1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Propellants?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Propellants

Medical PropellantsMedical Propellants by Type (HFC134a, HFC152a, HFC227ea, Other), by Application (Medical Aerosol, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

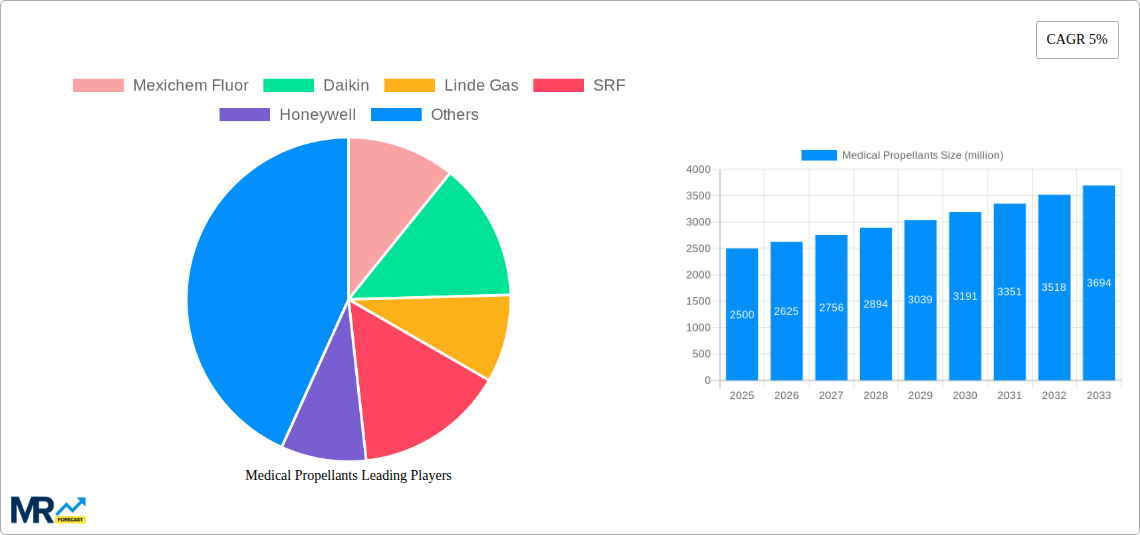

The global Medical Propellants market is poised for significant growth, estimated at USD 2,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5% over the forecast period of 2025-2033. This expansion is primarily driven by the increasing prevalence of respiratory diseases worldwide, coupled with a growing demand for advanced medical aerosol devices. The aging global population further fuels this demand, as older demographics are more susceptible to conditions requiring inhalant therapies. Innovations in propellant technology, focusing on reduced environmental impact and enhanced patient safety, are also key growth enablers. The market is expected to reach approximately USD 3,675 million by 2033, reflecting a robust upward trajectory.

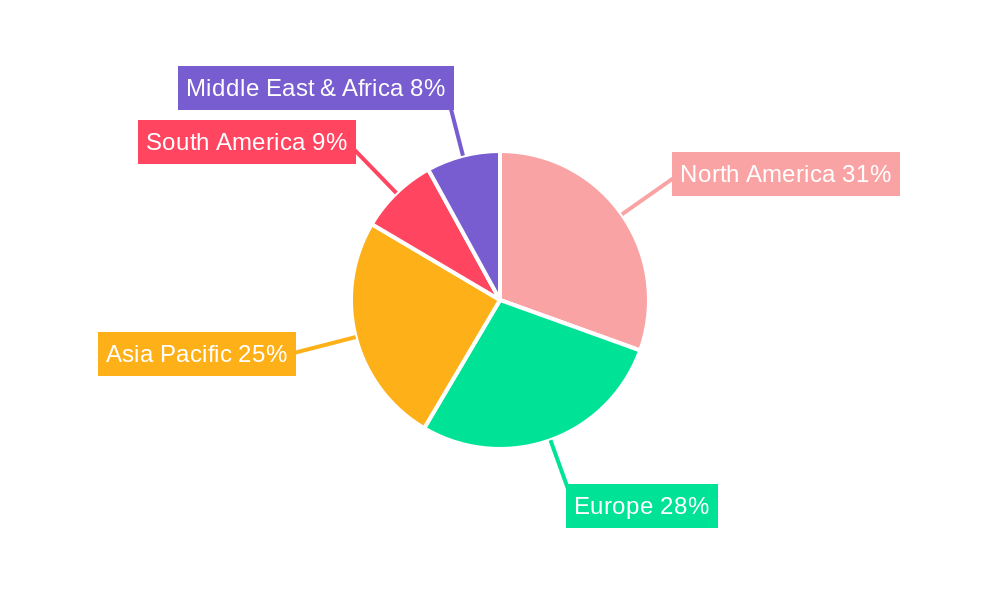

The market segmentation reveals a dynamic landscape. In terms of type, HFC134a is expected to dominate due to its established efficacy and widespread use in metered-dose inhalers (MDIs). However, there is a growing interest in next-generation propellants, such as HFC152a and HFC227ea, driven by regulatory pressures and environmental concerns regarding older propellant formulations. The Medical Aerosol segment is the primary application, encompassing MDIs and nebulizers, crucial for delivering therapeutic agents to the lungs. Geographically, North America and Europe currently lead the market, owing to well-established healthcare infrastructure and high patient awareness. However, the Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth due to expanding healthcare access, increasing disposable incomes, and a rising incidence of respiratory ailments.

This report offers a deep dive into the global Medical Propellants market, analyzing its trajectory from the historical period of 2019-2024 to a projected future extending to 2033. With 2025 designated as the base and estimated year, the study provides a robust framework for understanding market dynamics, key drivers, and future potential. The market is meticulously segmented by propellant type (HFC134a, HFC152a, HFC227ea, and Others) and application (Medical Aerosol and Other), allowing for granular insights into specific product demands. The report leverages extensive data, with market sizes expressed in millions of units, to quantify trends and forecast growth. Industry developments, crucial for understanding the evolving landscape, are also thoroughly examined. This comprehensive analysis aims to equip stakeholders with actionable intelligence for strategic decision-making within the dynamic medical propellants sector.

The global medical propellants market is on an upward trajectory, driven by a confluence of factors that underscore the critical role these substances play in modern healthcare delivery. During the historical period (2019-2024), the market exhibited steady growth, a trend that is projected to accelerate significantly. The estimated year of 2025 marks a pivotal point, with the market poised for substantial expansion in the subsequent forecast period of 2025-2033. A key trend is the increasing demand for metered-dose inhalers (MDIs), which are a primary application for medical propellants. The rising prevalence of respiratory diseases such as asthma and Chronic Obstructive Pulmonary Disease (COPD) globally directly fuels this demand. As populations age and urbanization continues, leading to increased exposure to environmental pollutants, the incidence of these conditions is expected to rise further. This surge in respiratory ailments translates into a consistent and growing need for effective drug delivery systems, with MDIs remaining a cornerstone of treatment.

Furthermore, the market is witnessing a gradual but significant shift in the types of propellants being utilized. While traditional Hydrofluorocarbons (HFCs) have long dominated, there is a growing awareness and regulatory push towards more environmentally sustainable alternatives. This is not to say that HFCs are disappearing; HFC134a and HFC227ea, in particular, continue to hold substantial market share due to their proven efficacy and established safety profiles in medical applications. However, research and development efforts are actively exploring and introducing newer generations of propellants with lower Global Warming Potential (GWP). This quest for sustainability, while a long-term trend, is beginning to influence procurement decisions and product development strategies. The "Other" category for propellants is therefore expected to see increased innovation and market penetration over the forecast period. The market's overall growth is also bolstered by advancements in drug formulation and device technology, which enable more efficient and targeted drug delivery, further solidifying the importance of reliable propellants. The robust growth projected for the medical aerosol segment is a testament to these interwoven trends, indicating a healthy and expanding market for medical propellants in the coming years.

The growth trajectory of the medical propellants market is propelled by several powerful underlying forces, chief among them being the escalating global burden of chronic respiratory diseases. Conditions like asthma and COPD are not only increasing in prevalence due to factors such as air pollution, lifestyle changes, and an aging global population, but they also require long-term management. Metered-dose inhalers (MDIs), which depend heavily on propellants for effective drug delivery, are the first-line treatment for many of these patients, making the demand for medical propellants intrinsically linked to the epidemiological trends of these diseases.

Beyond the direct impact of disease prevalence, advancements in pharmaceutical research and development play a crucial role. The continuous introduction of new inhaled medications and improved drug formulations necessitates the use of sophisticated delivery systems, with MDIs remaining a preferred choice for many therapeutic areas due to their portability, ease of use, and dose accuracy. Moreover, the increasing focus on patient convenience and adherence to treatment regimens further supports the demand for MDIs. As healthcare systems globally aim to improve patient outcomes and reduce healthcare costs associated with hospitalizations and emergency care for respiratory conditions, the adoption of home-based treatment solutions like MDIs is encouraged. This trend indirectly boosts the market for medical propellants. The inherent stability, efficacy, and well-established safety profiles of propellants like HFC134a and HFC227ea in medical applications ensure their continued widespread use, acting as a consistent driver for market expansion throughout the study period.

Despite the robust growth potential, the medical propellants market faces certain challenges and restraints that could temper its expansion. Perhaps the most significant ongoing challenge is the environmental scrutiny surrounding Hydrofluorocarbons (HFCs). Although medical-grade HFCs have stringent purity requirements and are used in relatively small quantities compared to industrial applications, they are still potent greenhouse gases. International regulations and agreements, such as the Kigali Amendment to the Montreal Protocol, are increasingly pushing for a phase-down of HFCs, which could eventually impact the availability and cost of certain medical propellants. While there are exemptions for essential medical uses, the long-term trend points towards a gradual transition away from high-GWP HFCs.

The development and adoption of alternative propellants or novel drug delivery systems present another restraint. While the transition for medical applications is slower than in other sectors due to rigorous testing and regulatory approvals required for patient safety, research into next-generation propellants with lower environmental impact and advanced inhaler technologies is ongoing. The high cost associated with research, development, and regulatory approval for new medical propellants and devices is also a significant barrier. Manufacturers must invest heavily to ensure that any new propellant meets the strict safety, efficacy, and compatibility standards for medical use, which can slow down market adoption. Furthermore, the availability and cost fluctuations of raw materials used in the production of propellants can impact market stability. While these challenges are present, the essential nature of medical propellants in treating critical conditions means that the market is more resilient than many other HFC-dependent industries, but these factors necessitate strategic adaptation and innovation from market players.

The global medical propellants market is characterized by distinct regional dynamics and segment dominance, with North America and Europe currently leading the charge, driven by established healthcare infrastructure, high disease prevalence, and strong regulatory frameworks that encourage advanced medical device adoption. However, the Asia-Pacific region is projected to exhibit the most significant growth over the forecast period (2025-2033), fueled by a rapidly expanding population, increasing disposable incomes, and a growing awareness and diagnosis of respiratory ailments. Countries like China and India, with their vast patient populations and developing healthcare systems, are becoming increasingly important markets.

Within the market segmentation, the Medical Aerosol application segment is undeniably the dominant force and is expected to continue its reign. This dominance is primarily attributed to the widespread use of metered-dose inhalers (MDIs) for treating prevalent respiratory conditions such as asthma and COPD.

In terms of propellant Type, HFC134a is anticipated to maintain its leading position throughout the study period, although HFC227ea also holds a significant share.

While HFC134a leads, HFC227ea also plays a crucial role, particularly in specific therapeutic applications where its properties offer an advantage. The "Other" category is expected to see growth as new, lower-GWP propellants gain traction and regulatory pressures on traditional HFCs intensify. However, the transition in this segment will be gradual due to the stringent regulatory pathway for medical applications. The interplay between these segments and their evolving market shares will be critical for stakeholders to monitor.

The medical propellants industry is poised for robust growth, driven by several key catalysts. Foremost among these is the escalating global prevalence of chronic respiratory diseases like asthma and COPD, necessitating continuous and reliable treatment solutions. This surge in demand for inhalable medications directly translates into increased consumption of medical propellants, particularly for metered-dose inhalers (MDIs). Furthermore, advancements in pharmaceutical technology are leading to the development of novel inhaled drugs and improved delivery devices, which in turn require sophisticated propellant systems. The increasing focus on patient convenience and adherence to treatment regimens also favors the use of portable and easy-to-use MDIs.

This report is designed to provide an exhaustive analysis of the medical propellants market, offering stakeholders a comprehensive understanding of its current state and future prospects. The study encompasses detailed historical data from 2019-2024 and extends to a projected forecast period of 2025-2033, with 2025 serving as the crucial base and estimated year. Market sizes are meticulously presented in millions of units, allowing for quantitative insights into trends and growth patterns. The report's segmentation by propellant type (HFC134a, HFC152a, HFC227ea, and Others) and application (Medical Aerosol and Other) provides a granular view of specific market dynamics. Furthermore, the inclusion of industry developments offers crucial context for understanding the evolving landscape. This comprehensive coverage ensures that all critical aspects of the medical propellants market are addressed, empowering informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Mexichem Fluor, Daikin, Linde Gas, SRF, Honeywell, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Propellants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Propellants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.