1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Car Rental?

The projected CAGR is approximately 19.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Car Rental

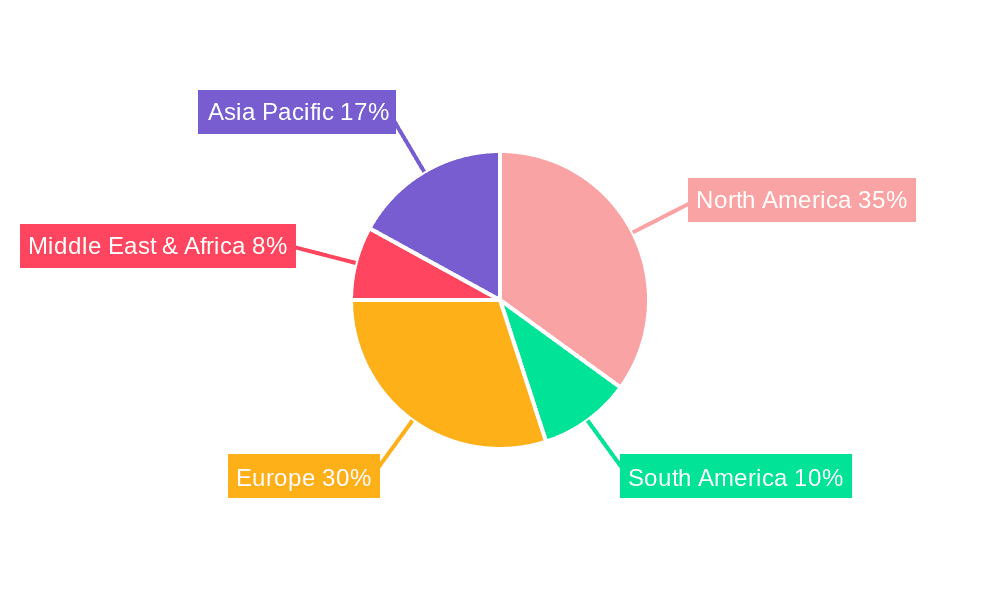

Luxury Car RentalLuxury Car Rental by Type (Business Rental, Leisure Rental), by Application (Airport, Off-airport), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

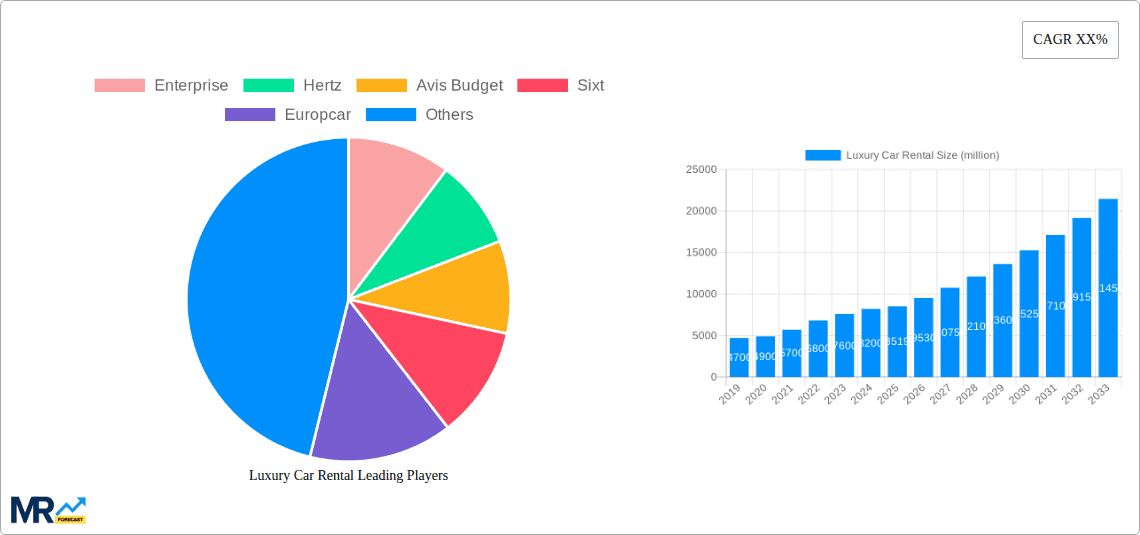

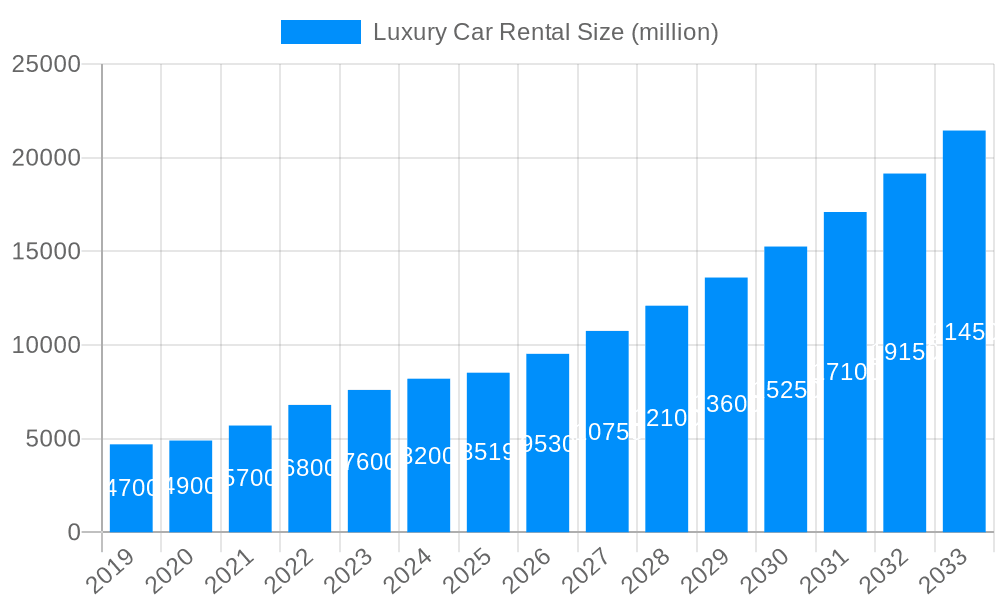

The luxury car rental market, currently valued at $25,000 million (2025), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 19.1% from 2025 to 2033. This expansion is driven by several key factors. Increasing disposable incomes, particularly amongst high-net-worth individuals and affluent millennials, fuel demand for premium travel experiences. The rise of experiential travel and luxury tourism further boosts the market, as travelers seek exclusive and personalized services. Technological advancements, such as improved online booking platforms and enhanced vehicle tracking systems, streamline the rental process, increasing convenience and attracting a wider clientele. Furthermore, a growing preference for chauffeur-driven services and the expansion of luxury car rental options into emerging markets contribute to the market's upward trajectory. The competitive landscape features established global players like Enterprise, Hertz, Avis Budget, and Sixt, alongside regional operators. These companies are constantly innovating, offering bespoke services and luxury vehicle fleets to maintain their market share and cater to evolving customer preferences.

However, challenges remain. Economic downturns and fluctuations in fuel prices can impact consumer spending on luxury goods and services. Increasing regulations concerning emissions and environmental sustainability necessitate investments in eco-friendly fleets, potentially impacting profitability. Intense competition and the need for continuous fleet modernization require significant capital expenditure. Nevertheless, the long-term outlook for the luxury car rental market remains positive, fueled by the enduring demand for premium travel experiences and the continued growth of the affluent consumer segment. Strategic partnerships, expansion into new markets, and the adoption of innovative business models will be crucial for companies aiming to thrive in this dynamic and competitive landscape.

The global luxury car rental market, valued at approximately $XX billion in 2024, is poised for significant expansion, with projections indicating a market size exceeding $YY billion by 2033. This robust growth reflects a confluence of factors, including the rising affluence of the global middle class, particularly in emerging economies, and a growing preference for premium travel experiences among discerning consumers. The historical period (2019-2024) witnessed a steady upward trajectory, punctuated by temporary dips during periods of economic uncertainty. However, the market demonstrated remarkable resilience, indicating underlying demand for luxury vehicles even amidst global challenges. The base year of 2025 serves as a crucial benchmark, showcasing the market's consolidation and the emergence of new business models. The forecast period (2025-2033) anticipates accelerated growth, driven by technological advancements, changing consumer preferences, and the increasing availability of luxury vehicles through rental platforms. The shift towards experiential travel and the growing popularity of luxury tourism are also key drivers. Consumers are increasingly willing to spend more for convenience, comfort, and exclusivity, fueling demand for high-end rental vehicles. This trend is amplified by the rise of bespoke travel services and the integration of luxury car rentals into holistic travel packages offered by premium travel agencies. The market's dynamism is further enhanced by the strategic investments made by major players in fleet expansion, technology upgrades, and customer service enhancements. This trend reflects a concerted effort to cater to the evolving needs and expectations of the sophisticated luxury traveler. The increasing adoption of online booking platforms and mobile applications has significantly streamlined the rental process, adding to the overall convenience and accessibility of the service. This digital transformation has been a critical factor in driving market expansion and enhancing customer satisfaction.

Several factors contribute to the explosive growth of the luxury car rental market. The expanding global high-net-worth individual (HNWI) population is a primary driver, with individuals seeking premium experiences and convenience. This demographic's disposable income fuels demand for luxury goods and services, including premium car rentals. The rise of experiential travel, where individuals prioritize unique and memorable experiences over traditional tourism, significantly boosts the market. Luxury car rentals enhance the overall travel experience, allowing for comfortable and stylish exploration. Technological advancements, such as sophisticated online booking platforms and personalized service features, have improved accessibility and convenience, thus broadening the market’s reach. Strategic partnerships between luxury car rental companies and high-end hotels, resorts, and concierge services create seamless, integrated travel experiences, increasing demand for these services. Moreover, the evolving preferences of millennials and Gen Z, who value unique experiences and are willing to invest in premium services, are also contributing to market expansion. These groups are increasingly utilizing luxury car rentals for business trips, special occasions, and leisure travel, adding significant momentum to market growth. The increasing disposable income in emerging economies is another major factor contributing to increased demand for luxury goods and services.

Despite its promising outlook, the luxury car rental market faces several challenges. Fluctuating fuel prices and potential increases in insurance costs directly impact rental prices, potentially deterring customers. Stringent government regulations related to emissions, vehicle standards, and licensing can increase operational costs and limit market expansion. Maintaining a diverse and up-to-date fleet of luxury vehicles requires substantial investments, posing a significant financial burden on rental companies. Competition is intense, with established players and emerging entrants vying for market share, putting pressure on pricing and profitability. Economic downturns and global uncertainties can impact consumer spending, especially in the luxury sector, leading to decreased demand for premium rental services. Ensuring sufficient insurance coverage for high-value vehicles is crucial, as any damage or loss can significantly impact profitability. Finally, managing customer expectations concerning service quality, vehicle condition, and prompt resolution of any issues are crucial to maintain a positive brand reputation and customer loyalty within this competitive space.

Segments:

The luxury car rental market's segmentation strategy plays a key role in driving its expansion. Businesses are developing diverse fleet strategies to cater to the varying demands of distinct customer segments, ensuring both broad appeal and niche targeting. This contributes to market dynamism and growth.

Several factors are catalyzing growth in the luxury car rental industry. The increasing availability of technological advancements such as online booking platforms and mobile apps has significantly enhanced customer convenience and improved market accessibility. The rising affluence of the global middle class, especially in emerging markets, is expanding the customer base for luxury goods and services. Strategic partnerships between car rental firms and high-end hotels, resorts, and concierge services offer seamless and integrated luxury travel experiences, driving demand for luxury car rentals. The growing trend toward experience-based travel emphasizes luxurious and memorable experiences, making luxury car rentals a coveted aspect of premium travel packages. Furthermore, the market's adaptability to new consumer preferences and market demands is also contributing to its ongoing growth trajectory.

This report provides an in-depth analysis of the luxury car rental market, encompassing key trends, growth drivers, challenges, and market forecasts. It profiles leading players and identifies key regional and segment opportunities for expansion. The comprehensive data and insights presented in this report are invaluable for businesses looking to participate and thrive in this dynamic and rapidly growing market. The report's historical data analysis, base year assessment, and detailed future projections offer a complete understanding of the luxury car rental industry's evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 19.1%.

Key companies in the market include Enterprise, Hertz, Avis Budget, Sixt, Europcar, Localiza, CAR, Movida, Unidas, Goldcar, eHi Car Services, Fox Rent A Car, .

The market segments include Type, Application.

The market size is estimated to be USD 25000 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Car Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Car Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.