1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Boxes Carrier Bags?

The projected CAGR is approximately 5.2%.

Luxury Boxes Carrier Bags

Luxury Boxes Carrier BagsLuxury Boxes Carrier Bags by Type (Plastic, Textiles, Kraft Paper, Others), by Application (Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, Tobacco, Gourmet Food and Drinks, Watches and Jewellery, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

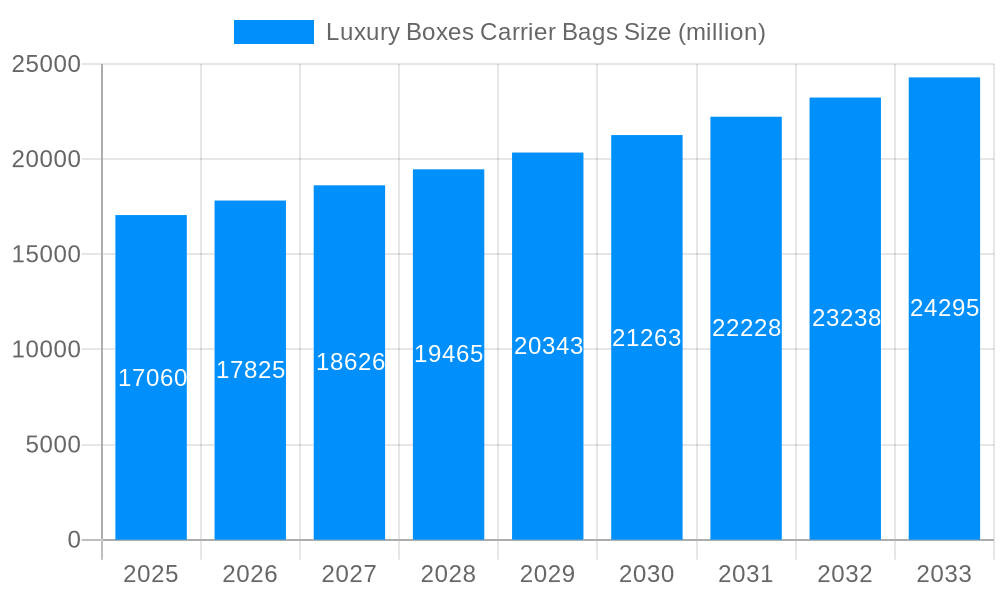

The global market for Luxury Boxes Carrier Bags is poised for significant expansion, projected to reach $17.06 billion by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 4.5% from 2019 to 2033. This impressive trajectory is underpinned by several key drivers. The escalating consumer demand for premium and branded goods across diverse sectors, including cosmetics, confectionery, and high-end beverages, directly fuels the need for sophisticated and aesthetically pleasing packaging solutions. Furthermore, the increasing emphasis on brand experience and unboxing moments, particularly driven by online retail and social media influence, elevates the importance of distinctive carrier bags that enhance perceived value and brand loyalty. The growing trend towards sustainable and eco-friendly packaging materials, such as recycled kraft paper and biodegradable plastics, is also creating new opportunities and influencing product development within the luxury packaging segment.

The market's growth is further stimulated by evolving consumer preferences for personalization and exclusivity. Brands are investing more in custom-designed carrier bags that reflect their unique identity and appeal to a discerning clientele. This is evident in the segmentation of the market, with applications in Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, and Watches and Jewellery being particularly prominent. While the overall outlook is highly positive, the market is not without its challenges. Rising raw material costs, particularly for premium paper and specialized plastics, can impact profit margins for manufacturers. Additionally, stringent environmental regulations in certain regions may necessitate significant investment in sustainable production processes. However, the continuous innovation in materials, designs, and printing technologies, coupled with the strategic expansion efforts of key players like GPA Global, Amcor, and Crown Holdings, are expected to overcome these restraints and ensure sustained market growth throughout the forecast period.

The Luxury Boxes Carrier Bags Market report provides an in-depth analysis of this burgeoning sector, encompassing the historical performance from 2019 to 2024, with a comprehensive forecast extending from 2025 to 2033, using 2025 as both the base and estimated year. This report delves into the intricate dynamics shaping the industry, offering invaluable insights for stakeholders navigating this high-value market. The global luxury boxes carrier bags market is projected to witness substantial growth, with current market value estimated to be in the tens of billions of US dollars. The forecast period is expected to see a robust CAGR, pushing the market size into the hundreds of billions by 2033. This comprehensive report equips industry players with critical data and strategic perspectives, covering market trends, driving forces, challenges, regional dominance, leading players, and significant industry developments.

The luxury boxes carrier bags market is characterized by an escalating demand for bespoke packaging solutions that not only protect products but also serve as an extension of brand identity and a testament to premium quality. Consumers in the luxury segment are increasingly discerning, seeking an unboxing experience that mirrors the exclusivity and craftsmanship of the products they purchase. This trend is driving innovation in material science and design, with a growing emphasis on sustainable yet sophisticated options. For instance, the integration of recycled materials with high-end finishes, such as debossing, embossing, foil stamping, and unique structural designs, is becoming a standard expectation. The market is witnessing a diversification of materials beyond traditional paper and plastic, with textiles and innovative composite materials gaining traction for their tactile appeal and eco-credentials. Furthermore, the integration of smart packaging technologies, although nascent, is beginning to emerge, offering features like authentication and enhanced storytelling through QR codes or NFC tags, further elevating the perceived value. The growing influence of e-commerce has also necessitated a reimagining of luxury carrier bags, ensuring they are robust enough for transit while maintaining their aesthetic appeal and brand presentation upon arrival. This duality requires sophisticated engineering and material choices that can withstand shipping challenges without compromising on the premium unboxing ritual. The personal care and cosmetics segment, in particular, is a significant contributor to these trends, with brands leveraging packaging to communicate efficacy, natural ingredients, and aspirational lifestyles. Similarly, the premium alcoholic beverages and watches and jewellery sectors are pushing the boundaries of intricate designs and high-quality finishes to convey opulence and exclusivity, directly influencing the evolution of luxury carrier bags. The pervasive adoption of minimalist aesthetics, coupled with a focus on unique textures and artisanal craftsmanship, defines the current and future trajectory of this dynamic market. The emphasis on experiential retail further fuels the need for carrier bags that enhance the in-store purchase journey, transforming a simple carry-all into a memorable brand interaction.

Several potent forces are driving the remarkable growth observed in the luxury boxes carrier bags market. Foremost among these is the increasing affluence and purchasing power of consumers globally, particularly in emerging economies. As disposable incomes rise, so does the appetite for premium and luxury goods, naturally extending to the packaging that houses them. Brands are keenly aware that their packaging is often the first physical interaction a consumer has with their product, and for luxury items, this interaction must convey prestige, quality, and exclusivity. This has led to significant investment in innovative and aesthetically superior carrier bags. The growing importance of brand perception and differentiation in a crowded marketplace is another critical driver. In the luxury sector, packaging is a tangible manifestation of brand values, craftsmanship, and commitment to quality. Brands are leveraging bespoke carrier bags to create a unique and memorable unboxing experience, fostering customer loyalty and encouraging social media sharing, which acts as organic marketing. The rise of e-commerce, while posing logistical challenges, has also created new opportunities for luxury packaging. Brands are investing in durable yet visually appealing shipping boxes and carrier bags that ensure products arrive in pristine condition and contribute to the overall luxury experience, even from a distance. Furthermore, the increasing consumer consciousness towards sustainability is influencing material choices and production processes. Luxury brands are actively seeking eco-friendly packaging solutions that do not compromise on aesthetics or perceived value, driving innovation in the use of recycled, recyclable, and biodegradable materials. This commitment to sustainability resonates with a growing segment of environmentally aware luxury consumers, further propelling the market forward.

Despite its robust growth trajectory, the luxury boxes carrier bags market faces several significant challenges and restraints that can impact its expansion. One of the primary hurdles is the escalating cost of raw materials. High-quality papers, specialized textiles, and advanced finishing materials, essential for luxury packaging, are susceptible to price volatility due to supply chain disruptions, geopolitical factors, and increased global demand. This directly translates to higher production costs for manufacturers and, consequently, for brands, potentially impacting profit margins or necessitating price increases for consumers. Another considerable challenge is the complexities associated with supply chain management. The intricate nature of sourcing specialized materials, maintaining stringent quality control throughout production, and ensuring timely delivery for bespoke orders can be demanding. This is particularly true for international operations, where logistical hurdles and customs regulations can add further strain. The increasingly stringent environmental regulations across various regions, while a positive development for sustainability, can also present a challenge. Brands and manufacturers must invest in adapting their processes and materials to meet these evolving standards, which can incur significant upfront costs and require ongoing research and development. Furthermore, the potential for counterfeit products that are packaged in lower-quality imitation luxury bags poses a threat to brand integrity and consumer trust. Distinguishing authentic luxury packaging from counterfeits requires sophisticated anti-counterfeiting measures, which add another layer of complexity and expense. Finally, the pressure to innovate while maintaining cost-effectiveness remains a constant challenge. Consumers expect ever-evolving designs and premium finishes, pushing brands to invest in new technologies and materials. However, balancing these innovative demands with the need to remain competitive in pricing requires careful strategic planning and efficient operational execution.

The Cosmetics and Fragrances segment is poised to be a dominant force in the luxury boxes carrier bags market, driven by the inherent value placed on aesthetic appeal, gifting culture, and the strong emotional connection consumers have with these products. The multi-billion dollar global cosmetics industry consistently invests heavily in packaging to capture consumer attention, convey brand luxury, and enhance the overall product experience. Luxury cosmetic brands, in particular, utilize carrier bags as an extension of their brand narrative, often incorporating intricate designs, premium materials, and unique finishing touches to create a palpable sense of opulence. This segment benefits from a high purchase frequency and a significant gifting market, where attractive and high-quality packaging plays a crucial role in purchase decisions. The desire for an "unboxing experience" is particularly pronounced in cosmetics and fragrances, with consumers actively seeking aesthetically pleasing and Instagrammable packaging. This translates into a continuous demand for innovative and visually striking carrier bags that can elevate the perceived value of serums, perfumes, makeup palettes, and skincare sets. The use of materials like coated papers, metallic finishes, soft-touch laminations, and embellishments like ribbons and bows are commonplace, contributing to the premium feel.

Furthermore, the Watches and Jewellery segment is another significant contributor, characterized by extremely high-value products where packaging integrity and presentation are paramount. For these items, the carrier bag is not merely a container but a protector of significant investment and a symbol of status. Brands in this sector invest in exceptionally robust and elegantly designed carrier bags that convey exclusivity and security. The emphasis here is on superior craftsmanship, often featuring rigid structures, plush interiors, and discreet branding to reflect the sophistication and value of the contents. The tactile experience of handling a luxury watch or jewellery box within a premium carrier bag is an integral part of the customer journey.

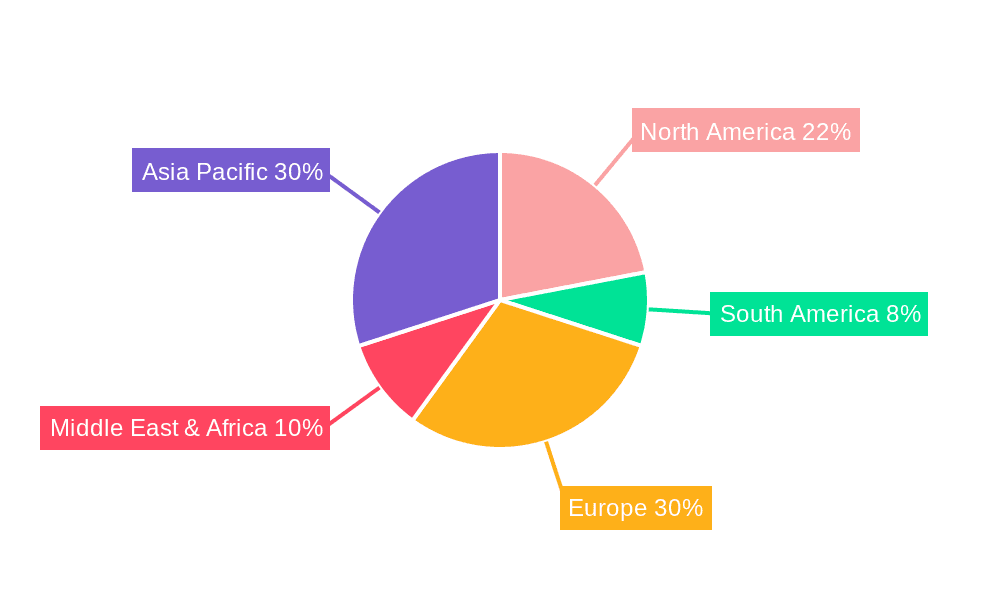

Geographically, North America and Europe are expected to continue their dominance in the luxury boxes carrier bags market. These regions boast a well-established and mature luxury goods market with a high concentration of affluent consumers who have a strong propensity for purchasing premium products. The presence of leading luxury brands in cosmetics, fragrances, watches, jewellery, and premium food and beverages solidifies their market share. The consumer demand for sophisticated and environmentally conscious packaging solutions is also highly developed in these regions, driving innovation and premiumization.

Dominant Segment:

Dominant Regions:

Several factors are acting as significant growth catalysts for the luxury boxes carrier bags industry. The burgeoning global luxury market, fueled by increasing disposable incomes and a growing middle class, directly translates to a higher demand for premium packaging. The e-commerce boom is also a key catalyst, as brands are investing in sophisticated, branded shipping solutions that extend the luxury experience beyond the physical store. Furthermore, the increasing emphasis on sustainability and eco-friendly practices is driving innovation in material science and design, with consumers actively seeking brands that align with their environmental values. This push for greener alternatives, without compromising on aesthetics, is creating new market opportunities.

The luxury boxes carrier bags market is populated by a diverse range of companies, each contributing to the sector's innovation and growth. These leading players are instrumental in shaping the industry's trends and providing high-quality solutions to luxury brands:

The luxury boxes carrier bags sector is a dynamic landscape marked by continuous evolution and strategic advancements. Key developments observed over the study period have significantly shaped the market:

This comprehensive report on the Luxury Boxes Carrier Bags Market offers an exhaustive examination of the industry's past, present, and future. It provides detailed insights into market dynamics, including key trends such as the growing demand for sustainable and bespoke packaging, and the increasing influence of e-commerce on premium unboxing experiences. The report meticulously analyzes the driving forces behind market expansion, such as rising global affluence and the critical role of packaging in brand differentiation. It also addresses the challenges and restraints, including escalating material costs and complex supply chain management, offering a balanced perspective. Furthermore, it identifies dominant regions and segments, such as North America, Europe, Cosmetics & Fragrances, and Watches & Jewellery, detailing their significance and projected growth. The report highlights crucial growth catalysts like the expansion of the global luxury market and the drive towards eco-friendly solutions. A curated list of leading players and a timeline of significant industry developments equip readers with a nuanced understanding of the market's evolution. This report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the opportunities within this high-value and continuously evolving market, estimated to be valued in the tens of billions currently and projected to reach the hundreds of billions by 2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include GPA Global, Owens-Illinois, PakFactory, Ardagh, Crown Holdings, Amcor, Progress Packaging, HH Deluxe Packaging, Prestige Packaging, Pendragon Presentation Packaging, Luxpac, Print & Packaging, Tiny Box Company, B Smith Packaging, Taylor Box Company, Pro Packaging, Rombus Packaging, Stevenage Packaging, Clyde Presentation Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Boxes Carrier Bags," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Boxes Carrier Bags, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.