1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal and Plastic Strapping?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Metal and Plastic Strapping

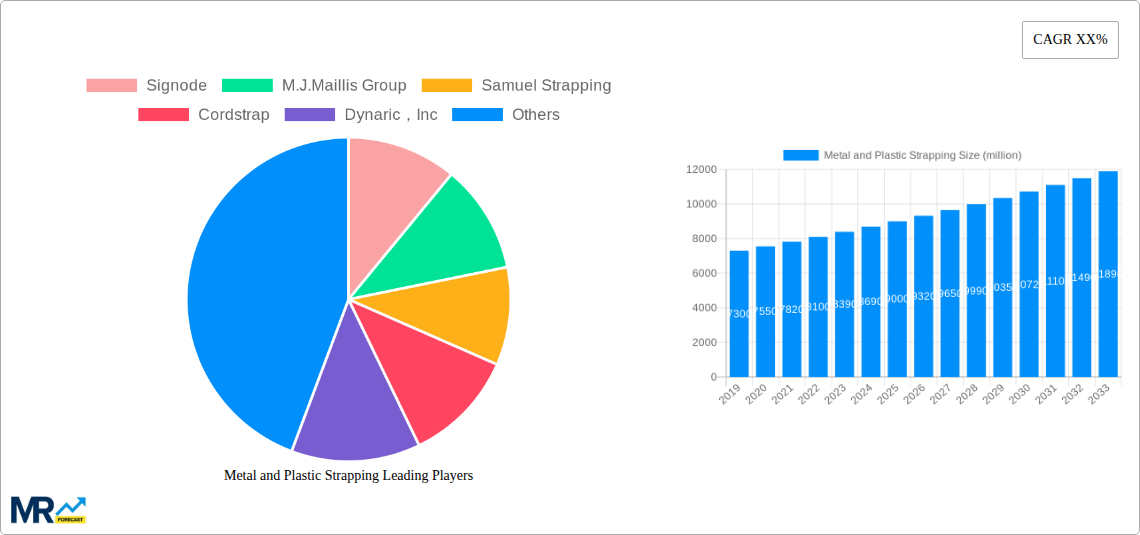

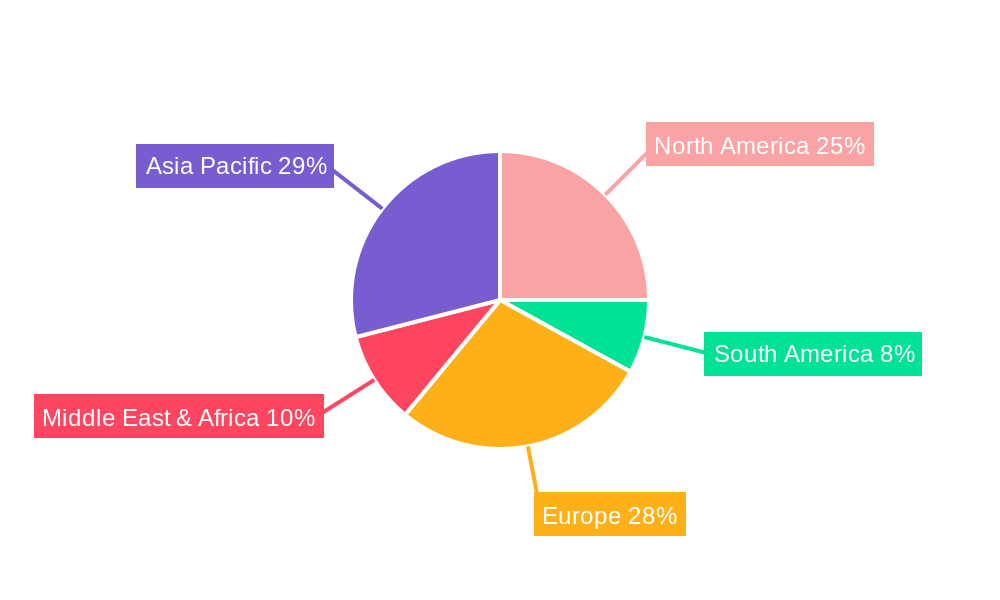

Metal and Plastic StrappingMetal and Plastic Strapping by Type (Metal Strapping, Plastic Strapping), by Application (Wood Industry, Paper Industry, Building Industry, Textile Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global metal and plastic strapping market is poised for significant growth, projected to reach an estimated USD 9,500 million by 2025, driven by a robust CAGR of 6.2% through 2033. This expansion is fueled by the increasing demand for secure and efficient packaging solutions across a multitude of industries. The metal strapping segment, historically dominant due to its superior strength and durability, continues to be a cornerstone for heavy-duty applications like securing large machinery, steel coils, and construction materials. Its resilience against extreme temperatures and physical stress ensures product integrity during transit and storage. Simultaneously, plastic strapping, particularly PET and PP, is gaining considerable traction owing to its cost-effectiveness, flexibility, and reduced risk of injury during handling. Innovations in recyclable and biodegradable plastic strapping are further enhancing its appeal, aligning with growing environmental consciousness and regulatory pressures for sustainable packaging. The wood, paper, building, and textile industries represent key application areas, each leveraging the distinct benefits of either metal or plastic strapping to optimize their supply chains.

The market's trajectory is further shaped by emerging trends such as the integration of smart strapping technologies, including RFID tagging for enhanced inventory management and tracking. Automation in strapping equipment is also a significant driver, leading to increased operational efficiency and reduced labor costs for businesses. However, the market faces certain restraints, including the volatility in raw material prices, especially for polymers and metals, which can impact profit margins. Furthermore, stringent environmental regulations concerning plastic waste and disposal may pose challenges for the plastic strapping segment, pushing manufacturers to invest in sustainable alternatives. Despite these hurdles, the overarching need for reliable product protection in global trade, coupled with advancements in material science and manufacturing processes, ensures a dynamic and expanding market landscape for both metal and plastic strapping solutions. The Asia Pacific region, with its burgeoning manufacturing sector and extensive trade activities, is expected to remain a dominant force in market consumption and production.

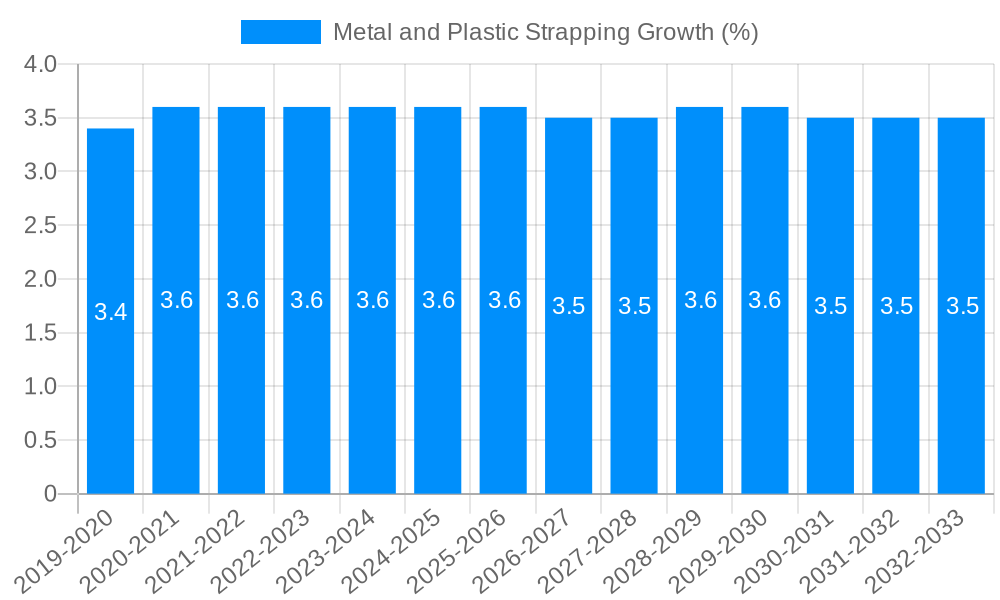

This report provides an in-depth analysis of the global metal and plastic strapping market, encompassing a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report delves into historical trends from 2019 to 2024, offering valuable insights into the market's trajectory.

XXX The global metal and plastic strapping market is poised for robust growth, driven by increasing industrialization, expanding e-commerce, and the growing demand for efficient and secure packaging solutions across diverse sectors. During the historical period (2019-2024), the market witnessed steady expansion, fueled by the need for robust load security in manufacturing, logistics, and transportation. The base year of 2025 represents a pivotal point, with significant advancements in material science and strapping technology contributing to enhanced performance and sustainability. The forecast period (2025-2033) is expected to see accelerated growth, propelled by a confluence of factors including the rise of automated packaging systems, increasing adoption of recycled and bio-based strapping materials, and the burgeoning demand from emerging economies.

Plastic strapping, particularly PET (Polyethylene Terephthalate) and PP (Polypropylene), has been a dominant force due to its cost-effectiveness, flexibility, and resistance to corrosion. PET strapping, in particular, has gained significant traction owing to its high tensile strength, comparable to steel strapping, making it a preferred choice for heavy-duty applications such as securing pallets of building materials, industrial goods, and consumer products. PP strapping, while offering less tensile strength, is highly flexible and resistant to splitting, making it ideal for lighter loads and applications where a more economical solution is required. The increasing focus on lightweighting in logistics to reduce transportation costs further favors the adoption of plastic strapping alternatives.

Metal strapping, primarily steel, continues to hold its ground in demanding applications where superior strength, rigidity, and tamper-evidence are paramount. High-tensile steel strapping is indispensable for securing extremely heavy or sharp-edged loads, such as large machinery, metal coils, and construction materials. Advancements in steel strapping include improved coatings to enhance corrosion resistance and the development of thinner yet stronger steel alloys, optimizing material usage and reducing weight. The market also observes a growing trend towards specialized metal strapping solutions tailored for specific industries, such as cord strapping (a composite material that combines the strength of steel with the flexibility of polyester) as an alternative to traditional metal strapping in certain applications. The growing emphasis on supply chain efficiency and damage reduction during transit is a key underlying trend shaping the demand for both metal and plastic strapping.

The metal and plastic strapping market is experiencing a significant uplift driven by several potent forces. A primary driver is the relentless expansion of the e-commerce sector. The sheer volume of goods being shipped globally necessitates robust and reliable packaging solutions to ensure products reach consumers in pristine condition. This surge in online retail translates directly into increased demand for strapping to secure parcels, consolidate shipments, and protect goods during transit. Furthermore, the ongoing industrialization and manufacturing growth, particularly in emerging economies, are creating a substantial need for efficient load containment and unitization. As factories ramp up production and distribution networks expand, the requirement for effective strapping to secure raw materials, finished goods, and semi-finished products becomes critical.

Another key propellant is the increasing awareness and adoption of supply chain optimization strategies. Businesses are actively seeking ways to minimize product damage, reduce pilferage, and improve handling efficiency. Strapping plays a pivotal role in achieving these objectives by providing a secure and tamper-evident seal for packages and pallets. The development of innovative strapping materials and technologies, offering improved tensile strength, durability, and ease of application, further fuels this growth. Innovations in automated strapping equipment are also contributing by enhancing operational efficiency and reducing labor costs for businesses, making strapping a more attractive and cost-effective solution for a wider range of applications. The global push for greater operational efficiency and reduced logistics costs is intrinsically linked to the demand for dependable strapping solutions.

Despite the positive growth trajectory, the metal and plastic strapping market is not without its challenges. One significant restraint is the increasing environmental scrutiny and the push towards sustainable packaging alternatives. While plastic strapping offers advantages in terms of weight and cost, its environmental impact, particularly concerning plastic waste, is a growing concern. This has led to increased regulatory pressure and a demand for more eco-friendly options, including biodegradable or easily recyclable materials. The cost volatility of raw materials, especially those derived from petroleum for plastic strapping and steel for metal strapping, can also pose a challenge. Fluctuations in global commodity prices can impact manufacturing costs and, consequently, the pricing of strapping products, potentially affecting market demand.

The capital investment required for advanced automated strapping machinery can be a barrier for smaller businesses or those in cost-sensitive sectors. While automation offers long-term benefits, the initial outlay might be prohibitive, limiting adoption. Furthermore, the availability of alternative packaging methods and materials, such as stretch wrap, shrink wrap, and advanced adhesive tapes, presents competition. Companies constantly evaluate the most cost-effective and efficient solution for their specific needs, and in some applications, these alternatives might be perceived as more suitable or economical than traditional strapping. The need for specialized training to operate certain strapping equipment and the potential for injury if not handled correctly can also act as minor deterrents in some scenarios, though these are largely mitigated by advancements in safety features and operational procedures.

The Plastic Strapping segment is anticipated to dominate the global metal and plastic strapping market, driven by its versatility, cost-effectiveness, and widespread adoption across numerous industries. Within the plastic strapping category, PET (Polyethylene Terephthalate) strapping is expected to witness particularly strong growth, owing to its superior tensile strength, high elongation, and excellent recovery properties, making it a viable alternative to steel strapping in many heavy-duty applications. This segment's dominance is further bolstered by the increasing demand from the Wood Industry and the Building Industry, where large and heavy items such as lumber, timber, bricks, tiles, and insulation materials require robust and secure bundling and palletizing.

Geographically, Asia-Pacific is projected to emerge as the leading region in the metal and plastic strapping market. This dominance is attributed to several factors, including the region's rapid industrialization, expanding manufacturing base, and the burgeoning e-commerce landscape. Countries like China, India, and Southeast Asian nations are witnessing significant growth in sectors that heavily rely on strapping for packaging and logistics. The massive production volumes in these countries, coupled with increasing investments in infrastructure and supply chain modernization, create a fertile ground for the widespread adoption of both metal and plastic strapping solutions.

Specifically focusing on the Wood Industry as a dominant application segment for plastic strapping, the sheer volume of timber and wood-based products produced and traded globally is immense. From raw lumber to finished furniture, wood products require secure strapping to prevent shifting during transportation and to maintain their structural integrity. PET strapping's resistance to moisture and UV radiation makes it particularly suitable for outdoor storage and transportation of wood products, further cementing its position. The Building Industry also presents a substantial demand. Large quantities of construction materials, including bricks, concrete blocks, pipes, and pre-fabricated components, are routinely strapped for safe transit to construction sites. The ability of plastic strapping, especially PET, to withstand significant tension and resist breakage under load makes it indispensable for these applications.

Furthermore, the Paper Industry also contributes significantly to the demand for plastic strapping, especially for securing large rolls of paper and corrugated cardboard products. The consistent and high-volume nature of the paper industry's output necessitates efficient and reliable strapping solutions to prevent damage and maintain roll integrity during storage and transport. While metal strapping will continue to hold a strong niche in highly demanding applications, the broader reach, cost-efficiency, and improving performance characteristics of plastic strapping, particularly PET, are set to propel its dominance in the overall market.

The metal and plastic strapping industry is experiencing significant growth catalysts, with the escalating e-commerce boom being a primary driver. The immense volume of goods shipped through online channels necessitates secure and reliable packaging, directly boosting demand for strapping solutions. Simultaneously, ongoing industrialization and manufacturing expansion, especially in emerging economies, are creating a sustained need for efficient load unitization and protection. Advancements in material science, leading to stronger, lighter, and more sustainable strapping materials like high-strength PET and bio-based plastics, are further fueling adoption and opening up new application possibilities. The development and integration of automated strapping equipment also act as a catalyst by enhancing operational efficiency and reducing labor costs for businesses.

This comprehensive report offers a holistic view of the global metal and plastic strapping market, meticulously analyzing its growth drivers, restraints, and future potential. The report delves into the intricate dynamics of key segments, such as the dominance of plastic strapping and its sub-segment PET strapping, and their pivotal roles in driving demand within industries like the Wood and Building sectors. It also highlights the significant geographical influence of the Asia-Pacific region, driven by its robust industrial and e-commerce growth. Furthermore, the report provides an exhaustive list of leading market players and significant industry developments, offering actionable insights for stakeholders to navigate this evolving landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Signode, M.J.Maillis Group, Samuel Strapping, Cordstrap, Dynaric,Inc, FROMM Group, Anshan Falan, Baosteel, Bhushan Steel, Youngsun, Messersì Packaging, Mosca, Scientex Berhad, Teufelberger, Linder, Granitol, TITAN Umreifungstechnik, MiDFIELD INDUSTRIES LTD, Brajesh Packaging, Polivektris, Strapack, Cyklop, Polychem, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Metal and Plastic Strapping," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Metal and Plastic Strapping, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.