1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Cell Phone?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Cell Phone

Luxury Cell PhoneLuxury Cell Phone by Type (Smartphone, Dumb Phone, World Luxury Cell Phone Production ), by Application (Men, Women, World Luxury Cell Phone Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

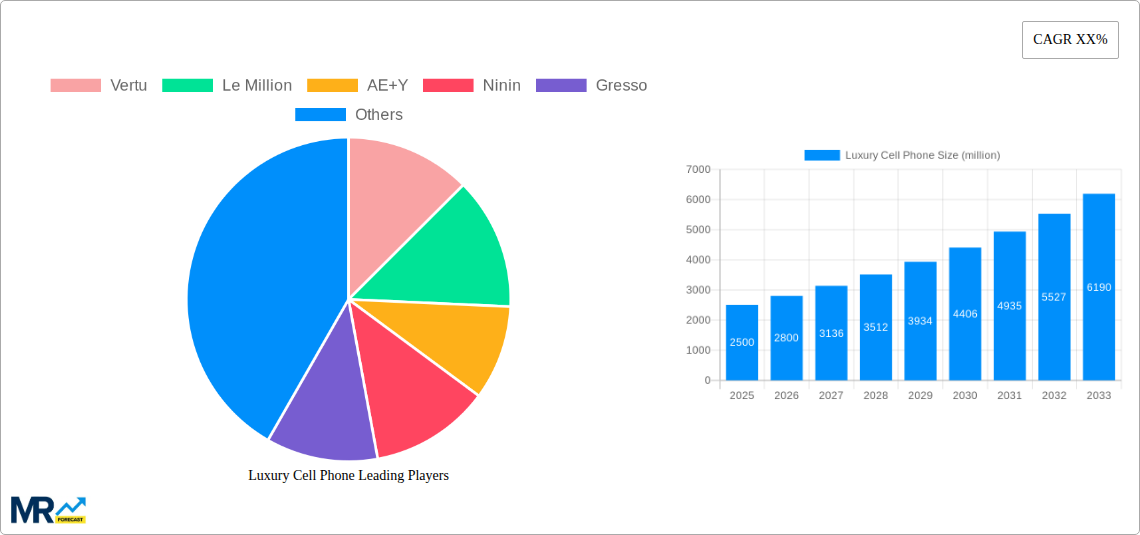

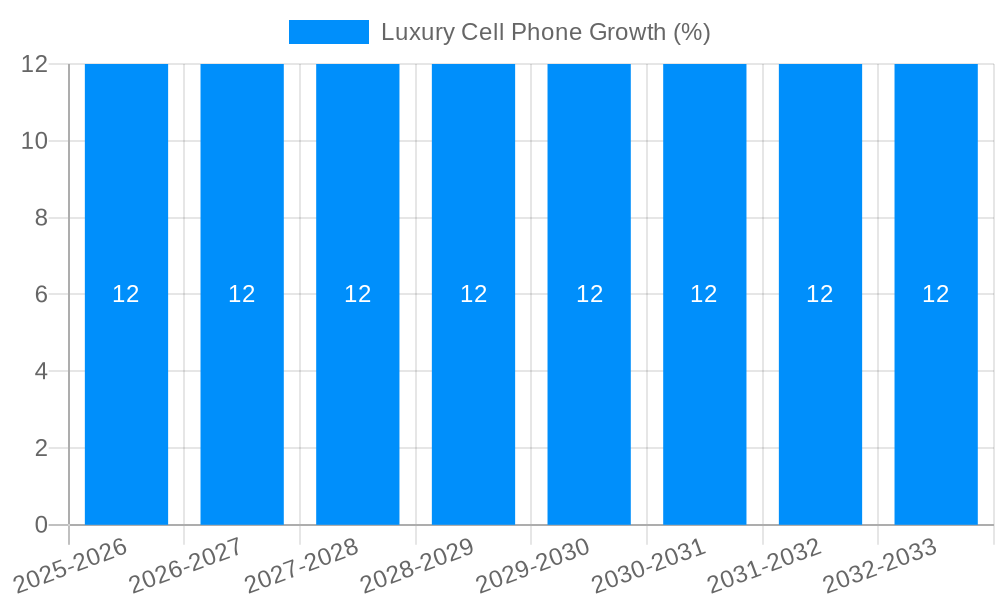

The global luxury cell phone market is poised for significant expansion, projected to reach an estimated market size of $2,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% anticipated through 2033. This growth is fueled by an increasing demand for exclusivity, unparalleled craftsmanship, and personalized user experiences among high-net-worth individuals. The market is characterized by its niche appeal, focusing on ultra-premium devices that blend cutting-edge technology with bespoke design and high-end materials like precious metals, exotic leathers, and intricate detailing. The "World Luxury Cell Phone Production" segment itself highlights the core value proposition, emphasizing superior build quality and often limited production runs that enhance desirability and exclusivity. While smartphones dominate the broader mobile landscape, the luxury segment caters to a discerning clientele seeking more than just functionality; they desire a statement piece that reflects their status and personal style.

The market's expansion will be driven by several key factors, including the growing affluence of consumers in emerging economies and the continuous innovation in materials science and personalized technology integration. Trends such as the incorporation of advanced security features, unique aesthetic customizations, and exclusive digital services are expected to further propel market growth. However, the high price point of these devices, coupled with a limited addressable market compared to mainstream smartphones, presents a significant restraint. The proliferation of premium features in mainstream smartphones also poses a competitive challenge, necessitating that luxury brands continuously innovate to maintain their distinct value proposition. Key players like Vertu, Gresso, and Mobiado are investing in sophisticated design, exclusive partnerships, and personalized customer service to capture this discerning market. Segmentation analysis reveals that while smartphones will continue to be the primary luxury device, the inherent allure of unique, high-end mobile phones catering to both men and women will sustain this specialized sector.

This report delves into the dynamic and highly specialized market for luxury cell phones, offering a comprehensive analysis of its trajectory from 2019 to 2033. With a base year of 2025, the study meticulously examines historical trends, current market conditions, and future projections for this elite segment. The report will quantify market sizes in millions of units, providing a clear picture of production volumes and demand across various product types, applications, and influential brands.

XXX The luxury cell phone market, while niche, exhibits a fascinating blend of enduring demand for exclusivity and evolving technological integration. During the historical period (2019-2024), the market experienced a steady, albeit modest, growth driven by a core clientele seeking status, unparalleled craftsmanship, and bespoke features. The estimated year (2025) signifies a point where the market is poised for a more pronounced evolution, with projections for the forecast period (2025-2033) indicating a sustained upward trend. A key trend observed is the increasing sophistication of "dumb phones" within the luxury segment. These are not mere basic communication devices but meticulously crafted artifacts, often featuring precious metals, exotic leathers, and intricate detailing, catering to individuals who value discretion and timeless elegance over constant connectivity. The production of these high-end "dumb phones" is expected to remain a significant contributor to the overall market volume, with projections of reaching into the low millions of units annually by 2025 and potentially double that by the end of the forecast period.

Conversely, the integration of advanced smartphone technology into luxury devices is also a defining trend. While the core appeal remains exclusivity, consumers in this segment are increasingly demanding cutting-edge functionality. This has led to brands like Vertu, historically known for its opulent feature phones, to either adapt or face obsolescence. The market is seeing a bifurcated approach: some brands are doubling down on the artisanal, non-connected luxury experience, while others are meticulously engineering ultra-premium smartphones that offer not only advanced features but also a level of personalization and security that mass-market devices cannot match. The "World Luxury Cell Phone Production" is a crucial metric here, encompassing both types of devices. By 2025, we estimate this production to hover around 2.5 million units, with a projected growth to over 5 million units by 2033, showcasing a robust appetite for these exclusive communication tools. The demand is increasingly segmented by application, with distinct offerings catering to both discerning men and women. The "Women" segment, while historically smaller, is showing promising growth as brands launch more aesthetically refined and feature-rich devices tailored to their preferences. The report will further dissect these trends, providing granular insights into the evolving definition of luxury in the mobile communication space.

The luxury cell phone market is propelled by a confluence of distinct and powerful drivers that ensure its continued relevance and growth. At its core, the enduring desire for exclusivity and status remains the primary engine. In a world saturated with mass-produced goods, luxury cell phones represent a tangible symbol of wealth, success, and discerning taste. This aspirational appeal is particularly strong among high-net-worth individuals who seek products that set them apart from the crowd. Furthermore, the craftsmanship and artistry embedded in these devices are a significant draw. Brands like Gresso and Mobiado have built reputations on their meticulous attention to detail, utilizing precious metals, rare woods, and premium gemstones to create unique, often handcrafted, pieces. This artisanal approach appeals to a consumer base that values heritage, quality, and the inherent beauty of meticulously made objects.

Beyond aesthetics, the increasing emphasis on privacy and security in the digital age is also fueling demand for luxury cell phones. Many of these devices offer enhanced security features, encrypted communication channels, and personalized support services that provide peace of mind to individuals who handle sensitive information. Companies are increasingly offering bespoke software solutions and dedicated concierge services, further differentiating their offerings. The limited production runs of many luxury models also contribute to their desirability, creating a sense of scarcity that enhances their value. Finally, the evolving understanding of what constitutes a "luxury" product is expanding. It’s no longer solely about ostentatious display; it’s about a holistic experience encompassing superior materials, unparalleled functionality, personalized service, and a connection to heritage and craftsmanship. This holistic approach ensures that the luxury cell phone market, though small in volume, remains a potent force.

Despite its inherent appeal, the luxury cell phone market is not without its significant challenges and restraints that can temper its growth trajectory. One of the most prominent hurdles is the rapid pace of technological advancement in the mainstream smartphone market. As mass-market devices become increasingly sophisticated, incorporating features once exclusive to high-end luxury models, the perceived technological gap narrows. This can make it challenging for luxury brands to justify their premium pricing solely on the basis of features, forcing them to lean more heavily on craftsmanship and brand heritage. Furthermore, the cyclical nature of consumer spending and economic downturns can disproportionately affect the luxury market. During periods of economic uncertainty, discretionary spending on high-value items like luxury cell phones tends to decline as consumers become more cautious with their finances.

The niche nature of the market also presents a restraint. The limited customer base means that production volumes are inherently low, which can lead to higher per-unit manufacturing costs and a reduced ability to achieve economies of scale. This financial constraint can limit the R&D budgets of smaller luxury brands, making it difficult for them to keep pace with technological innovation. Brand perception and counterfeiting also pose ongoing threats. Maintaining an aura of exclusivity and authenticity is crucial, and the proliferation of counterfeit luxury goods can dilute brand value and erode consumer trust. Lastly, the increasing demand for sustainable and ethically sourced materials, while an opportunity, can also be a restraint if sourcing rare or precious materials becomes prohibitively expensive or complex, impacting the final price and availability of these coveted devices.

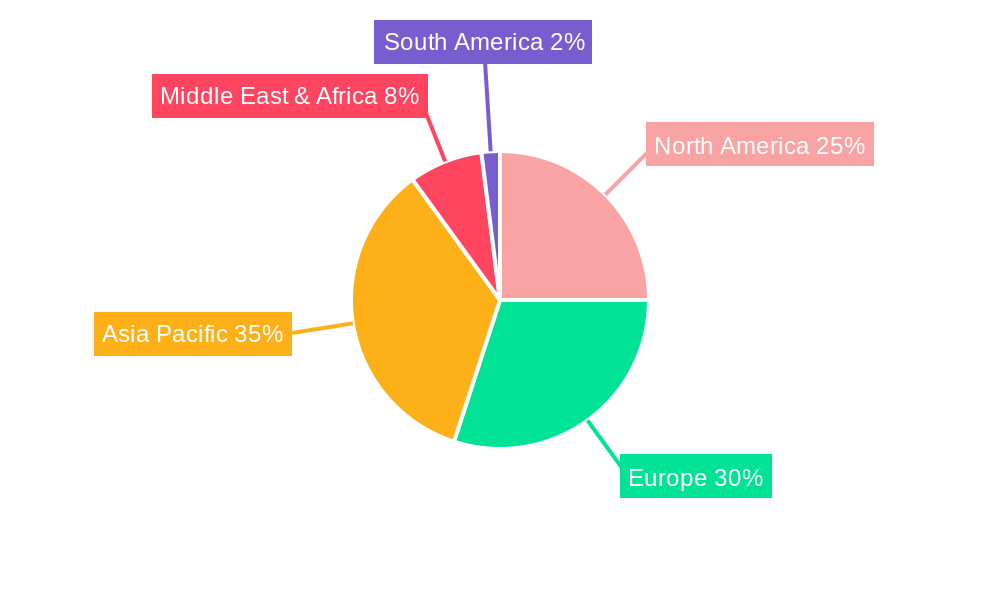

The global luxury cell phone market, while characterized by its exclusivity, exhibits distinct regional preferences and segment dominance that shape its overall landscape. In terms of regions, Asia-Pacific is emerging as a powerhouse, driven by a rapidly growing affluent population in countries like China, India, and South Korea. The burgeoning middle and upper classes in these regions have a strong propensity for displaying wealth and embracing aspirational brands, making them fertile ground for luxury cell phones. The demand here is not just for established Western brands but also for unique, culturally resonant luxury offerings. The sheer volume of potential consumers and their increasing disposable income positions Asia-Pacific as the leading revenue generator and a significant contributor to production volumes.

Europe, with its long-standing tradition of luxury goods and a concentration of high-net-worth individuals in countries like Switzerland, France, and the United Kingdom, continues to be a crucial market. The established prestige of European luxury houses and their heritage in craftsmanship translates directly to a sustained demand for meticulously crafted cell phones. The discerning European consumer often prioritizes timeless design, exceptional build quality, and a rich brand story, making them ideal patrons of brands like Vertu and Celsius X VI II.

The Middle East, particularly countries like the UAE and Saudi Arabia, represents another vital market characterized by extreme wealth and a culture that embraces ostentatious displays of luxury. Here, demand for the most opulent and customized devices, often adorned with precious stones and personalized engravings, remains exceptionally high. The desire for unique, status-defining accessories fuels consistent sales within this region.

Within the segments, the Smartphone type is steadily gaining traction, even within the luxury space. While the "dumb phone" segment, characterized by brands like Le Million and Segments like Ninin, continues to hold its ground due to its emphasis on pure craftsmanship and discreet luxury, the allure of advanced technology combined with exclusivity is undeniable. Vertu, for instance, has been exploring and re-entering the smartphone arena, recognizing the need to offer cutting-edge functionality alongside its signature luxury. This hybrid approach, where high-end smartphones are infused with bespoke materials and enhanced security, is expected to see significant growth. The "World Luxury Cell Phone Production" figure is increasingly being influenced by these premium smartphone offerings.

The Application segment of Men continues to be the dominant force in the luxury cell phone market. Traditionally, luxury accessories have been heavily geared towards male consumers, and this holds true for high-end mobile devices, which are often perceived as a reflection of professional success and personal achievement. However, the Women segment is exhibiting robust growth. Brands are increasingly recognizing the purchasing power and specific aesthetic preferences of female consumers, leading to the development of more elegantly designed, sophisticated, and sometimes more subtly luxurious devices tailored to their tastes. This segment is expected to contribute an increasing share of the "World Luxury Cell Phone Production" in the coming years. The convergence of these regional demands and segment preferences, particularly the rise of the luxury smartphone catering to both genders, will be a key determinant of market dominance.

Several key catalysts are poised to invigorate the luxury cell phone industry. The increasing customization and personalization options offered by brands are a significant growth driver, allowing consumers to imbue their devices with individualistic flair. Furthermore, the growing emphasis on sustainability and ethical sourcing, when effectively integrated into the luxury narrative, can attract a new wave of conscious consumers. The ongoing development of exclusive, integrated services – from dedicated concierge support to personalized app experiences – further enhances the value proposition. Finally, strategic collaborations with high-fashion houses and renowned designers can inject fresh appeal and wider recognition into the luxury cell phone market, drawing in enthusiasts from adjacent luxury sectors.

This report offers a panoramic view of the luxury cell phone landscape, providing an indispensable resource for stakeholders. It meticulously analyzes market dynamics, from historical performance in the 2019-2024 period to future projections up to 2033, with 2025 serving as the pivotal base and estimated year. The report delves into the nuanced trends shaping the industry, distinguishing between the enduring appeal of artisanal "dumb phones" and the increasing sophistication of luxury smartphones. It quantifies production in millions of units, offering clear insights into market scale and growth potential across diverse segments like Type (Smartphone, Dumb Phone) and Application (Men, Women). Furthermore, it dissects the driving forces, challenges, regional dominance, and crucial growth catalysts, painting a complete picture of this exclusive market. With a detailed overview of leading players and significant historical developments, this report equips businesses with the strategic intelligence needed to navigate and capitalize on the evolving world of luxury mobile communication.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vertu, Le Million, AE+Y, Ninin, Gresso, Mobiado, Meridiist, Celsius X VI II, Chistian Dior, Versace Unique.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Cell Phone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Cell Phone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.