1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Wallets?

The projected CAGR is approximately XX%.

Luxury Wallets

Luxury WalletsLuxury Wallets by Type (Men Type, Women Type, Kids Type), by Application (Online Store, Supermarket, Direct Store), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

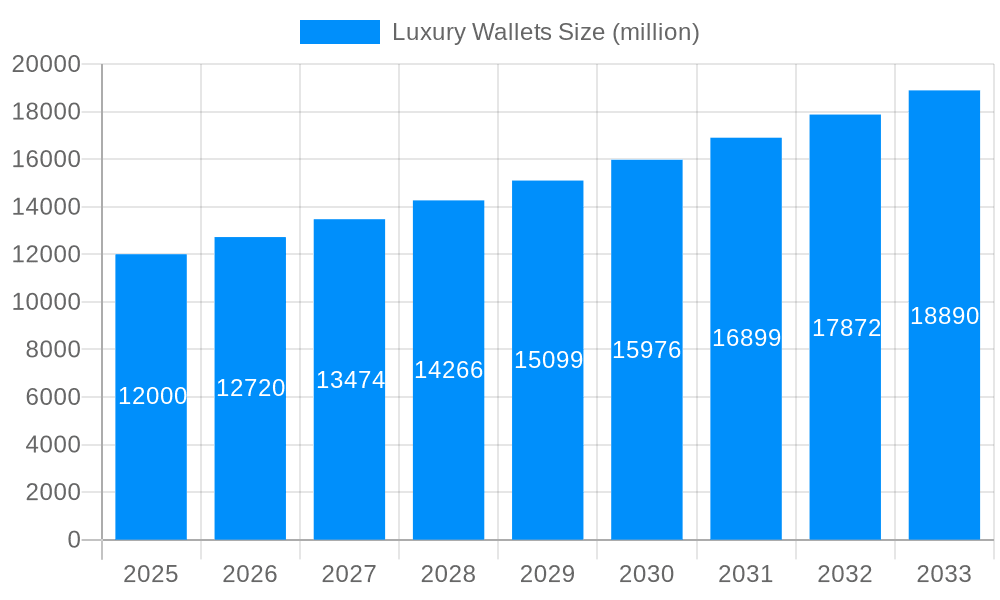

The global luxury wallets market, encompassing men's, women's, and children's segments across various distribution channels, is experiencing robust growth. While precise market size figures for 2019-2024 are unavailable, analyzing current market dynamics and the presence of established luxury brands like LVMH, Kering, and Hermes, suggests a sizable market value exceeding $10 billion in 2025. This is driven by increasing disposable incomes in key markets, particularly in Asia-Pacific and North America, and a rising demand for high-quality, durable, and status-symbol accessories. The growing popularity of online luxury retail significantly contributes to market expansion, offering consumers broader access to coveted brands. Further fueling growth is the trend of personalization and customization within luxury goods, allowing consumers to express individuality through their accessories.

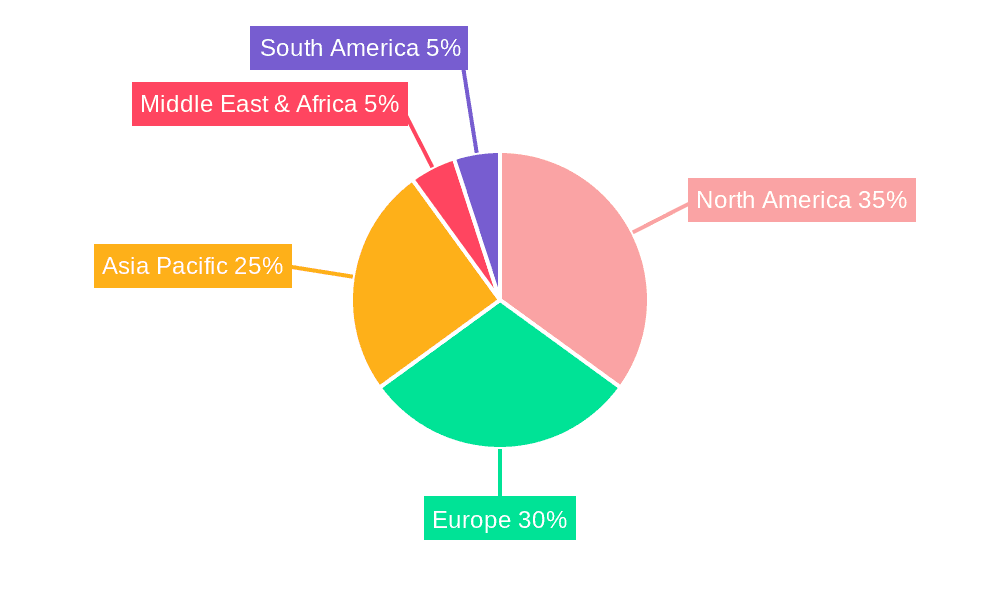

However, several factors restrain market growth. Economic downturns can impact luxury spending, particularly in price-sensitive segments. Counterfeit products represent a significant challenge, eroding the value proposition of genuine luxury brands. Furthermore, shifting consumer preferences and the emergence of sustainable and ethical brands could pose a challenge if luxury brands don't adapt accordingly. Segmentation analysis reveals that the men's luxury wallet segment likely holds the largest market share, followed by women's and then children's. Online stores are progressively gaining traction, representing a major growth area in the distribution channels, though physical luxury boutiques remain a vital presence. Geographic analysis indicates a robust market in North America and Europe, with significant growth potential in the Asia-Pacific region due to expanding affluence and a burgeoning middle class. The market is projected to maintain a healthy CAGR throughout the forecast period (2025-2033), driven by continued demand for luxury goods and innovative product offerings from leading brands. Competitive analysis reveals a highly consolidated market dominated by established luxury conglomerates and iconic individual brands, highlighting a highly competitive landscape.

The global luxury wallets market, valued at several million units in 2025, is experiencing significant transformation driven by evolving consumer preferences and technological advancements. The historical period (2019-2024) witnessed a steady growth trajectory, primarily fueled by rising disposable incomes in emerging markets and a growing appreciation for high-quality, durable goods. The forecast period (2025-2033) projects continued expansion, with the market expected to surpass previous milestones. This growth is not uniformly distributed across all segments. While men's luxury wallets continue to dominate the market, women's luxury wallets are exhibiting faster growth rates, driven by increased female participation in the workforce and a desire for sophisticated accessories. The rise of e-commerce platforms is significantly impacting distribution channels, with online stores gaining traction, especially among younger demographics. Luxury brands are increasingly leveraging digital marketing strategies and personalized experiences to cater to the unique preferences of individual consumers. Furthermore, sustainability and ethical sourcing are gaining prominence, with consumers increasingly favoring brands that align with their values. This trend is compelling luxury brands to incorporate eco-friendly materials and sustainable manufacturing practices into their production processes. The market is also witnessing the emergence of innovative designs, collaborations with artists, and limited-edition releases to further enhance brand exclusivity and appeal. Finally, the growing popularity of personalized customization options allows consumers to create bespoke luxury wallets, adding another dimension to market growth. The shift towards experience-based luxury and a focus on craftsmanship is reinforcing the market's upward trajectory.

Several key factors are propelling the growth of the luxury wallets market. Firstly, the expanding global middle class, particularly in developing economies, is creating a larger pool of consumers with the disposable income to afford luxury goods. This increase in purchasing power, coupled with a shift in consumer behavior towards prioritizing experiences and self-expression, drives demand for premium accessories. Secondly, the rising popularity of online shopping has expanded market access, enabling consumers worldwide to easily purchase luxury wallets from brands previously inaccessible to them. The convenience and personalized shopping experiences offered by online retailers significantly influence purchase decisions. Thirdly, the emphasis on branding and status symbolism plays a crucial role. Owning luxury wallets from established brands confers a sense of prestige and social status, influencing consumer choices. This is further amplified by the aspirational appeal of luxury brands, which positions luxury wallets as coveted status symbols. Finally, the increasing preference for durable and high-quality goods is contributing to the market's growth. Luxury wallets are viewed as long-term investments, representing superior craftsmanship and lasting value compared to mass-market alternatives. This emphasis on quality and longevity resonates strongly with consumers seeking enduring value and mindful consumption.

Despite the positive outlook, the luxury wallets market faces several challenges. Economic downturns and global uncertainties can significantly impact consumer spending on luxury goods, leading to decreased demand. Fluctuations in exchange rates and rising inflation can further impact the pricing and profitability of luxury wallets, forcing brands to navigate complex market dynamics. Furthermore, counterfeiting remains a persistent issue, undermining the authenticity and value proposition of genuine luxury wallets. The fight against counterfeit products requires continuous brand vigilance and stringent enforcement measures. The rising cost of raw materials and manufacturing impacts profitability, potentially driving up prices and affecting affordability. Competition from other luxury accessory categories, such as designer bags and jewelry, creates a dynamic market landscape where brands must constantly innovate and adapt to retain market share. Finally, maintaining brand reputation and upholding the promise of exclusivity is paramount. Any negative publicity or quality control issues can severely damage a brand's image, negatively impacting sales and consumer trust.

The market is geographically diverse, with several regions exhibiting strong growth potential. However, North America and Western Europe are expected to continue dominating the market due to high per capita incomes and established luxury consumer culture. Asia-Pacific is also a rapidly growing market, driven by rising disposable incomes and a burgeoning middle class in countries like China and India. Within the segments, the men's luxury wallets segment currently holds the largest market share, driven by the greater purchasing power of men within this sector. However, the women's luxury wallets segment shows a faster growth rate. The online store channel demonstrates significant growth potential as consumer preference moves to e-commerce.

The shift toward online purchasing presents a significant opportunity for growth. The convenience of online shopping, coupled with the ability of brands to personalize the shopping experience and build relationships with individual customers, makes it a key driver of market expansion. The shift in consumer preferences towards sustainable and ethical products is also creating opportunities for luxury brands to incorporate environmentally friendly materials and responsible sourcing practices into their production processes. This trend resonates positively with increasingly environmentally conscious consumers.

Several factors are catalyzing growth within the luxury wallets sector. Increased disposable incomes in emerging markets coupled with a rise in luxury consumption globally are key drivers. The increasing influence of social media and celebrity endorsements promotes aspirational purchases. Moreover, the constant innovation in design, materials, and technological integration of features into luxury wallets caters to evolving consumer demands and preferences.

This report provides a comprehensive overview of the luxury wallets market, covering key trends, drivers, challenges, and leading players. The detailed analysis, including forecasts up to 2033, provides valuable insights for businesses, investors, and stakeholders involved in or interested in the luxury goods industry. The information is based on rigorous data analysis and industry expertise, offering a thorough understanding of the market's dynamics and future potential. This report is essential for strategic decision-making related to the luxury wallets market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kering SA, Hermes International S.A, Versace, Prada, Dolce and Gabbana, Burberry Group Inc, LVMH Moet Hennessy Louis Vuitton S.E, Giorgio Armani S.P.A, Ralph Lauren Corporation, Ermenegildo Zegna, Kiton, Hugo Boss A.G, Channel, Kering, Levi Strauss Co., GIVI Holding, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Wallets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Wallets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.