1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Optronics?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Maritime Optronics

Maritime OptronicsMaritime Optronics by Type (Multispectral, Hyperspectral, World Maritime Optronics Production ), by Application (Military, Civil, World Maritime Optronics Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

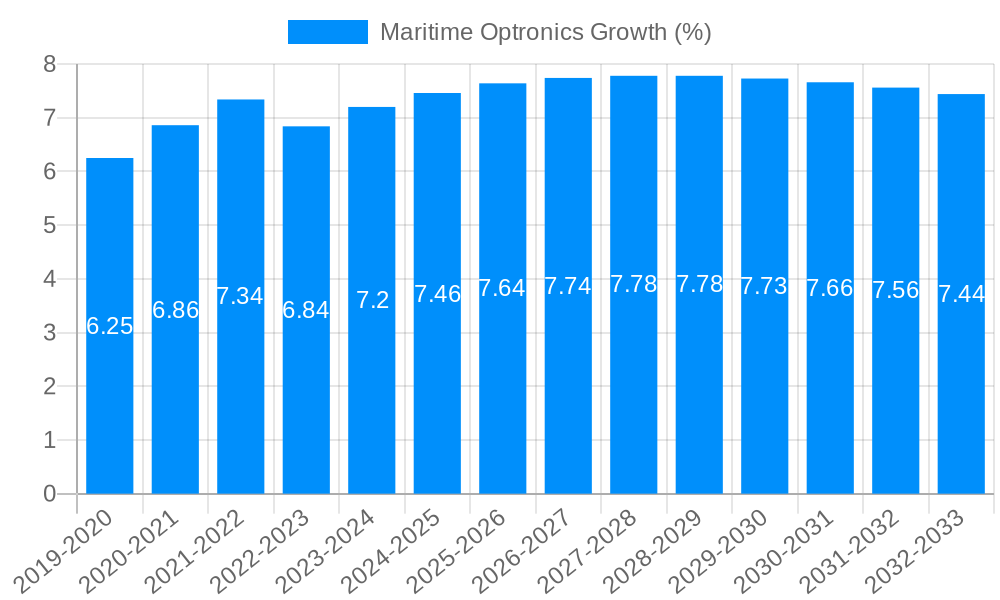

The global Maritime Optronics market is poised for robust expansion, projected to reach an estimated $7,500 million by 2025 and grow at a compound annual growth rate (CAGR) of approximately 8.5% through 2033. This significant market value reflects the increasing demand for advanced electro-optical and infrared (EO/IR) systems in maritime applications. The primary growth drivers stem from heightened geopolitical tensions and the subsequent surge in defense spending worldwide, necessitating enhanced surveillance, reconnaissance, and threat detection capabilities for naval vessels and coastal areas. Furthermore, the growing adoption of maritime optronics for civil applications such as search and rescue operations, environmental monitoring, and offshore exploration is contributing to market dynamism. Key trends include the integration of artificial intelligence (AI) and machine learning (ML) for improved target identification and situational awareness, the miniaturization and modularity of optronic systems for greater adaptability, and the increasing focus on hybrid sensor solutions that combine multiple technologies for comprehensive data acquisition.

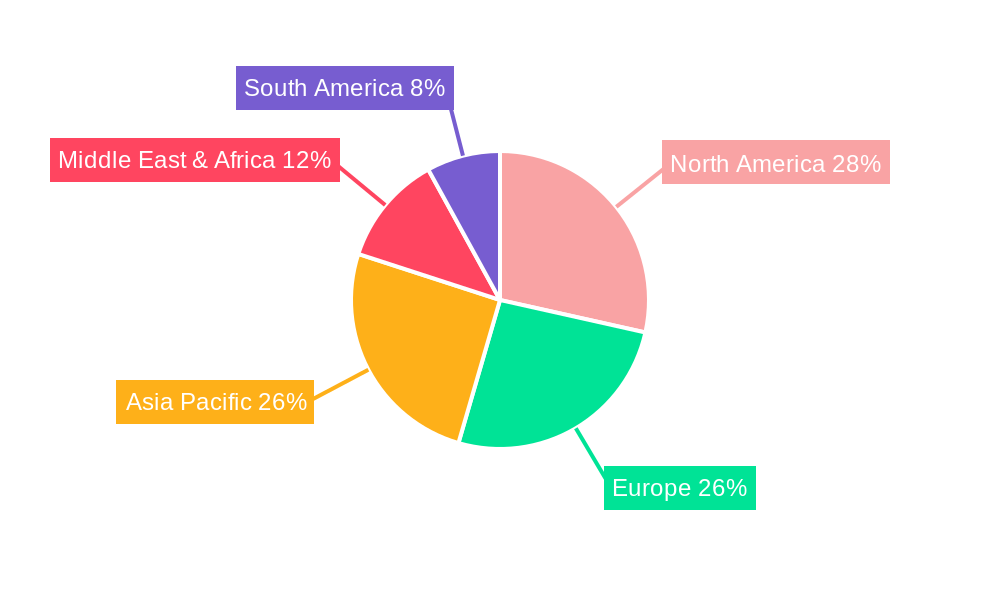

The market's trajectory is shaped by several influential factors. While the demand for sophisticated surveillance and defense technologies fuels growth, certain restraints may temper the pace. These include the substantial initial investment required for advanced maritime optronic systems and the ongoing need for skilled personnel to operate and maintain complex equipment. Nevertheless, the market's segmentation reveals a strong emphasis on both Multispectral and Hyperspectral imaging, offering detailed environmental and target characterization. In terms of application, the Military sector continues to dominate, driven by the need for superior naval warfare capabilities, including anti-submarine warfare, anti-surface warfare, and border protection. However, the Civil sector is experiencing steady growth, particularly in areas like maritime security and offshore asset management. Asia Pacific, led by China and India, is emerging as a critical growth region, alongside established markets in North America and Europe, due to significant investments in naval modernization and infrastructure development.

This report provides an in-depth analysis of the global Maritime Optronics market, encompassing a comprehensive study from the historical period of 2019-2024 to an extensive forecast period extending to 2033, with a specific focus on the Base Year and Estimated Year of 2025. The World Maritime Optronics Production is meticulously examined, delving into its multifaceted applications across both military and civil sectors. The study leverages a wealth of quantitative data, with market values presented in millions of US dollars, offering a clear financial perspective on the industry's trajectory.

The report critically assesses the evolving landscape of Maritime Optronics, exploring key market insights and emerging trends that are shaping its future. It identifies and analyzes the critical driving forces behind market expansion, alongside the significant challenges and restraints that could impede growth. Furthermore, the analysis pinpoints key regions and market segments poised for dominance, providing a strategic outlook on geographical and sectoral opportunities. The report also highlights crucial growth catalysts and presents an overview of significant industry developments and the leading players within the Maritime Optronics ecosystem.

XXX The global Maritime Optronics market is experiencing a significant upswing, driven by escalating geopolitical tensions and the increasing demand for enhanced maritime surveillance and security capabilities. From a historical perspective, the market has witnessed steady growth, fueled by the continuous integration of advanced sensor technologies into naval platforms and commercial vessels. The Base Year of 2025 positions the market at a critical juncture, with emerging technologies and shifting defense priorities poised to accelerate this growth trajectory through to 2033. The estimated value in 2025 is projected to reach USD 5,500 million, indicating a robust market landscape. The study period, 2019-2033, covers a dynamic phase where innovations in multispectral and hyperspectral imaging, alongside advancements in electro-optical and infrared (EO/IR) systems, are redefining the operational capabilities of maritime assets.

In the military segment, the focus is on enhancing situational awareness, target detection, and identification at extended ranges. This includes sophisticated systems for naval combatants, submarines, and maritime patrol aircraft. The civil sector, on the other hand, is seeing increased adoption for applications such as port security, offshore infrastructure monitoring, search and rescue operations, and environmental surveillance. The World Maritime Optronics Production is becoming increasingly sophisticated, moving beyond traditional optical systems to incorporate AI-powered analytics for real-time threat assessment and data interpretation. This integration of artificial intelligence and machine learning algorithms is a key trend, promising to unlock new levels of operational efficiency and effectiveness. The forecast period (2025-2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5%, with the market value projected to surpass USD 9,500 million by 2033. This substantial growth underscores the strategic importance of advanced optronic solutions in safeguarding maritime interests and ensuring the efficient utilization of ocean resources. The evolution from single-spectrum to multi- and hyperspectral capabilities is a notable trend, enabling the discrimination of subtle differences in targets and environments, thereby enhancing detection and identification accuracy.

The surge in global maritime trade and the associated increase in the volume of vessel traffic are significant driving forces for the Maritime Optronics market. As a direct consequence, the need for enhanced maritime security and surveillance has become paramount. Geopolitical uncertainties and the rise of asymmetric threats, such as piracy and illegal fishing, necessitate advanced optronic systems for early detection and response. The World Maritime Optronics Production is increasingly geared towards fulfilling these evolving security demands. Furthermore, the continuous innovation in sensor technology, particularly in the realms of multispectral and hyperspectral imaging, is propelling the market forward by offering superior performance and more comprehensive data acquisition capabilities. The development of compact, lightweight, and energy-efficient optronic systems is also a key driver, enabling their integration into a wider array of maritime platforms, from small unmanned aerial vehicles (UAVs) to large naval vessels. The growing awareness and regulatory emphasis on maritime environmental protection and sustainable resource management are also contributing to the adoption of sophisticated optronic solutions for monitoring pollution, oil spills, and illegal activities. The estimated market value in 2025 of USD 5,500 million reflects this multifaceted growth.

Despite the robust growth prospects, the Maritime Optronics market faces several challenges and restraints. The high cost associated with the research, development, and manufacturing of advanced optronic systems is a significant barrier, particularly for smaller navies and civil organizations. The complexity of integrating these sophisticated systems with existing maritime platforms and legacy infrastructure can also pose technical and logistical hurdles. Stringent regulatory frameworks and the need for adherence to international standards for maritime safety and security can slow down the adoption of new technologies. Moreover, the rapid pace of technological evolution means that deployed systems can quickly become obsolete, requiring continuous investment in upgrades and replacements. The availability of skilled personnel to operate and maintain these advanced systems is another critical constraint, necessitating specialized training programs. The cybersecurity of optronic systems, especially those connected to networks, is also a growing concern, requiring robust protection against potential breaches. The historical period of 2019-2024 has seen these challenges persist, and they are expected to continue influencing market dynamics throughout the forecast period.

The Military segment is anticipated to be the dominant force in the World Maritime Optronics Production, driven by sustained defense spending and increasing geopolitical tensions. Countries with significant naval presence and active maritime security operations are at the forefront of this demand.

Within the Type segment, Multispectral optronics are expected to dominate the market in the foreseeable future. While hyperspectral technology offers deeper insights, its higher cost and complexity currently limit its widespread adoption. Multispectral systems, which capture data across several specific spectral bands, provide a versatile and cost-effective solution for a wide range of applications, including target detection, classification, and environmental monitoring. The estimated market for multispectral optronics in 2025 is projected to reach USD 3,200 million.

The World Maritime Optronics Production is thus heavily influenced by the synergy between these dominant segments. The military's demand for advanced multispectral capabilities for national security, coupled with the growing civil applications for safety and environmental stewardship, creates a powerful market momentum. The forecast period (2025-2033) will see continued innovation in multispectral sensor technology, leading to improved performance and wider adoption across diverse maritime operations. The estimated value of the overall World Maritime Optronics Production in 2025 is USD 5,500 million, with the military segment and multispectral type playing a pivotal role.

The primary growth catalysts for the Maritime Optronics industry are the escalating global maritime security concerns, necessitating advanced surveillance and defense capabilities. Continuous technological advancements in sensor fusion, artificial intelligence, and miniaturization are enabling the development of more sophisticated and versatile optronic systems. Furthermore, the increasing focus on maritime domain awareness for both military and civil applications, including environmental monitoring and resource management, is fostering market expansion. The growing adoption of unmanned maritime systems (UMS) also presents a significant growth opportunity, as these platforms increasingly rely on compact and high-performance optronic payloads.

This report delves into the intricate workings of the Maritime Optronics market, offering a holistic view of its present and future. The analysis goes beyond mere market sizing, dissecting the underlying trends, driving forces, and challenges that sculpt its trajectory. With a detailed breakdown of regional dominance and segment-specific growth, alongside a spotlight on key players and significant developments, this report provides an indispensable resource for stakeholders. The estimated market value in 2025 of USD 5,500 million is a testament to the sector's current significance, while the forecast period's projected growth underscores its promising future. The comprehensive coverage ensures that strategic decision-makers are equipped with the insights needed to navigate this dynamic and vital industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

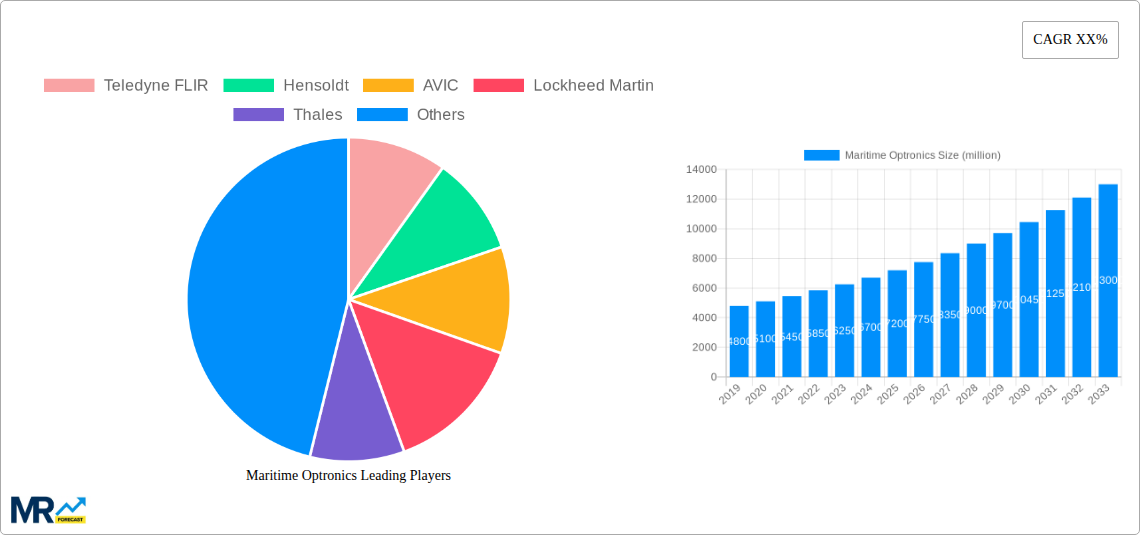

Key companies in the market include Teledyne FLIR, Hensoldt, AVIC, Lockheed Martin, Thales, Rafael Advanced Defense Systems Ltd., Northrop Grumman, Elbit Systems, BAE Systems, Leonardo, Safran, Israel Aerospace Industries, Aselsan, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Maritime Optronics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Maritime Optronics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.