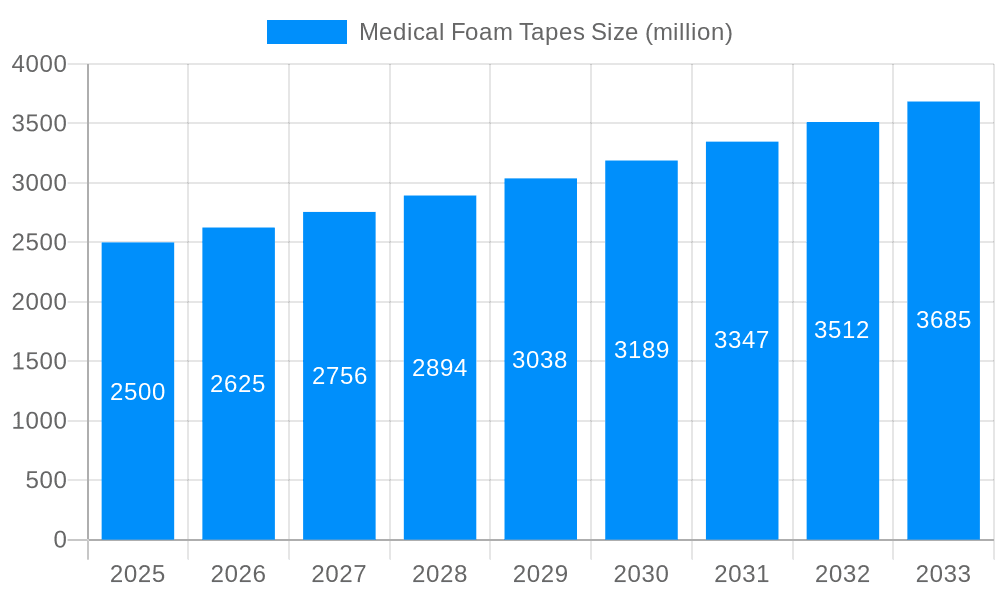

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Foam Tapes?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Foam Tapes

Medical Foam TapesMedical Foam Tapes by Type (Solvent-based, Water-based, Hot-melt-based), by Application (Hospital, Clinic, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

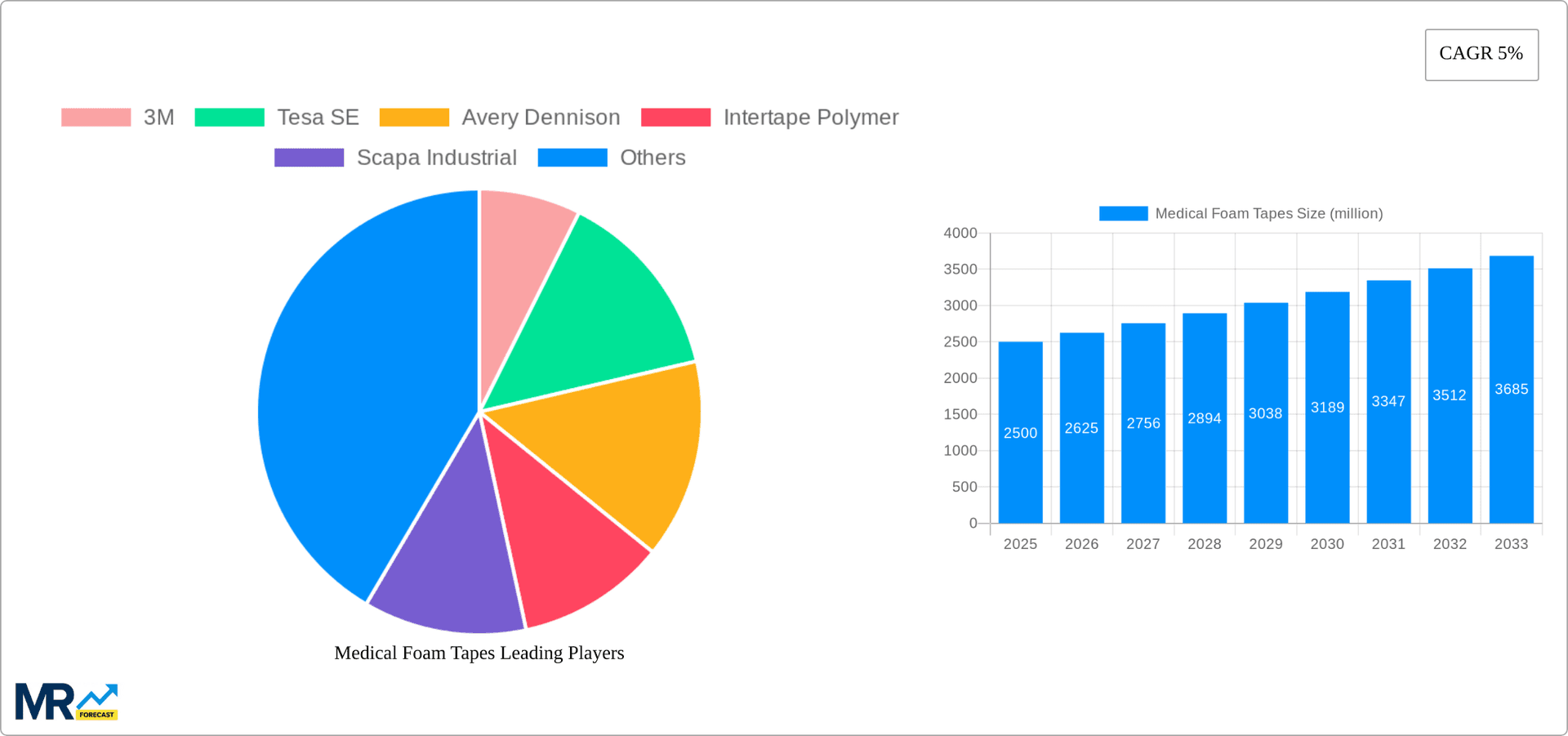

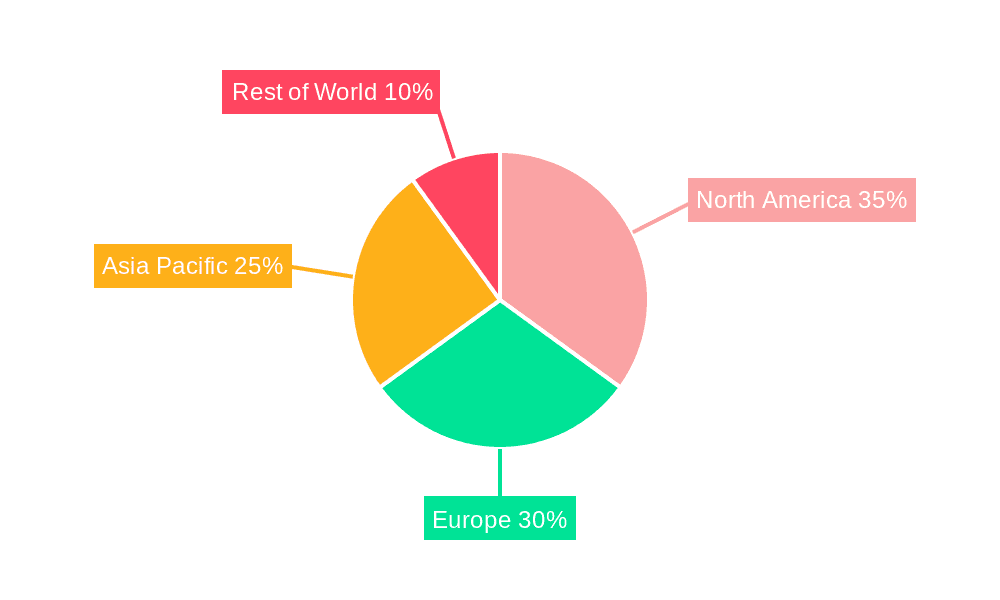

The global medical foam tape market is experiencing steady growth, driven by the increasing demand for advanced wound care solutions and minimally invasive surgical procedures. A 5% CAGR suggests a consistently expanding market, projected to reach a substantial size in the coming years. The market is segmented by type (solvent-based, water-based, hot-melt-based) and application (hospital, clinic, other). Solvent-based tapes currently dominate the market due to their strong adhesive properties and cost-effectiveness, but water-based and hot-melt options are gaining traction owing to their biocompatibility and ease of use in sensitive applications. The hospital segment holds the largest market share, reflecting the high volume of surgical procedures and wound care treatments performed in these settings. Key players like 3M, Tesa SE, and Avery Dennison are driving innovation through the development of hypoallergenic, antimicrobial, and high-performance medical tapes catering to the rising need for infection control and improved patient outcomes. Geographical distribution shows strong performance in North America and Europe, fueled by robust healthcare infrastructure and high per capita healthcare expenditure. However, emerging markets in Asia-Pacific are exhibiting significant growth potential due to rising disposable incomes and increasing healthcare awareness. The market faces challenges, including stringent regulatory approvals and the potential for price fluctuations in raw materials. Nevertheless, the long-term outlook remains positive, driven by continuous advancements in medical technology and the increasing prevalence of chronic diseases requiring advanced wound care management.

The competitive landscape is characterized by the presence of both established multinational corporations and regional players. Major players are focusing on strategic partnerships, mergers, and acquisitions to expand their market reach and product portfolios. Innovation is a key driver of competition, with companies constantly striving to develop new materials and technologies to improve the performance and functionality of medical foam tapes. This includes the development of tapes with enhanced breathability, reduced irritation, and improved adhesion. Future growth will be fueled by the rising adoption of minimally invasive surgical techniques and the increasing demand for comfortable and effective wound care solutions, particularly in the aging population. The market's continued growth trajectory suggests a strong opportunity for both established and emerging players to capitalize on the increasing demand for high-quality medical foam tapes. Further market expansion is expected in developing countries as healthcare infrastructure improves and access to advanced medical technologies increases.

The global medical foam tape market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing healthcare expenditure, a rising geriatric population requiring more frequent medical procedures, and advancements in adhesive technology, the market shows significant potential. The period between 2019 and 2024 (historical period) saw substantial growth, setting the stage for continued expansion in the forecast period (2025-2033). Key market insights reveal a shift towards specialized foam tapes offering enhanced features like hypoallergenic properties, improved breathability, and superior adhesion. This is particularly evident in the hospital and clinic segments, which are driving demand for high-performance tapes used in wound care, drug delivery systems, and medical device fixation. The estimated market value for 2025 shows a significant increase compared to previous years, indicating strong market momentum. Competition among key players like 3M, Tesa SE, and Avery Dennison is intensifying, leading to innovations in material science and manufacturing processes. The market is also witnessing the emergence of new players, particularly in regions with rapidly developing healthcare infrastructures. This competitive landscape is further fueled by increasing demand for cost-effective and readily available medical supplies. Furthermore, regulatory changes and evolving healthcare practices are influencing the type of foam tapes favored in different applications. The market's future trajectory is largely dependent on ongoing technological improvements, regulatory approvals, and the overall growth of the healthcare sector globally. The study period (2019-2033) encompasses both periods of growth and potential market shifts, making it crucial to understand these trends for effective strategic planning.

Several factors contribute to the growth of the medical foam tape market. Firstly, the aging global population is a significant driver. Elderly individuals often require more medical procedures and ongoing care, significantly increasing the demand for medical tapes used in wound dressings, securement of medical devices, and various other applications. Secondly, advancements in adhesive technology are leading to the development of superior medical foam tapes with enhanced properties like improved adhesion, breathability, and hypoallergenic qualities. These improvements enhance patient comfort and reduce the risk of skin irritation or allergic reactions, driving adoption in healthcare settings. Thirdly, the increasing prevalence of chronic diseases necessitates more frequent medical interventions and thus elevates the demand for medical tapes. The ongoing need for efficient and reliable medical devices and consumables fuels the market's expansion. Finally, rising healthcare expenditure globally, particularly in developing economies, provides financial support for the adoption of advanced medical supplies such as specialized foam tapes. The demand for reliable and effective medical tapes is directly correlated with the overall growth and modernization of healthcare systems worldwide.

Despite the positive growth outlook, the medical foam tape market faces certain challenges. Stringent regulatory requirements and compliance standards for medical devices and materials pose a hurdle for manufacturers. Meeting these standards often entails significant investment in research, development, and testing, impacting profitability. Furthermore, price sensitivity in certain market segments can constrain growth, especially in cost-conscious healthcare environments. Competition from alternative securement and fixation methods, such as clips or sutures, also presents a challenge to market expansion. Fluctuations in raw material prices, particularly those of adhesives and polymers, can also affect production costs and market pricing strategies. The increasing focus on sustainability and environmental concerns necessitates the development of eco-friendly and biodegradable options, adding another layer of complexity and cost to manufacturing. Finally, the market is susceptible to variations in healthcare spending and economic fluctuations, potentially impacting demand in certain regions or during specific periods.

Hospital Segment Dominance:

The hospital segment is projected to dominate the medical foam tape market throughout the forecast period (2025-2033). Hospitals represent the largest consumers of medical foam tapes due to the high volume of surgical procedures, wound care treatments, and ongoing patient needs for securement of medical devices. This segment's growth is significantly fueled by the increasing complexity of medical interventions and the demand for high-performance tapes that meet strict hygiene standards and deliver superior results. The advanced healthcare infrastructure found in many hospitals requires advanced taping technology, leading to high demand.

North America and Europe as Key Regions:

North America and Europe are expected to lead the global market throughout the study period (2019-2033). These regions benefit from well-established healthcare infrastructure, high healthcare expenditure, and a significant geriatric population. Furthermore, advanced medical technologies and robust regulatory frameworks within these regions fuel the demand for high-quality medical foam tapes. These factors contribute to their continued dominance in the market, making them key focus areas for manufacturers.

Several factors are catalyzing growth within the medical foam tape industry. The development of innovative adhesives and foam materials with enhanced properties is a key driver. These improvements translate to better performance in terms of adhesion, breathability, and hypoallergenic characteristics, making them preferable for various applications. Furthermore, increasing technological integration within healthcare is driving the adoption of specialized medical tapes suited for advanced medical devices and procedures. The ongoing demand for improved patient comfort and reduced risk of complications further contributes to the market's dynamic expansion.

This report provides a comprehensive overview of the medical foam tape market, encompassing historical data, current market insights, and future projections. It analyzes key market drivers, challenges, and opportunities, and identifies leading players and their strategies. The detailed analysis of different tape types, applications, and geographic regions equips stakeholders with a clear understanding of the market landscape and potential for future growth. The report provides crucial data for informed decision-making in the ever-evolving medical tape industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include 3M, Tesa SE, Avery Dennison, Intertape Polymer, Scapa Industrial, Nitto Denko, LINTEC, Guangzhou Broadya Adhesive Products, Wuxi Qida Tape, Nippon Industries, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Foam Tapes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Foam Tapes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.