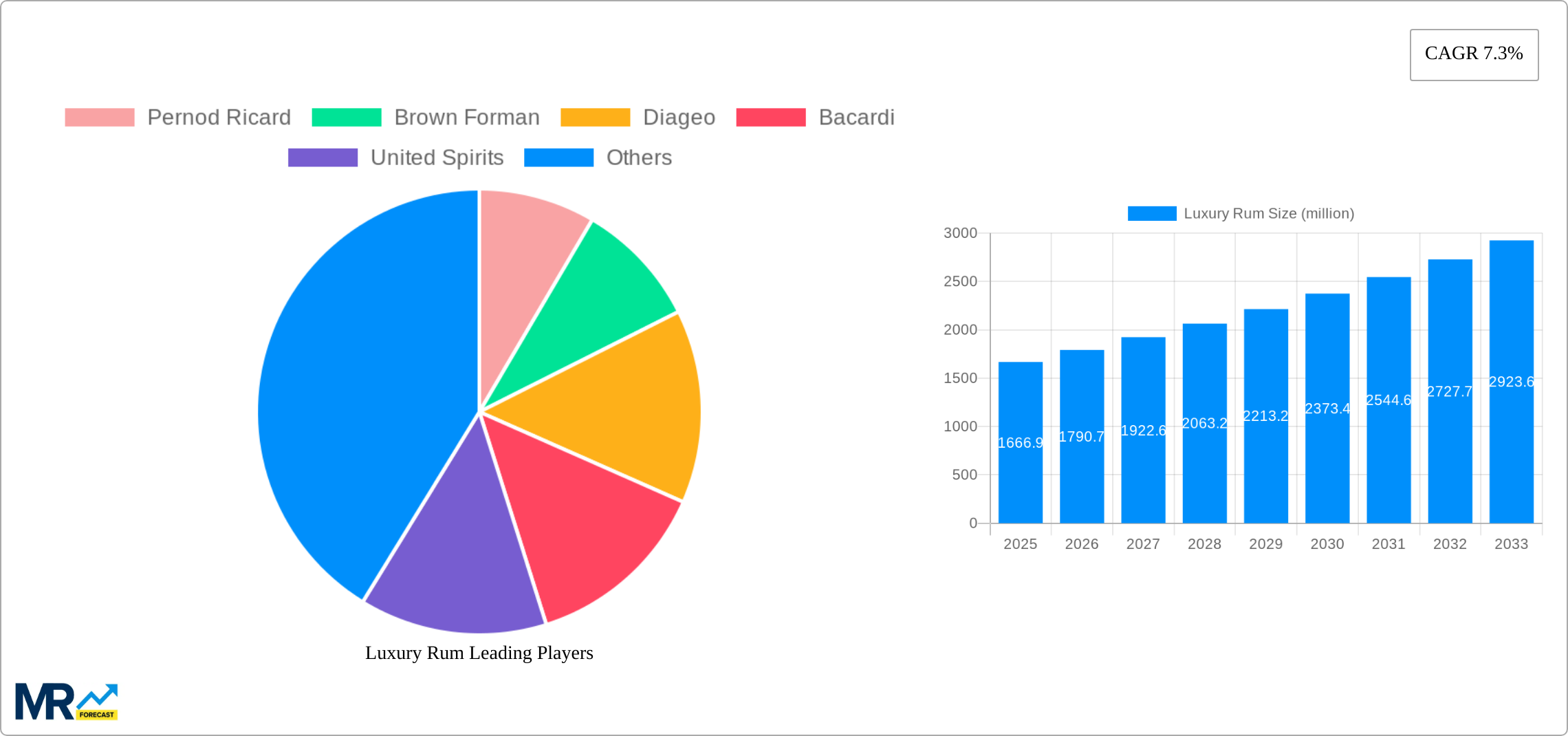

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Rum?

The projected CAGR is approximately 7.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Rum

Luxury RumLuxury Rum by Type (White Rum, Dark Rum, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

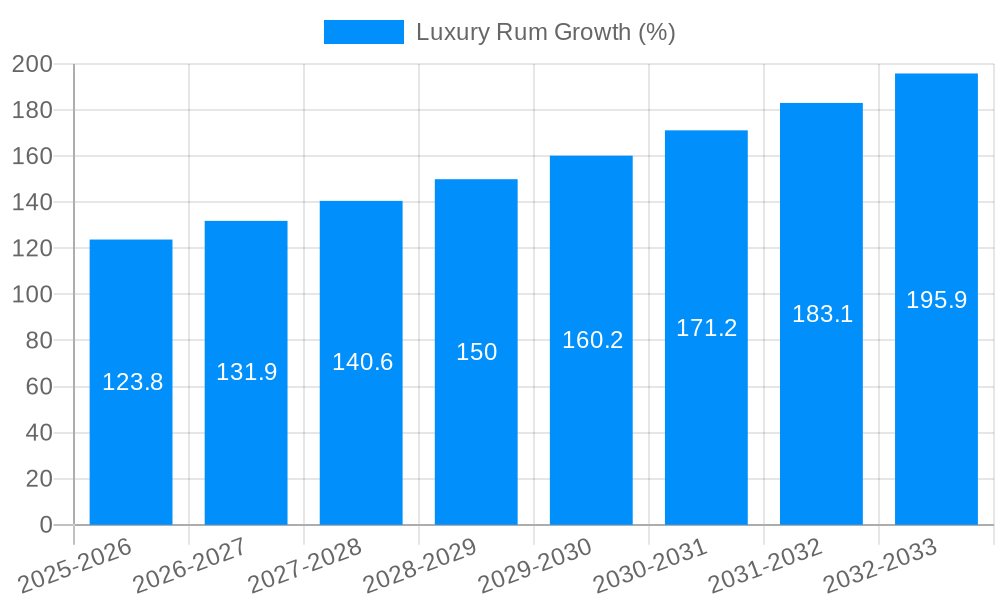

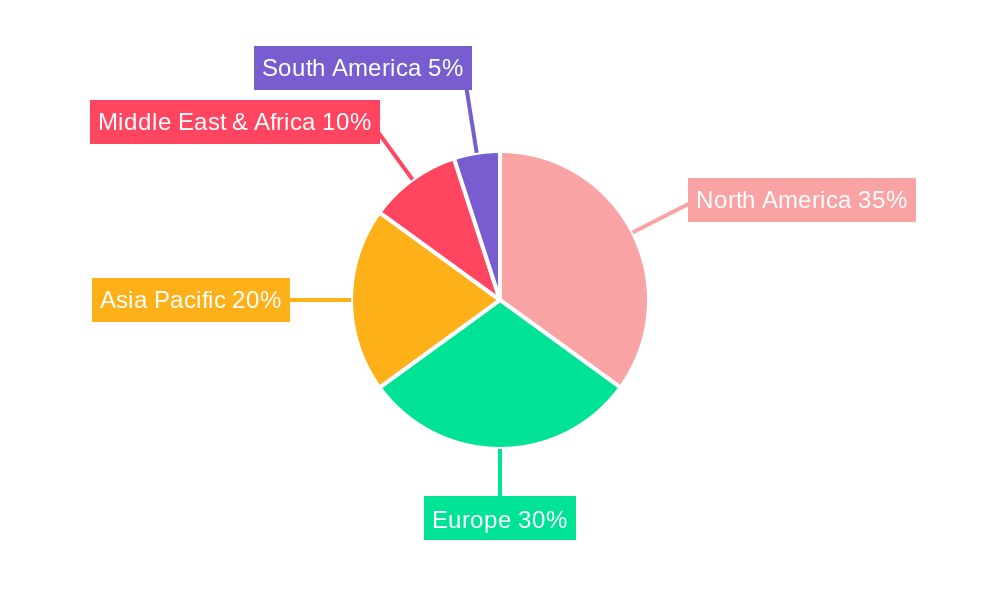

The global luxury rum market, valued at $1666.9 million in 2025, is projected to experience robust growth, driven by increasing disposable incomes in emerging economies and a rising preference for premium spirits among affluent consumers. The market's Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2033 indicates significant expansion potential. Key drivers include the growing popularity of rum cocktails in both on-premise and off-premise consumption channels, particularly among millennials and Gen Z. Furthermore, the increasing availability of luxury rum through online sales channels and targeted marketing campaigns are expanding market reach. The premiumization trend within the spirits industry fuels demand for high-quality, aged rums, further driving market growth. While the market faces constraints such as fluctuating raw material prices and stringent regulations concerning alcohol production and distribution, the overall outlook remains positive. The segment analysis reveals a strong preference for white and dark rums, with online sales channels demonstrating significant potential for future growth. Major players, including Pernod Ricard, Brown Forman, Diageo, and Bacardi, are strategically investing in brand building, product innovation, and expanding distribution networks to capitalize on the growth opportunities in this segment. Geographic analysis points to strong demand in North America and Europe, with considerable growth potential in rapidly developing markets across Asia-Pacific.

The competitive landscape is characterized by both established global players and regional brands. Successful companies are focusing on crafting unique product offerings, building strong brand identities, and effectively targeting specific consumer demographics. The rise of craft distilleries producing small-batch, high-quality luxury rums also presents a significant challenge and opportunity for established brands. Future growth will depend on consistent product innovation, targeted marketing strategies, and a focus on sustainability and responsible consumption. The market's success will hinge on adapting to evolving consumer preferences and effectively navigating the regulatory environment in key global markets. Strategic partnerships and acquisitions are expected to play an increasingly important role in shaping the market's dynamics over the forecast period.

The global luxury rum market, valued at approximately XXX million units in 2025, is experiencing robust growth, projected to reach XXX million units by 2033. This expansion is fueled by several interconnected factors. Firstly, a burgeoning global middle class, particularly in emerging economies, is driving increased demand for premium spirits. Consumers are increasingly willing to spend more on high-quality, sophisticated products like luxury rums, viewing them as a symbol of success and refined taste. Secondly, the rise of sophisticated cocktail culture and mixology has broadened the appeal of rum beyond traditional consumption methods. The versatility of rum, lending itself to both classic and innovative cocktail creations, has significantly boosted its desirability. Furthermore, targeted marketing campaigns highlighting the heritage, craftsmanship, and unique characteristics of luxury rum brands have successfully cultivated a strong brand loyalty and elevated perception among consumers. This is evident in the increasing popularity of limited-edition releases and aged rums, commanding premium prices and fueling market expansion. Finally, the growing interest in sustainable and ethically sourced products is influencing consumer choices, with luxury rum brands increasingly emphasizing their commitment to responsible production practices. This focus on sustainability enhances the luxury appeal and attracts environmentally conscious consumers. The market's historical period (2019-2024) showcases a consistent upward trend, solidifying the prediction of continued growth throughout the forecast period (2025-2033).

Several key factors are propelling the growth of the luxury rum market. The increasing disposable income in key markets worldwide directly translates to a greater capacity for consumers to afford premium spirits. This is particularly evident in Asia-Pacific and Latin America, regions exhibiting strong economic growth and rising middle classes with a penchant for high-end alcoholic beverages. Moreover, the growing awareness and appreciation for the history and craftsmanship behind premium rum brands are influencing consumer choices. Consumers are drawn to brands with compelling stories and traditional production methods, adding a layer of exclusivity and prestige to their purchase. The rise of experiential marketing, including exclusive tastings, distillery tours, and brand collaborations with luxury hotels and restaurants, further enhances the luxury perception and desirability of these products. Strategic partnerships with high-profile influencers and celebrities are also contributing to increased brand visibility and driving sales, particularly among younger demographics. Finally, the continued innovation in rum production, with the introduction of new flavor profiles, limited-edition releases, and unique aging processes, keeps the market exciting and caters to the evolving preferences of discerning consumers.

Despite the positive market outlook, several challenges and restraints may hinder the growth of the luxury rum market. Increased competition, particularly from other premium spirits such as whiskey and tequila, poses a significant threat. The emergence of new artisanal brands can also fragment the market and intensify the battle for market share. Furthermore, fluctuating raw material prices and the impact of adverse weather conditions on sugarcane crops could impact production costs and profitability for luxury rum producers. Stricter regulations and taxation policies on alcoholic beverages in some countries can also create barriers to market entry and limit sales growth. Another potential challenge is maintaining brand authenticity and preventing counterfeiting, which can damage consumer trust and brand reputation. Finally, economic downturns or global uncertainties could decrease consumer spending on luxury goods, impacting demand for premium rum. Addressing these challenges effectively will be crucial for sustained growth in the luxury rum sector.

The North American market is projected to dominate the luxury rum segment during the forecast period (2025-2033), driven by high consumer spending power and established brand presence. Europe also holds significant market share, with established consumer preferences for premium spirits. However, developing regions, particularly in Asia-Pacific, show promising growth potential due to the expanding middle class and increasing disposable incomes. Within the segments, Dark Rum enjoys a significant lead due to its complex flavor profiles and association with luxury and sophistication. The Offline Sales channel currently holds the lion's share, though Online Sales are experiencing impressive growth, driven by the convenience and accessibility of e-commerce platforms for premium spirits. This online expansion is projected to significantly increase over the coming years, with more sophisticated online platforms offering bespoke experiences. While white rum maintains a presence, its simpler flavor profile and association with more affordable options makes its growth in the luxury sector comparatively slower. "Other" types of rum, including spiced and flavored rums, present a growing niche market driven by innovation and changing consumer tastes.

The interplay between these factors shapes the future of the luxury rum market. The rising preference for sophisticated flavors and experiences will drive innovation in product offerings. Online sales will continue to grow, potentially impacting traditional distribution channels. Meanwhile, the need for responsible sourcing and environmentally friendly production methods will continue to influence consumer perception and buying decisions.

The luxury rum industry's growth is fueled by several factors, including rising disposable incomes, a growing appreciation for sophisticated spirits, and innovative marketing strategies that highlight the craft and heritage of premium rum. Consumers are increasingly seeking unique and high-quality experiences, further propelling demand for luxury products. Strategic partnerships and brand collaborations are creating unique product offerings, driving interest and sales. This coupled with the evolution of online sales channels further expands market reach.

This report provides a thorough analysis of the luxury rum market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It details market trends, driving factors, challenges, and key players. A regional breakdown and segmentation analysis (by type and application) provides comprehensive insights. The report is invaluable for businesses seeking to understand and navigate the evolving luxury rum market, enabling informed strategic decision-making and market penetration strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.3%.

Key companies in the market include Pernod Ricard, Brown Forman, Diageo, Bacardi, United Spirits, ThaiBev, Campari, Edrington Group, Bayadera Group, LMVH, William Grant & Sons, HiteJinro, Beam Suntory, .

The market segments include Type, Application.

The market size is estimated to be USD 1666.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Rum," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Rum, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.