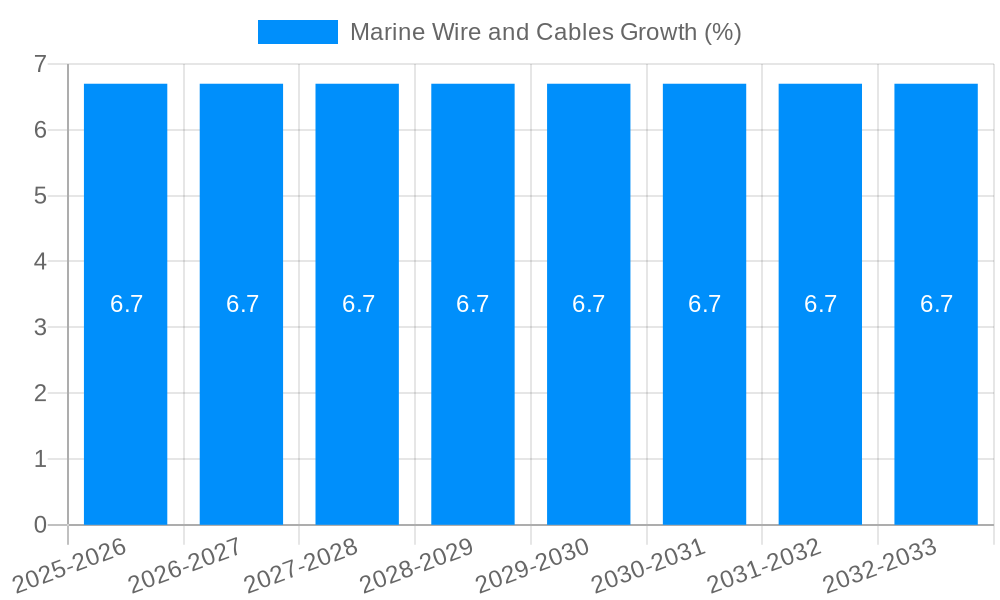

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Wire and Cables?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Marine Wire and Cables

Marine Wire and CablesMarine Wire and Cables by Type (Flat Multi-conductor Marine Cable, GPTM (Bare Copper) Marine Cable, GPTM (Tinned Copper) Marine Cable), by Application (Oil and Gas, Military and Defence, Power Transmission and Telecommunication, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

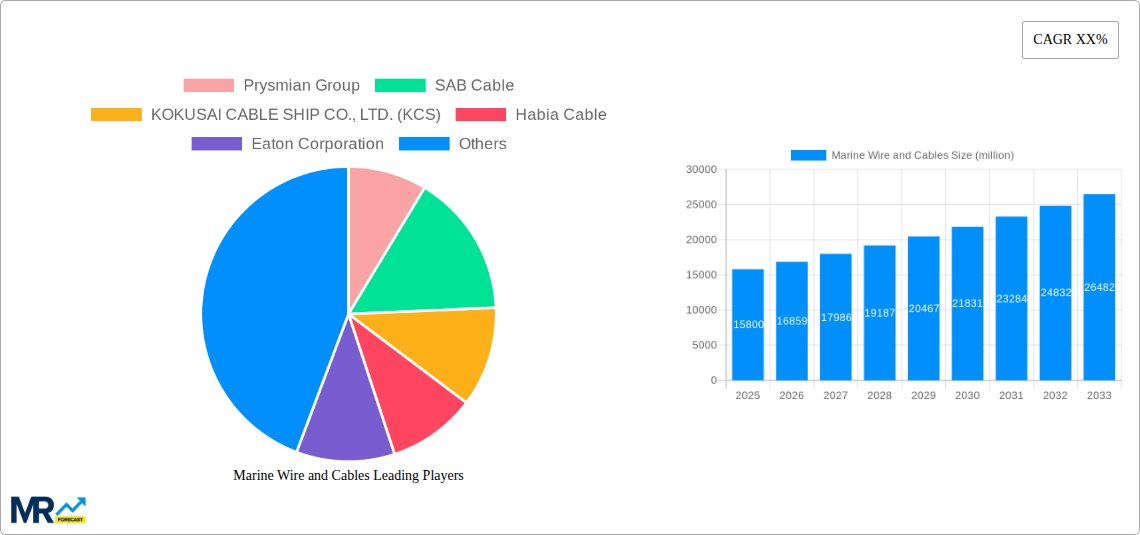

The global Marine Wire and Cables market is poised for significant expansion, projected to reach approximately USD 15,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This upward trajectory is primarily fueled by the escalating demand for offshore oil and gas exploration and production activities, which necessitate reliable and high-performance cabling solutions for subsea equipment and offshore platforms. Furthermore, the continuous modernization and expansion of naval fleets across various nations, coupled with increased defense spending, are significant drivers for specialized marine cables offering enhanced durability and resistance to harsh environmental conditions. The growing adoption of advanced power transmission infrastructure and the burgeoning telecommunication sector, particularly with the expansion of subsea fiber optic networks, are also contributing to market growth. Emerging economies are increasingly investing in maritime infrastructure, further bolstering the demand for marine wires and cables.

The market's growth is further supported by technological advancements, including the development of more efficient, lightweight, and fire-retardant marine cables that meet stringent international safety standards. While the market exhibits strong growth potential, certain restraints, such as fluctuating raw material prices, particularly copper, and the high upfront investment required for specialized manufacturing facilities, could pose challenges. The complex regulatory landscape and the need for continuous compliance with evolving maritime safety and environmental regulations also add to the operational complexities for manufacturers. Key market segments include Flat Multi-conductor Marine Cables and GPTM (both Bare and Tinned Copper) Marine Cables, with the Oil and Gas, Military and Defence, and Power Transmission and Telecommunication sectors being the dominant application areas. Leading companies in this competitive landscape are actively engaged in research and development, strategic partnerships, and capacity expansions to cater to the diverse needs of this dynamic market.

This comprehensive report delves into the dynamic global Marine Wire and Cables market, offering an in-depth analysis of its historical performance, current landscape, and future projections. Spanning the Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025-2033, this report provides actionable insights for stakeholders. The analysis is grounded in a detailed examination of the Historical Period from 2019-2024, capturing past market trajectories and performance. The report is meticulously structured to provide a holistic understanding of the market, encompassing key trends, driving forces, inherent challenges, regional dominance, growth catalysts, leading players, and significant sector developments.

The global Marine Wire and Cables market is projected to witness substantial growth, with an estimated market size of USD 6,500 million in 2025, expanding to USD 9,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.3% during the forecast period. This growth is fueled by a confluence of factors, including the increasing demand for advanced offshore infrastructure, the burgeoning offshore renewable energy sector, and the continuous advancements in shipbuilding and maritime technology. The report provides a granular breakdown of market segmentation by cable type and application, offering detailed insights into the performance and future potential of each segment.

The global Marine Wire and Cables market is experiencing a significant evolution, driven by technological advancements and shifting industry demands. A key trend observed is the increasing integration of advanced materials and innovative designs to meet the stringent requirements of harsh marine environments. This includes the growing adoption of specialized insulation materials offering superior resistance to oil, chemicals, and extreme temperatures. Furthermore, the trend towards miniaturization and higher data transmission capabilities is prominent, especially in the Power Transmission and Telecommunication segment, enabling more efficient and robust onboard systems. The Oil and Gas sector, while facing cyclical fluctuations, continues to be a significant demand driver, with ongoing exploration and production activities requiring extensive subsea and topside cabling solutions. The report highlights that the demand for high-performance, flame-retardant, and low-smoke halogen-free (LSHF) cables is escalating due to stringent safety regulations in maritime operations. This is particularly evident in passenger vessels and offshore installations. Another notable trend is the increasing focus on sustainability and environmentally friendly cable solutions, with manufacturers investing in materials and processes that minimize environmental impact. The Military and Defence segment is also a crucial influencer, with a growing emphasis on advanced communication systems, sonar technology, and weapon systems, all of which necessitate specialized, high-reliability marine cables. The adoption of smart technologies and the Internet of Things (IoT) on vessels is also fostering the demand for advanced connectivity solutions, further shaping the market's trajectory. The report anticipates a growing preference for customized cable solutions tailored to specific vessel types and operational needs. The ongoing modernization of fleets and the construction of new, larger, and more technologically advanced vessels are continuously injecting demand into the market. The report estimates the market size for marine wires and cables to be USD 6,500 million in 2025, with a projected surge to USD 9,800 million by 2033, signifying a healthy CAGR of approximately 5.3% throughout the forecast period. This growth is underpinned by the robust demand across various applications, including offshore energy, defense, and telecommunications.

Several potent forces are collectively propelling the growth of the global Marine Wire and Cables market. Foremost among these is the burgeoning offshore renewable energy sector, particularly wind and solar farms. The construction and maintenance of these offshore installations necessitate vast amounts of specialized marine cables for power transmission and connectivity, representing a significant and sustained demand driver. The Oil and Gas industry, despite its inherent volatility, remains a critical pillar of market growth. Ongoing exploration and production activities in deep-sea reserves, coupled with the need for infrastructure upgrades and replacements, continuously drive demand for robust and reliable marine cables. Furthermore, the increasing global maritime trade and the continuous expansion and modernization of shipping fleets, encompassing both commercial and specialized vessels, are key contributors to market expansion. The development of new ports, the upgrading of existing ones, and the rise of cruise tourism also add to the demand for sophisticated electrical and communication infrastructure. The Military and Defence sector is another substantial driving force, with nations across the globe investing heavily in naval modernization programs. This includes the development of advanced submarines, warships, and offshore surveillance systems, all of which require high-specification, resilient marine cables. The increasing emphasis on cybersecurity and the deployment of sophisticated electronic warfare systems further amplify this demand. Additionally, advancements in shipbuilding technology, leading to larger and more complex vessels with integrated smart systems, are creating a need for more advanced and higher-capacity cabling solutions. The report projects that the market will be significantly influenced by these factors, contributing to the estimated market size of USD 6,500 million in 2025 and its projected rise to USD 9,800 million by 2033.

Despite the promising growth trajectory, the Marine Wire and Cables market is not without its challenges and restraints. One of the primary hurdles is the high cost of raw materials, particularly copper and specialized polymers, which directly impacts the manufacturing cost of marine cables. Volatility in commodity prices can significantly affect profit margins for manufacturers and influence pricing strategies. Furthermore, the stringent regulatory landscape and the need for adherence to various international standards and certifications (e.g., IEC, NEC, ABS) can pose a significant challenge for manufacturers, requiring substantial investment in research, development, and quality control. The complex and time-consuming installation processes in offshore environments, often conducted in harsh weather conditions, can lead to increased project costs and delays, indirectly impacting cable demand. The inherent cyclical nature of the Oil and Gas industry, a key end-user, can lead to fluctuating demand patterns, making long-term market forecasting and production planning more challenging. Moreover, the intense competition among market players, both established and emerging, can lead to price wars and put pressure on profitability. The long lead times associated with the production and delivery of specialized marine cables can also be a restraint, especially for projects with tight deadlines. The threat of piracy and geopolitical instability in certain maritime regions can disrupt supply chains and project execution, thereby impacting market growth. Lastly, the increasing adoption of wireless technologies in certain communication applications within the maritime sector could potentially cannibalize a small portion of the demand for traditional wired solutions, although the core need for robust power and data transmission cabling remains strong. These factors collectively contribute to the dynamic and complex nature of the Marine Wire and Cables market, influencing its overall growth trajectory.

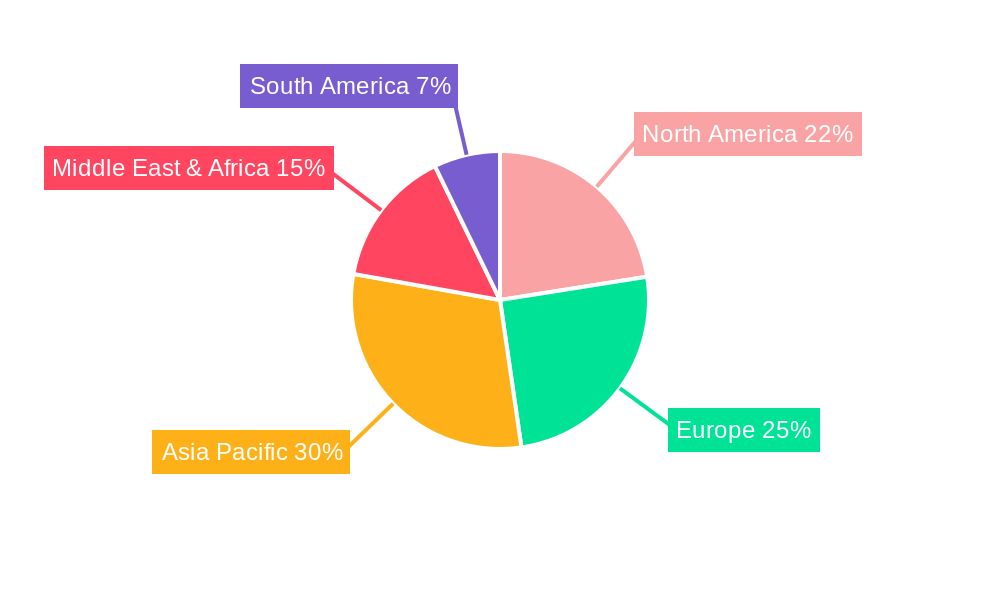

The global Marine Wire and Cables market is characterized by regional and segmental dominance, each contributing significantly to the overall market dynamics.

Dominant Segments:

Application: Oil and Gas: This segment has historically been and is expected to continue to be a dominant force in the marine wire and cable market. The relentless pursuit of hydrocarbon exploration and production in increasingly challenging offshore environments, including deep-water and Arctic regions, necessitates robust, high-performance, and specialized cabling solutions. This includes subsea power cables, umbilical cables, and topside power and control cables that can withstand extreme pressures, corrosive environments, and fluctuating temperatures. The continued investment in offshore infrastructure, coupled with the ongoing need for maintenance and upgrades of existing facilities, ensures a sustained demand for marine wires and cables within this sector. The estimated market size for the Oil and Gas application segment alone is projected to contribute a substantial portion of the overall market, estimated to be around USD 2,000 million in 2025.

Application: Power Transmission and Telecommunication: The growing emphasis on offshore renewable energy, particularly wind farms, is a significant growth engine for this segment. The vast networks of inter-array and export cables required to transmit power from offshore turbines to the grid are driving substantial demand. Furthermore, the increasing connectivity needs of modern vessels, with the integration of advanced communication systems, navigation equipment, and onboard entertainment, are boosting the demand for high-speed and reliable telecommunication cables. The development of subsea telecommunication cables to enhance global connectivity further adds to the market's expansion. This segment is anticipated to exhibit a robust CAGR during the forecast period, with an estimated market size of USD 1,800 million in 2025.

Type: GPTM (Bare Copper) Marine Cable: While GPTM (Tinned Copper) cables offer enhanced corrosion resistance, GPTM (Bare Copper) marine cables remain a cornerstone due to their excellent conductivity and cost-effectiveness for applications where extreme corrosion is not the primary concern or is managed through other protective measures. They are widely used in various onboard power distribution and control systems where reliability and efficient current carrying capacity are paramount. The sheer volume of applications in shipbuilding and offshore infrastructure makes this a consistently strong performer. The estimated market size for GPTM (Bare Copper) Marine Cable is projected to be around USD 1,500 million in 2025.

Dominant Region/Country:

Asia Pacific: This region stands out as a dominant force in the global Marine Wire and Cables market. The rapid expansion of shipbuilding industries in countries like China, South Korea, and Japan, which are global leaders in constructing commercial vessels, cruise ships, and offshore platforms, significantly drives demand. Furthermore, substantial investments in offshore oil and gas exploration and production, as well as the burgeoning offshore wind energy sector in countries like China and Vietnam, are major contributors to the region's dominance. The robust industrial base and the presence of leading cable manufacturers further solidify the Asia Pacific's leading position. The region is expected to account for over 40% of the global market share by 2025, with an estimated market value of USD 2,600 million.

North America: The North American region, particularly the United States and Canada, is a significant market driven by its extensive offshore oil and gas activities in the Gulf of Mexico and the Arctic, respectively. The increasing focus on renewable energy, including offshore wind projects along the East Coast, is also a substantial growth catalyst. The robust defense sector and the ongoing modernization of naval fleets further contribute to the demand for high-specification marine cables. The estimated market size for North America is projected to be around USD 1,600 million in 2025.

Europe: Europe, with its strong maritime heritage and significant investments in offshore renewable energy, particularly in the North Sea, is another key region. Countries like Norway, the United Kingdom, and Germany are at the forefront of offshore wind development, requiring extensive marine cabling infrastructure. The established shipbuilding industry and the presence of major oil and gas players also contribute to sustained demand. The estimated market size for Europe is projected to be around USD 1,500 million in 2025.

The interplay between these dominant segments and regions creates a dynamic market landscape, with continuous innovation and strategic investments shaping future growth patterns.

The Marine Wire and Cables industry is experiencing robust growth fueled by several key catalysts. The burgeoning offshore renewable energy sector, particularly wind farms, is a primary driver, necessitating extensive cabling for power transmission and interconnections. Continued exploration and production activities in the Oil and Gas sector, especially in deeper and more challenging offshore environments, demand specialized and high-performance cables. The ongoing modernization of global shipping fleets, alongside the construction of new, technologically advanced vessels across various segments (commercial, cruise, and specialized), ensures consistent demand. Furthermore, increasing governmental investments in naval modernization and defense infrastructure globally are significant growth stimulants.

The global Marine Wire and Cables market is populated by a diverse range of key players, each contributing to the market's innovation and supply chain. These leading companies are instrumental in shaping the industry's technological advancements and market reach.

The Marine Wire and Cables sector has witnessed numerous significant developments over the study period, reflecting the industry's drive for innovation and adaptation to evolving market needs. These developments have often been driven by technological advancements, regulatory changes, and emerging application demands.

This comprehensive report on the Marine Wire and Cables market offers an exhaustive analysis, providing stakeholders with critical insights for strategic decision-making. It delves into the market size and forecast, projecting a significant expansion from USD 6,500 million in 2025 to USD 9,800 million by 2033, with a CAGR of approximately 5.3%. The report meticulously examines the historical market trends from 2019 to 2024, identifying key patterns and influences. It further dissects the driving forces propelling the market, such as the growth of offshore renewables, the persistent demand from the Oil and Gas sector, and advancements in naval technology. Challenges like raw material price volatility and stringent regulations are also thoroughly addressed. The report highlights dominant segments like Oil and Gas and Power Transmission and Telecommunication, as well as leading regions like Asia Pacific, detailing their market contributions and future potential. Key growth catalysts and a detailed list of leading players are also included. This report is designed to empower businesses with a deep understanding of the market's present and future, enabling them to capitalize on emerging opportunities and mitigate potential risks.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Prysmian Group, SAB Cable, KOKUSAI CABLE SHIP CO., LTD. (KCS), Habia Cable, Eaton Corporation, Belden, FSC Global, Fujitsu, LEONI, Eland Cables, Nuhas Oman, LS Cable, Sumitomo Electric Industries, KEI IND, Jiangsu Zhongli Group, Hengtong Group, Guangzhou Panyu Cable Group, Baosheng Group, FAR EAST Holding Group, TBEA Co., Ltd., WANMA Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Marine Wire and Cables," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Marine Wire and Cables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.