1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Jewelry?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Jewelry

Luxury JewelryLuxury Jewelry by Type (Hair Ornaments, Hand Decoration, Other), by Application (Men Use, Ladies Use, World Luxury Jewelry Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

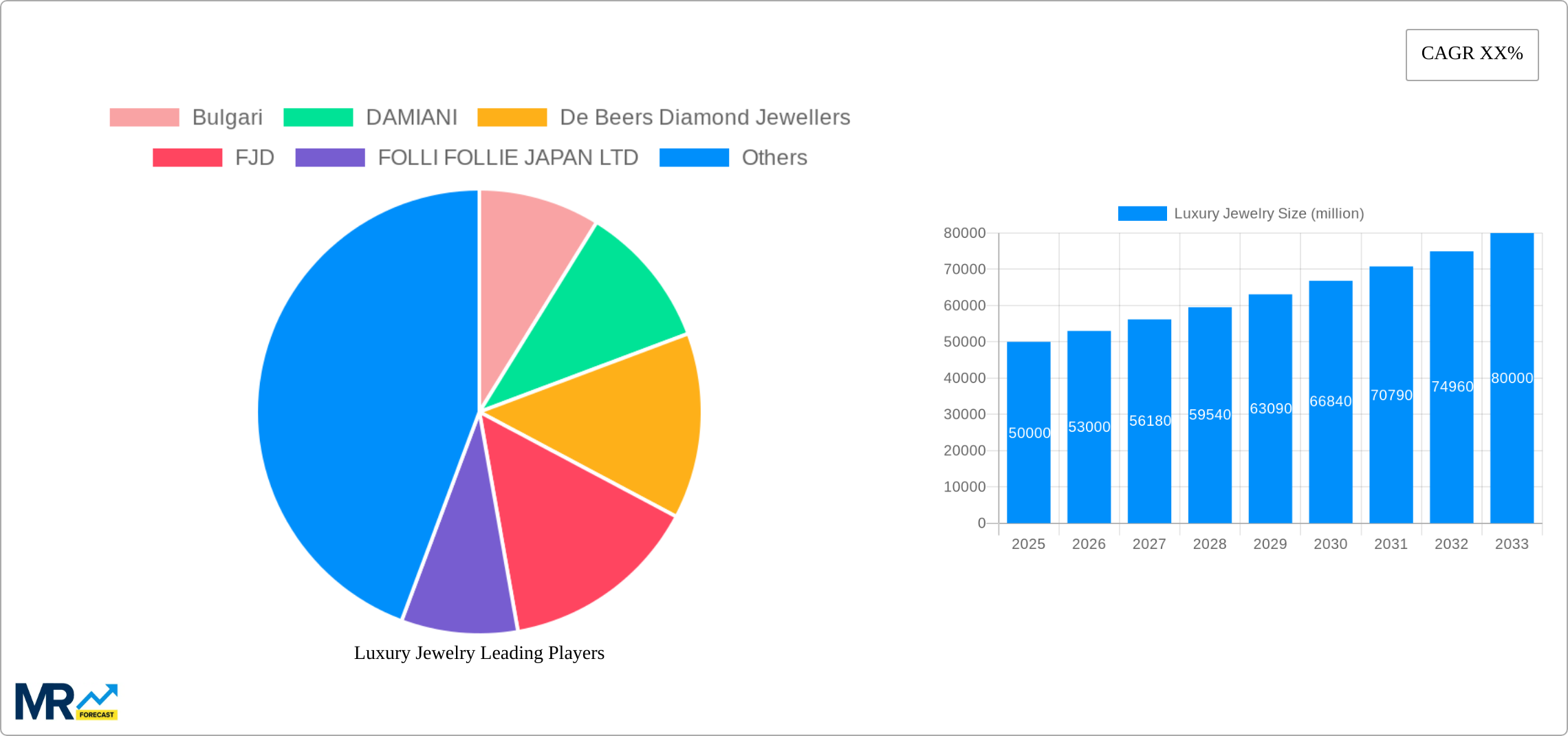

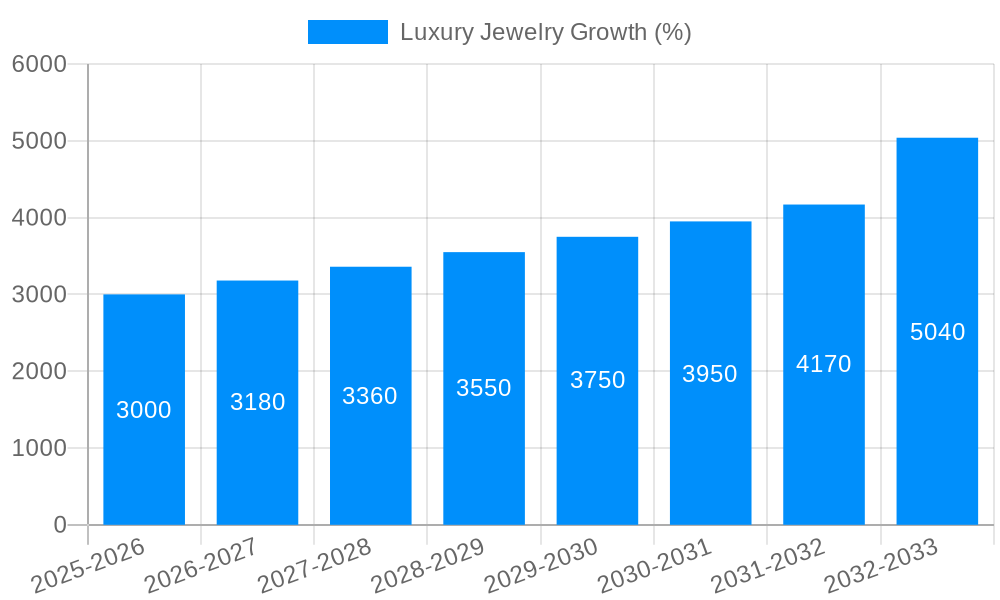

The luxury jewelry market, encompassing high-end pieces like hair ornaments and hand decorations, is experiencing robust growth, driven by increasing disposable incomes in emerging markets and a rising preference for personalized, high-quality accessories. The market's value, estimated at $50 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 6% between 2025 and 2033, reaching approximately $80 billion by 2033. This growth is fueled by several key factors, including the strong performance of luxury brands like Bulgari, Tiffany & Co., and Richemont, which consistently introduce innovative designs and leverage effective marketing strategies. Furthermore, the burgeoning demand for luxury jewelry from affluent consumers in Asia-Pacific, particularly China and India, significantly contributes to market expansion. The "Ladies Use" application segment currently dominates the market, though the "Men Use" segment shows promising growth potential, driven by increasing male interest in luxury accessories. However, economic downturns and fluctuating precious metal prices pose potential restraints to market expansion.

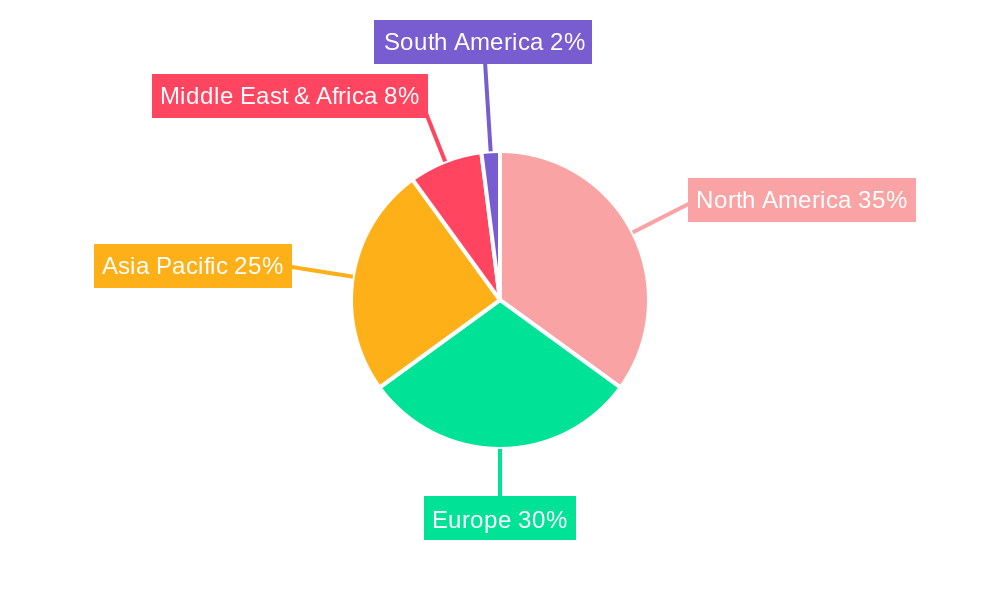

Despite the promising growth outlook, the luxury jewelry market faces challenges. The industry's high concentration among established luxury houses creates a barrier to entry for smaller players. Moreover, ethical sourcing and sustainability concerns are gaining prominence, forcing brands to implement transparent and responsible supply chain practices. Geographical segmentation reveals a significant concentration of market share in North America and Europe, though Asia-Pacific is projected to witness the highest growth rate over the forecast period due to rapid economic development and an expanding middle class. Competition is intense among key players, necessitating constant innovation and brand building. The market's segmentation by type (hair ornaments, hand decoration, etc.) reveals significant potential for growth in specialized categories catering to evolving consumer preferences for unique and personalized pieces. Success in the luxury jewelry market hinges on a combination of exquisite craftsmanship, powerful branding, and a strong commitment to ethical and sustainable practices.

The global luxury jewelry market, valued at several million units in 2025, is experiencing a dynamic evolution shaped by shifting consumer preferences and technological advancements. The historical period (2019-2024) witnessed a surge in demand for sustainable and ethically sourced materials, driving brands to emphasize transparency in their supply chains. This trend is expected to intensify throughout the forecast period (2025-2033), with consumers increasingly prioritizing brands aligned with their values. Furthermore, personalization is gaining traction, with bespoke jewelry and customizable pieces becoming increasingly popular. The rise of e-commerce has also significantly impacted the market, offering brands new avenues for reaching consumers and providing a more personalized shopping experience. However, the market isn't without its complexities. Geopolitical instability and economic fluctuations can impact consumer spending on luxury goods, creating uncertainties for brands. The increasing popularity of lab-grown diamonds presents a challenge to traditional diamond miners, forcing them to innovate and adapt their strategies. Despite these challenges, the market's growth trajectory remains positive, driven by a growing affluent middle class, particularly in emerging markets, and a continued fascination with luxury goods as a symbol of status and self-expression. The rise of "conscious luxury," where sustainability and ethical considerations are paramount, is reshaping the landscape, pushing brands to implement eco-friendly practices and demonstrate commitment to social responsibility. Finally, collaborations between luxury brands and influencers, particularly on social media platforms, are significantly impacting consumer perception and driving sales. The integration of technology, from augmented reality for virtual try-ons to blockchain for provenance tracking, are transforming the consumer experience and creating new opportunities for growth.

Several key factors are propelling the growth of the luxury jewelry market. Firstly, the expanding global affluent population, particularly in emerging economies like China and India, fuels demand for luxury goods, including jewelry. This expanding consumer base represents a substantial growth opportunity for luxury brands. Secondly, the enduring appeal of jewelry as a symbol of status, wealth, and personal expression remains a significant driver. Jewelry transcends mere adornment; it represents an investment and a legacy. Thirdly, innovation in design and craftsmanship continues to captivate consumers, with brands constantly pushing creative boundaries and introducing novel materials and techniques. This constant evolution keeps the market fresh and exciting. Moreover, the increasing adoption of online channels for luxury jewelry sales provides greater accessibility and convenience for consumers, expanding the market reach. The development of robust e-commerce platforms with secure payment systems and personalized experiences contributes to the positive trajectory of the market. Finally, strategic marketing and branding efforts by luxury houses, leveraging influencer marketing and targeted advertising, successfully cultivate desire and aspiration amongst consumers. These combined factors create a powerful synergy that is driving significant growth in the global luxury jewelry market.

Despite its positive outlook, the luxury jewelry market faces several challenges. Economic downturns and geopolitical uncertainties can significantly impact consumer spending on luxury goods, resulting in decreased demand. Fluctuations in precious metal and gemstone prices directly affect production costs and profitability, creating pricing pressures for brands. The rising popularity of lab-grown diamonds poses a threat to the traditional diamond industry, requiring established players to adapt their strategies to compete. Counterfeit products and the gray market represent a substantial challenge, undermining brand authenticity and eroding consumer trust. Additionally, evolving consumer preferences, particularly the growing demand for sustainable and ethically sourced materials, necessitate significant adjustments in supply chains and production practices for brands to remain competitive. Meeting these evolving expectations requires investments in transparent sourcing and environmentally friendly manufacturing processes. Furthermore, maintaining brand exclusivity and prestige in an increasingly accessible market through digital channels is crucial for sustaining high profit margins. Addressing these challenges effectively will be key to maintaining the robust growth of the luxury jewelry market.

The luxury jewelry market presents a diverse landscape, with certain regions and segments exhibiting more prominent growth trajectories.

Ladies' Use: This segment overwhelmingly dominates the market, reflecting the enduring association of luxury jewelry with female adornment and self-expression. Women represent the primary consumer base for luxury jewelry, driving significant demand across various product categories.

Key Regions: Asia-Pacific, particularly China, and the Middle East are anticipated to experience substantial growth due to the rising affluent population and strong cultural significance attached to jewelry. The established luxury markets of Europe and North America will continue to contribute significantly but at a potentially slower pace than emerging markets.

Specific Countries: China, India, and the United Arab Emirates are projected to be key growth drivers within their respective regions, reflecting considerable economic expansion and growing consumer purchasing power.

Paragraph: While the "Ladies' Use" segment's dominance is undeniable, the men's jewelry segment shows potential for future growth, driven by changing gender roles and a heightened appreciation for high-quality men's accessories. However, the "Ladies' Use" segment’s strong foundation and consistent demand will likely maintain its market leadership throughout the forecast period. The geographical spread of growth suggests a globalized luxury market, with emerging economies playing an increasingly crucial role. The ongoing demand for luxury goods, coupled with the unique cultural contexts in these key regions, points to a continued upward trajectory for the luxury jewelry market in these areas, creating both opportunity and complexity for brands navigating this diverse global market.

Several factors act as catalysts for growth in the luxury jewelry industry. Firstly, the increasing disposable incomes of the global middle class fuel demand for luxury goods, with jewelry being a significant purchase. Secondly, the rising popularity of personalization and bespoke designs allows customers to create unique pieces expressing individual style, driving demand. Thirdly, the continued innovation in design, craftsmanship, and the use of new materials keeps the market fresh and dynamic, attracting new customers and maintaining consumer interest. Finally, the effective use of e-commerce and targeted digital marketing expands reach and enhances the consumer experience.

This report provides a comprehensive analysis of the luxury jewelry market, covering historical data (2019-2024), the current state (estimated year 2025), and detailed forecasts up to 2033. The report analyzes market trends, identifies key growth drivers and challenges, profiles leading players, and offers insights into key regional and segmental performances. It will serve as a valuable resource for businesses operating in or seeking to enter the luxury jewelry market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bulgari, DAMIANI, De Beers Diamond Jewellers, FJD, FOLLI FOLLIE JAPAN LTD, Georg Jensen, GUCCI Group, Harry Winston, JOAQUIN BERAO JAPAN, MUSEO, Richemont, San Freres S A, Tiffany & Co, UNO A ERRE JAPAN, URAI, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Jewelry," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Jewelry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.