033), the High-end Consumption segment is poised for substantial growth, driven by evolving consumer preferences for luxury and perceived product quality. This trend is fueled by brands seeking to differentiate their premium offerings through sophisticated and durable packaging solutions that enhance the overall unboxing experience. Metal packaging, with its inherent elegance, tactile appeal, and robust nature, perfectly aligns with this demand. Furthermore, the growing awareness around environmental impact is subtly influencing material choices, leading to increased interest in recyclable and responsibly sourced metal options. While Ordinary Consumption continues to represent a significant volume, the growth potential is increasingly being channeled towards innovative and cost-effective metal solutions that can bridge the gap between affordability and a more elevated presentation. The market is observing a diversification of designs, incorporating intricate detailing, unique finishes, and ergonomic considerations to capture a wider consumer base. The increasing adoption of advanced manufacturing techniques is also playing a crucial role, enabling intricate designs and customization that were previously challenging to achieve with metal. From a material perspective, the dominance of Aluminum Material is expected to persist due to its lightweight, corrosion-resistant properties, and its inherent recyclability, making it an attractive choice for both brands and environmentally conscious consumers. However, the report also highlights the potential for resurgence in Copper Material for ultra-luxury and niche applications, where its distinct aesthetic and historical association with opulence can command a premium. The overall market is characterized by a dynamic interplay between aesthetic appeal, functional performance, and the evolving ethical considerations of packaging.

The ascent of the Metal Lipstick Packaging market is being propelled by a confluence of powerful factors. Foremost among these is the unyielding consumer desire for luxury and perceived quality, particularly within the High-end Consumption segment. Brands are leveraging the inherent elegance and durability of metal to create packaging that not only protects the product but also serves as a tactile statement of prestige. This elevates the consumer's perception of value and enhances the overall brand experience. Secondly, the increasing focus on sustainability, albeit still in its nascent stages for some metal applications, is becoming a significant driver. As consumers become more environmentally aware, the recyclability and longevity of metal packaging offer a compelling alternative to less sustainable materials. The industry is responding by investing in research and development for more eco-friendly production processes and exploring recycled metal content. Thirdly, the aesthetic versatility of metal allows for intricate designs, unique finishes, and a premium feel that plastic alternatives often struggle to replicate. This allows brands to create highly differentiated and memorable products on crowded retail shelves. Finally, advancements in manufacturing technologies are making metal packaging more accessible and cost-effective, opening up new avenues for its adoption across a broader spectrum of the market, even encroaching on what was traditionally the domain of plastic packaging.

Despite its burgeoning popularity, the Metal Lipstick Packaging market is not without its hurdles. A primary challenge lies in the cost of production compared to conventional plastic alternatives. The inherent expense of raw materials and the more complex manufacturing processes associated with metal can translate to higher unit costs, potentially limiting its widespread adoption, especially within the Ordinary Consumption segment. This price sensitivity can be a significant restraint for brands aiming for mass-market appeal. Furthermore, the weight of metal packaging can also be a concern, impacting shipping costs and potentially leading to higher carbon footprints during transportation if not mitigated by optimized logistics. Another significant challenge revolves around the design and manufacturing complexity. While metal offers aesthetic advantages, intricate designs or features like integrated applicators can require specialized tooling and expertise, which may not be readily available or cost-effective for all manufacturers. Consumer perception also plays a role; while metal is often associated with luxury, some consumers may perceive it as less hygienic or prone to scratching, requiring brands to actively address these concerns through design and communication. Finally, the dependency on specific raw material prices (e.g., aluminum, copper) can introduce volatility into the market, making long-term pricing strategies more challenging for both packaging manufacturers and their clients.

The global Metal Lipstick Packaging market is set to witness significant dominance from specific regions and segments, driven by a complex interplay of consumer demand, economic prosperity, and manufacturing capabilities.

Asia Pacific (APAC): This region is emerging as a powerhouse in the Metal Lipstick Packaging market, driven by several key factors.

North America and Europe: These established markets will continue to be significant contributors, primarily driven by the sustained demand for High-end Consumption products.

Dominant Segment: High-end Consumption: This segment is unequivocally set to dominate the Metal Lipstick Packaging market in terms of value and growth potential.

While Ordinary Consumption will continue to represent a substantial volume of units, its growth in the metal packaging sector will likely be more moderate and contingent on the development of more cost-effective metal solutions or the introduction of hybrid packaging models. The inherent cost advantage of plastic in this segment remains a significant barrier for widespread metal adoption.

The Aluminum Material segment is expected to lead in terms of production volume due to its favorable balance of cost, weight, recyclability, and aesthetic adaptability. While Copper Material will hold a niche for ultra-luxury, its overall market share in terms of volume will remain considerably smaller.

The Metal Lipstick Packaging industry is experiencing significant growth catalysts that are shaping its future. The escalating consumer demand for premium and luxurious cosmetic products is a primary driver, with metal packaging being the preferred choice for conveying prestige and quality. Furthermore, a growing global awareness regarding sustainability is nudging consumers and brands towards more durable and recyclable packaging options, with aluminum and other metals presenting viable alternatives. Technological advancements in metal forming and finishing are also making intricate and customized designs more accessible and cost-effective, enabling brands to create unique product identities.

This comprehensive report offers an exhaustive exploration of the Metal Lipstick Packaging market, dissecting its evolution from 2019 to 2033. It provides granular insights into market segmentation, including the dominant High-end Consumption segment and the material types like Aluminum Material, while also acknowledging the significance of Ordinary Consumption and Copper Material. The report meticulously analyzes the historical data (2019-2024) and projects future market trends through to 2033, with a clear focus on the base and estimated year of 2025. It goes beyond basic market sizing, delving into the underlying forces driving growth, potential challenges, and strategic opportunities for stakeholders. The detailed company profiles and significant developments listed offer a panoramic view of the competitive landscape and the industry's innovative trajectory, making it an indispensable resource for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Albea, ILEOS, HCP, World Wide Packaging, LIBO Cosmetics, Baoyu Plastic, RPC GROUP, The Packaging Company (TPC), COLLCAP PACKAGING LIMITED, GCC Packaging, IMS Packaging, Kindu Packing, SPC, Quadpack, Yuga, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Metal Lipstick Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Metal Lipstick Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.