1. What is the projected Compound Annual Growth Rate (CAGR) of the Maotai Flavor Liquor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Maotai Flavor Liquor

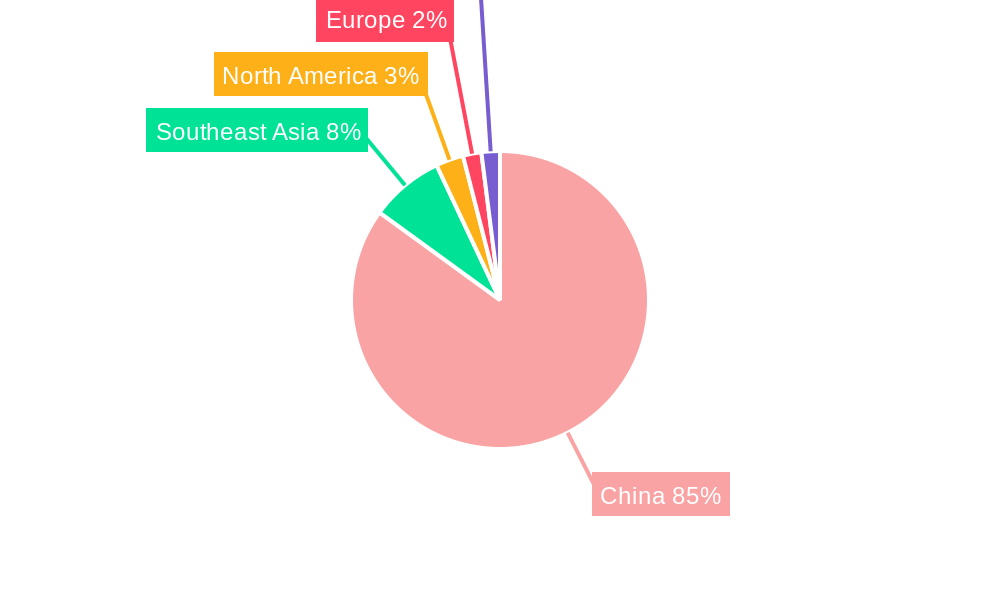

Maotai Flavor LiquorMaotai Flavor Liquor by Type (50 Degrees and Above, 40-49 Degrees, 35-39 Degrees, Below 35 Degrees, World Maotai Flavor Liquor Production ), by Application (Distributor, Liquor Manufacturers, E-Commerce Platform And Official Website, Offline Supermarket, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

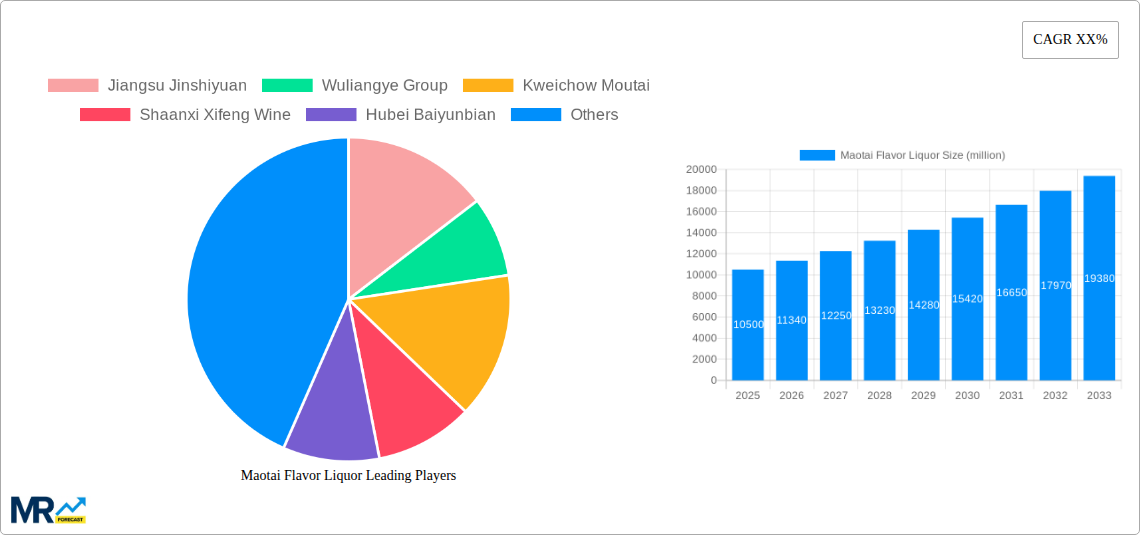

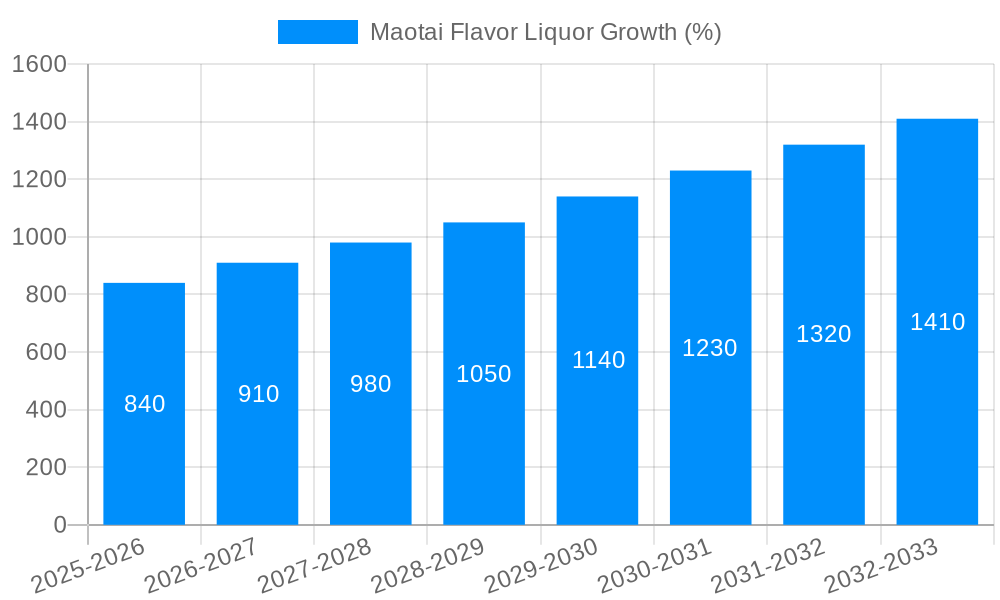

The global Maotai flavor liquor market is experiencing robust growth, driven by increasing consumer demand for premium spirits and the rising popularity of Chinese baijiu internationally. The market, segmented by temperature classifications (50 Degrees and Above, 40-49 Degrees, 35-39 Degrees, Below 35 Degrees) and distribution channels (Distributor, Liquor Manufacturers, E-Commerce Platform And Official Website, Offline Supermarket, Other), demonstrates significant potential across diverse consumer segments. While precise market sizing data is unavailable, based on industry reports and the prominence of major players like Kweichow Moutai and Wuliangye Group, we can estimate a current market value in the billions of dollars. The Compound Annual Growth Rate (CAGR) is projected to remain strong over the forecast period (2025-2033), fueled by expanding middle classes in Asia and increased brand awareness in Western markets. Key market trends include the rise of e-commerce platforms as a significant sales channel and the increasing focus on product diversification and premiumization by major producers to cater to evolving consumer preferences.

However, challenges remain. Government regulations regarding alcohol production and consumption can significantly impact market growth. Additionally, the competitive landscape is intensely concentrated, with a few major players holding substantial market share. Maintaining brand loyalty and innovating to attract younger demographics while addressing concerns about alcohol consumption are crucial for sustained market expansion. Growth in emerging markets, particularly within Asia Pacific and select regions in Africa, presents considerable opportunity, although potential regulatory hurdles and infrastructural constraints will need careful consideration. Successful market players will focus on strategies balancing premium brand positioning with broader market accessibility, adapting to changing consumer behaviors, and strategically leveraging various distribution channels. This blend of traditional production methods with innovative marketing and distribution approaches will dictate future success in this dynamic market.

The Maotai flavor liquor market, valued at XXX million units in 2024, exhibits a dynamic landscape shaped by evolving consumer preferences and intense competition. The historical period (2019-2024) witnessed robust growth, driven primarily by increasing disposable incomes in China and a rising appreciation for high-quality spirits. However, the market is not without its nuances. While premium segments, particularly those above 50 degrees, continue to perform strongly, there's a noticeable shift towards diversification. Consumers are increasingly exploring a wider range of price points and flavor profiles, leading to growth in the 40-49-degree segment. The estimated market size for 2025 is projected at XXX million units, reflecting this ongoing evolution. Furthermore, e-commerce channels are rapidly gaining traction, challenging traditional distribution networks and creating new avenues for growth. The forecast period (2025-2033) anticipates continued expansion, although the rate of growth may moderate slightly as the market matures and faces increased regulatory scrutiny. The market's future trajectory will depend critically on the success of brands in adapting to changing consumer tastes, effectively managing production costs, and navigating evolving regulations. Maintaining quality while expanding reach will be key for success in this competitive arena. The report provides a detailed analysis of these trends, offering valuable insights for stakeholders looking to navigate this complex and dynamic market.

Several key factors are driving the expansion of the Maotai flavor liquor market. Firstly, the growing Chinese middle class, with increased disposable incomes and a penchant for luxury goods, fuels demand for premium spirits like Maotai-flavor liquors. Secondly, the enduring cultural significance of Baijiu in Chinese society, particularly for gifting and celebratory occasions, firmly establishes its position as a staple beverage. Thirdly, successful branding and marketing strategies by leading producers have successfully cultivated a strong brand image and loyalty, commanding premium pricing. Furthermore, ongoing innovation in production techniques and product diversification, including the introduction of new flavor profiles and variations, cater to evolving consumer tastes and prevent market saturation. Finally, the expanding distribution networks, both online and offline, ensure greater accessibility for consumers across China and increasingly, internationally. The synergy between these driving forces creates a potent combination that underpins the robust growth trajectory of the Maotai flavor liquor market.

Despite its significant growth potential, the Maotai flavor liquor market faces several challenges. Stringent government regulations concerning alcohol production and marketing pose a considerable hurdle, particularly concerning advertising and pricing. Counterfeit products represent a major threat, eroding consumer trust and damaging brand reputation. The increasing cost of raw materials, particularly high-quality sorghum, impacts production costs and profitability. Moreover, heightened consumer awareness of health issues related to excessive alcohol consumption is impacting overall alcohol consumption levels, although this trend affects the lower-priced segments more significantly. Furthermore, intense competition among established players and the emergence of new entrants create a highly competitive landscape, forcing companies to constantly innovate and adapt. Finally, fluctuations in consumer spending due to economic downturns can impact sales, particularly in the premium segments. Effectively addressing these challenges is crucial for sustained growth and profitability within the Maotai flavor liquor market.

The Maotai flavor liquor market is predominantly concentrated in China, with key regions like Guizhou (the birthplace of Maotai) and Sichuan exhibiting particularly strong demand. However, increasing international interest, particularly from Asian markets, suggests potential for future expansion beyond China's borders.

Segment Dominance: The 50 Degrees and Above segment commands a significant market share due to its association with prestige, quality, and cultural significance. This segment caters to high-end consumers willing to pay a premium for the perceived status and taste profile. While other segments (40-49 degrees, 35-39 degrees, Below 35 degrees) experience growth, they primarily serve a broader, price-sensitive consumer base.

Application Dominance: Distributor channels remain the most significant application segment, reflecting the established distribution networks throughout China. However, the rapid growth of E-commerce Platforms and Official Websites indicates a substantial shift towards online sales, particularly among younger consumers. The Offline Supermarket channel also plays a role, although its growth may be slower than that of e-commerce.

The dominance of the 50 Degrees and Above segment highlights the importance of premiumization strategies for producers. The concurrent rise of e-commerce applications points toward the need for companies to develop robust digital marketing and distribution strategies. The report further breaks down regional and segmental performance with detailed projections for the forecast period. These insights are crucial for businesses strategizing their market entry or expansion plans within the Maotai flavor liquor market.

Several factors are expected to propel the Maotai flavor liquor industry's growth in the coming years. The expanding middle class in China will continue to fuel demand for premium spirits. Innovative product development, such as the introduction of new flavors and variations, will cater to evolving consumer tastes. Effective marketing campaigns focusing on brand heritage and cultural significance will build and sustain strong brand loyalty. Investment in technology and efficient production processes will optimize efficiency and reduce costs. Finally, improved distribution networks and an increased focus on e-commerce will enhance market reach and accessibility.

This report provides a comprehensive overview of the Maotai flavor liquor market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. It provides granular data on segment performance, regional variations, and application channels, empowering stakeholders to make well-informed business decisions within this dynamic and evolving market. The detailed analysis, historical data, and future projections create a valuable resource for both established players and new entrants looking to navigate the complexities of the Maotai flavor liquor industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Jiangsu Jinshiyuan, Wuliangye Group, Kweichow Moutai, Shaanxi Xifeng Wine, Hubei Baiyunbian, Guizhou Dongjiu, Luzhou Laojiao, Guizhou Xijiu, Sichuan Langjiu, Beijing Shunxin, Guizhou Guotai, Red Star Group, North Dacang Group, Baofeng Wine, Shandong Jingzhi, Shede Liquor, Guizhou precious wine brewing, Guizhou Jinsha Cellar Wine, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Maotai Flavor Liquor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Maotai Flavor Liquor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.