1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Wood Furniture?

The projected CAGR is approximately 6.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Wood Furniture

Luxury Wood FurnitureLuxury Wood Furniture by Type (Solid Wood Furniture, Wood-Based Panels Furniture, Miscellaneous Furniture), by Application (Home Furniture, Office Furniture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

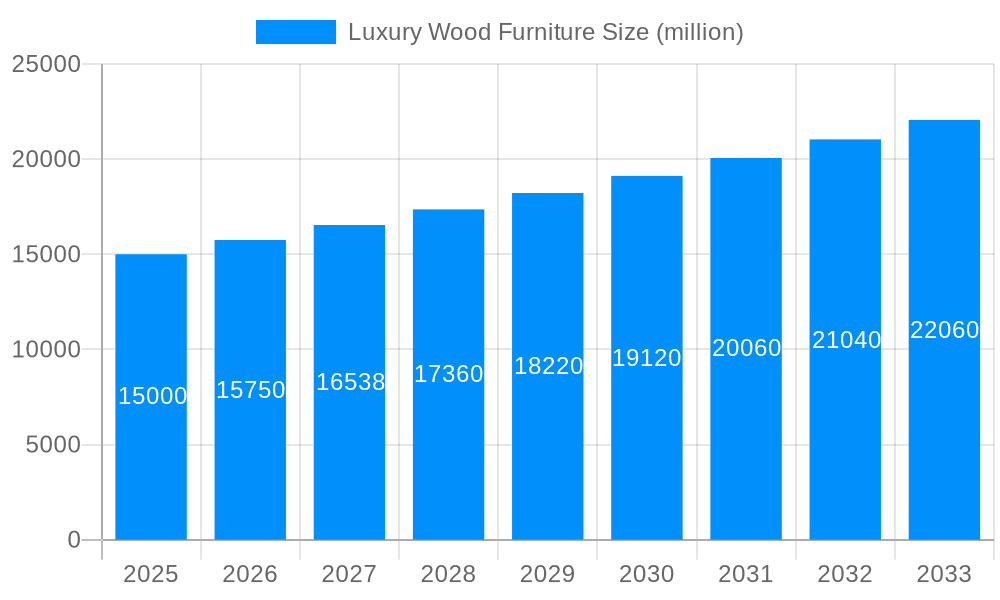

The global luxury wood furniture market is poised for substantial expansion, propelled by rising disposable incomes in emerging economies and a growing consumer demand for sustainable, high-quality home furnishings. This sector's inherent allure to discerning clientele seeking status and enduring craftsmanship ensures its resilience. The market is projected to reach $27.19 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.6% from the base year of 2025. Key growth drivers include the increasing popularity of minimalist and bespoke designs, a notable shift towards eco-friendly materials, and the pervasive influence of interior design trends disseminated through digital platforms. The market is segmented by product type, style, and price point. Leading manufacturers are continuously innovating to meet evolving consumer preferences, while artisanal brands are capitalizing on the demand for unique, handcrafted pieces.

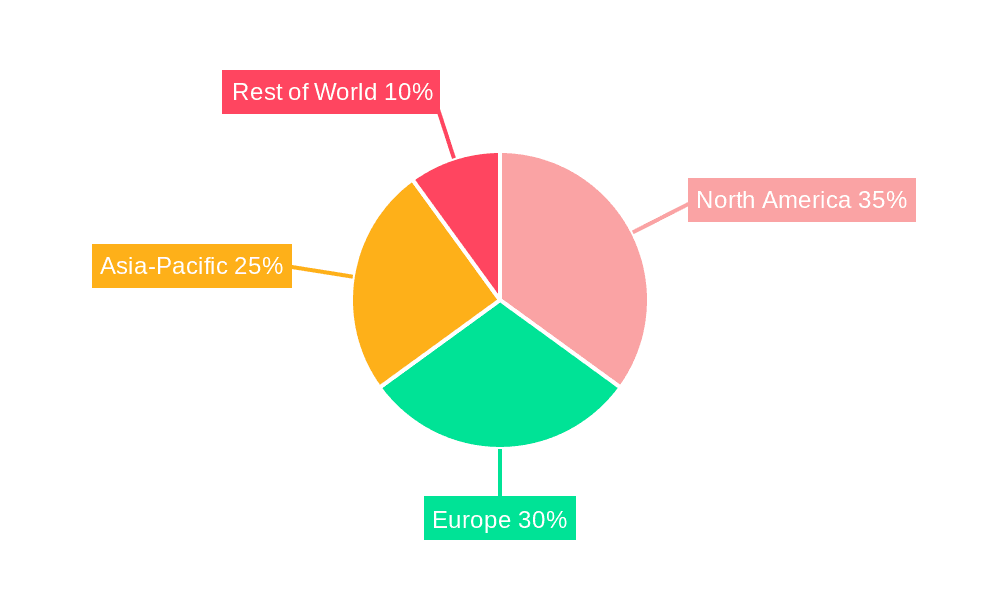

Market challenges encompass fluctuating raw material costs, increasing labor expenses, and supply chain volatility. Nevertheless, the long-term outlook for luxury wood furniture remains exceptionally positive, underpinned by the persistent demand for handcrafted quality, the rising affluent class's desire for personalized living spaces, and the sustained emphasis on sustainable living. Significant regional variations are anticipated, with North America and Europe currently holding dominant market shares. However, robust growth is expected in the Asia-Pacific region as middle-class incomes ascend and consumer preferences evolve towards sophisticated and premium furniture offerings. The success of market participants will depend on their capacity to integrate sustainable practices, effectively utilize digital marketing strategies, and deliver personalized services to cater to the diverse needs of a global consumer base.

The global luxury wood furniture market, valued at XXX million units in 2025, is experiencing a period of significant transformation driven by evolving consumer preferences and technological advancements. Over the study period (2019-2033), we project robust growth, fueled by a rising affluent population globally, particularly in Asia and the Middle East. These consumers are increasingly seeking bespoke, high-quality furniture pieces that reflect their individual style and enhance their living spaces. This trend is pushing manufacturers towards more customized, handcrafted designs, often incorporating sustainable and ethically sourced materials. The integration of smart technology, such as built-in charging stations and automated lighting within furniture pieces, is also gaining traction, blurring the lines between traditional craftsmanship and modern convenience. Furthermore, a growing appreciation for heritage and traditional craftsmanship is contributing to the popularity of antique-inspired designs and the use of rare and exquisite wood types. The market is witnessing a shift away from mass-produced furniture towards exclusive, limited-edition collections that offer a unique ownership experience. This trend is fostering partnerships between luxury furniture brands and renowned designers, resulting in highly sought-after pieces that become status symbols. Simultaneously, the rise of e-commerce and online marketplaces is changing the way luxury wood furniture is marketed and sold, providing new avenues for both established brands and emerging artisans to reach a global clientele. The increasing adoption of virtual reality (VR) and augmented reality (AR) technologies allows consumers to visualize furniture in their homes before purchase, further enhancing the buying experience. The forecast period (2025-2033) anticipates continued market expansion, driven by these evolving trends and sustained demand for high-quality, aesthetically pleasing, and technologically advanced furniture.

Several key factors are propelling the growth of the luxury wood furniture market. The expanding global middle and upper classes, particularly in developing economies, represent a significant driver. These consumers are increasingly willing to invest in premium furniture to improve their living standards and express their personal style. The rising disposable incomes in these regions are directly correlated with increased spending on luxury goods, including high-end furniture. Beyond economic factors, a shift towards experiential consumption plays a critical role. Consumers are prioritizing quality over quantity, seeking investment pieces that add value and longevity to their homes. This preference for durability and craftsmanship is fueling the demand for solid wood furniture, known for its resilience and aesthetic appeal. Sustainability is another important factor. Consumers are increasingly conscious of environmental impact, leading to a higher demand for sustainably sourced wood and eco-friendly production processes. Luxury brands are responding by adopting sustainable practices and transparent supply chains, enhancing their brand reputation and attracting environmentally conscious consumers. Finally, the influence of design trends and interior design styles, as showcased through media platforms and social influencers, plays a pivotal role in shaping consumer preferences and driving demand for specific styles and finishes within the luxury wood furniture market.

Despite the positive market outlook, the luxury wood furniture sector faces several challenges. The high cost of raw materials, especially rare and exotic wood types, can significantly impact production costs and pricing. Fluctuations in the prices of these materials can create uncertainty for manufacturers and affect profit margins. Furthermore, the labor-intensive nature of crafting high-quality wood furniture makes production processes relatively slow and costly, potentially limiting the scale of production and affecting accessibility for some consumers. Competition from cheaper alternatives, such as mass-produced furniture made from composite materials, presents a significant challenge. Marketing and distribution of luxury goods require specialized strategies to reach the target audience effectively. This includes building brand awareness, showcasing the unique value proposition, and establishing strong distribution channels to reach discerning consumers. The global supply chain complexities, especially disruptions caused by geopolitical instability or unforeseen events, can impact the availability of raw materials and the timely delivery of finished products. Finally, the rising awareness of sustainability and ethical sourcing puts pressure on manufacturers to demonstrate responsible and transparent sourcing practices, potentially increasing production costs and complexities.

North America: The North American market, particularly the United States and Canada, is expected to remain a dominant player in the luxury wood furniture sector due to high disposable incomes, established consumer preferences for high-quality furniture, and a robust interior design industry. This region showcases a strong demand for both traditional and contemporary styles, coupled with a preference for eco-friendly and ethically sourced products.

Europe: European countries, especially those with a long history of fine woodworking craftsmanship, maintain a substantial market share. Consumers in these markets value traditional techniques, unique designs, and high-quality materials. The presence of established luxury brands and a strong design culture contributes significantly to this region's market dominance.

Asia-Pacific: Rapid economic growth in countries like China, Japan, South Korea, and India is driving a significant increase in demand for luxury goods, including high-end furniture. These markets show a growing preference for Western-style furniture, alongside a strong appreciation for traditional Asian design elements.

Segment Dominance: The high-end residential segment, encompassing custom-designed pieces for luxury homes and apartments, is expected to dominate the market. This segment caters to the most discerning clientele who prioritize quality, craftsmanship, and unique designs.

In summary, the combination of high disposable incomes in mature markets and the rising affluence in developing regions, coupled with a growing preference for bespoke, high-quality furniture, fuels the expansion of the luxury wood furniture market in these key regions and the residential segment. The market will likely witness a continued focus on sustainability, technological integration, and a deeper appreciation for artisanal craftsmanship within the next decade.

The luxury wood furniture industry's growth is fueled by a convergence of factors including rising disposable incomes globally, a strong emphasis on personalization and bespoke designs, the increasing adoption of sustainable practices by manufacturers, and a growing appreciation for craftsmanship and heritage. These catalysts are driving both consumer demand and industry innovation, ensuring continued market expansion.

This report provides a comprehensive analysis of the luxury wood furniture market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into market trends, driving forces, challenges, key players, and significant developments, providing a detailed overview of this dynamic and growing sector. The report serves as a valuable resource for businesses, investors, and industry stakeholders seeking a deep understanding of the luxury wood furniture market and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.6%.

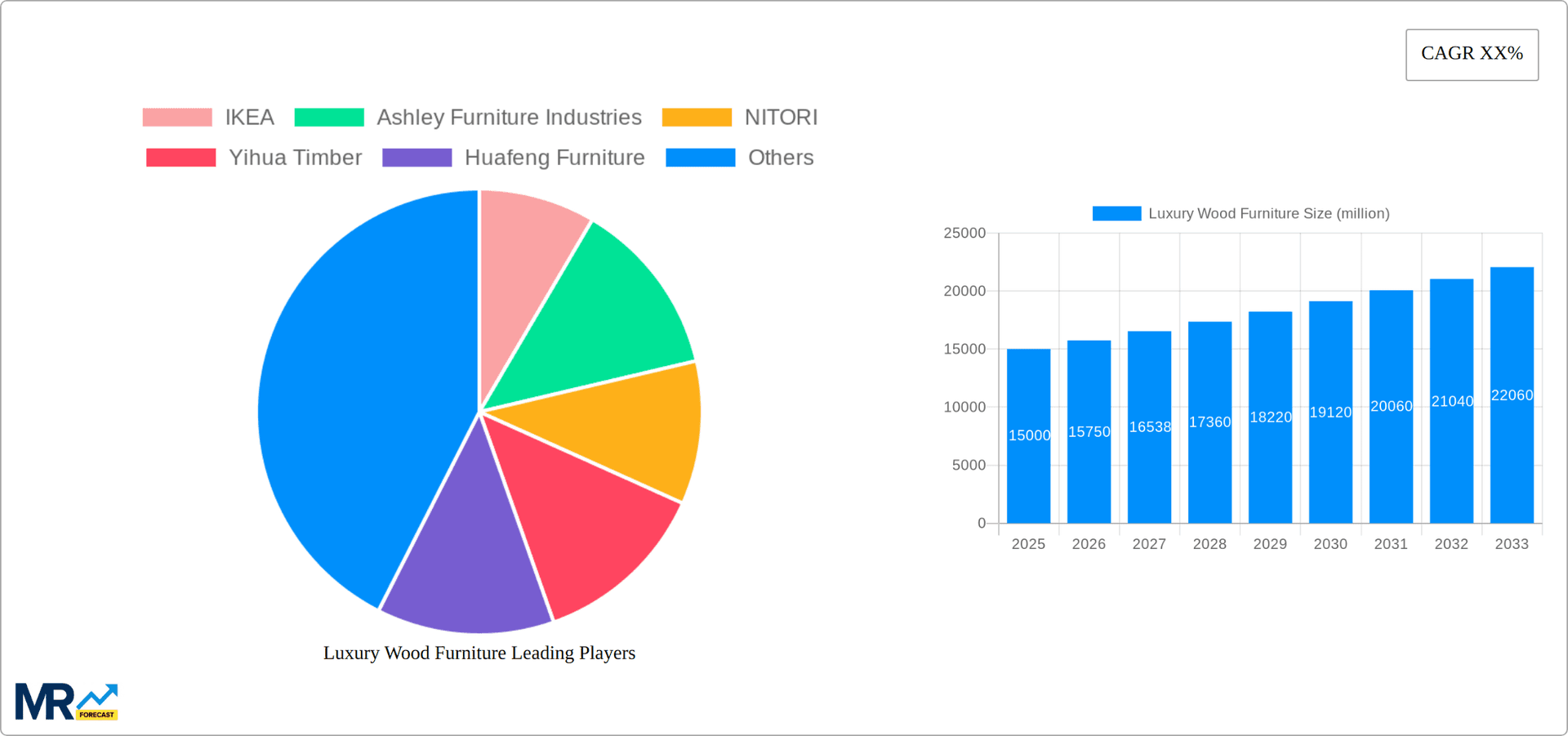

Key companies in the market include IKEA, Ashley Furniture Industries, NITORI, Yihua Timber, Huafeng Furniture, Dorel Industries, Nobilia, Sauder Woodworking, Suofeiya, La-Z-Boy Inc., Nolte Furniture, Hooker Furniture, QUANU, Man Wah Holdings, Natuzzi, Hülsta group, Markor, Kinnarps AB, Klaussner Furniture Industries, Doimo, Samson Holding, Sunon, Nowy Styl Group, .

The market segments include Type, Application.

The market size is estimated to be USD 27.19 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Luxury Wood Furniture," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Wood Furniture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.