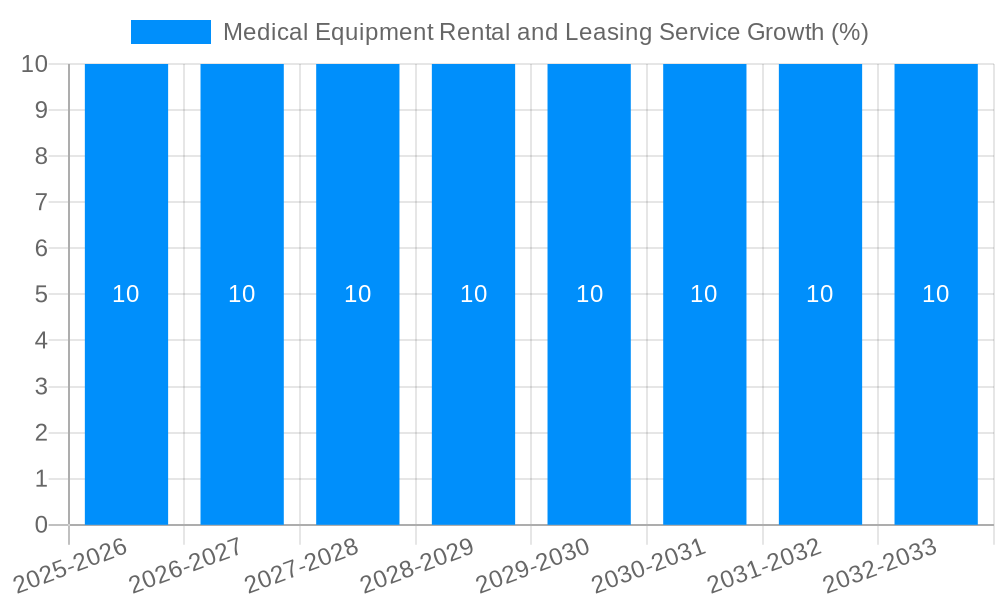

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Equipment Rental and Leasing Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Equipment Rental and Leasing Service

Medical Equipment Rental and Leasing ServiceMedical Equipment Rental and Leasing Service by Type (/> Finance Lease Direct Lease, Manufacturer's Financial Leasing, Sale and Leaseback), by Application (/> Medical Institution, Individual), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Medical Equipment Rental and Leasing Service market is poised for significant expansion, projected to reach an estimated XXX million by 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of XX% through 2033. This substantial market valuation underscores the increasing reliance on flexible and cost-effective solutions for acquiring and utilizing medical technology. Key drivers propelling this growth include the escalating healthcare expenditure worldwide, the continuous advancement and innovation in medical devices necessitating frequent upgrades, and the inherent need for healthcare providers to manage capital efficiently. The shift towards value-based care models also plays a crucial role, encouraging institutions to invest in state-of-the-art equipment without the burden of outright ownership and its associated depreciation. Furthermore, the growing prevalence of chronic diseases and an aging global population are directly contributing to a higher demand for a diverse range of medical equipment, from diagnostic tools to specialized treatment apparatus.

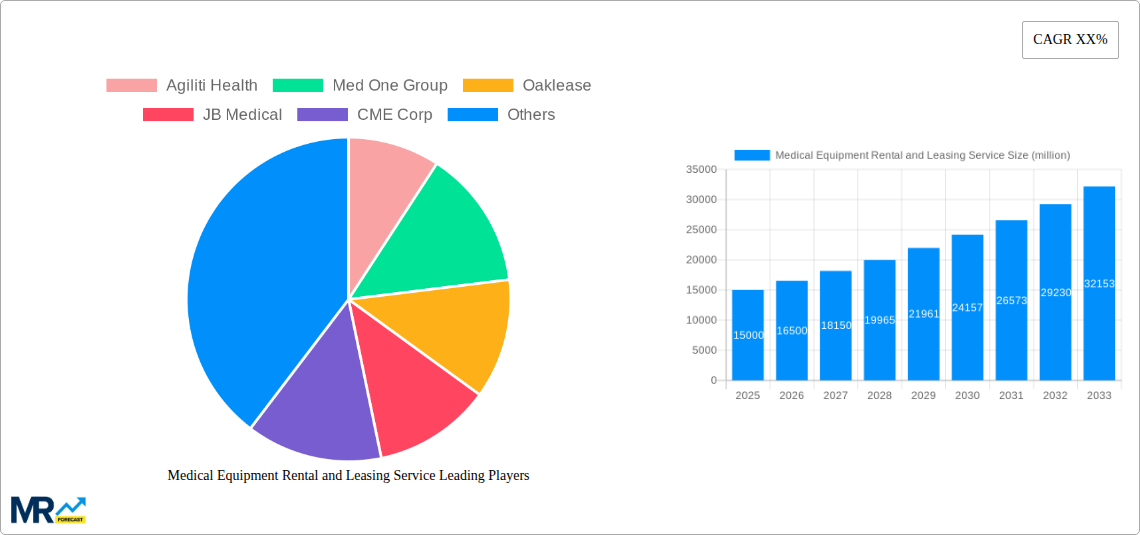

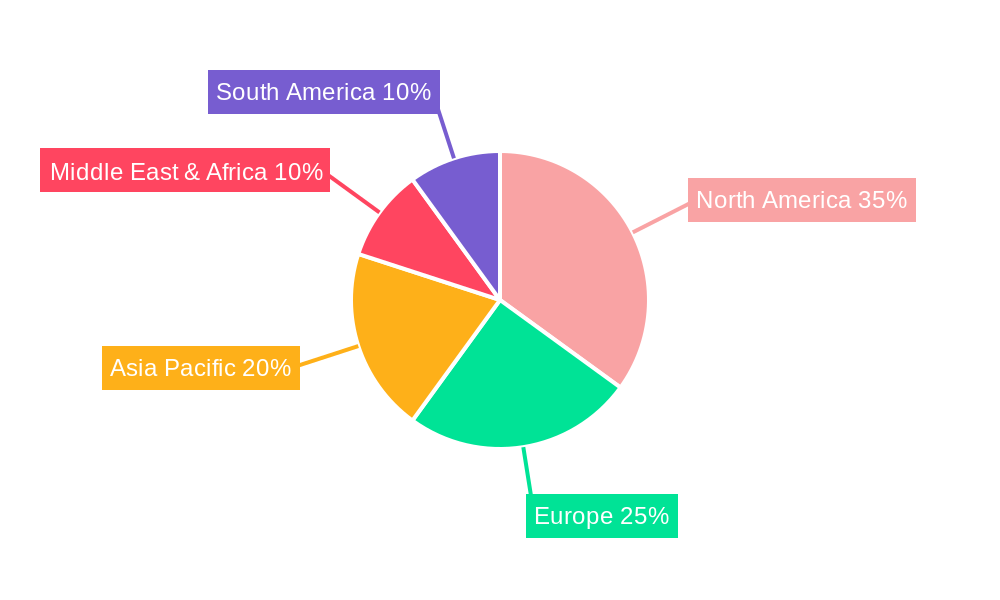

The market is segmented into distinct types, with Finance Lease and Direct Lease dominating the landscape due to their comprehensive financial benefits and operational flexibility for healthcare providers. Manufacturer's Financial Leasing and Sale and Leaseback also represent significant sub-segments, offering tailored solutions and liquidity management for both manufacturers and end-users. On the application front, Medical Institutions are the primary consumers, leveraging these services to equip hospitals, clinics, and specialized treatment centers. However, the growing demand from Individual users, particularly for home healthcare and long-term care solutions, is an emerging trend that will shape the market's future trajectory. Geographically, North America is anticipated to lead the market, driven by its advanced healthcare infrastructure and high adoption rates of new medical technologies. Asia Pacific is expected to witness the fastest growth due to increasing investments in healthcare and a burgeoning patient population. The market's competitive landscape is characterized by a mix of established players and emerging companies, all vying to offer innovative leasing models and comprehensive service packages to cater to the evolving needs of the healthcare industry.

This report provides an in-depth analysis of the global Medical Equipment Rental and Leasing Service market, offering crucial insights for stakeholders. The study covers the Study Period: 2019-2033, with a Base Year: 2025, and a Forecast Period: 2025-2033, building upon Historical Period: 2019-2024 data.

The global medical equipment rental and leasing service market is experiencing a significant upward trajectory, driven by a confluence of evolving healthcare economics and technological advancements. Over the Historical Period: 2019-2024, the market demonstrated consistent growth, fueled by increasing demand for flexible and cost-effective access to essential medical devices. In 2025, the market is estimated to reach a valuation in the high millions of US dollars, with projections indicating sustained and robust expansion throughout the Forecast Period: 2025-2033. A key trend observed is the growing preference for operational leasing over outright capital expenditure, especially among smaller healthcare providers and those in emerging economies. This allows them to access cutting-edge technology without the burden of substantial upfront investment, thereby improving their financial agility. The rising prevalence of chronic diseases globally, necessitating continuous monitoring and treatment, further amplifies the demand for readily available medical equipment. Furthermore, the rapid pace of technological innovation in the medical device sector means that equipment can become obsolete quickly. Leasing and rental services provide a solution, allowing healthcare facilities to upgrade to newer, more advanced models without the significant depreciation costs associated with ownership. The COVID-19 pandemic also acted as a catalyst, highlighting the critical need for flexible access to equipment, particularly for surge capacity needs in hospitals. This led to increased adoption of rental models for specialized equipment such as ventilators and patient monitors. The trend towards value-based healthcare is also subtly influencing this market, as providers seek solutions that optimize patient outcomes while managing costs effectively. Rental and leasing services offer a predictable cost structure, enabling better budgeting and financial planning for healthcare institutions. The digitalization of healthcare, including the adoption of telehealth and remote patient monitoring, is also creating new avenues for specialized rental equipment.

Several powerful forces are propelling the growth of the Medical Equipment Rental and Leasing Service market. Foremost among these is the increasing financial burden on healthcare providers, particularly in the face of rising operational costs and reimbursement pressures. Leasing and rental models offer a significantly more attractive alternative to outright purchase, allowing for predictable expenditure and freeing up capital for other critical investments, such as staffing or specialized treatments. This financial flexibility is particularly crucial for smaller clinics, independent practices, and healthcare facilities in developing regions. Secondly, the rapid pace of technological innovation in medical devices creates a constant need for upgrades. New imaging technologies, advanced surgical equipment, and sophisticated diagnostic tools are introduced at an accelerated rate. Leasing and rental services enable healthcare institutions to access the latest technology without the risk of rapid depreciation and obsolescence associated with ownership, ensuring they can offer the most advanced patient care. The growing demand for specialized and high-cost equipment also fuels this market. Devices like MRI machines, CT scanners, and specialized surgical robots represent significant capital outlays. Rental and leasing services make these essential, albeit expensive, technologies accessible to a wider range of healthcare providers, thereby democratizing access to advanced medical care. Furthermore, the flexibility and scalability offered by rental agreements are invaluable for healthcare facilities that experience fluctuating patient volumes or require equipment for temporary projects, such as research studies or outbreak management. This adaptability ensures that resources are utilized efficiently, avoiding the underutilization of costly owned assets.

Despite its robust growth, the Medical Equipment Rental and Leasing Service market faces several challenges and restraints that can temper its expansion. A primary concern is the potential for higher long-term costs compared to outright ownership, especially for equipment that is used consistently over extended periods. While leasing offers initial capital savings, the cumulative rental payments can eventually exceed the purchase price, impacting the profitability of long-term usage. Another significant restraint is the complexity of contractual agreements. Lease and rental contracts can be intricate, often involving detailed clauses regarding maintenance, insurance, usage limitations, and end-of-lease terms. Misunderstanding these agreements can lead to unforeseen costs or disputes. The risk of equipment damage or misuse by lessees also poses a challenge. While insurance and maintenance agreements are in place, significant damage or improper handling can result in substantial repair costs or replacement fees, which can be passed on to the lessee, impacting their overall expense. Furthermore, the availability of financing and the creditworthiness of potential lessees can be a bottleneck, especially for smaller or newer healthcare entities. Lenders and leasing companies often perform thorough due diligence, and a lack of robust financial standing can prevent access to these services. The perception of renting versus owning can also be a cultural or psychological barrier in some established healthcare systems, where ownership is traditionally favored. Finally, the logistical challenges associated with equipment delivery, installation, maintenance, and return can be complex and time-consuming, potentially impacting operational efficiency and requiring dedicated resources.

The Medical Equipment Rental and Leasing Service market exhibits distinct dominance across specific regions and segments, influenced by economic conditions, healthcare infrastructure, and regulatory frameworks.

Dominant Region: North America, particularly the United States, is poised to be a leading force in the medical equipment rental and leasing service market. This dominance is underpinned by:

Dominant Segment: Within the application spectrum, Medical Institutions are unequivocally the largest and most influential segment driving the Medical Equipment Rental and Leasing Service market. This dominance stems from several key factors:

While Individual use of medical equipment rental and leasing services exists, it primarily caters to specific needs like home healthcare equipment (e.g., oxygen concentrators, wheelchairs for temporary use) or specialized diagnostic equipment for personal health monitoring. This segment, while growing, is significantly smaller in value and volume compared to the institutional demand. The focus of this report and the market's primary drivers remain firmly rooted in the needs and purchasing power of medical institutions.

Several factors are acting as significant growth catalysts for the Medical Equipment Rental and Leasing Service industry. The escalating cost of healthcare, coupled with tightening budgets for healthcare providers, is pushing them towards flexible financial solutions like leasing and rentals. The rapid obsolescence of medical technology, driven by continuous innovation, compels organizations to adopt newer equipment, making leasing a more attractive option than the rapid depreciation of purchased assets. Furthermore, the growing prevalence of chronic diseases necessitates a sustained demand for medical equipment, which rental services can efficiently cater to, especially for fluctuating patient needs. The expansion of healthcare infrastructure in emerging economies, where capital is often scarce, also opens up significant new markets for rental and leasing services.

This comprehensive report delves into the intricate dynamics of the global Medical Equipment Rental and Leasing Service market, offering a panoramic view of its current status and future potential. It meticulously examines the Study Period: 2019-2033, with a deep dive into the Base Year: 2025 and an extended Forecast Period: 2025-2033, built upon an analysis of the Historical Period: 2019-2024. The report provides critical market insights, dissecting key trends such as the growing preference for operational leasing, the impact of technological advancements, and the strategic financial benefits for healthcare providers. It also illuminates the driving forces, including cost containment and the need for flexible access to advanced equipment, alongside an honest appraisal of challenges like potential long-term cost discrepancies and contractual complexities. Furthermore, the report identifies dominant regions and segments, highlighting Medical Institutions as the primary market driver, particularly within the North America region. Leading players are identified, and significant market developments, including strategic expansions and technological integrations, are detailed with specific timelines. This holistic approach ensures stakeholders are equipped with the necessary intelligence to navigate and capitalize on opportunities within this vital sector of the healthcare industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Agiliti Health, Med One Group, Oaklease, JB Medical, CME Corp, Siemens Financial Services, USME, Lojer Group, lnfiniti Medical Solutions, AGITO Medical, AdvaCare Systems, State Medical Equipment, Meridian Group, Byrne Medical Equipment Rental, Hillrom, Technical Life Care, Vesta Elder Care, Apria Healthcare, US Med-Equip.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Medical Equipment Rental and Leasing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Equipment Rental and Leasing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.